The BOJ held their interest rate at 0.25%, but it seems there was still some hope they might have raised rates, given the yen's response. Even if the odds of a hike yesterday were greatly diminished, just a few weeks ago the odds firmly backed one. Furthermore, their tone was quite dovish, indicating that the central bank is in no rush to raise rates. While I suspect they will be in a better position to next year, yesterday’s moves were in the response to any hopes of an imminent hike dying a sudden death.

The Japanese yen was the clear laggard among FX majors on Thursday, with most of them far exceeding their average daily ranges. Only NZD/JPY failed to exceed its 10-day ATR as the Kiwi dollar faced selling pressure due to a weak and recessionary GDP report. Growth contracted for a second quarter in New Zealand to confirm a technical recession.

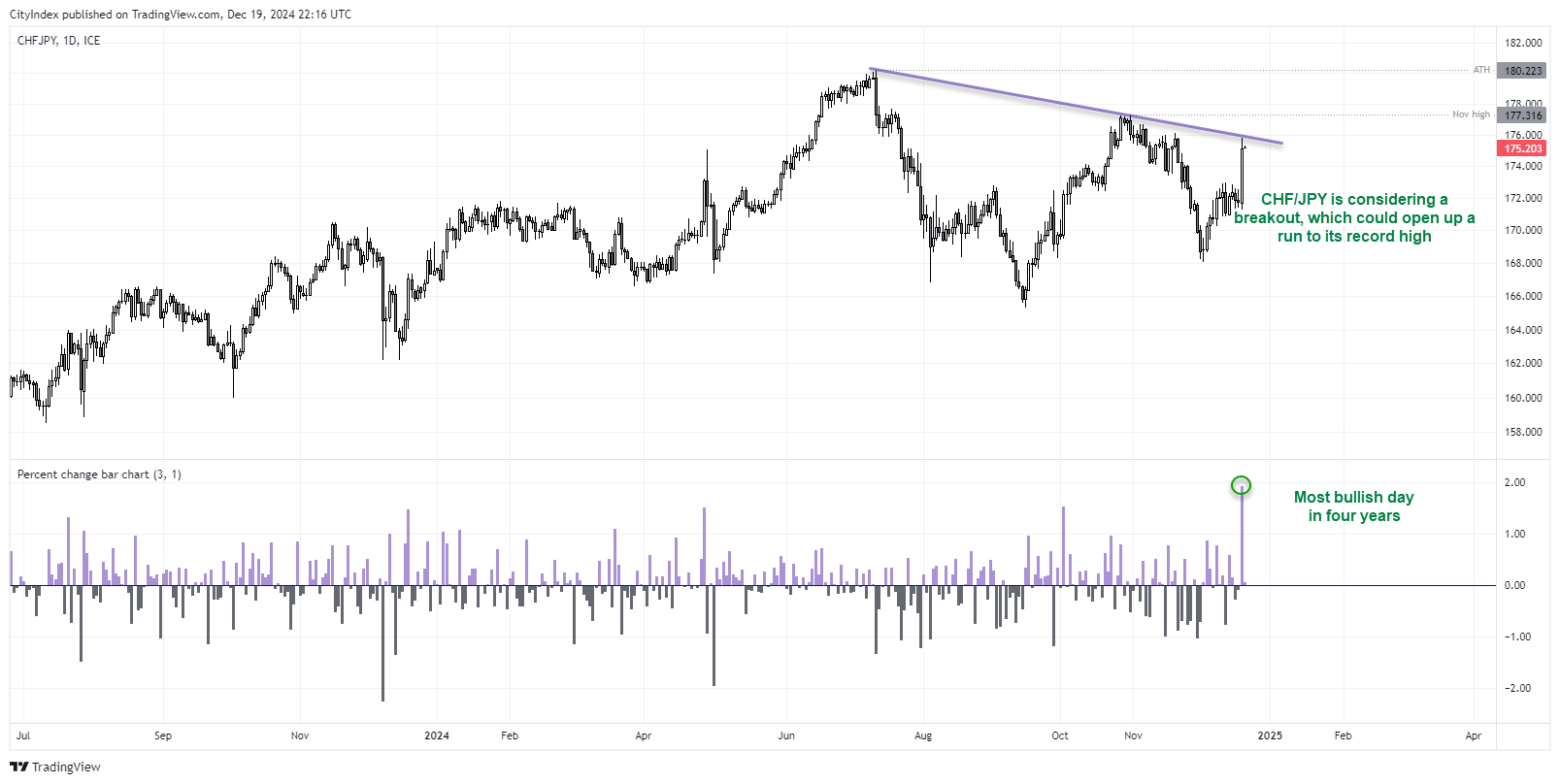

- CHF/JPY was the strongest major against the yen, rising 2% during its best day in two years

- GBP/JPY smashed its way above the 2015 high in style, and in line with my bullish bias.

