How to trade

Using orders to open positions

When trading, you'll open and close positions using orders.

What is an order?

An order is an instruction to execute a trade. You use them to tell your broker or trading provider when you want to open or close positions. There are a few different types of order available, and learning how they all work is an important part of understanding the markets.

Traditionally, investors gave orders to brokers over the phone. But the rise of web trading means most traders today raise orders using online platforms.

If you've been using your demo to buy and sell as you learn with Trading Academy, then you've been placing orders.

We're going to look at all the standard types of order you might use in day-to-day trading. Starting with the simplest: market orders.

Market orders

The most basic type of order is the market order, which tells your provider to execute at the best price available at the time. If EUR/USD is at 1.0745/1.0746, using a market order is an instruction to execute your trade as close to that level as possible.

You can use market orders to open or close a position.

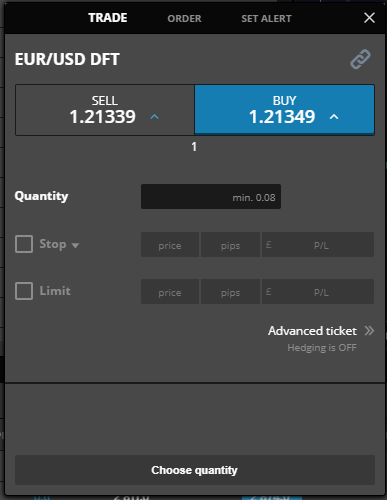

In your FOREX.com demo, you'll execute market orders using the TRADE tab on your deal ticket.

Entry orders

But what if you didn't want to trade at the current market price? You might, for example, think that buying EUR/USD is a great opportunity – but only if it drops to 1.0699. You could watch Eurodollar and open a market order when it hits 1.0699. Or, you could use an entry order.

Entry orders automatically open a position when the market hits a pre-determined level set by you.

This is particularly useful for traders looking to buy/sell at a specific price and who don't want or don't have the time to monitor the markets constantly until this level is reached.

There are four types of entry orders: buy stops, buy limits, sell stops and sell limits.

BuyBuy stops instruct your broker to open a long position on a market when it hits a specified price above its current price. Buy limits open a long position when the market hits a specified price below its current price. |

SellSell stops open a short position on a market when it hits a specified price below the current one. Sell limits open a short position when the market hits a specified price above the current one. |

Stops vs limits

You'll hear the terms stop and limit used a lot when it comes to orders.

- Stop means an order that will execute at a level that is worse than the current price

- Limit means an order that will execute at a level that is more favourable than the current price

'Worse' or 'more favourable' doesn't have to mean 'below' or 'above', however. Take our buy and sell limit entries above. When you're going long, a more favourable level to open at is below the current price – you'll make more profit if you open there. But if you're going short, it's above the current price.

Good 'til when?

As well as deciding your trade direction, quantity and level, you can decide how long an entry order will remain active for before your provider cancels it. The three options you'll see on the FOREX.com platform are good 'til canceled GTC), good 'til end of day (GTD) and good 'til time (GTT).

Good 'til canceled (GTC)

If you choose GTC, then your entry order will remain active until you cancel it manually, the market expires or it is triggered. That could mean it is still active weeks or months after you first place it.

Good 'til end of day (GTD)

GTD orders, meanwhile, will automatically cancel at the end of the trading day. This is useful if you think that your chosen opportunity won't last – with a GTD, there's no risk of you forgetting to cancel and ending up with an unwanted trade.

Good 'til time (GTT)

GTT's give you maximum flexibility by enabling you to choose the precise time and date that you want your order to remain active until. If the market hits your chosen level in that timeframe, your order will trigger. If it doesn't, your order will cancel.

Placing an entry order in your FOREX.com demo

When you're trading with FOREX.com, there's no need to select between the types of entry order. To open a practice position, simply:

- Log in to your demo

- Choose a market and open its trade ticket

- Select 'ORDER' from the top bar

- Choose whether to buy or sell and enter your order price, which dictates the level at which your trade will open

- Choose your quantity and decide when the order should cancel

- Hit 'Place order'