US inflation was released earlier, and it wasn’t good. Although headline inflation was in line with expectations for January (MoM) at 0.3%, it was core inflation which set the tone for the markets. Core inflation for January (MoM) was 0% vs and expectation of 0.2%! Core inflation strips out the often-volatile components of the headline number, which are food and energy prices. As a result, the January annualized inflation remained unchanged from December’s number at 1.4%, while the annualized headline inflation component down ticked from 1.6% to 1.4%!

Just as inflation expectations were starting to creep up in the markets, along with the US Dollar, the positive news of the $1.9 trillion stimulus package making its way through Congress and todays lower inflation data should bring concern to US Dollar bulls. While prices of commodities such as Crude Oil, Iron Ore, and Copper, have been rising, it is not feeding through to the overall market. Therefore, inflation remains low. As a result, markets may now be anticipating longer accommodative monetary policy, which means higher stock markets, lower bond prices, and a lower US Dollar.

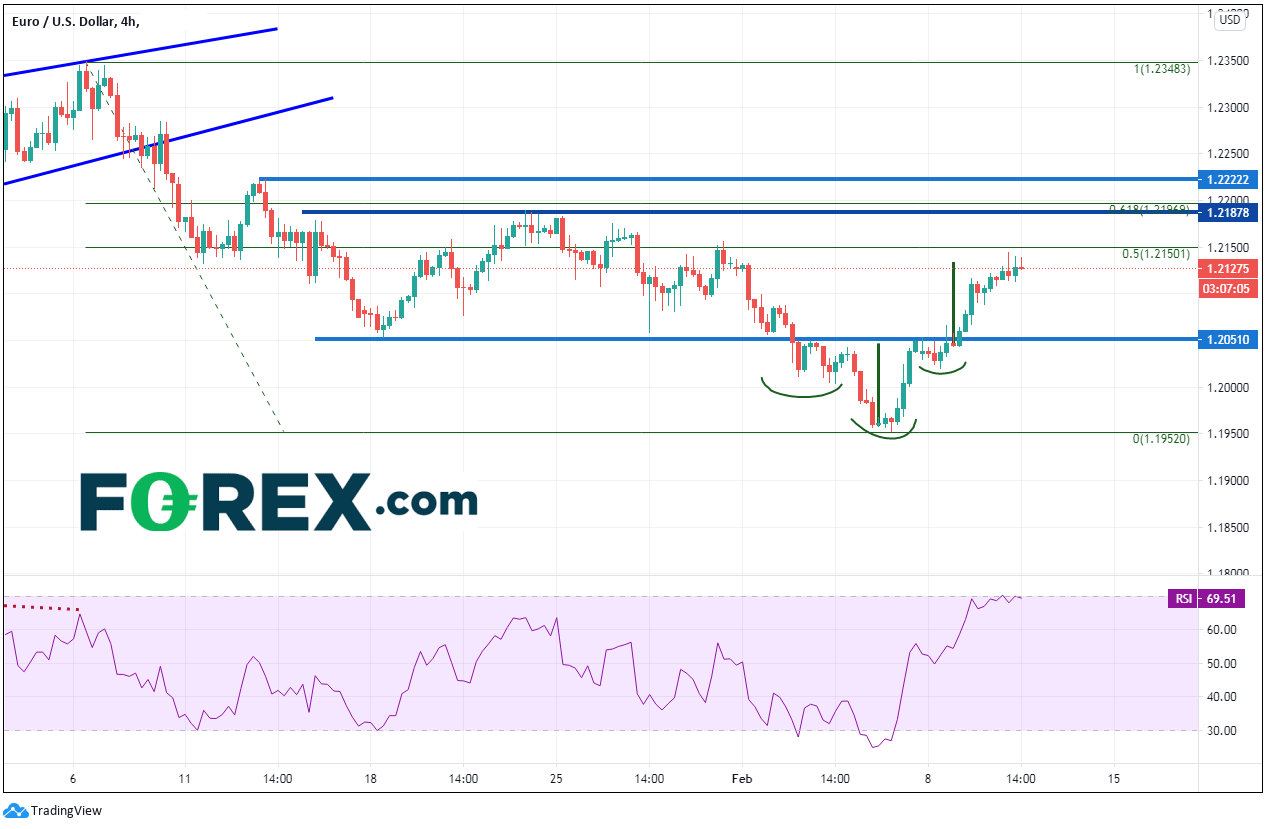

The main beneficiary from a lower US Dollar is the EUR/USD. The Euro currently makes up 57% of the US Dollar Index (DXY). On a 240-minute timeframe, EUR/USD has been moving higher since Friday’s lows after payrolls at 1.1952. Price then formed an inverted head and shoulders pattern and reached the target near 1.2130 earlier today. In addition, price is nearing overbought conditions on the RSI, indication a pause or pullback in price may be near. Bears will be looking to sell near the 50% retracement level of the move from the January 6th highs to Fridays lows near 1.2150. Horizontal resistance and the 61.8% Fibonacci retracement level from the previously mentioned timeframe crosses between 1.2188 and 1.2197. Above there, horizontal resistance is at 1.2222. However, EUR/USD bulls (and therefore, US Dollar bears) will be looking to by on dips if they believe weaker inflation is still in play. Neckline support crosses at 1.2050. Below there is the 1.20000 psychological support level and then Fridays lows at 1.1952.

Source: Tradingview, FOREX.com

With the recent inflation data and the $1.9 trillion stimulus package, both fiscal and monetary stimulus may be at the forefront of trader’s minds. As a result, markets may see a lower US Dollar, which could mean a higher EUR/USD.

Learn more about forex trading opportunities.