Key Events

- Tight US Election Reports

- Ongoing Geopolitical Conflicts

- US Retail Sales (Thursday)

- Japanese National Core CPI (Friday)

- Technical Analysis: USDJPY, XAGUSD

JPY Outlook

The recent rebound in USDJPY has been bolstered by Japan’s new prime minister signaling support for continued monetary easing, alongside positive U.S. economic data suggesting a less aggressive rate cut cycle. With Japanese elections approaching on October 27th, the likelihood of a rate hike at the Bank of Japan's October 31st meeting is decreasing, weakening the JPY trend.

Silver Outlook

In tandem with the Gold rally in the midst of critical market uncertainties ahead of US elections and ceasefire hopes, Silver remains on track within the borders of its primary uptrend. Silver is eyeing new 2024 highs following the firm breakout above the 33-resistance barrier.

Technical Analysis

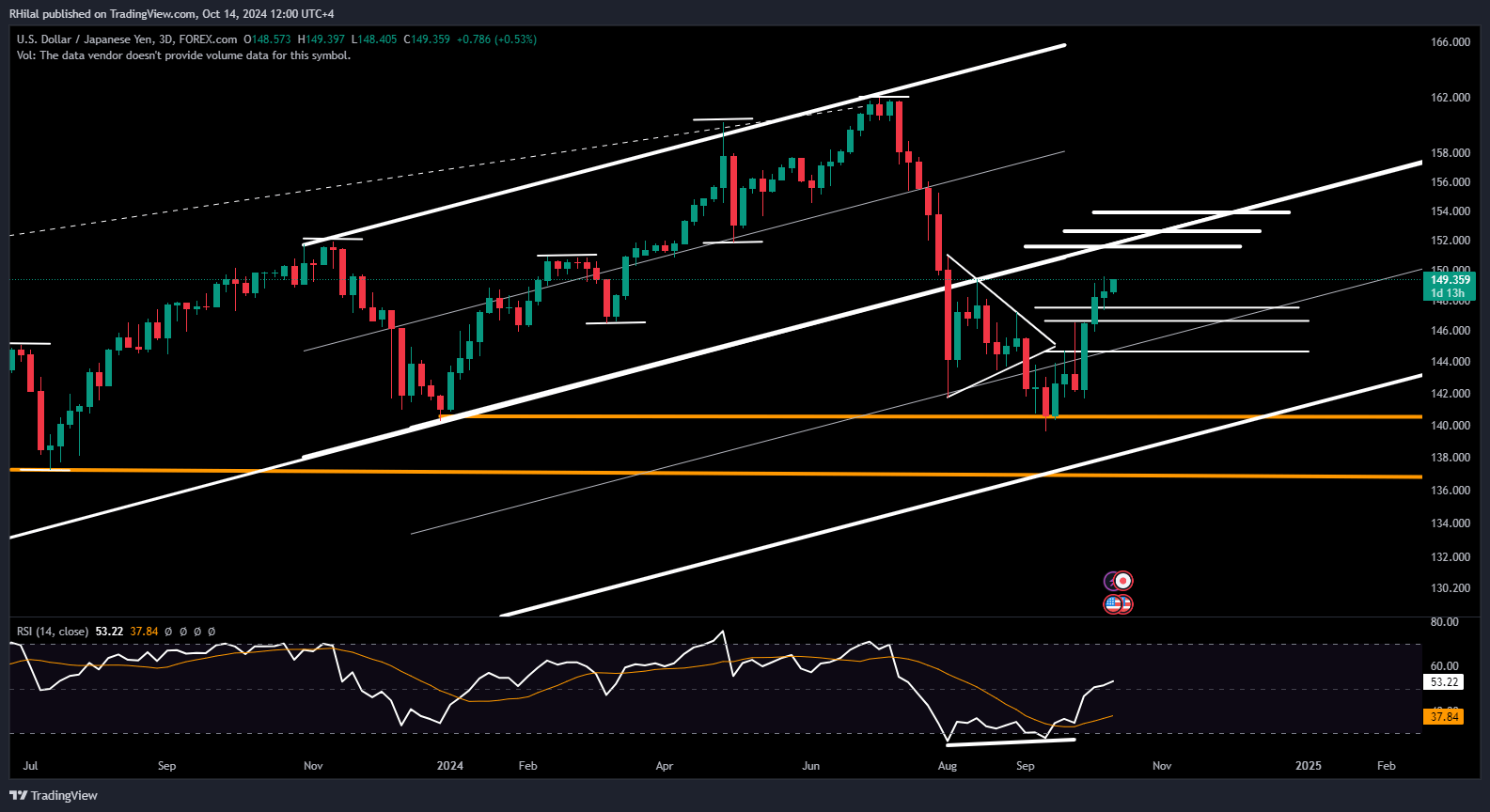

USDJPY Forecast: 3Day Time Frame – Log Scale

Source: Tradingview

In line with the U.S. Dollar Index (DXY) recovery from December 2023 lows, USDJPY has respected the 140-support zone from December and is hovering just below the 150 level. A close above 150 could trigger a bullish continuation toward resistance at 151.30 and 152.30, aligning with the trendline formed from consecutive lows between January 2023 and 2024.

The 3-day Relative Strength Index (RSI) above 50 supports this bullish outlook, with an eventual alignment with 154 if USDJPY closes above 152. On the downside, any drop is expected to find support between 147.60 and 146.50. A deeper correction could test the 144 zone, before potentially shifting the chart toward a bearish/neutral bias.

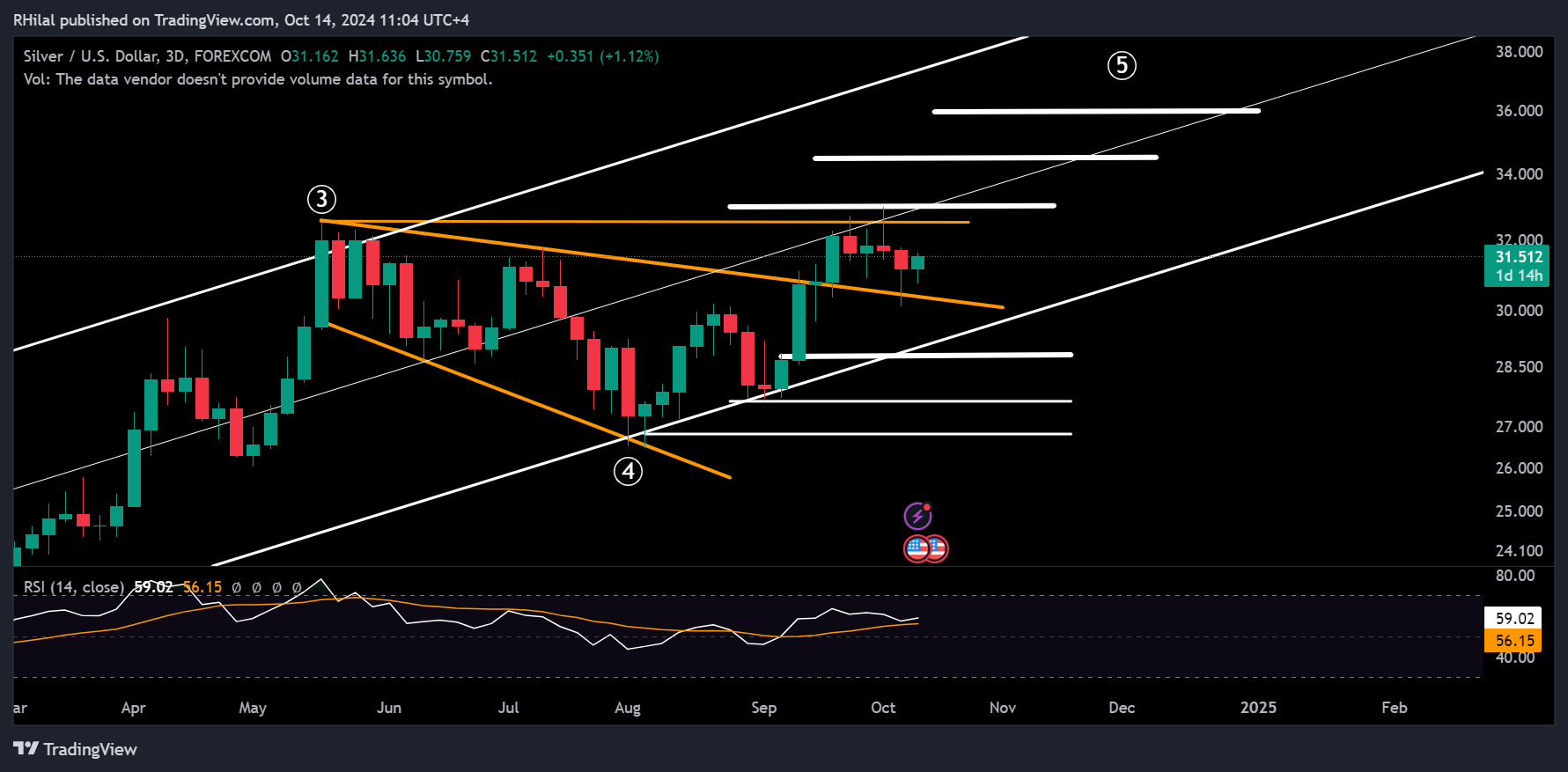

Silver Forecast: 3Day Time Frame – Log Scale

Source: Tradingview

Silver has retested the upper boundary of its expanding consolidation pattern from May to September 2024, confirming a bullish breakout. Respecting its primary uptrend and benefiting from its positive correlation with gold, silver remains poised for further gains.

Bullish Scenario: A break above the 2024 high of 33 could extend the uptrend toward 34.60 and 36.20.

Bearish/Corrective Scenario: a close below the 30-ground can extend a bearish correction towards potential support levels 28.80, 27.80, and 26.80.

--- Written by Razan Hilal, CMT – on X: @Rh_waves