USD/JPY Talking Points:

- Expectations for US rate cuts have been moderating leading some to tie the rally in USD/JPY to a return of the carry trade.

- I was looking for pullback in USD/JPY for much of last month as a falling wedge had built even with heavy expectations for US rate cuts. But I remain of the mind that much of the bullish drive is short cover after a massive sell-off appeared in July. I stand ready to be wrong, however, and the 150-151.95 zone is a big area of interest in longer-term themes.

- I’ll be looking into these setups in the weekly webinar on Tuesday. Click here for registration information.

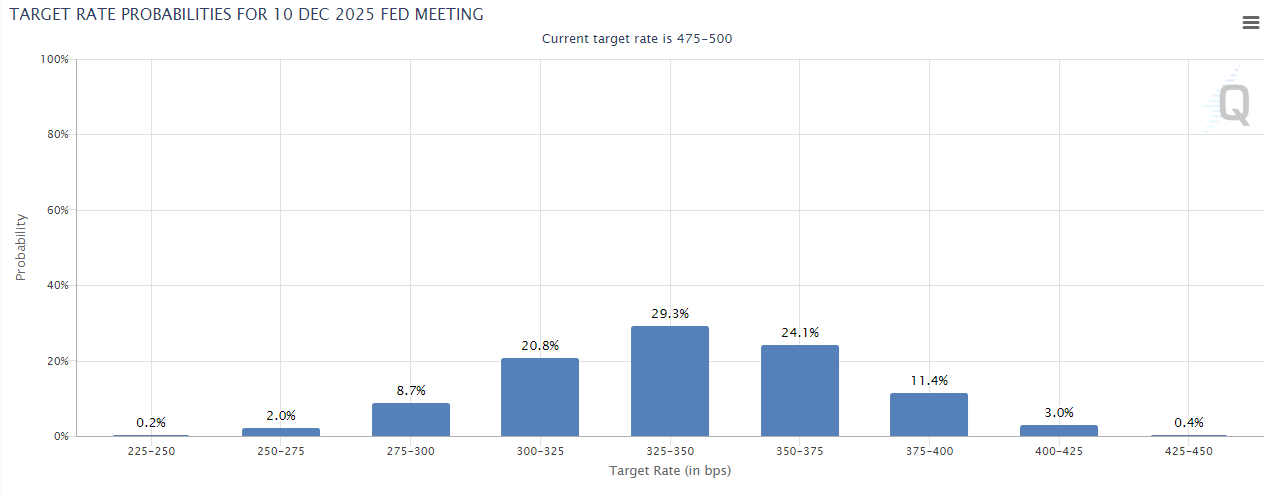

While US rate cuts have been moderating and 10-year Treasury yields rising since the Fed cut rates, expectations are still heavily dovish around the FOMC. As of this writing the central expectation and mode of expectation for December of 2025 is for another 150 bps of softening, with a current 61% probability of at least that much in rate cuts.