- USD/JPY reached a 5-month high during its most bullish day in six weeks

The Bank of England held interest rates at 4.75% as expected, although three MPC members voted to cut as opposed to two. This makes it slightly less dovish than expected, prompting the pound to further ground against the US dollar and send GBP/USD to within pips of its November low.

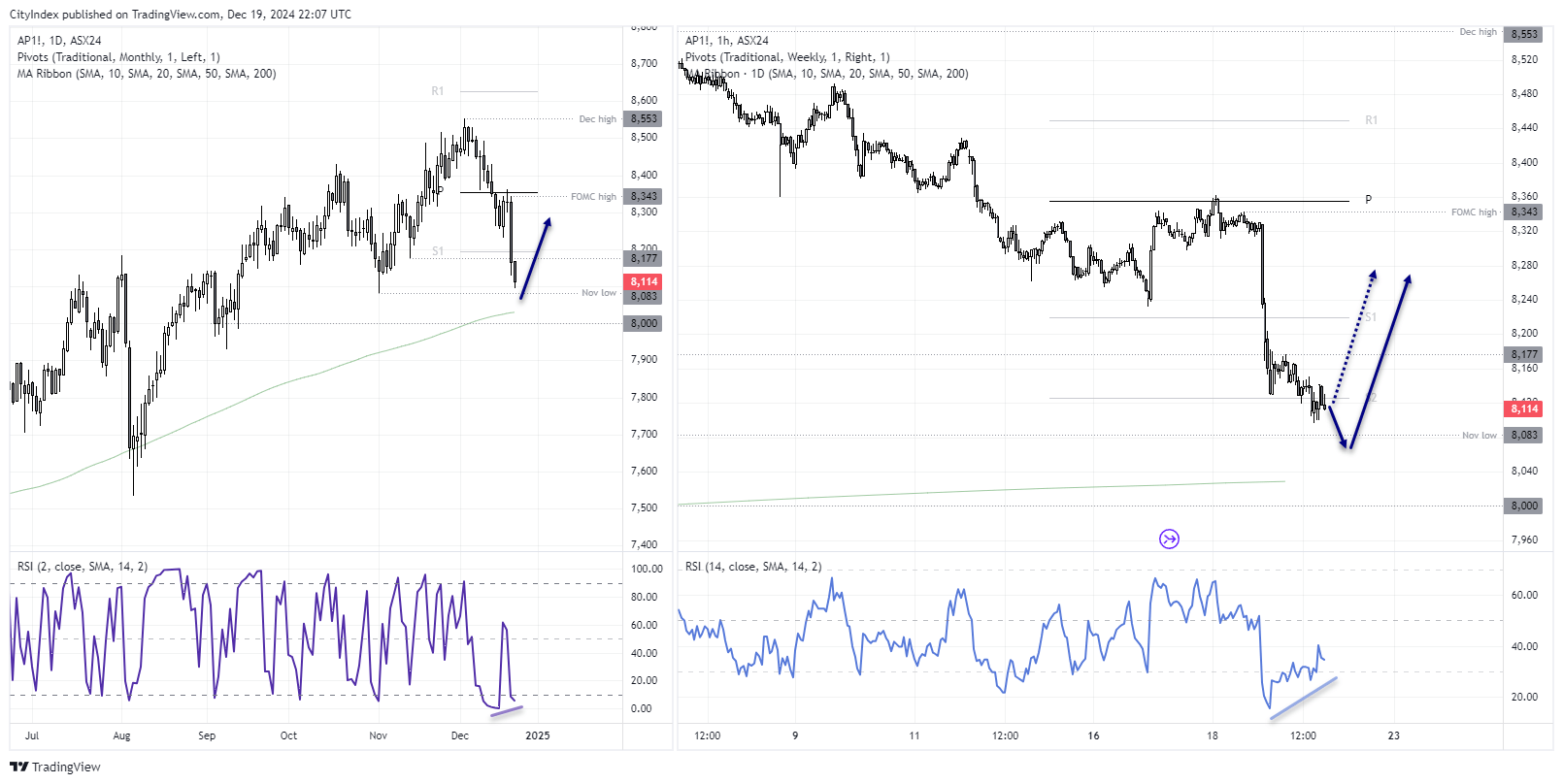

ASX 200 futures (SPI 200) technical analysis:

ASX futures have fallen around -5.4% from the December high, but the November low is close by and bearish momentum is waning. The daily bullish RSI (2) has formed a bullish divergence within the oversold zone and post-FOMC price action has made hard work of continued losses (looking at price action on the 1-hour chart). A bullish divergence has also formed on the 1-hour RSI (14).

The November low is so close that I suspect the market will try and break it early in today’s session. But I am sceptical prices will close beneath it today, given Wall Street indices held their ground above their FOMC lows and we’re at that time of year that indices tend to rally.

I’m not looking for strong gains, but I see the potential to at least partially retrace from of their FOMC losses.

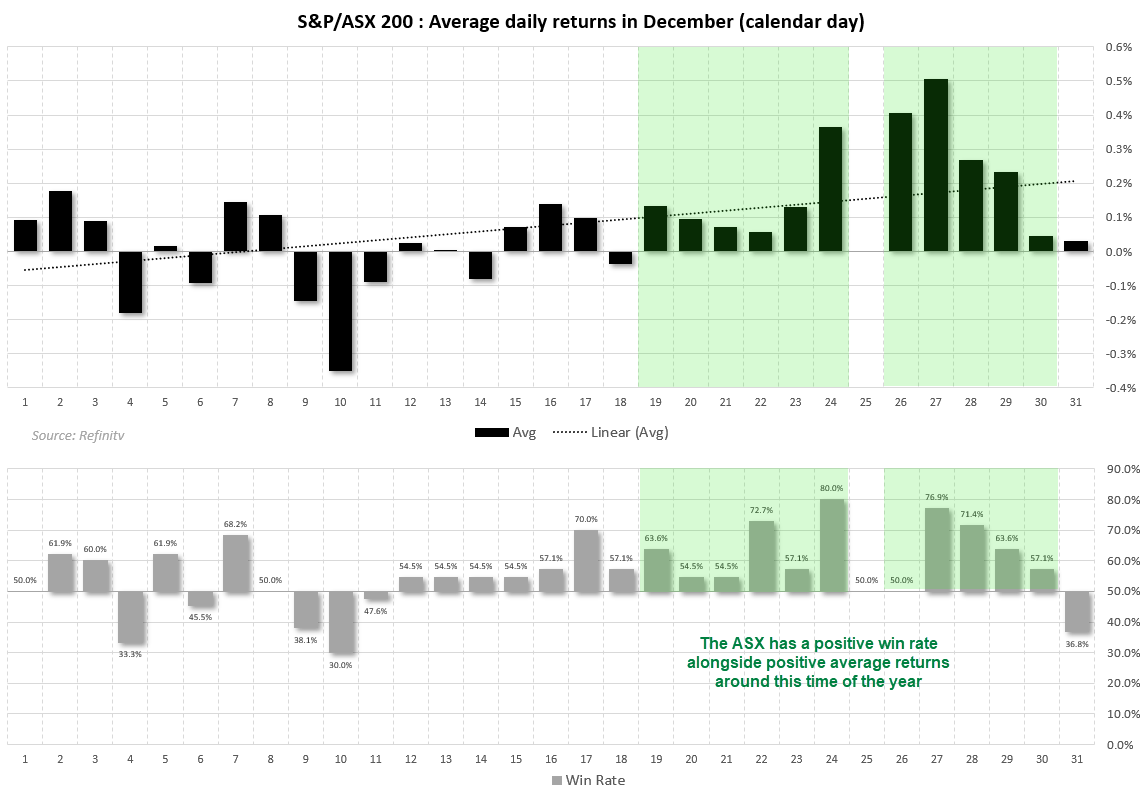

Also, we’re at that time of year that indices tend to do well irrespective of fundamentals. The average daily returns for the ASX 200 tend to be positive alongside a positive win rate between December 19th – 30th.

Economic events in focus (AEDT)

- 10:30 – JP CPI

- 11:30 – AU housing credit

- 12:00 – CN loan prime rate

- 13:00 – NZ credit card spending

- 18:00 – UK retail sales

- 23:30 – FOMC Daly speaks

- 00:30 – US PCE inflation

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge