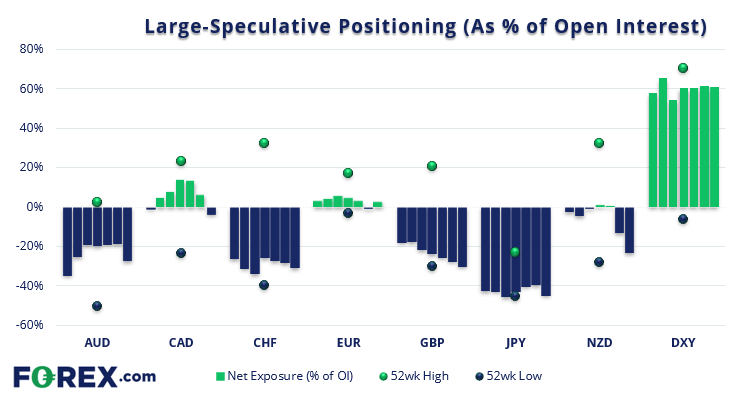

As of Tuesday the 10th of May:

- Large speculators flipped to net-long exposure on euro futures

- Traders flipped to net-short exposure on Canadian dollar futures (all three commodity FX majors are now net-short)

- Bearish exposure to Australian dollar futures increased by 13.2k contracts

- Traders were their most bearish on British pound futures since September 2019

This content will only appear on Forex websites!

Read our guide on how to interpret the weekly COT report

This content will only appear on Forex websites!

Read our guide on how to interpret the weekly COT report

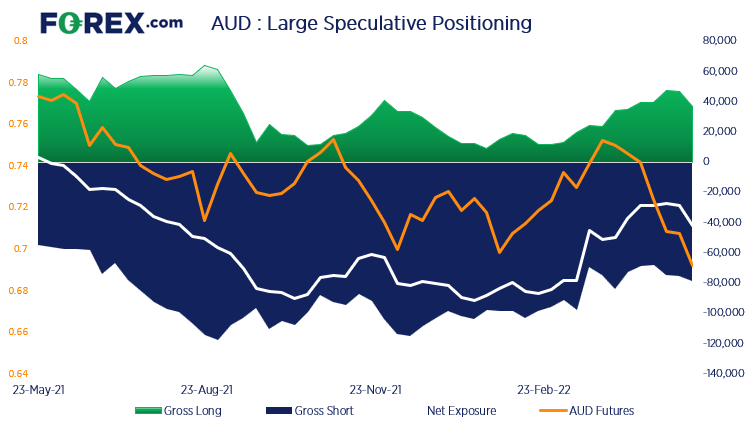

AUD futures:

Large speculators increased their net-short exposure to AUD futures by 13.2k contracts last week, which is its largest weekly increase for longs this year. 10.1l of those contracts were longs being trimmed whilst 3.1k new short contracts were added. So we’re now left wondering if we saw a cycle trough on et-short exposure two weeks ago.

But if we look at commodity FX more broadly, traders are now net-short on AUD, CAD and NZD. So we are bracing ourselves for further losses against the US dollar in general.

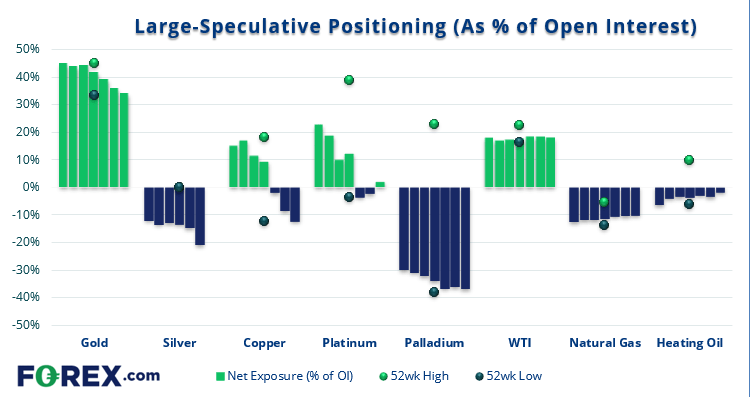

As of Tuesday the 10th of May:

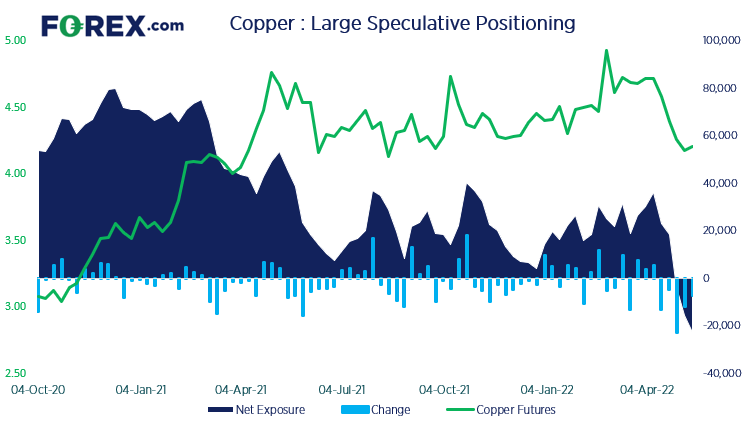

- Metals markets continue to get hammered, with either a decrease in net-long or increase of net-short exposure

- Copper futures were net-short for a third consecutive week and rose to the most bearish level since April 2020

- Net-long exposure to gold fell for a fourth consecutive week

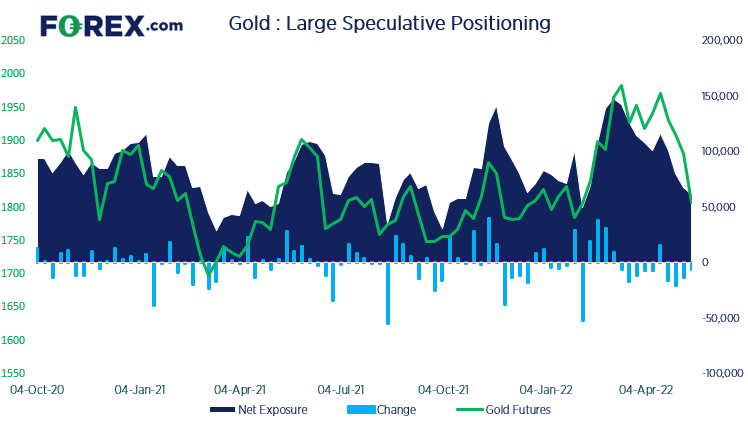

Gold futures:

The fall in gold has been accompanied with net-long exposure to gold futures falling for four consecutive weeks. Gross shorts among large speculators have risen to their most bearish level since late February and gross longs to their least bullish since mid February.

Spot gold prices traded briefly below 1800 last week and it remains a key level to monitor, as a break beneath it invalidates the trend support level from the March 2020 low.

Copper futures:

Copper futures fell to their lowest level since September last week before finding support just above $4.00. Traders flipped to net-short exposure

Like gold, the sharp declines have been accompanied with a combination of longs being closed and shorts being initiated. The lockdowns across parts of China have been a key driver for the selloff in such commodities, although we noted that reports state that Shanghai will reopen malls, supermarkets and restaurants from today.

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.