US tech stocks fell sharply last week, with the Nasdaq falling 2.5%, extending losses of 3.65% in the previous week. Underwhelming results from Tesla and Alphabet sparked the selloff, highlighting how high the bar had been set for magnificent seven earnings as these stocks helped to drive US indices to record highs this year.

Earnings from Apple, Amazon, Meta, and Microsoft could drive sentiment this week, in addition to the FOMC rate decision and NFP report.

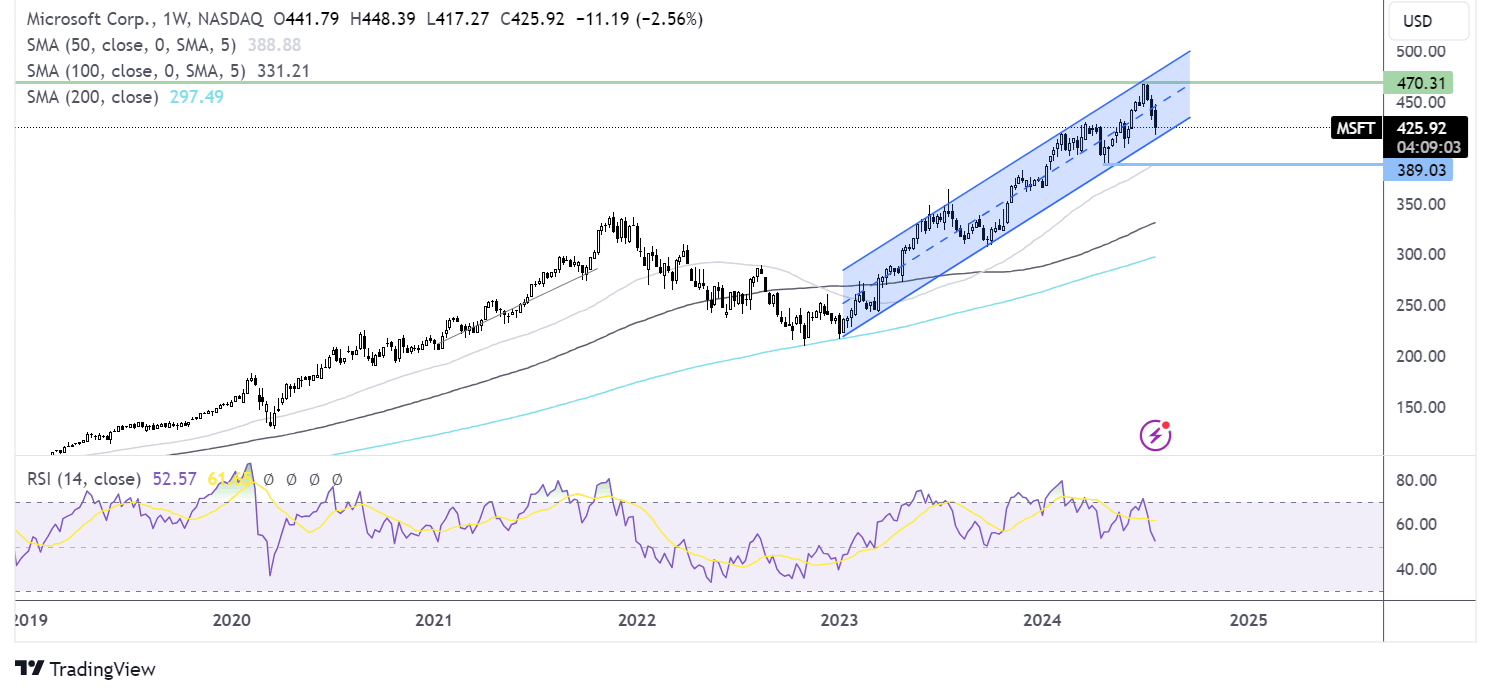

Microsoft Q4 earnings preview

Microsoft is set to report fiscal Q4 earnings after the close on July 30. Expectations are EPS of $2.93 on revenue of $64.38 billion. This marks a 9.3% and 14.6% increase, respectively, compared to last year's period.

Beyond the headline figures, investors will be watching for sustained growth in Microsoft's cloud platform Azure, which has been fueling sales and earnings growth in previous quarters.

Azure has benefited from the AI boom as customers train and run AI workloads through the cloud platform. Cloud revenue is expected to reach $37.2 billion.

Furthermore, investors will also be watching closely commentary on AI as the firm has established itself as an early leader in the sector.

The share price has traded up 14% so far this year.

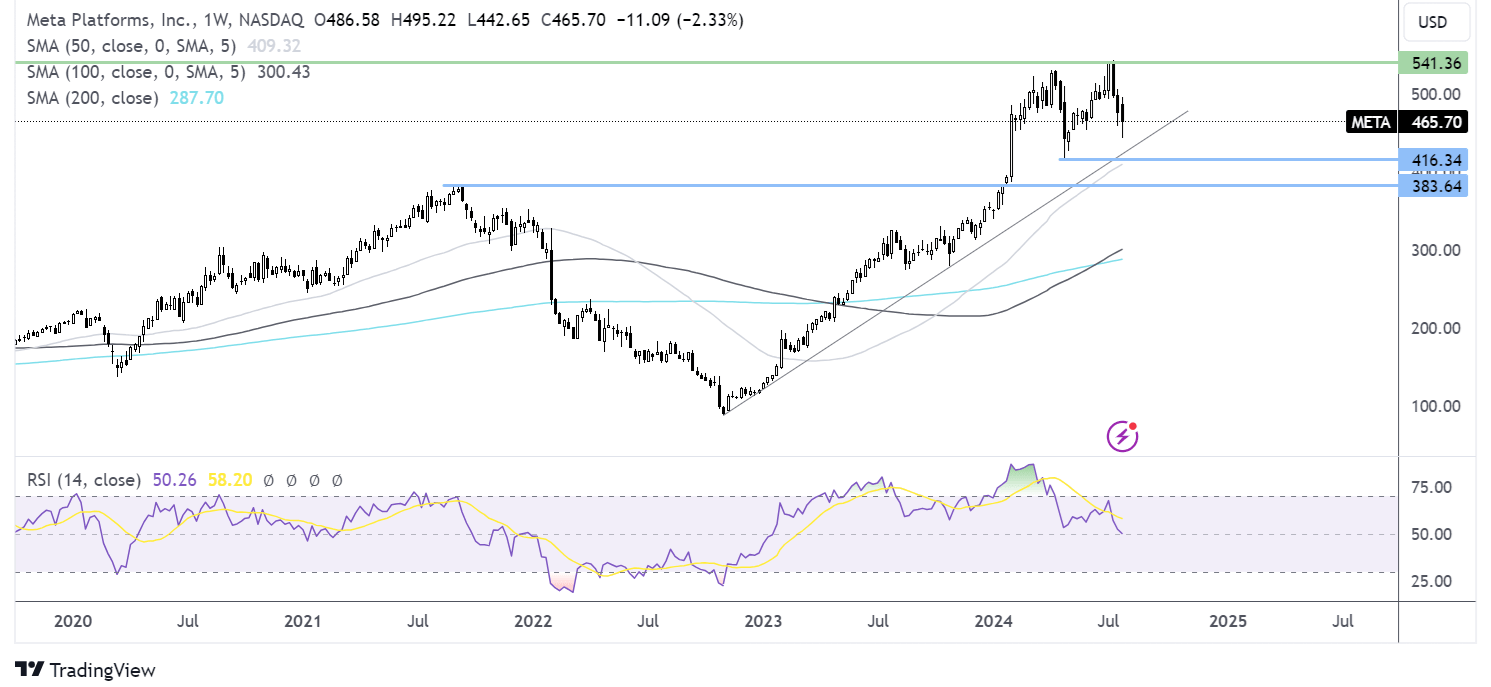

Meta Q2 earnings preview

Meta will report its second-quarter earnings after the market closes on Wednesday, July 31. Wall Street expects an EPS of $4.70 and a revenue of 38.29 billion.

In the previous quarter's report, Meta warned that total expenses in 2024 could be between $96 and $99 billion—more than previously expected owing to higher legal and infrastructure investment to support the ramping up of AI. The market will be keen to see if there are any further increases to expense projections and the impact of AI integration.

Meta has emphasised that AI integration in its products contributed to strong Q1 results. Investors will seek an update on how this could continue improving user engagement.

Elsewhere, advertising performance will also be in focus. Advertising revenues increased by a solid 27% in Q1, and investors will hope for a similar performance in Q2.

