Apple Glow Time event

Apple is due to launch the highly anticipated iPhone 16 at its annual Glow Time event on Monday, September 9th, in addition to a 10th anniversary edition of its Apple Watch and AirPods. Historically, Apple's product launch events have provoked a sell-the-news reaction, and this event could follow a similar pattern.

CEO Tim Cook is expected to unveil four new iPhone models. The focus will also be on the rollout of Apple's intelligence AI platform for iOS. As part of this, Siri, the Voice Assistant, is expected to get an update from generative AI, marking its biggest upgrade since its release 14 years ago.

However, it's unclear if the update will be enough to spark a significant upgrade cycle among iPhone owners, which is what the market will be watching for to spark a bullish reaction to the event.

Rising concerns over global smartphone demand and increasing competition could limit the upside potential for Apple stock in the near term.

Apple's share price has remained relatively unchanged in the run-up to the event, but it is up 16% year to date, so much of the news surrounding the new product lineup could already be priced in.

With a market cap of $3.45 trillion, Apple is the most valuable company on the US Stock Exchange.

How to trade the Apple event?

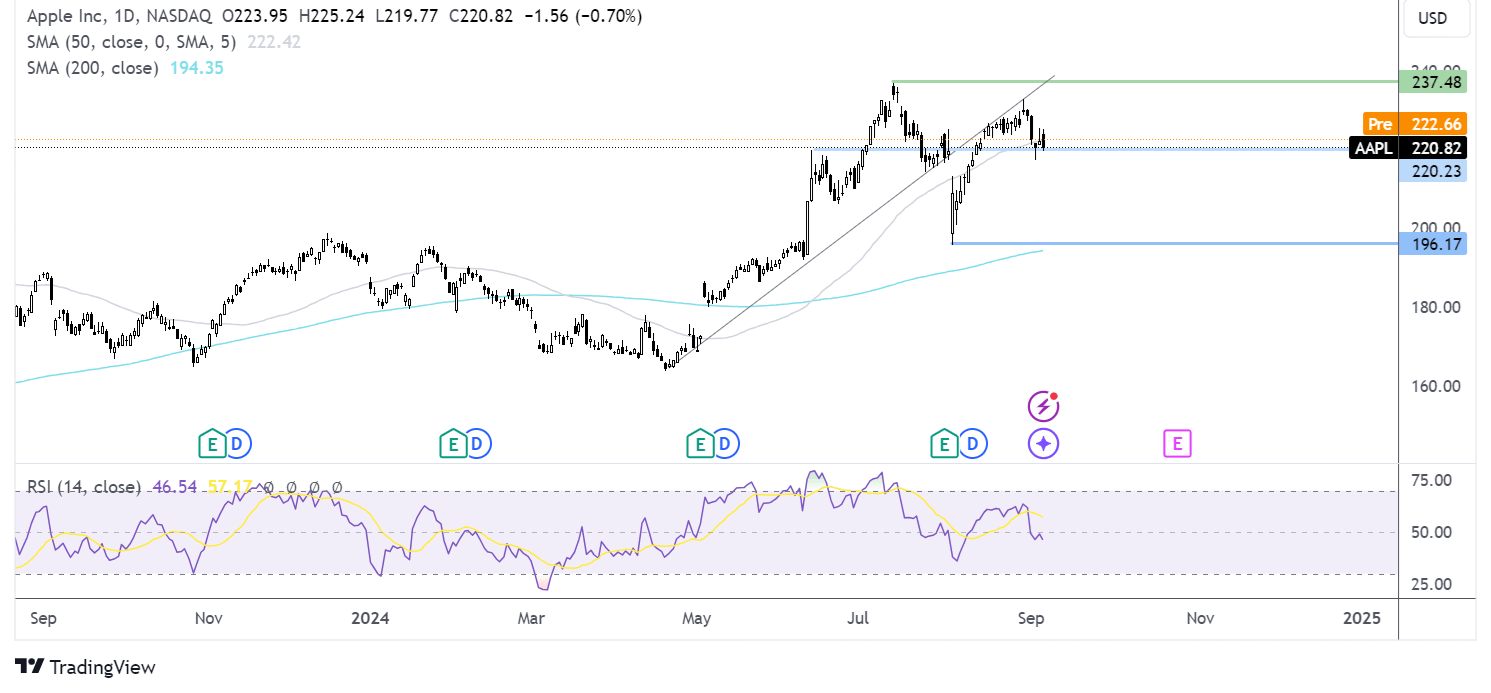

Apple recovered from the $195 August low, rising above the 50 SMA, but ran into resistance at the rising trendline resistance at $232. The price has corrected lower to test support at $220, the June high and the 50 SMA. A break below here could prompt a deeper decline towards $196.

Oracle Q1 preview

The cloud and software leader is due to report fiscal Q1 earnings after the US market closes today, Monday, September 9. Thanks to the broad strength of its cloud business, Oracle is expected to report upbeat top and bottom-line growth and provide solid guidance.

