US Dollar Forecast: USD/CAD

USD/CAD still holds below the monthly high (1.3959) as the Federal Reserve delivers a dovish rate-cut, and the exchange rate may struggle to retain the advance from the October low (1.3473) as it appears to be reversing ahead of the 2022 high (1.3978).

USD/CAD Still Holds Below Monthly High Following Dovish Fed Rate Cut

USD/CAD falls toward the weekly low (1.3821) even though the Federal Open Market Committee (FOMC) ‘judges that the risks to achieving its employment and inflation goals are roughly in balance’ as Chairman Jerome Powell reveals that ‘in the near term the election will have no effects on our policy decisions.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

The comments from Chairman Powell suggest the Fed will stay on track to further unwind its restrictive policy as the committee ‘made significant progress and we expect there to be bumps,’ and the FOMC may move at a steady pace in normalizing monetary policy as ‘nothing in the economic data suggests that the committee needs to be in a hurry to get there.’

Canada Economic Calendar

In turn, speculation for lower US interest rates may drag on the Greenback ahead of the Fed’s last meeting for 2024, and the update to Canada’s Employment report may fuel the recent weakness in USD/CAD as the economy is anticipated to ad 25.0K jobs in October.

A third consecutive rise in Canada Employment may limit the Bank of Canada’s (BoC) scope to deliver another 50bp rate-cut at its next meeting on December 11 as the ‘Bank expects inflation to remain close to the target over the projection horizon,’ but a dismal development may curb the recent decline in USD/CAD as it puts pressure on Governor Tiff Macklem and Co. to implement lower interest rates at a faster pace.

With that said, USD/CAD may consolidate within the opening range for November should it continue to hold above the weekly low (1.3821), but the exchange rate may struggle to retain the advance from the October low (1.3473) amid the failed attempts to test the 2022 high (1.3978).

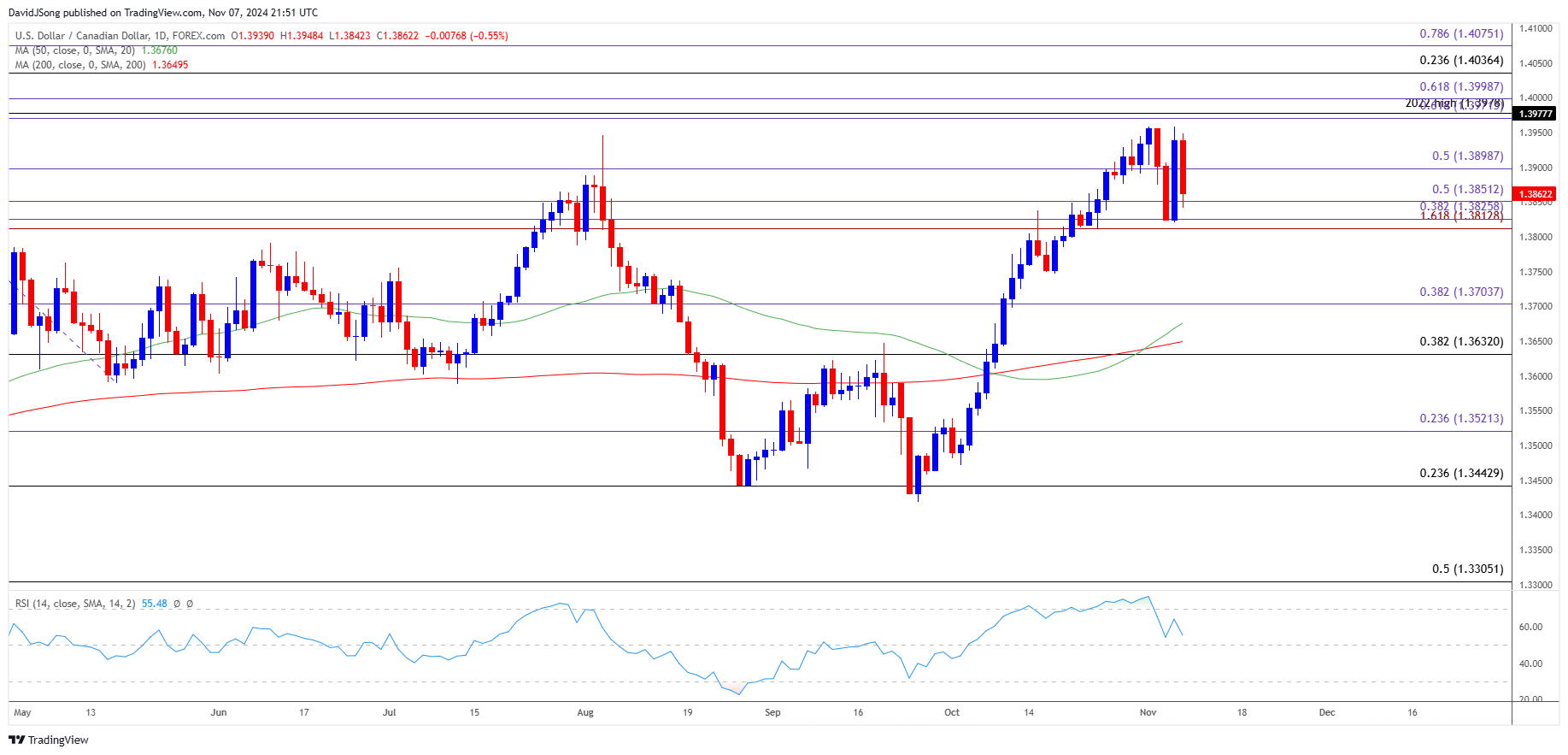

USD/CAD Price Chart – Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- The opening range for November remains in focus for USD/CAD as it falls towards the weekly low (1.3821), with a break/close below the 1.3810 (161.8% Fibonacci extension) to 1.3850 (50% Fibonacci extension) zone bringing 1.3700 (38.2% Fibonacci extension) on the radar.

- Next area of interest comes in around 1.3630 (38.2% Fibonacci retracement) but USD/CAD may may stage further attempts to test the 2022 high (1.3978) should it defend the weekly low (1.3821).

- In turn, the range bound price action in USD/CAD may end up short-lived, with a break/close above the 1.3970 (61.8% Fibonacci extension) to 1.4000 (61.8% Fibonacci extension) region opening up the 1.4040 (23.6% Fibonacci retracement) to 1.4080 (78.6% Fibonacci extension) area.

Additional Market Outlooks

Monetary vs Fiscal Policy: Implications for FX Markets

GBP/USD Recovers Ahead of 200-Day SMA amid Hawkish BoE Rate Cut

US Dollar Forecast: USD/JPY Vulnerable to Looming Fed Rate Cut

AUD/USD Recovery Pulls RSI Away from Oversold Territory

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong