Key Events for the Week Ahead

- Japanese Bank Holiday (Monday)

- US Retail Sales (Tuesday)

- Fed Rate and FOMC Meeting (Wednesday)

- BOJ Policy Rate and Press Conference (Friday)

Source: CME Fed Watch Tool

With market expectations leaning 50-60% towards a 50bps Fed rate cut, the US Dollar has dropped to its December 2023 lows, pushing USDJPY below the 140 mark and propelling gold to fresh highs near the $2,600 barrier. Strong technical barriers lie ahead of the Fed rate decision and FOMC meeting on Wednesday—an event that has been highly anticipated throughout 2024, raising the potential for significant volatility. In the midst of political and economic uncertainty in the US, gold continues to hold its ground as a safe-haven investment until more clarity emerges.

As we approach the end of the trading week, the Bank of Japan (BOJ) adds to market tension, with its rate decision expected to remain on hold, contrasting with the Fed's potential easing. A hawkish tone is anticipated during the BOJ's press conference, which could further stir the markets.

Technical Outlook

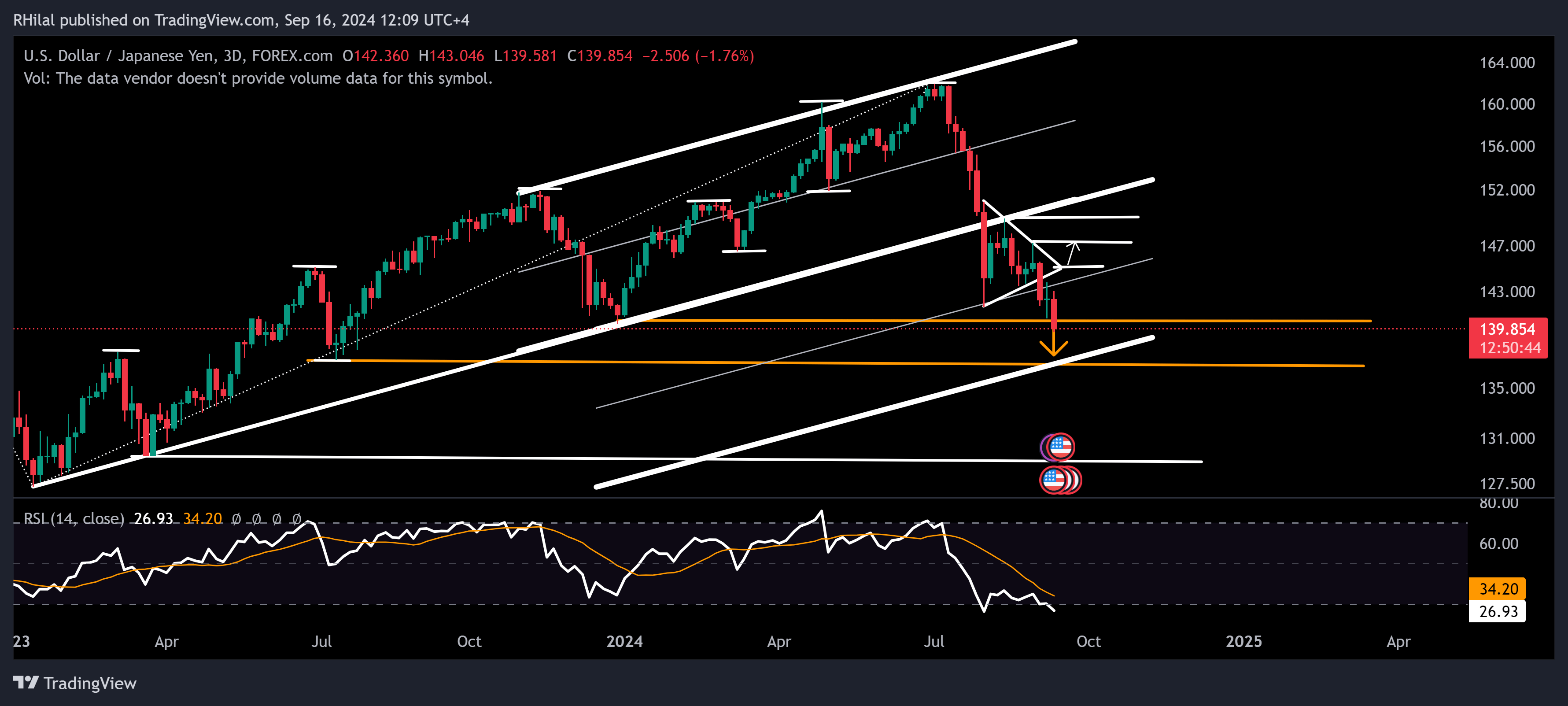

USDJPY Outlook: USDJPY – 3 Day Time Frame – Log Scale

Source: Tradingview

With divergent policies on the horizon between a potential Fed rate cut and a BOJ rate hold or hike, USDJPY has fallen below the 140 barrier and its December 2023 low, likely heading toward strong support at the July 2023 low of 137.

