Netflix Q3 earnings preview

Netflix will release its Q3 earnings report on October 17 as the share price trades at an all-time high. Expectations for the quarter are EPS of $5.16 on revenue of $9.77 billion, significantly up from EPS of $3.73 and revenue of $8.5 billion in the same period last year.

The streaming giant is expected to post stronger growth than its peers as it continues to benefit from the password crackdown and ad-tiered approach.

Netflix has invested heavily in content that has performed well with global audiences and provided Netflix the opportunity to start raising prices. The company may choose to announce price increases at a later date, but they might be touted on the 17th

subscriber numbers will also be in focus. However, this is the penultimate report where subscriber figures will be included, as Netflix has said it will scrap reporting on subscribers from 2025. Netflix has seen strong subscriber growth so far this year, with Q2 figures rising by 8.05 million worldwide to 277.65 million.

Analysts broadly bullish on the stock, with the vast majority having a buy recommendation. The stock price is currently outperforming the average target price of $721. Any negative surprise could weigh on the share price.

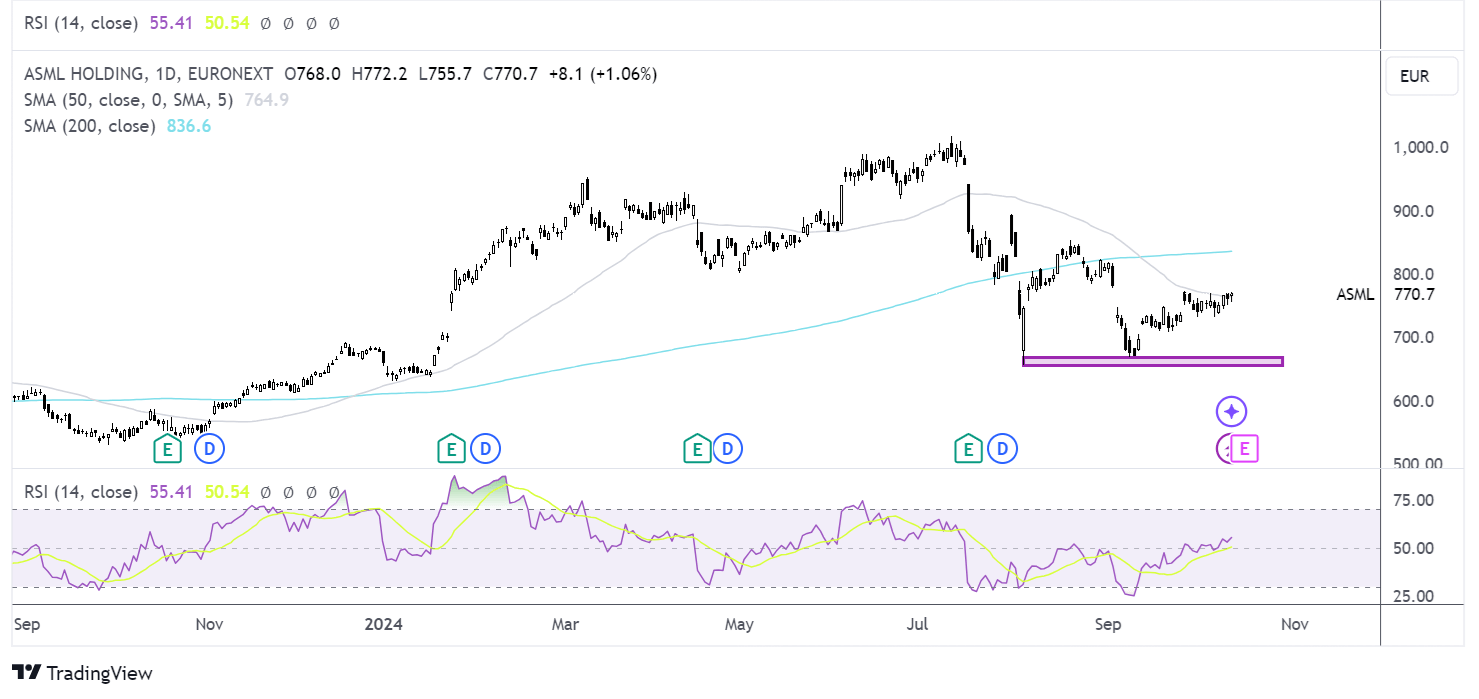

How to trade NTFLX earnings?

