Germany Manufacturing PMI (Aug) 42.1 Expected, 43.2 Previous

Eurozone Manufacturing PMI (Aug) 45.6 Expected, 45.8 Previous

German Manufacturing PMI (Aug)

The economic picture for Germany is still dire, as seen by the substantial drops in a number of important metrics.

Manufacturing PMI Contraction

August saw a decline in the HCOB Flash Germany Manufacturing PMI for the 26th straight month. This reduction was caused by weak building activity and reluctance on the part of customers, as new orders fell at the fastest rate in nine months.

Business Climate and Consumer Sentiment Decline

The Ifo Business Climate indicator for Germany dropped to its lowest point since February, indicating a rise in business pessimism. As September approached, the GfK Consumer Climate Indicator likewise declined, falling short of market forecasts. The pessimistic forecast is exacerbated by worries about job security, an increase in business insolvencies, and a struggling economy.

According to Ifo President Clemens Fuest, the German economy is "increasingly entering a crisis." This view is reflected in the corporate and consumer sectors, where income expectations have fallen to the lowest level in two years.

Eurozone Manufacturing PMI (Aug)

In August 2024, the HCOB Eurozone Manufacturing flash PMI fell short of forecasts of 45.8 and reached 45.6, the lowest level in eight months. The production fell off at a rate that was comparable to July's, which was among the biggest in 2024. The biggest decrease in new orders since last year was observed. The number of workers in manufacturing decreased as well. Input purchases dropped off quickly, reaching its lowest point in four months. Purchase and finished products inventories also saw significant declines. Because of the decline in demand, suppliers' delivery times decreased for the seventh consecutive month. The 18-month high for manufacturing cost inflation remains intact, while output prices increased for the first time since April 2023.

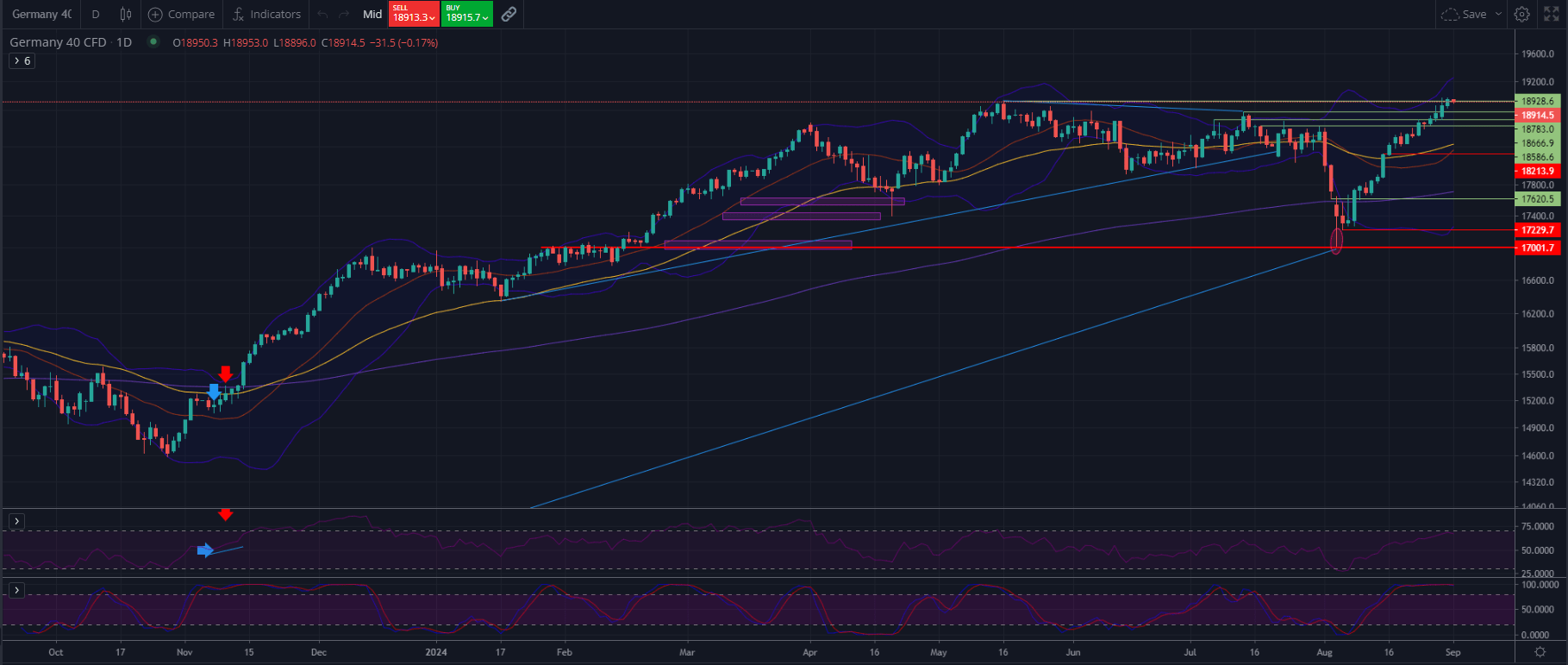

DAX – Technical Analysis

Support Levels: 17229.7, 18213.9

Resistance Levels: 18926.6, 18567.5

Bollinger Bands: Price is touching the upper band indicating a potential strong bullish momentum.

Moving Averages: The 50-day and 200-day moving averages are trending upwards.

RSI: The RSI is relatively high at around 70, indicating the possibility of overbought conditions. Although it is not yet operating at full utilisation.

Amid falling consumer sentiment in Germany, the DAX rose, leading to a situation in which ‘bad news is good news’ for the German leading index. However, futures are neither bullish nor bearish for the day before the publication of the purchasing managers' index. Caution is advised.

Conclusion: A Crossroads for the Global Economy

It's evident that recovery will be unequal across areas as the global economy continues to navigate through a complicated web of obstacles, from manufacturing woes in Germany to inflationary pressures in Australia and Japan. While the U.S. economy appears resilient, other economies continue to face challenges.