Should the pair weaken further below 137, the trend may extend toward the lower end of the 130 range. On the upside, given the oversold conditions on the 3-day relative strength indicator and the likelihood of priced in effects ahead of the policies, levels 144, 147, and 150 are poised to offer resistance for potential rebounds.

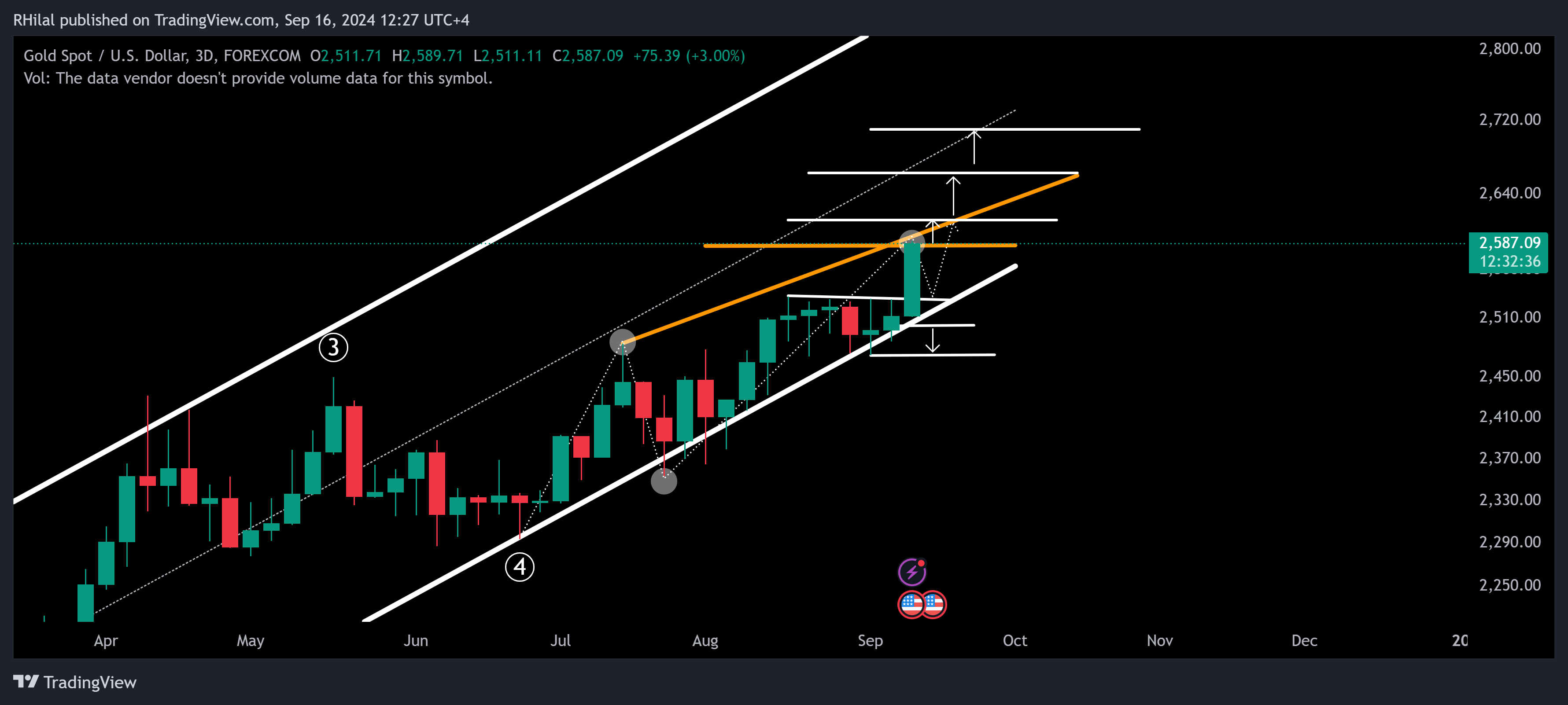

Gold Outlook: XAUUSD – 3 Day Time Frame – Log Scale

Source: Tradingview

The strong uptrend in gold is approaching the critical $2,600 barrier, in tandem with gold futures. While the primary trend remains bullish, potential headwinds could emerge, as market effects have already been priced in and gold is facing key resistance levels, including the psychological barrier at $2,600.

On the upside, potential resistance zones are expected at $2,610 and between $2,650 and $2,660. On the downside, the $2,540-$2,530 range is positioned to support any pullbacks from current highs. In a more extreme scenario, support can be offered from levels $2,500 and $2,470 before confirming a broader bearish outlook for gold.

--- Written by Razan Hilal, CMT – on X: @Rh_waves