Netflix has been trending higher across the year, reaching a fresh all-time high of 736 on Friday. Buyers will look to extend gains towards 750 and new highs. Minor support can be seen at 700, with a break below here negating the near-term uptrend and opening the door to 660, the September low.

Goldman Sachs Q3 earnings preview

Goldman Sachs will release earnings on October 15th as the share price attempts to break fresh record highs. Earnings come after several banks reported on Fridays to kick off earnings season, with JP Morgan and Wells Fargo beating expectations.

Goldman Sachs is expected to report EPS of $7.31 on revenue of $11.79 billion. The results come from Goldman Sachs' posted profits, which soared 150% compared to a year ago in the second quarter as its investment banking surged. CEO David Solomon said we are in the early innings of capital markets and M and a recovery, which bodes well for the investment bank's outlook.

Client activity and market volatility were decent in Q3. This, combined with the likelihood of a soft landing for the US economy, cooling inflation, and easing monetary policy, could put Goldman Sachs on track for a solid Q3.

Mergers and acquisitions in Q3 markedly improved after a subdued few years prior. Deal volume and value are all expected to provide tailwinds for the firm. Meanwhile, net interest income is not likely to have been impacted much by the Federal Reserve cutting interest rates by 50 basis points.

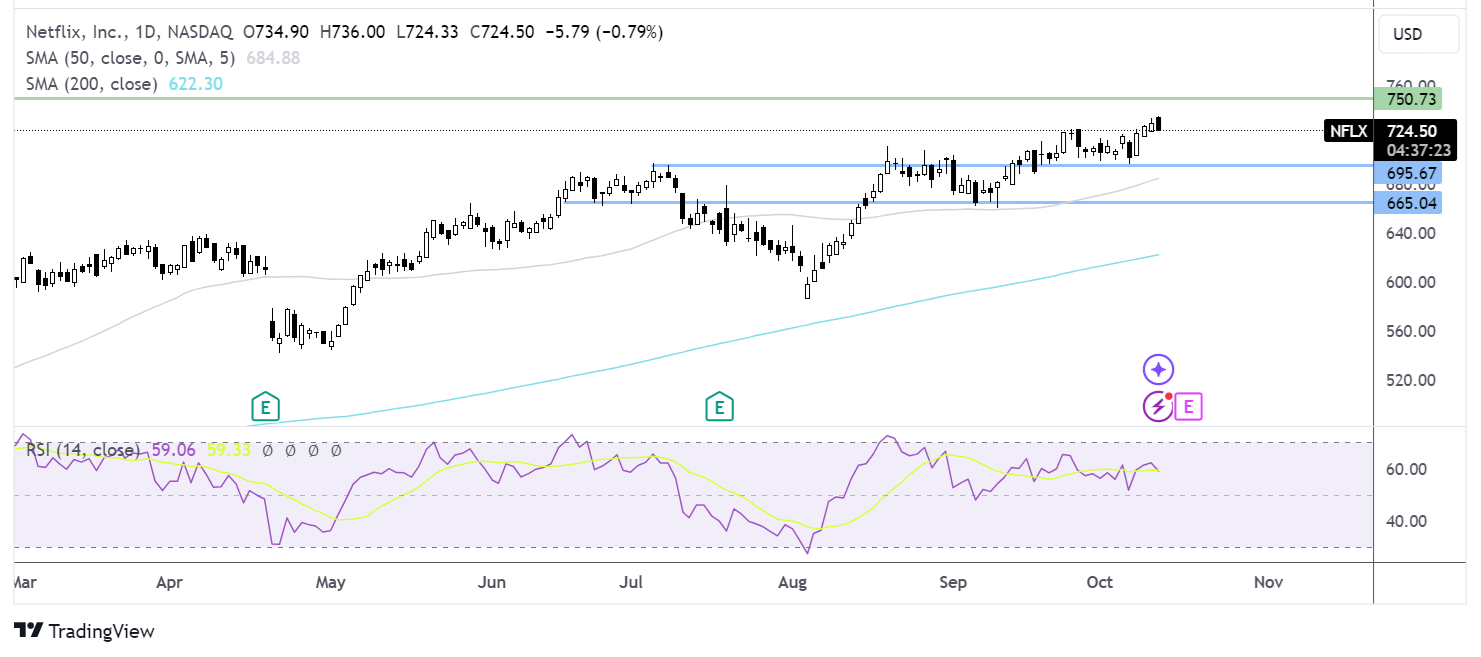

How to trade GS earnings?

Goldman Sachs recovered firmly from its August and September lows but has failed to rise above the 510-514 resistance zone to reach fresh all-time highs. A rise above this zone opens the door to clear skies and fresh record levels. Failure to rise above this zone could see the price retest to 485, the October low, and below here, 458, the September low, comes into play.

ASML earnings preview

ASML is set to report its latest quarterly results on October 16. ASML is a semiconductor equipment company, meaning it is an essential supplier key to making the most advanced AI chips for training large language models. In other words, without ASML’s machines, there are no AI chips.

ASML considers 2024 a transition year and doesn't expect much revenue growth as it gears up to sell its latest ultraviolet lithography machinery, EUV, the necessary technology for printing the most advanced chips. However, ASML expects 2025 to be a big year.

Q2 net sales were €6.24 billion, down from €6.9 billion in the previous quarter. In 2023, the company's net income declined to €1.58 billion from €1.94 billion the previous year.

ASML’s technology means it's well placed to benefit from longer-term megatrends such as AI; however, some of its key customers are facing their own challenges. Investors will look for clues over next year's outlook when growth is expected to accelerate.

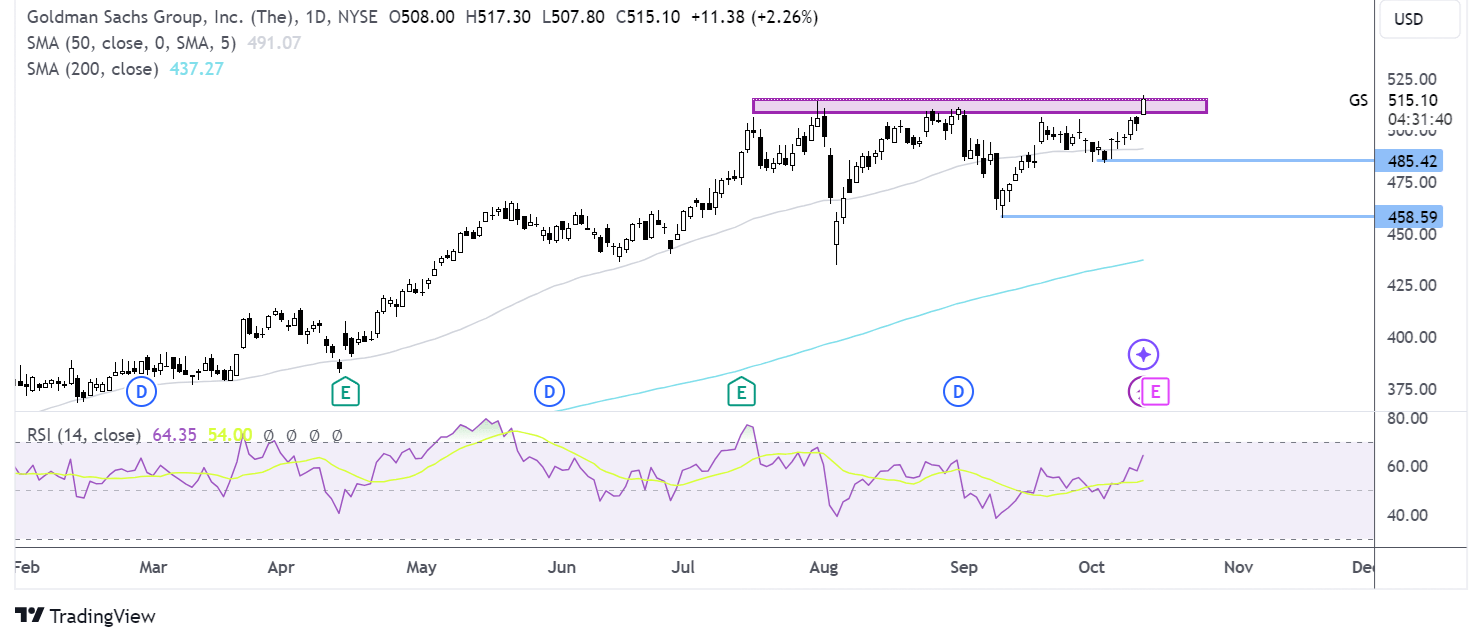

How to trade ASML earnings?

ASML Rose to a record high of 1000 in early July before falling lower, forming a series of lower highs. More recently, the price has recovered from the September low of 679 and is testing resistance at the 50 SMA at 770. A rise above her exposes the 200 SMA at 835. Above here, buyers could gain traction and look back up towards record high levels.

On the downside, support can be seen at the 660 -670 zone. Below 630, the 2024 low comes into play.