Rate Probabilities to December 2025

Chart prepared by James Stanley; data derived from CME Fedwatch

Chart prepared by James Stanley; data derived from CME Fedwatch

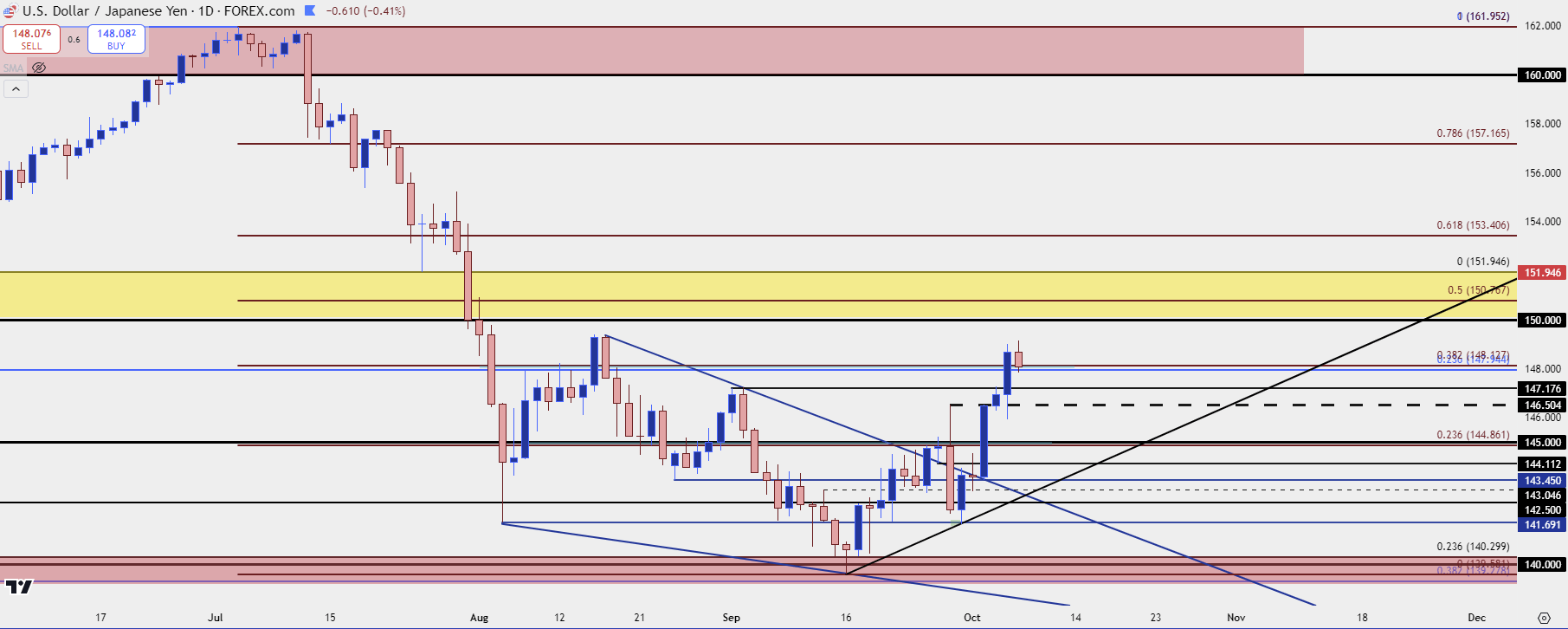

USD/JPY Bears Had Strong Motive For Continuation, but…

I had looked at this earlier in September as a major zone of long-term support was coming into play and as RSI divergence had begun to build. USD/JPY even pushed below the 140.00 level temporarily but couldn’t find selling pressure as the pair pulled back. And then when the Fed cut rates, reducing the rate divergence between the US and Japan, the pair merely made a higher-low while continuing to work within a falling wedge formation.

Last week saw the US Dollar and USD/JPY breakout of falling wedges, and now we’re hearing about the possibility of the carry trade returning. But, to me, that doesn’t make a lot of sense as the wide expectation is for the Fed to continue cutting rates, just at a slower pace than what was expected before the Friday NFP report.

From that perspective, it seems that what we’re seeing now is more of a short-cover theme after the 2,000+ pip sell-off stalled last month at the 140.00 handle.

At this point, we’ve retraced 38.2% of the sell-off move from the July high to the September low.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

The Friday Election Bar

One telling item, in my opinion, was the 400+ pip peak to trough move on the back of Japanese elections on the Friday before last. It doesn’t seem that there’s a lot of hawkish indication coming from that election yet the pair still showed a massive move in a short period of time.

That move even ran into last week’s open, all the way until 141.69 came into play which was the August 5th swing low.

But, this very well may have been driven by that longer-term carry unwind theme as longer-term traders decided to take profit on the prospect of change after the pair had run up to 146.50. Bulls ultimately prevailed after holding the higher-low but this also speaks to the possibility of longer-term carry unwind potential, even if the Fed is expected to cut at a slower pace.

