The primary catalyst for this expected rate cut is the recent drop in inflation, which has fallen below the ECB's 2% target. September's preliminary inflation rate came in at 1.8%, the lowest level in over three years, strengthening the case for monetary easing. This shift in policy is expected to have broad implications for currencies, inflation trends, and the overall economic outlook.

Europe: Rate Cuts by the ECB Are Anticipated

This week, the ECB is expected to cut its benchmark interest rates by 0.25%, which would be the third rate cut of 2024. As the ECB shifts its focus to tackling weakening economic indicators and a cooling inflation environment, this comes after similar decreases in June and September. Even while the central bank remained hawkish at its September meeting, the most recent data has strongly supported more easing.

For the first time in more than three years, eurozone inflation fell below the ECB's 2% target in September, falling to 1.8%, according to Eurostat. Additionally, core inflation, which excludes volatile food and energy costs, decreased to 2.7%, a two-year low. As the ECB looks to boost a faltering economy, this development has cemented expectations for more aggressive policy easing.

Many analysts are now forecasting a faster rate-cutting cycle, with the deposit rate potentially falling to 3% by the end of the year, as both inflation and economic growth weaken. Market pricing indicates that October and December will both see 25 basis point drops. Additionally, the ECB is now expected to achieve its neutral rate (estimated between 2.00-2.50%) by mid-2025, six months earlier than previously anticipated, according to Deutsche Bank's updated outlook.

Potential Market Impacts:

- Equity Markets: Stock markets typically respond positively to rate cuts, as lower borrowing costs stimulate economic activity and boost corporate profits. With expectations of further cuts, European equities could benefit in the near term.

- Bond Markets: Lower interest rates lead to reduced yields, driving bond prices higher. Investors holding bonds issued during periods of higher interest rates may see their holdings become more attractive.

- Savings and Borrowing: Borrowers are set to benefit from the rate cuts, as mortgages and consumer debt become cheaper. However, savers could see lower returns on their bank deposits, as interest rates fall.

Nevertheless, rising energy prices due to geopolitical tensions in the Middle East could still pose an upside risk to inflation. If inflation rises again, the ECB may take a more cautious approach.

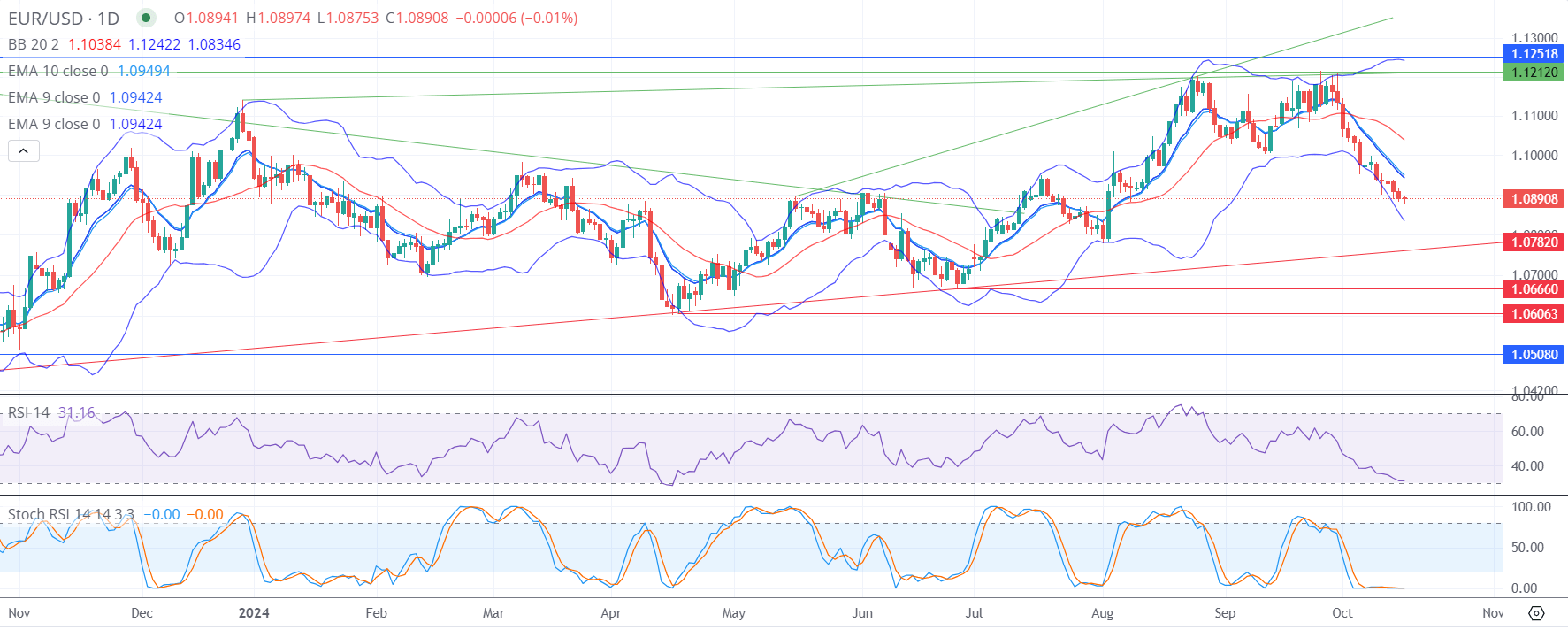

EUR/USD Technical Analysis

Talk of an ECB rate cut has hit the EUR/USD exchange rate, erasing most of the gains made since early August. However, some tentative buying has emerged above $1.09 as traders reassess the potential for a more dovish ECB.

If the ECB remains confident in its outlook for the eurozone economy or takes a hawkish tone, we could see the EUR/USD recover from its recent losses. On the downside, a close below $1.09 would negate any bullish signals and could open the door to further weakness in the pair.

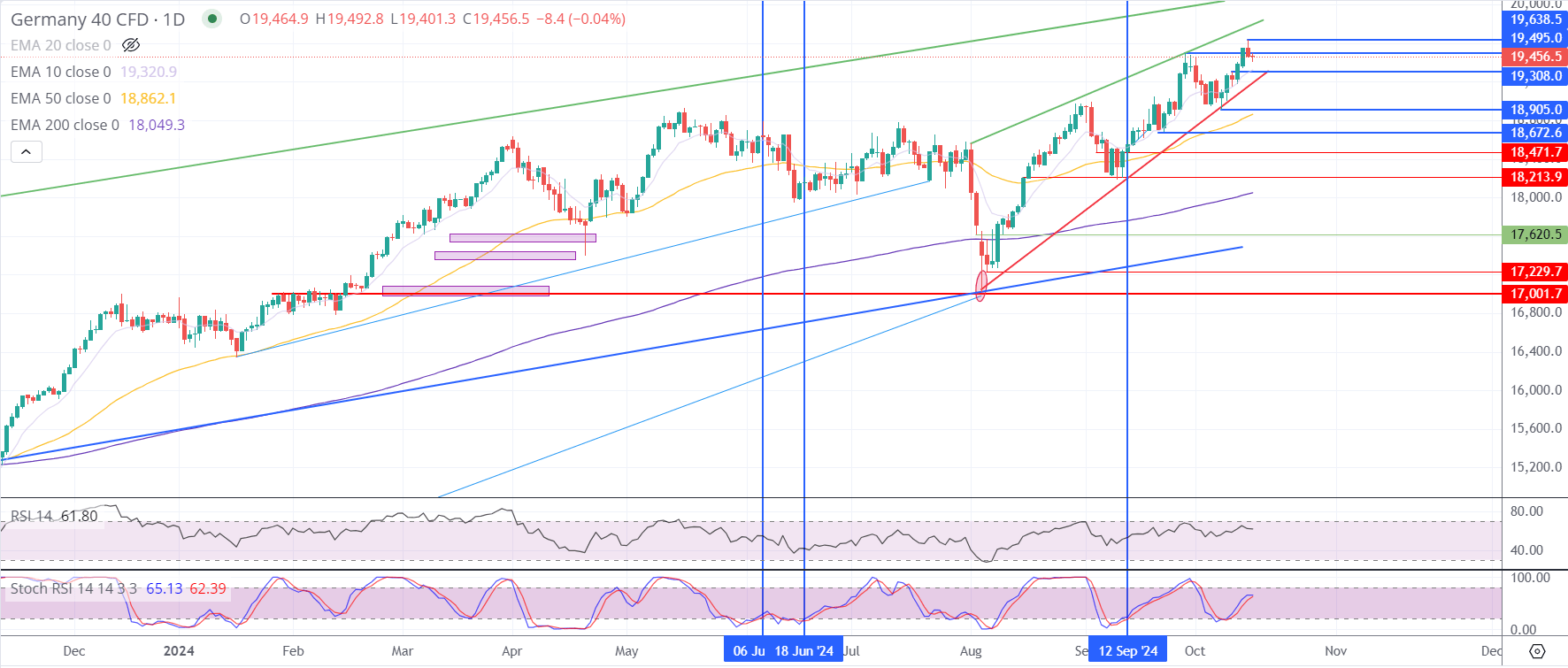

DAX Technical Analysis

The talk of ECB rate cuts also influenced the DAX index positively. The fist interest rate cut on the 6th of June had little effect on the price of the DAX. However, as optimism increased about the accuracy if the timing, the DAX did reach a series of new all-time highs 1 week after the last cut that happened on the 12th of September and continues its upward trajectory since then.

The index is currently easing off the 19,638.5 highs and is at the highs made 2 weeks ago. A recapture above the 19,495 level would generate a pro-cyclical bullish bias, potentially driving the index toward the psychological barrier at 19,800 points.

However, should the DAX fall below 19,323 points, this would invalidate the current bullish trend, prompting a possible pullback.

Asia-Pacific: An Examination of China's GDP and Economic Information

After the long awaited ECB interest rate decision on the 17th of October, attention will then focus on China’s third-quarter GDP results, which are scheduled to be released on Friday, in the Asia-Pacific area.

China's economic performance is a crucial metric for international markets, especially for commodities like oil and copper that are sensitive to growth.

China's third-quarter GDP growth is predicted to be 4.7%, below Beijing's 5% target. This would be a decrease from the first quarter's 5.3% growth, illustrating China's economy's continued difficulties in spite of government stimulus initiatives.

Other important economic metrics, including retail sales, fixed asset investment, and industrial production, will be disclosed in addition to GDP. Given that economists anticipate that third-quarter GDP may slow to 4.6%, further underscoring the need for extra stimulus measures, these data points will be widely watched for indications of further economic deterioration.

Possible Effects on International Markets:

A dismal GDP number would raise more questions about global development, especially in Europe, where export performance is heavily influenced by Chinese demand.

Commodities that are vulnerable to growth, such as copper and oil, may become more volatile since a weaker Chinese economy may result in less demand.

Conclusion

The ECB's expected rate cut will be a major focus for European markets this week, while China’s GDP data will dominate the economic narrative in the Asia-Pacific region. The implications of these events will be far-reaching, influencing currencies, equities, bonds, and commodities alike.

Investors will be watching closely for any unexpected signals from central banks and governments, particularly as economic data from the eurozone and China continue to highlight weaknesses. With major market-moving events on the horizon, volatility is likely to remain elevated in the days ahead.

Regards,

Philip J. Papageorgiou

Follw me on X (ex Twitter) for more up to date information