Key Events

- BOJ raises caution against a rate hike in the face of deflation risks

- Japanese PPI rises to 3.4%, targeting Aug 2023 highs

- Event risk of the day: US CPI (m/m, y/y, and core)

- Fed rate anticipations following US CPI result

- FOMC member and Fed Powell remarks following CPI results

- Japanese prelim GDP (Friday)

Japan’s Monetary Policy and Economic Pressures

Amid political turmoil in Japan and US elections, economic instability has driven the yen to critical lows against a strong dollar following the US elections. This situation raises questions about Japan’s inflation trajectory and the timing of its next rate hike decisions.

From a technical perspective, both the DXY and USDJPY rebounded from July 2023 lows (key support levels), reversing their second-half declines of 2024 and aiming towards their highs from early 2024 in November.

Japanese elections have brought about significant changes unseen since 2009, and the yen’s weakened state, alongside deflation risks, intensifies anticipation for the timing of Japan’s next rate hike.

US Inflation, Elections, and Monetary Policy Impact on Japan

The dollar's rally, fueled by a Republican election victory, has added pressure on the yen, and today’s CPI results may impact expectations for a 25 bps Fed rate cut in December. Current CPI forecasts have risen to 2.6% from 2.4%, boosting dollar momentum and pushing USDJPY above the 155-mark.

Japanese PPI has hit levels last seen in August 2023, while October Tokyo inflation eased to 1.8%, adding complexity to Japan’s monetary outlook amid a strong dollar trend.

Technical Analysis: Quantifying Uncertainties

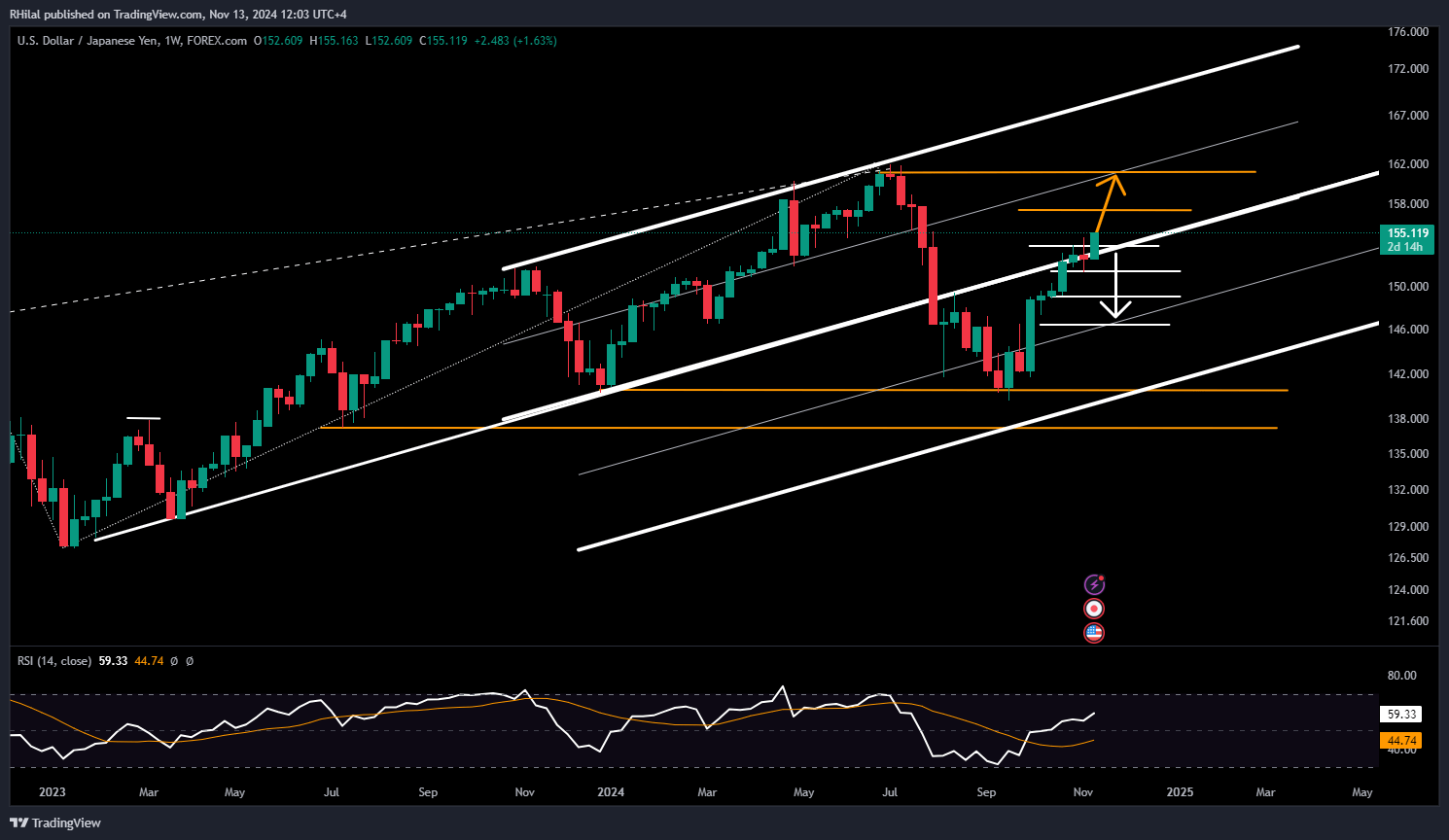

USDJPY Forecast: Weekly Time Frame – Log Scale

Source: Tradingview

Following the DXY’s breakout above its year-long consolidation and the 106 level, the USDJPY pair’s bullish rebound from July 2023 lows (140) has returned it to its primary uptrend, targeting resistance at 155.30, 157, and 160.

A decisive close above 160 could extend the uptrend toward record highs, though BOJ intervention may be anticipated if the yen weakens further.

On the downside, a shift in US dollar fundamentals could pull USDJPY back toward the 146.50 level, provided it closes below the 153.80, 151.30, and 149 support levels.

--- Written by Razan Hilal CMT, on X: @Rh_waves