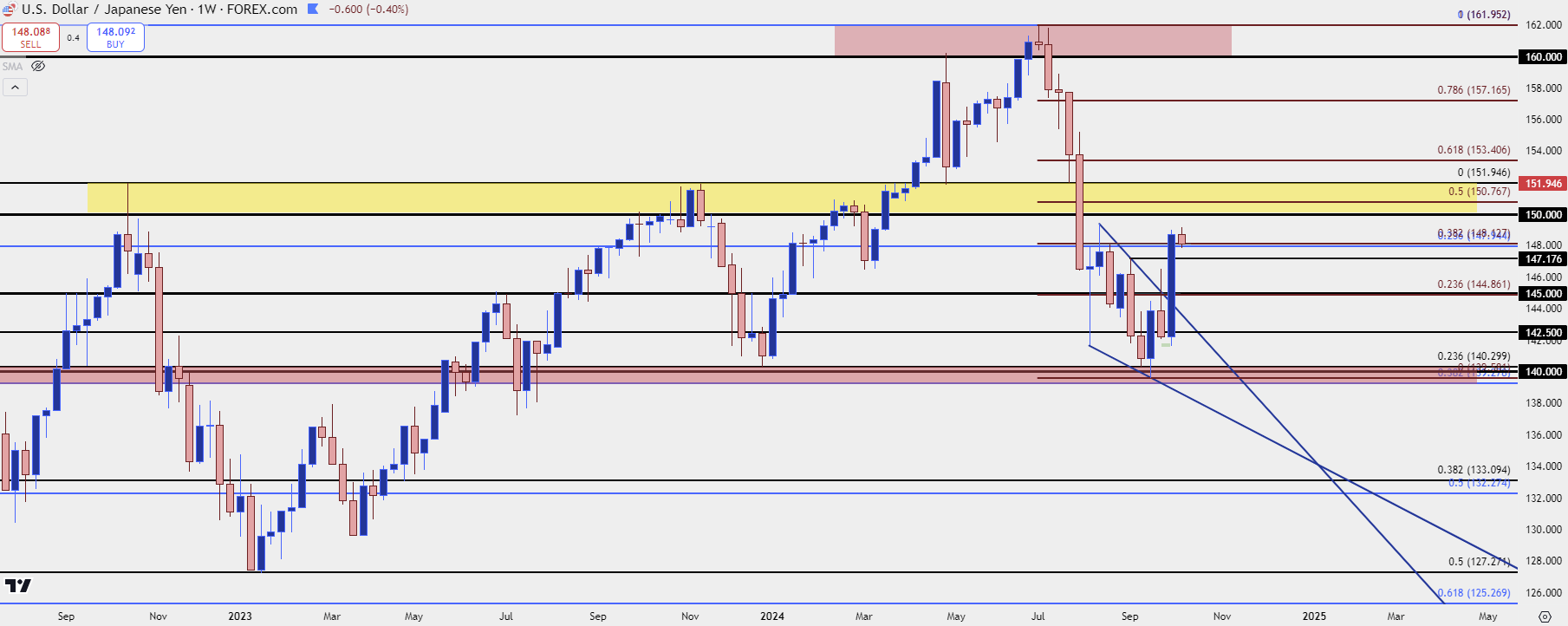

For that, I’m tracking the 50% retracement of the July-September sell-off, which plots near the middle of a longer-term zone running from 150-151.95. That zone held the highs in 2022 and 2023 before coming in as support in the first half of 2024. This is where longer-term bulls have opportunity to take profit on the carry trade in anticipation of more eventual rate cuts from the Fed. If bulls are able to power through that, perhaps there is a returning carry trade scenario but until that happens, I remain cautious on the prospect of carry returning in a falling rate backdrop around US rates.

USD/JPY Weekly Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

--- written by James Stanley, Senior Strategist