USD, yields rise into next week’s PCE inflation: The Week Ahead

It was a more eventful week than anticipated, thanks to hotter PMI data across Europe and the US, serving as a reminder that inflationary pressures persist. This keeps the pressure on central banks to maintain higher interest rates. Consequently, traders will closely monitor flash CPI reports for Europe throughout the week, in the build-up to Friday's PCE inflation report for the US. Both reports have the potential to influence the timing of ECB or Fed rate cuts, if they occur at all.

A glance at the calendar reveals Australian retail sales and a monthly CPI report worth noting. If disappointing retail sales persist, it may support those calling for an RBA cut. However, this would need to be reinforced by softer inflation data on Wednesday, which notably exceeded expectations last month.

The US will release the revised GDP figures. They don’t tend to spark a large market reaction, but it will be duly noted if any of the growth figures are revised higher as it would be deemed inflationary (and bad for bearish USD bets).

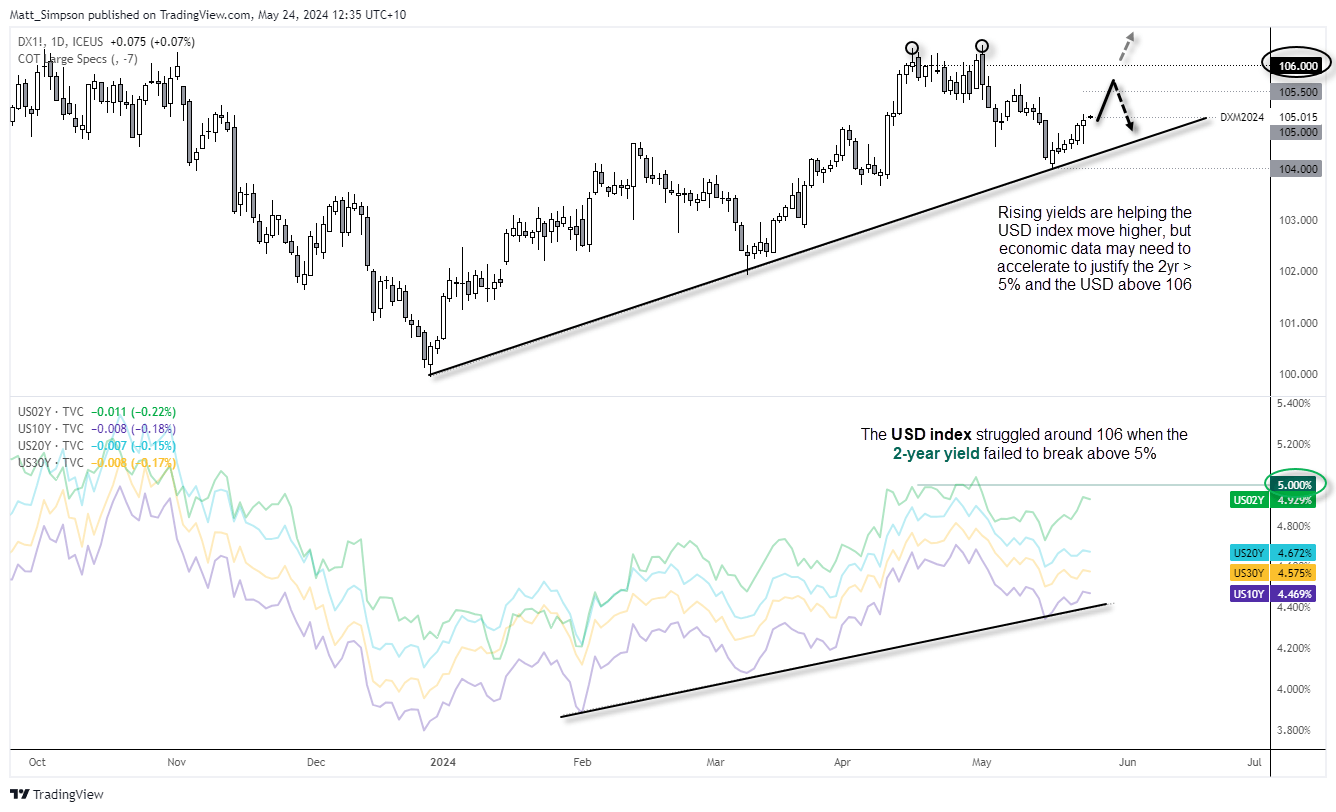

US dollar index, yields:

Like it or not, the yield curve is higher and that is helping to support the US dollar as we head towards the weekend. As noted in my weekly COT report, large speculators were net-long US dollar index futures for a second week and asset managers remain heavily long (even if slightly less so the past few weeks). So demand for the dollar is there.

The USD index has risen ~1% since rise from 104 ad the bullish trendline, although a hanging man candle formed on Thursday after reaching my 105 target. We may be in for a quiet start to next week, and the PCE inflation report on Friday is likely to have the final say as to where the dollar goes next.

