On Tuesday, the US Dollar was bearish against all of its major currency pairs while the US Dollar Currency Index broke below its 92.50 level, reaching a low last seen in May 2018. On the U.S. economic data front, Housing Starts jumped to 1,496K on month in July (1,245K expected), from a revised 1,220K in June. Building Permits increased to 1,495K on month in July (1,326K expected), from a revised 1,258K in June.

On Wednesday, the Mortgage Bankers Association's Mortgage Applications data for the week ending August 14th is expected. Finally, the Federal Open Market Committee is expected to release its Meeting Minutes for July 29th.

The Euro was bullish against most of its major pairs with the exception of the NZD and GBP. In Europe, no major economic data was released.

The Australian dollar was bearish against most of its major pairs with the exception of the USD.

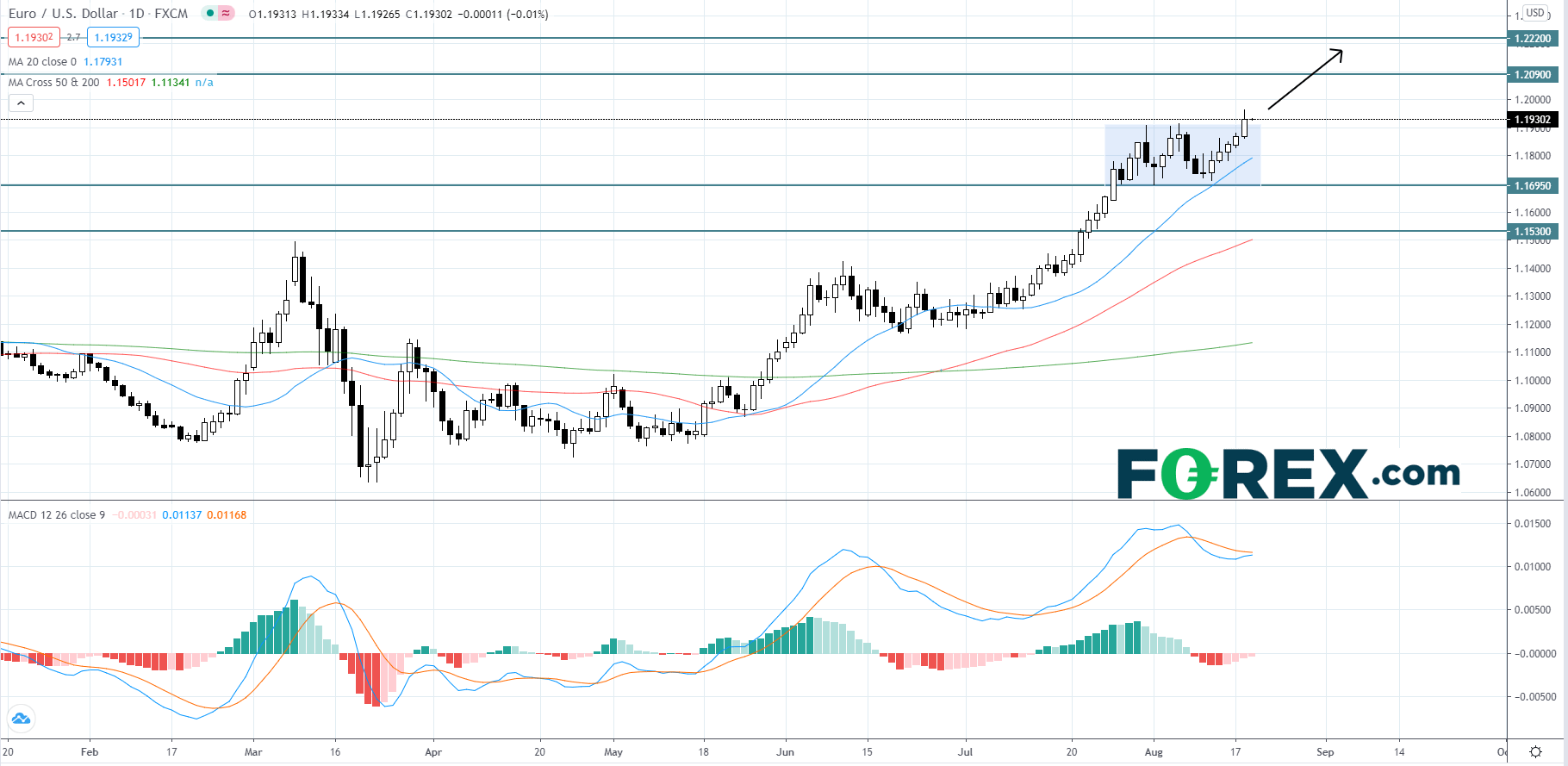

The EUR/USD surged 61 pips to 1.1931 on Tuesday, reaching a high last seen in May 2018. The currency pair broke to the upside of a short-term sideways channel that began to form on July 27th. Price is using the 20-day moving average as rough support. The pair will likely continue advancing towards 1.2090, a major level from 2017. If price can break above 1.2090, it could likely grind higher to 1.2220. If price pulls back, look to the 20-day moving average for a potential bounce. If price falls below its 20-day moving average there is a high probability that it will bounce off of the 1.1695 support level.