Wall Street expects EPS of $1.33, up 11.8% from the year ago. Meanwhile, revenue is projected to rise 5.9% unexpectedly to $13.24 billion.

Oracle's cloud services and license support segment is expected to be a primary driver of growth, benefiting from rising demand for cloud computing solutions, particularly in the AI space.

Given Oracle's strong cloud business and partnership with Nvidia and Microsoft-backed Open-AI, the firm is well-positioned to benefit from positive momentum in the AI trade.

Adding to the excitement about the stock, Oracle will also host its annual CloudWorld consumer conference later this week. Attention is expected to be focused on AI-related contract announcements.

The share price has traded up more than 30% this year due to its clear competitive advantage.

How to trade ORCL earnings?

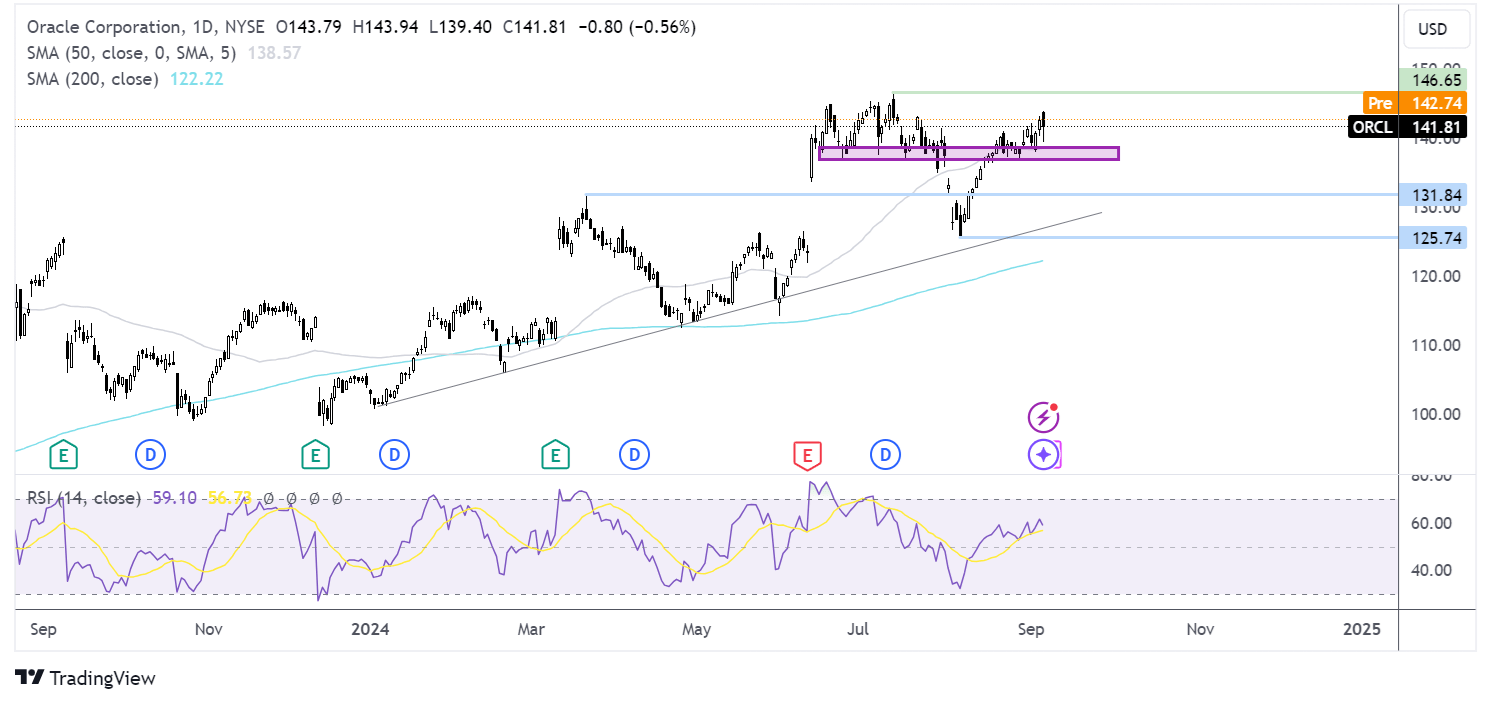

Oracle trades above its rising trendline and upward-sloping 200 SMA. The price recovered from the $125 August low, rising back above the 50 SMA to a 2-month high of 144 last week.

Buyers supported will look to extend the bullish trend towards 146.60 and fresh record highs.

Immediate support is at the 50 SMA at $138-$134 zone. Below here, 132, the March high comes into play ahead of $125 and the August low.

GameStop Q2 earnings preview

GameStop is due to report earnings after the closing bell on Tuesday, September 10, and Wall Street expects lower revenue and a slightly larger net loss than Q2 of 2023.