Whilst my bias is for a move to 105.50 or even 105.80, we likely need to see the US 2-year yield break above 5% with conviction before can seriously chat about USD rising above 106. As we saw earlier this year, the market seems to struggle with the 2-year at 5% and that coincided with choppy trade on the US dollar index ~106. But it could be argued that the dollar index trades at a slight discount to the 2-year this time around.

Therefore, I am cautiously bullish the US dollar, but economic data likely needs to accelerate before we can expect a move (and break above) 106.

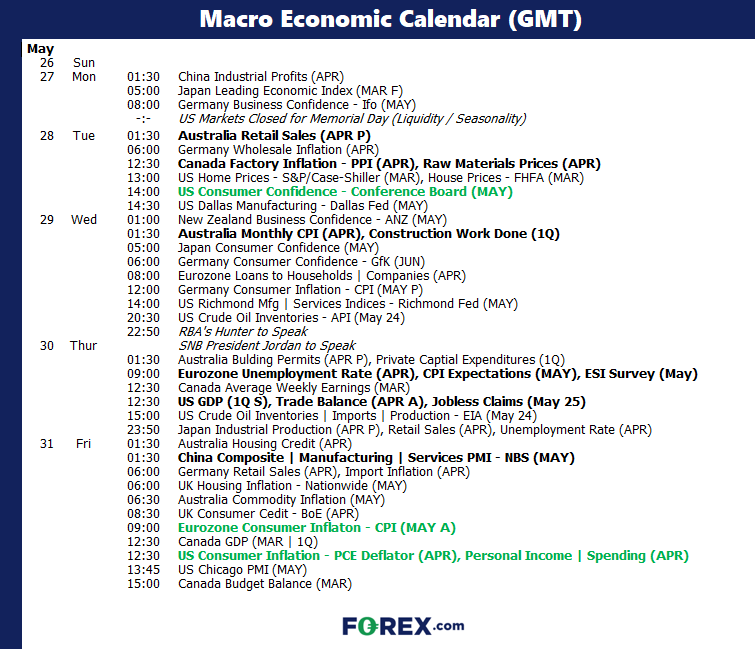

The week ahead (calendar):

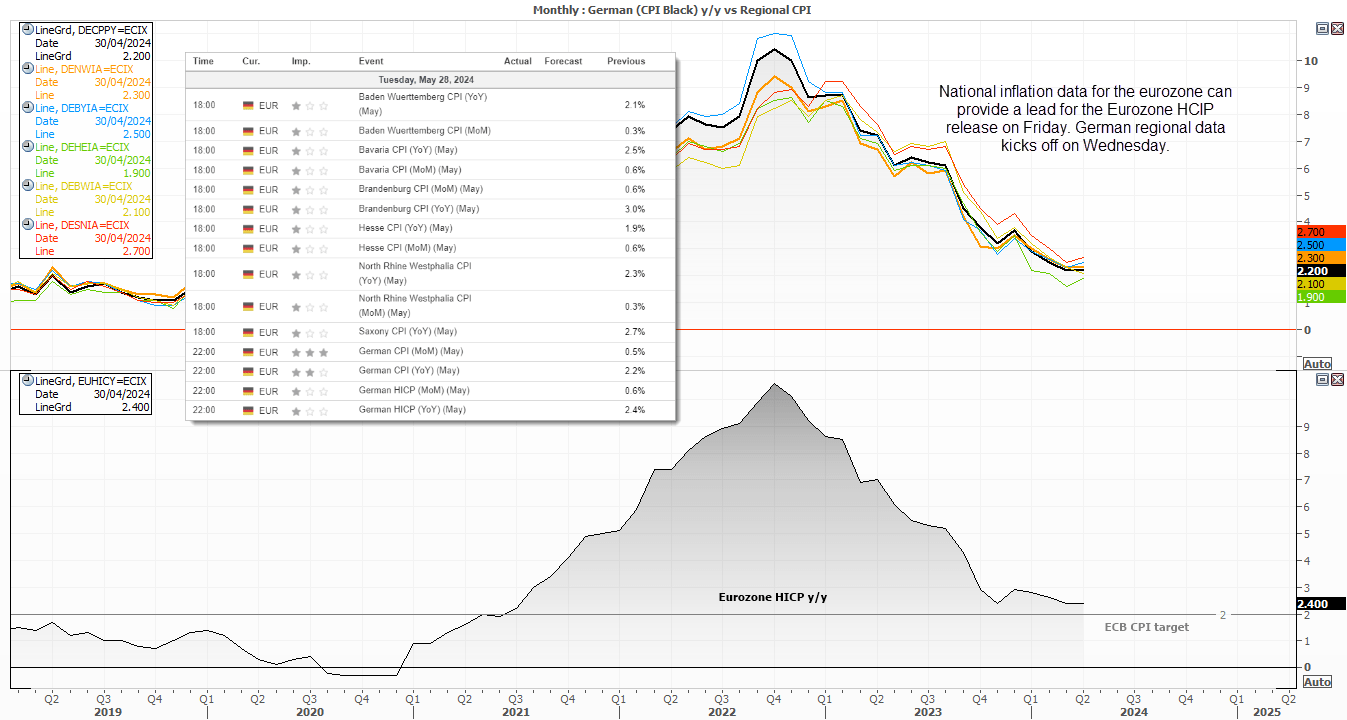

Eurozone flash CPIs

The ECB next meet on June 6th, which leaves room a final round of inflation figures before they announce their decision on rates. As things stand, a June cut is expected. Although hotter PMI reports and rising wages in Germany mean the ECB are unlikely to unveil a dovish cut, unless next week’s inflation data surprises to the downside.