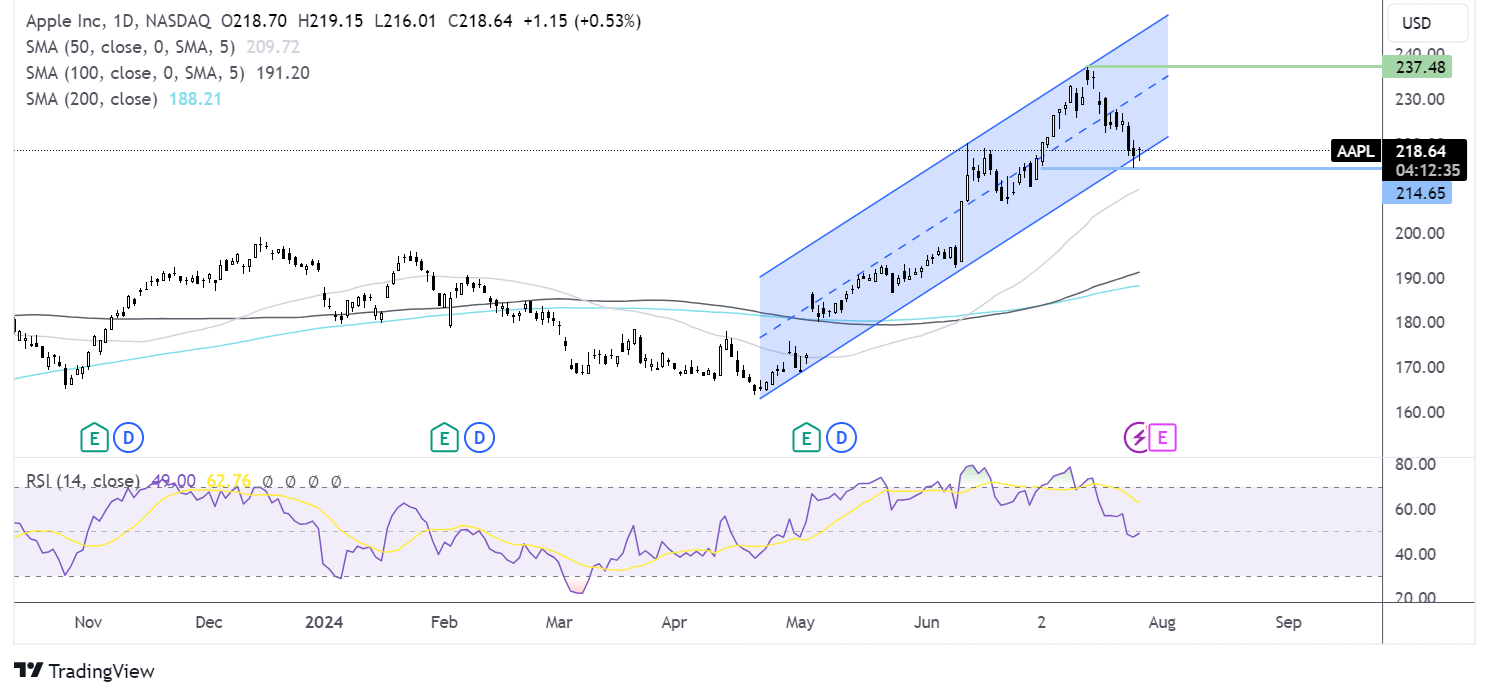

Apple Q3 earnings preview

Apple will release Q3 earnings on August 1, after the market closes. Wall Street expects EPS of $1.34 on revenue of $84.3 billion.

iPhone revenue is still the bellwether for the Apple business, making up the majority of total revenue. iPhone sales have seen headwinds amid slowing global cycles and greater competition in China, and attention will be on whether those headwinds are starting to evaporate. The latest figures from China suggest not, as Apple smartphone shipments to China dropped 6.7%. IPhone sales are expected to fall again this quarter to $37.7 billion from $45.96 billion in the previous quarter.

Gross margins will also be under the spotlight amid a steady upward trajectory over the past few years, lifted as the firm has bought more of its supply chain in-house and grown its IT services businesses. The service business is anticipated to continue its strong performance thanks to higher App Store sales and rising subscription services.

AI developments will also be closely watched, with any updates on Apple's new generative AI software, Apple Intelligence, also closely watched. Apple intelligence is expected to drive a device upgrade cycle that could boost iPhone and iPad sales.