Source: GAIN Capital, TradingView

On Wednesday, the Mortgage Bankers Association's Mortgage Applications data for the week ending August 14th is expected. Finally, the Federal Open Market Committee is expected to release its Meeting Minutes for July 29th.

The Euro was bullish against most of its major pairs with the exception of the NZD and GBP. In Europe, no major economic data was released.

The Australian dollar was bearish against most of its major pairs with the exception of the USD.

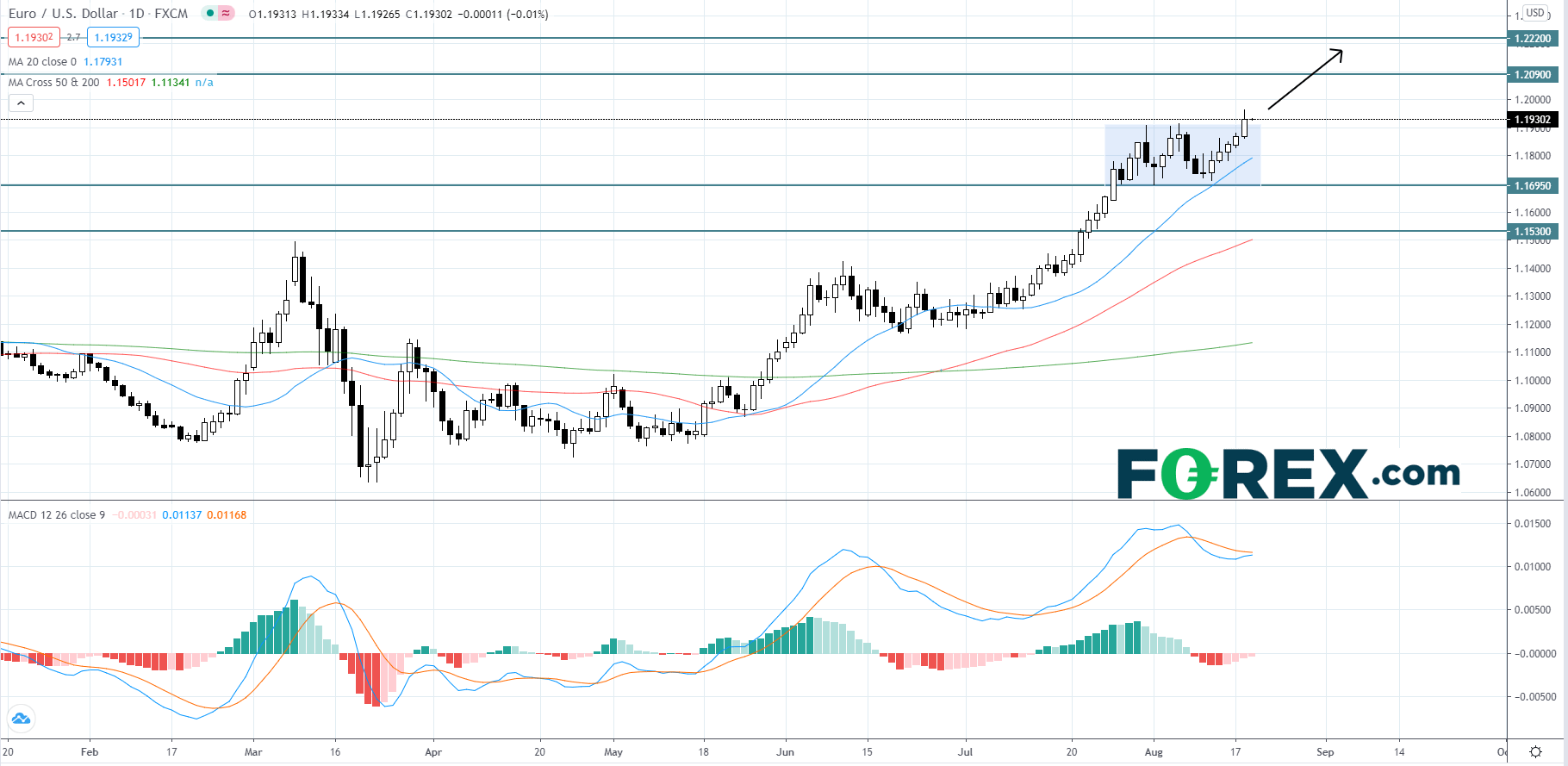

The EUR/USD surged 61 pips to 1.1931 on Tuesday, reaching a high last seen in May 2018. The currency pair broke to the upside of a short-term sideways channel that began to form on July 27th. Price is using the 20-day moving average as rough support. The pair will likely continue advancing towards 1.2090, a major level from 2017. If price can break above 1.2090, it could likely grind higher to 1.2220. If price pulls back, look to the 20-day moving average for a potential bounce. If price falls below its 20-day moving average there is a high probability that it will bounce off of the 1.1695 support level.

Source: GAIN Capital, TradingView

市场最新资讯

三月 28, 2023 02:13 上午

十月 28, 2022 04:43 上午

十月 28, 2022 04:43 上午

八月 19, 2022 05:44 上午

七月 26, 2022 03:43 上午

五月 10, 2022 02:22 上午