Key Events

- Tokyo Core CPI meets BOJ target at 2.0%

- US PCE drops to 2024 lows

- US ISM Manufacturing PMI & US JOLTS Job Openings (Tuesday)

- US ISM PMI (Thursday)

- US NFP (Friday): to tip off the balance between 25 bps and 50 bps rate cut expectations

USD Perspective

The recent dip in the Fed’s preferred inflation gauge, the US Core PCE, to its 2024 low of 0.1%, has shifted market expectations toward a 54.1% likelihood of a 50-bps rate cut in November, according to the CME Fed Watch Tool.

The next indicators to determine the dollar’s direction are the sticky ISM services PMI on Thursday and the critical non-farm payrolls on Friday. Despite the dovish expectations, the US Dollar and USDJPY are still shy from breaking towards their July 2023 support.

JPY Perspective

BOJ Governor Ueda, in his latest speech, expressed a willingness to consider a rate hike but emphasized a cautious pace due to the vulnerability of prices to downside risks and the focus on keeping inflation anchored at the BOJ’s 2.0% target. This has contributed to ongoing uncertainty regarding the pair’s direction.

The Japanese Yen, however, is positioned for potential strength ahead of the snap elections on October 27th, with incoming Prime Minister Shigeru Ishiba, known for his support of hawkish monetary policies, likely to influence the yen positively.

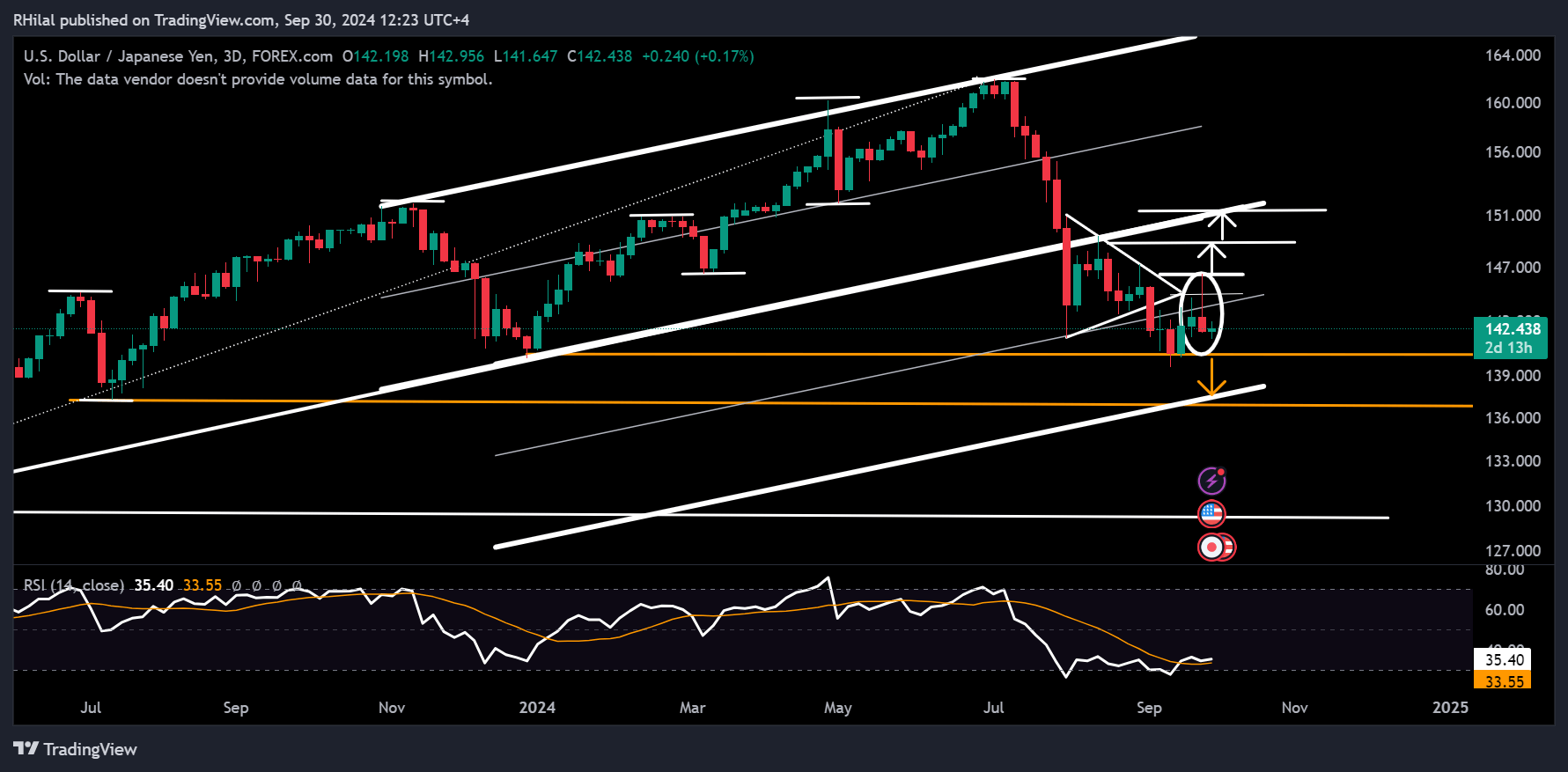

USDJPY Forecast: 3Day Time Frame – Log Scale

Source: Tradingview

The USDJPY pair is still respecting the December 2023 support (140) alongside the bullish rebound and positive divergence of the relative strength index indicator (RSI) from the oversold zone. However, the latest shooting star candlestick pattern, with a shadow extension towards the 146-resistance, alongside the bearish engulfing body to the previous 3-day session, adds further indecision on the chart.

With the latest price action leaning towards a bearish track, a break below the 140-barrier could push the pair down to 137 and possibly 130 in more extreme scenarios.

On the other hand, a bullish scenario could unfold if the US Dollar Index rebounds, with USDJPY climbing above resistance levels at 146.50, 149, and 151.40.

--- Written by R azan Hilal, CMT – on X:@Rh_waves