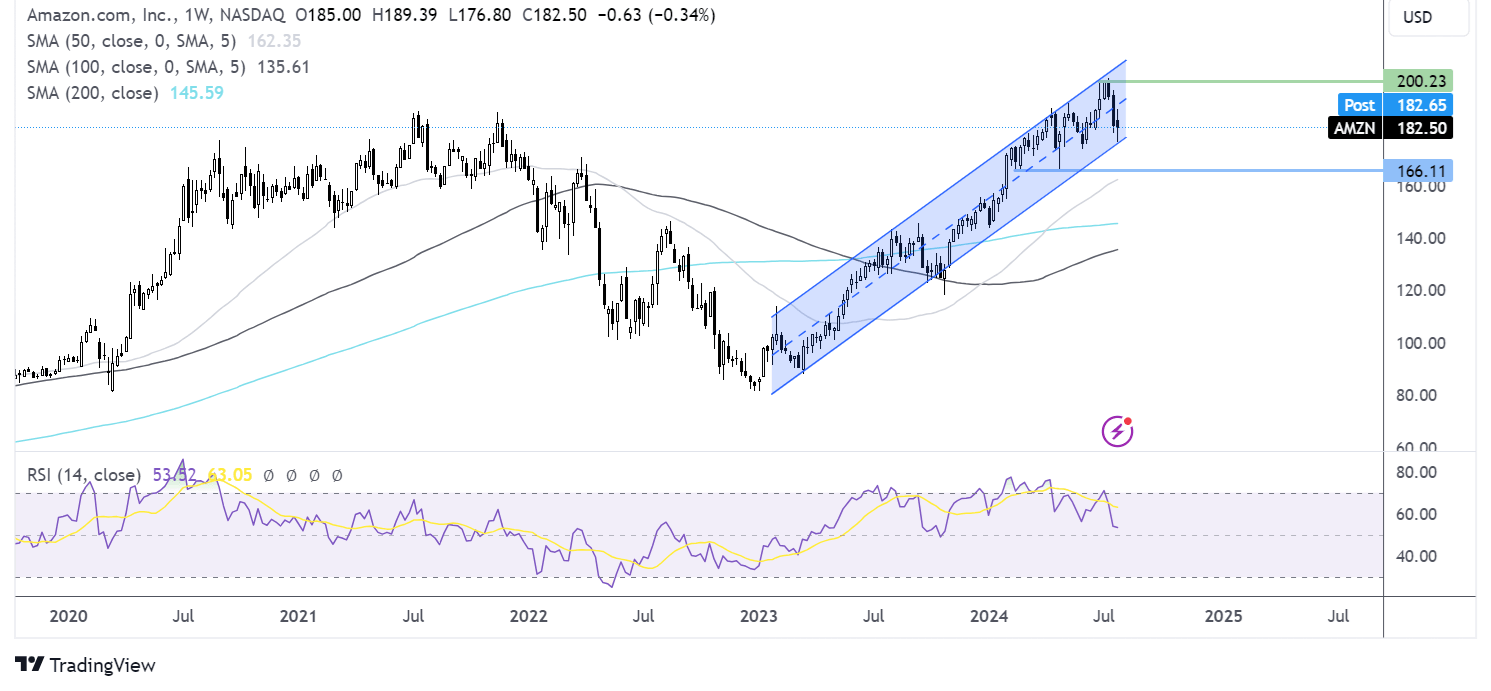

Amazon Q2 earnings preview

Amazon is scheduled to release earnings after the market closes on August 1. Wall Street expects EPS of $1.01 and revenue of $148.54 billion, while Amazon guides for 144.00 billion to $149.00 billion.

The results come as the share price has had a strong start to the year, rising 21% so far this year. EBIT is expected to increase 17% in Q2 and 10% in Q3, boosted by improved profitability in Norther America and accelerated growth of Amazon Web Services.

E-commerce and advertising had a strong showing in Q1, which investors will be keen to see continue this quarter.

While the chart shows that the long-term trend is up, in the near term, the share price has corrected from its ATH, bringing the share price to the July low and the RSI into oversold territory. Bulls, respecting the long-term trend, could look to retest the ATH at 200. Meanwhile, sellers could look to break out below the rising channel and monthly low below 176 to create a lower low.