What do today's FOMC speakers and the minutes mean for the US?

Yesterdays recap

Wall Street were mixed yesterday, due to disappointing news from the meeting held in China about stimulus measures within the country. As a result, the China A50 dropped 10% and is also in the red at today’s open. This pessimism partly swamped over into Europe due to the presumption of decreasing demand, especially in the luxury goods sector. Regarding the US economy, for today there more FOMC speakers planned for today, but the US CPI on Thursday and the opening of earnings season on Friday remain the week's big events.

FOMC?

The Federal Open Market Committee (FOMC) meetings are significant events in the financial world, where key decisions about U.S. monetary policy are made. The FOMC is the policy-making arm of the Federal Reserve (the central bank of the United States), and its primary objective is to promote maximum employment, stable prices, and moderate long-term interest rates in the economy.

Each of the 12 regional Federal Reserve Banks will present their observations on economic conditions in their respective districts, which provides a broader view of the U.S. economy. Following Fed Chairman Jerome Powell's dovish remarks about future monetary policy action and last week's strong non-farm payrolls (NFPs) gains, traders will be watching to see if either of these two officials can provide more details about their economy and in turn about the size of the next rate cut at the FOMC meetings in November and December.

Because where until recently a 50-basis point cut was expected, a 25 basis point cut has now become more likely, and even the probability of no cut at all has now increased. As a result, markets are currently somewhat subdued.

These meetings have become critical as members are split about the next interest rate decisions

FOMC minutes

The minutes from the Federal Open Market Committee’s Sept. 17-18 meeting will also be published at 18:00 PM GMT.

The Federal Reserve's September meeting minutes should clarify the rationale behind the organization's decision to cut interest rates by 0.5 percentage points last month. Economists and investors will also be keenly observing to see whether officials expressed any concern about the U.S. economy and labor market that appear to show mixed results.

The September jobs report was substantially better than anticipated since the previous Fed meeting. The unemployment rate dropped, job growth skyrocketed, and hiring figures for the previous two months were increased. As a result, the authorities' descriptions of the American labor market and economy in the minutes might seem a little outdated however.

When will the events happen?

12:00 GMT – FOMC Member Bostic (hawk - voter)

13:15 GMT - Fed's Logan (neutral - non voter)

14:30 GMT - Fed's Goolsbee (dove - non voter)

14:30 GMT - FOMC Member Barkin Speaks (neutral - voter)

15:00 GMT – FOMC Member Williams (neutral - voter)

16:15 GMT – FOMC Member Barkin (neutral - voter)

16:30 GMT - Fed's Governor Jefferson (neutral - voter)

18:00 GMT – FOMC Meeting Minutes

21:00 GMT - Fed's Collins (neutral - non voter)

22:00 GMT – FOMC Member Daly (neutral - voter)

S&P Technical Analysis

Powell has shifted to a more circumspect tone on his part. In an early statement last week, he stated that the threats to the outlook for the economy are "two-sided" and that the US central bank is not in a rush to lower interest rates. Similar opinions have been expressed by other officials in follow-up remarks, particularly in the wake of some remarkably positive economic figures.

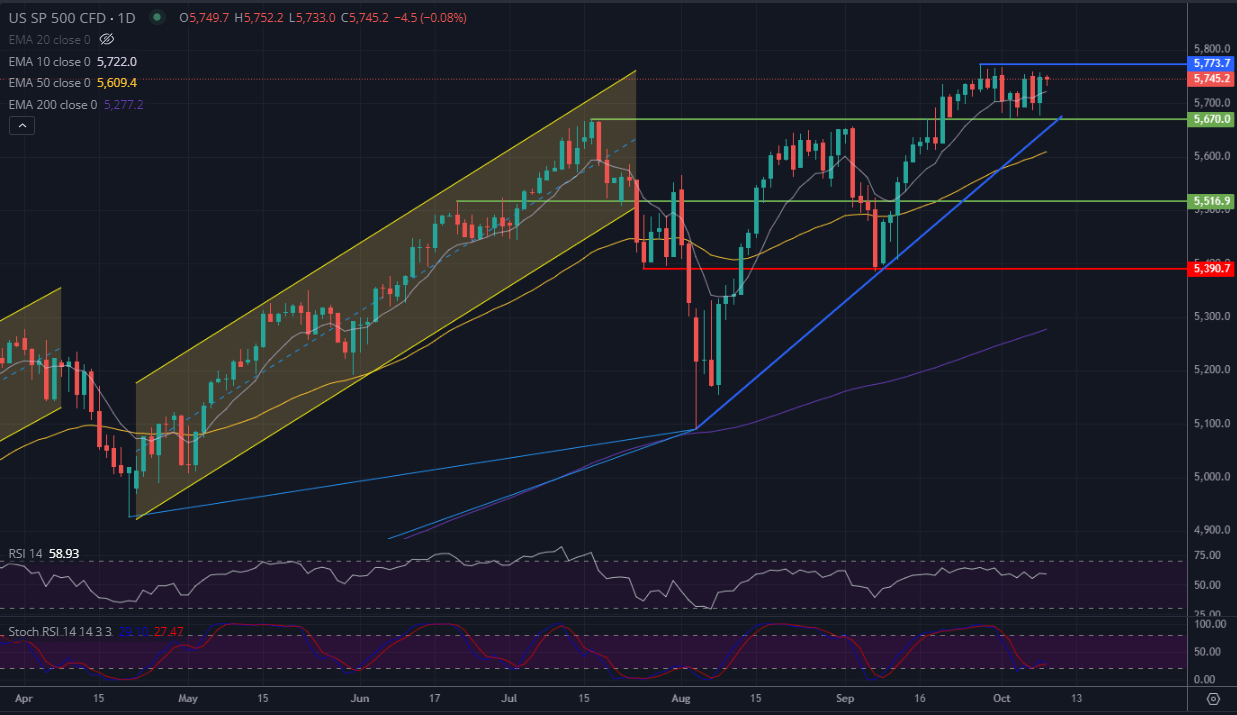

Currently the price of the S&P500 is in a consolidation phase between the 5,773 and 5,670 level. To the top we have the all time high, and to the bottom we have the high of July 2024 and the bottom of the consolidation range. Bullish indicators are the RSI which has made higher lows since August 2024, and if buying picks up then the Stochastic RSI could continue moving upwards and out from oversold areas to verify the trend. We are still far above the 50EMA which indicates that the mid term trend is not in danger down to the level of 5,600.

The to-be announced FOMC meeting minutes will have the ability to move markets. Market participants may reduce their expectations for further interest rate cuts if the central bank signals through the minutes release that it is not operating in a dovish manner and is prepared to change course. That might strengthen the currency and be bad news for bonds and stock markets.