Next week we’ll see flash CPI reports from Eurozone nations ahead of the Eurozone CPI print on Friday. This means markets will react to the national reports throughout the week, with Germany’s being a key focal point on Wednesday. And that’s because Germany will release regional CPI data ahead of their national inflation report, essentially making them leading indictors for a leading indicator.

Given UK inflation was uncomfortably high, perhaps traders should be on guard for an upside surprise for European CPI next week. And that could diminish hopes of another cut this year form the ECB and support the euro.

Trader’s watchlist: EUR/USD, EUR/GBP, EUR/JPY, EUR/CHF, DAX, STOXX

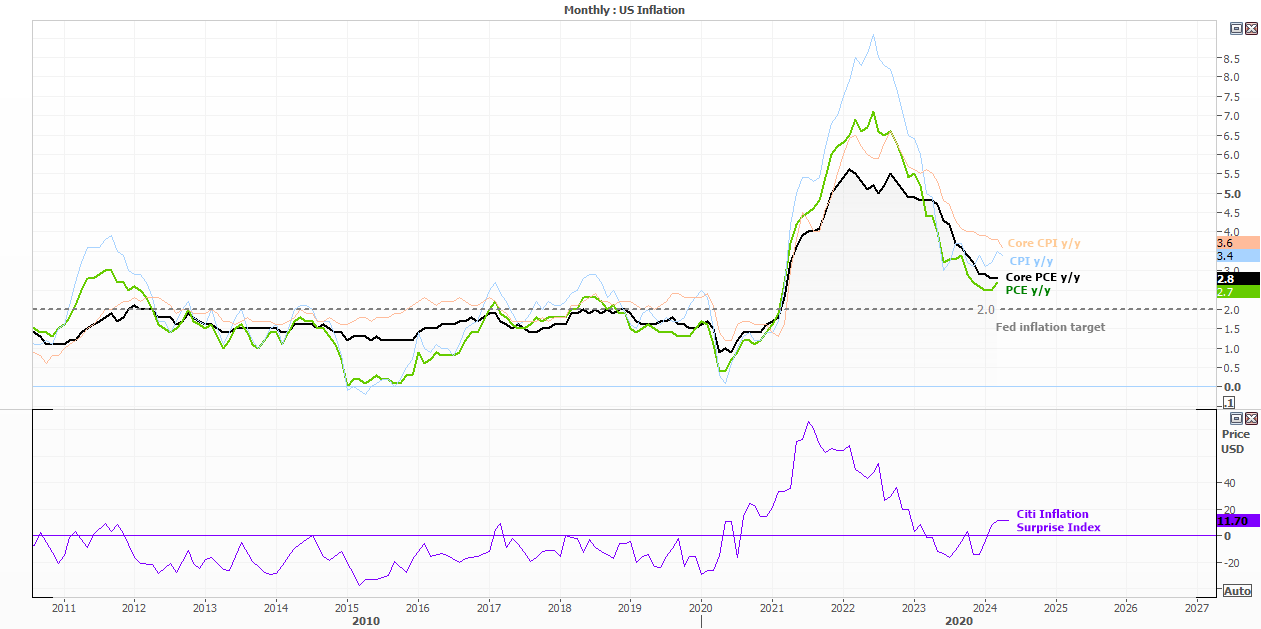

US PCE inflation

Despite CPI levels remaining elevated relative to the Fed’s 2% inflation target, they are at least below the Fed’s interest rate of 5.25-5.5%. Yet at 3.6% y/y CPI is only marginally closer to the inflation target than the interest rate, so there is clearly more work to be done. And that is why Fed members keep pushing back on imminent rates cuts, despite softer NFP and CPI figures over the past few weeks.

And that puts next week’s PCE inflation report into focus, as it is the Fed’s preferred measure of consumer prices.

In a nutshell, traders really need PCE inflation to cool to justify rate cuts, which should then lead to lower yields and US dollar. Core PCE is the one to watch, as even a slight uptick to 2.9% y/y could further spook traders out of dovish-Fed bets to send the US dollar higher alongside yields.

And given the hot PMI reports and the fact the Citi FX inflation surprise index has been edging higher in recent months, traders may want to brace themselves for an uncomfortable PCE report.

Trader’s watchlist: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge