As was discussed in out FOMC Preview, not much has changed in the FOMC’s view since the March 17th meeting. Although they acknowledge that inflation has risen, they also note that the inflation is transitory. They noted that the vaccinations and strong policy support economic activity. They also note that employment has strengthened, although risks remain.

What do those changes mean? Not much at this time. With no economic and inflation forecasts, and not enough hard data for the Fed to look at since the last meeting, they left interest rates unchanged and maintained the $120bln bond purchase program. No mention of bond tapering or guidance whatsoever. The decision was 11-0.

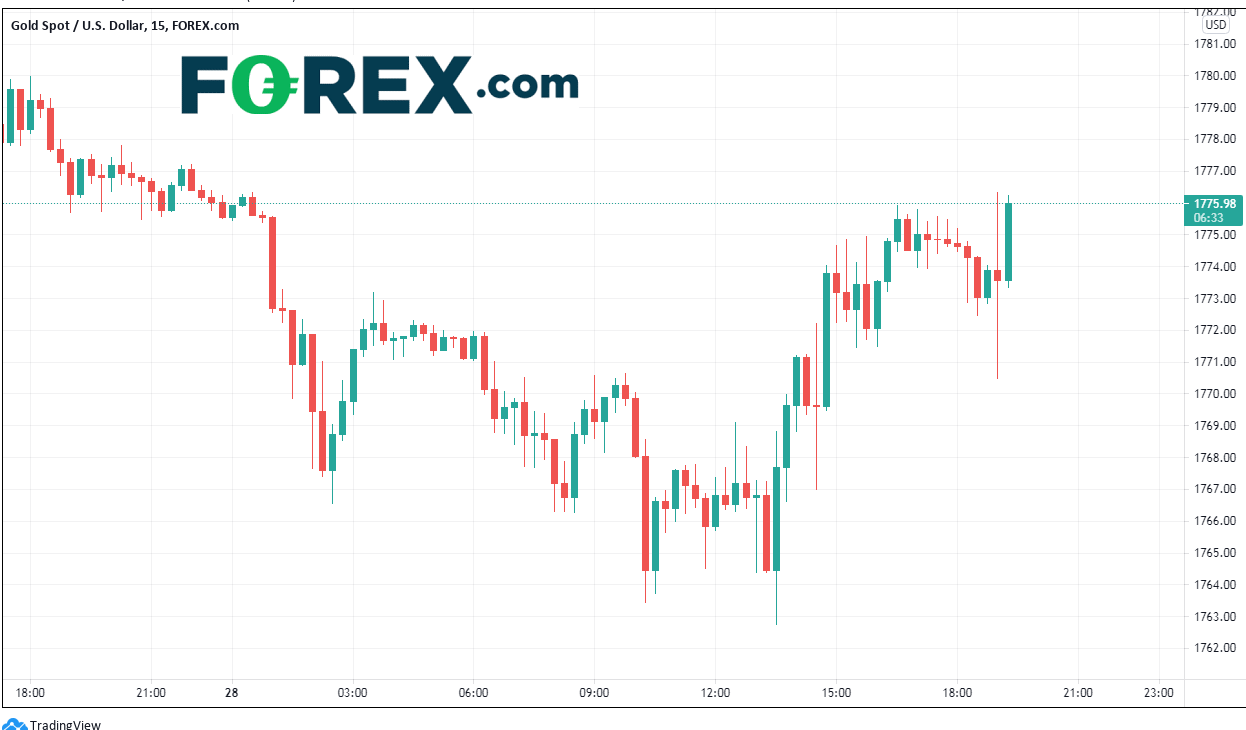

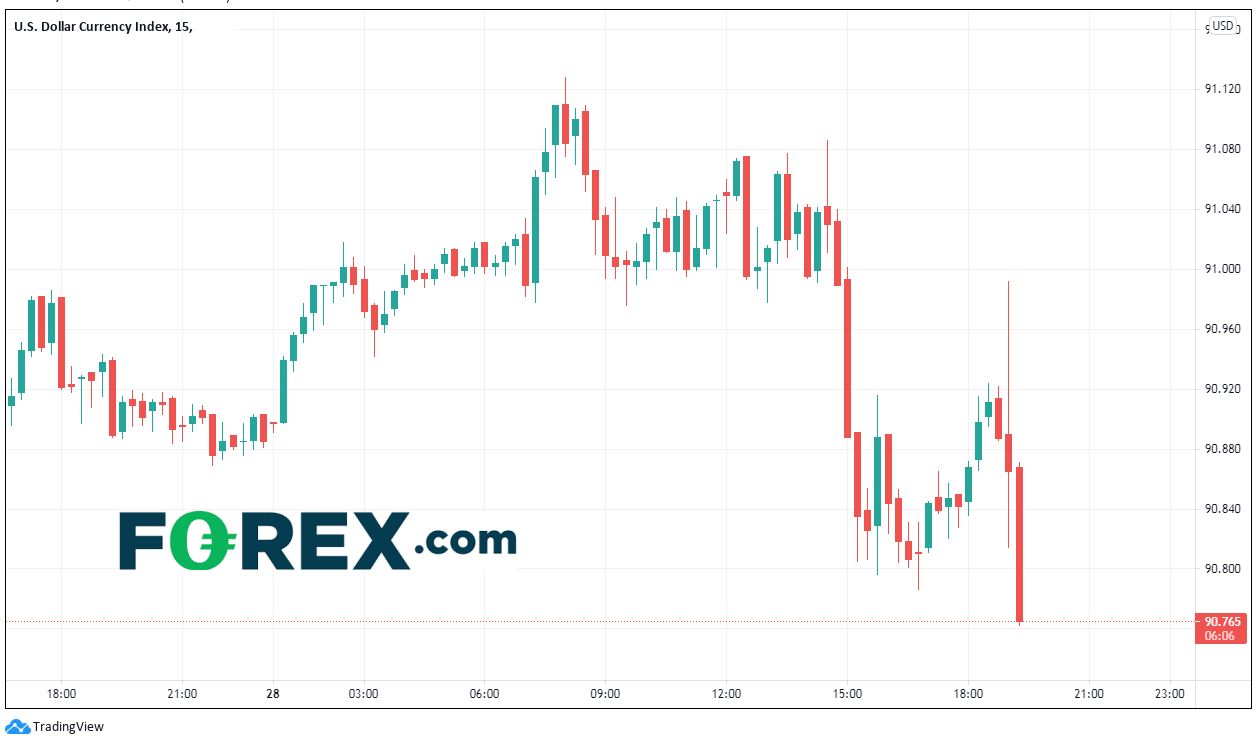

Gold initially spiked lower to spiked lower to 1770 and the DXY spiked to resistance at 91.00. However, the pre-FOMC moves continued for the day as the press conference gets under way.

Gold

Source: Tradingview, FOREX.com

DXY

Source: Tradingview, FOREX.com

Watch for comments any hints of tapering which could reverse both above instruments quickly.