Bitcoin halving, a core feature of the cryptocurrency's protocol, is poised to reduce the block reward from 6.25 BTC to 3.125 BTC, marking the third halving event in Bitcoin's history.

Bitcoin Halving

As the cryptocurrency community eagerly awaits the impending Bitcoin halving event scheduled for tomorrow, it's imperative to assess its potential impact in comparison to previous occurrences. Bitcoin halving, a core feature of the cryptocurrency's protocol, is poised to reduce the block reward from 6.25 BTC to 3.125 BTC, marking the third halving event in Bitcoin's history. The next halving is projected on April 19th, 2024, in the evening US Eastern time. Historically, halving events have been associated with increases in Bitcoin's price, attributed to its reduced supply growth rate and increased scarcity.What is the Bitcoin Halving?

Bitcoin halving, often referred to as "the halvening," is a pre-programmed event encoded into Bitcoin's protocol, occurring once every 210,000 blocks mined, or roughly every four years. During a halving event, the reward that miners receive for validating transactions and securing the network is reduced by half. Initially set at 50 BTC per block when Bitcoin was launched by its pseudonymous creator, Satoshi Nakamoto. Currently we are about to see the 4th halving, from 6.25BTC to 3.125BTC per block.Past halvings were as follows:

• November 28, 2012: The reward was reduced to 25 bitcoins.• July 9, 2016: It decreased to 12.5 bitcoins.• May 11, 2020: It was further cut to 6.25 bitcoins.

What is the Purpose of the Bitcoin Halving?

Satoshi Nakamoto the anonymous creator of Bitcoin set out in his whitepaper that he wanted to create a deflationary monetary system. By coding in the halving events into the code every 210,000 blocks, Satoshi hoped to achieve a deflationary economic environment. By slowing the rate at which new bitcoins are created, the halving helps to maintain scarcity and potentially increase the cryptocurrency's value, assuming demand remains steady or increases. As less bitcoin will be produced.Bitcoin Halving: What impact can it have

Historically, halving events have been associated with increases in Bitcoin's price, attributed to its reduced supply growth rate and increased scarcity.

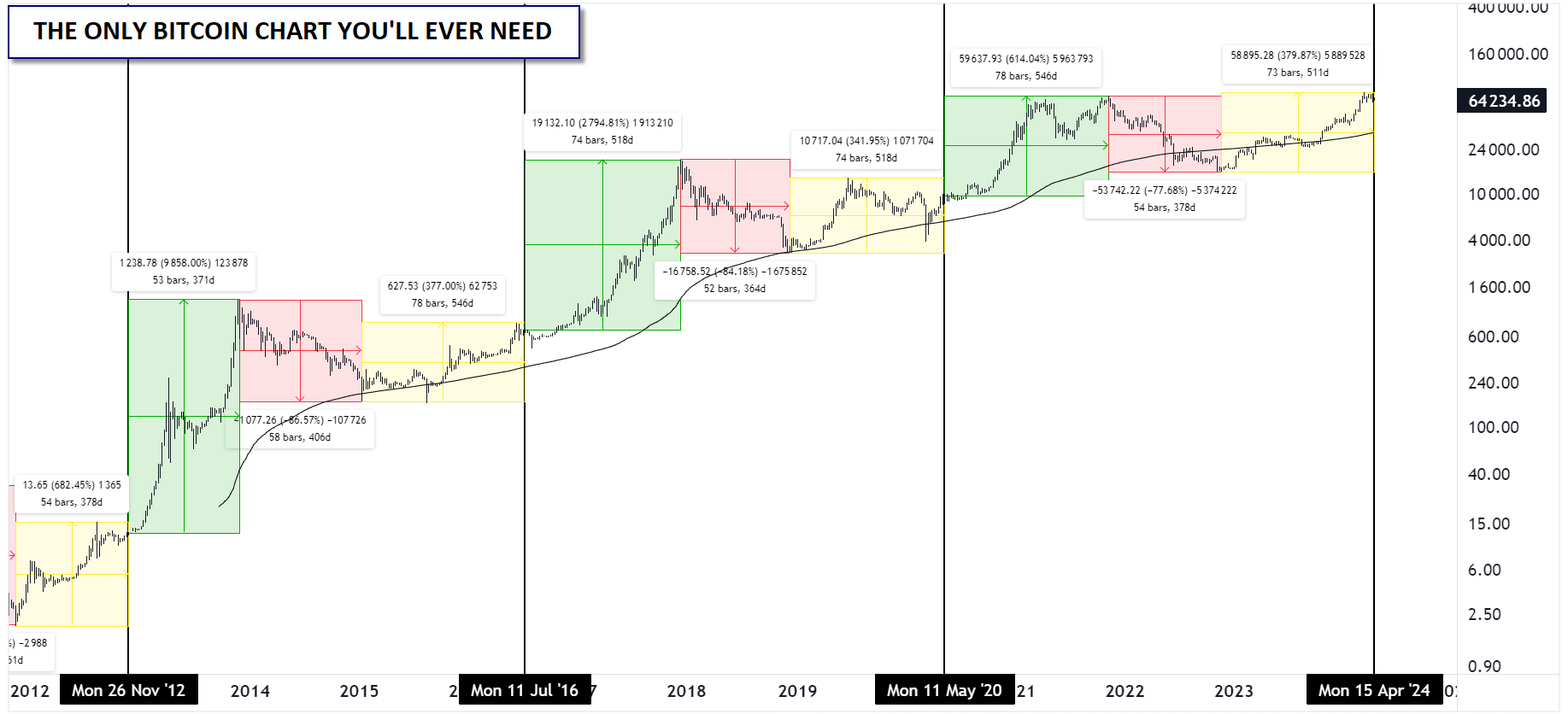

As “The Only Bitcoin Chart You'll Ever Need™” shows below, the strongly bullish “mania” phase of Bitcoin’s 4-year cycle (green) has historically kicked off after the halving, though it can take a handful of months before it kicks into gear in earnest:

Source: Matt Weller CFA, TradingView, StoneX.

As always, it’s worth noting that past performance is not indicative of future results and factors beyond the halving will impact Bitcoin’s price.

What will happen longterm?

The final Bitcoin is expected to be mined around the year 2140, at which point the maximum supply of 21 million bitcoins will have been reached. Post-2140, miners will primarily earn from transaction fees rather than block rewards. This transition could have implications for the security and viability of the Bitcoin network, relying more heavily on transaction volume and fees. Over this most recent cycle, there were some “green shoots” with fees rising slightly as alternative use cases for Bitcoin gained some ground.

Bitcoin Technical Analysis – BTC/USD Daily Chart

Source: Forex.com

Looking at the more traditional technical chart above, Bitcoin is sitting near the bottom of its 6-week range between $61K support at resistance at $73K. The last down move was just 1 day short of the halving, where BTC briefly touched the $60,000 mark.