Revenue is expected to drop to $900 million from $1.16 billion in the same quarter a year ago, and the video game retailer is forecast to post a loss of $5.3 million, up from $2.8 million in the second quarter of last year but significantly smaller than the $32.3 loss million posted in Q1.

Comparable store sales increased over 2% in Q2 last year, and expectations are for this key metric to drop 23% when the figures are released on Tuesday. This would align with several retailers, which have reported lower spending on discretionary items in recent quarters as households face higher prices for essential items.

The results come as the frenzy surrounding meme stocks, which was reignited earlier this year, has fizzled out. The meme stock trend emerged in 2021 when stocks became popular with investors through social media and specifically targeted companies that were heavily shorted.

The return of Roaring Kitty, an influential trader, to social media fuelled a resurgence in May. Other names, such as AMC Entertainment and BlackBerry, also saw surges in trading activity.

The GameStop share price spiked in early June, but that has fizzled out, and the stock is up 28% year to date.

How to trade GME earnings

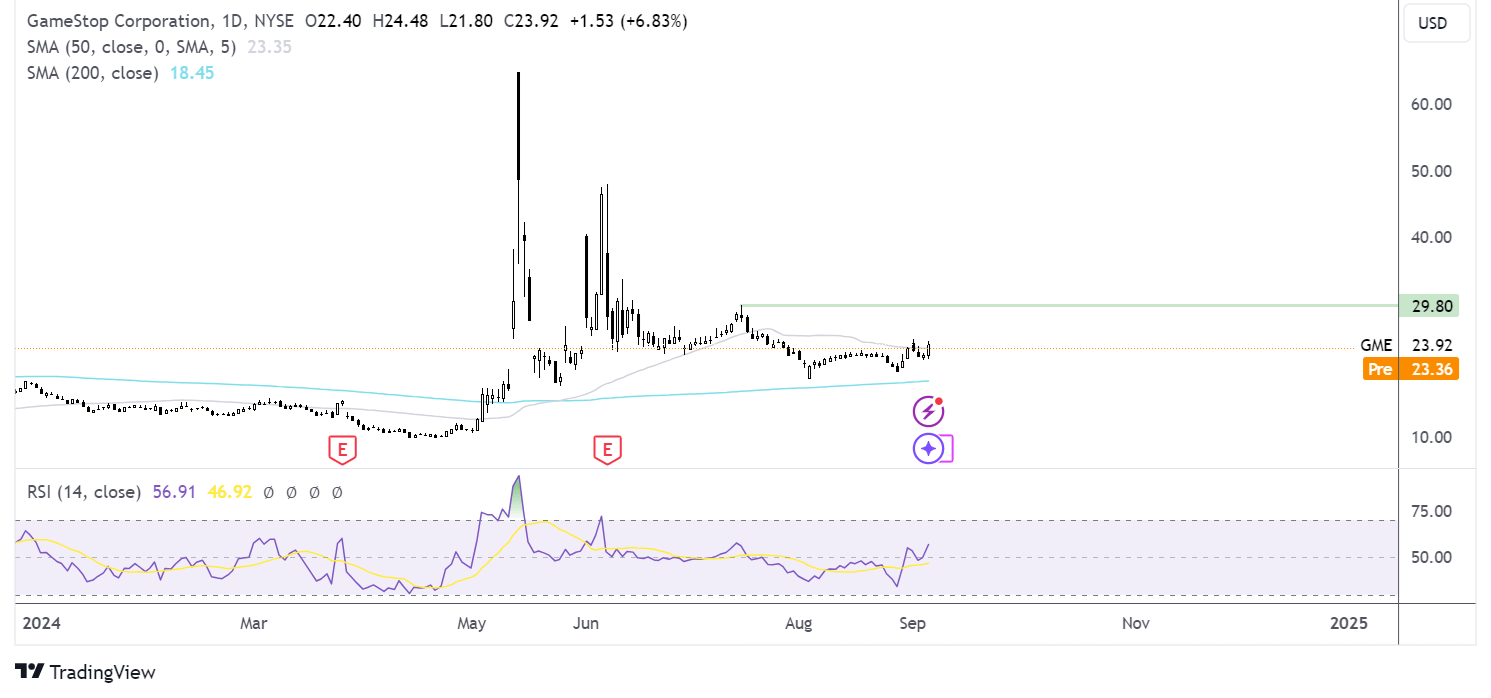

After spiking to a high of 64.80 in May, the share price volatility has calmed notably in the second half of the year. The price is being supported by a gently rising 200 SMA and is testing the resistance of the 50 SMA.

Buyers will look to rise above the 50 SMA to bring 29.70, the July high, into play.

On the downside, the 200 SMA at 18.45 acts as key support. The price has traded above the 200 SMA since May, and a break below here could see more downside.