USD, USD/JPY Talking Points:

- It’s been a fast start to Q4 for the US Dollar as the currency broke out of a falling wedge and already has pushed into overbought conditions on the four-hour chart.

- EUR/USD was initially a large driver of that move but USD/JPY has been driving today. After the early-week support at 141.69, the pair has now gained as much as 450 pips in just a few days.

- I’ll be going over these setups in the weekly webinar, held each Tuesday at 11am ET: Click here for registration information.

The US Dollar was beaten down last quarter. The first two months saw the currency in a consistent sell-off as USD/JPY carry unwind dominated the FX market. And even with oversold conditions flashing on the weekly chart in mid-to-late August, DXY still had trouble holding a bid.

But the month of September is when sellers had actual motive as the FOMC started a rate cut cycle while retaining a dovish overall appearance. Despite that, sellers started to spin their wheels and failed to drive fresh short-side trends upon multiple tests of fresh lows.

That USD weakness even held through this week’s open, with USD/JPY testing the August 5th low of 141.69, and EUR/USD putting in another test above 1.1200. Matters have materialized quickly since then, however, and already, the US Dollar is flashing overbought conditions on the four-hour chart.

US Dollar Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

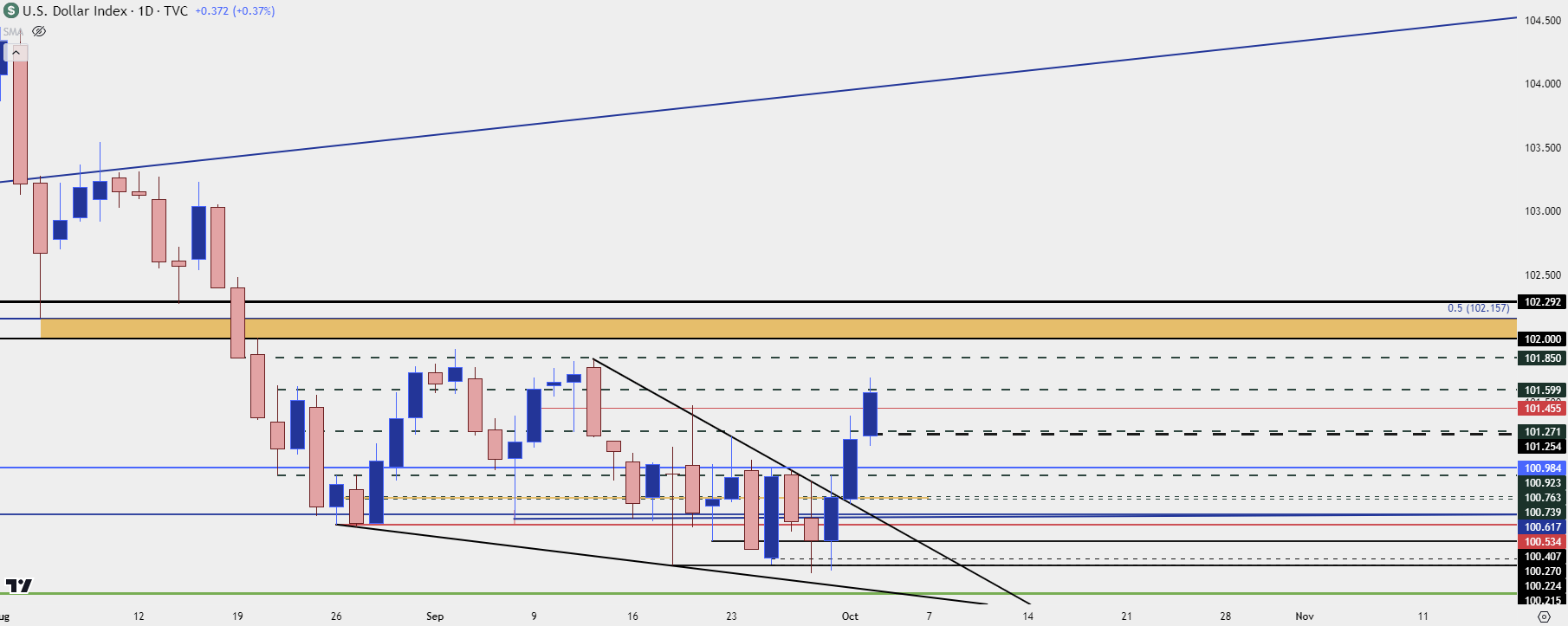

US Dollar Trajectory

Just as I had shared in late-August when RSI went into oversold on the weekly DXY chart, overbought/oversold is not a direct lead-in to a fade. It does, however, highlight that chasing could be a challenge and, instead, it points to the potential for pullbacks to higher-lows that can be of interest for trend continuation. This statement can be spanned from DXY to the USD/JPY setup that I’ll look at in a moment.

In DXY, the same levels from yesterday’s webinar remain in-play. There’s spot of support-turned-resistance at 101.46. Another key spot is around the 101.27 level, which was already defended this morning with a swing low at 101.25. That could be usable again but as I’ve shared, I would want to see buyers holding any corresponding lows above that price.

Currently, it’s the 101.60 level that’s giving resistance to DXY and that remains a big spot if bulls can forge a path of topside continuation.

US Dollar Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

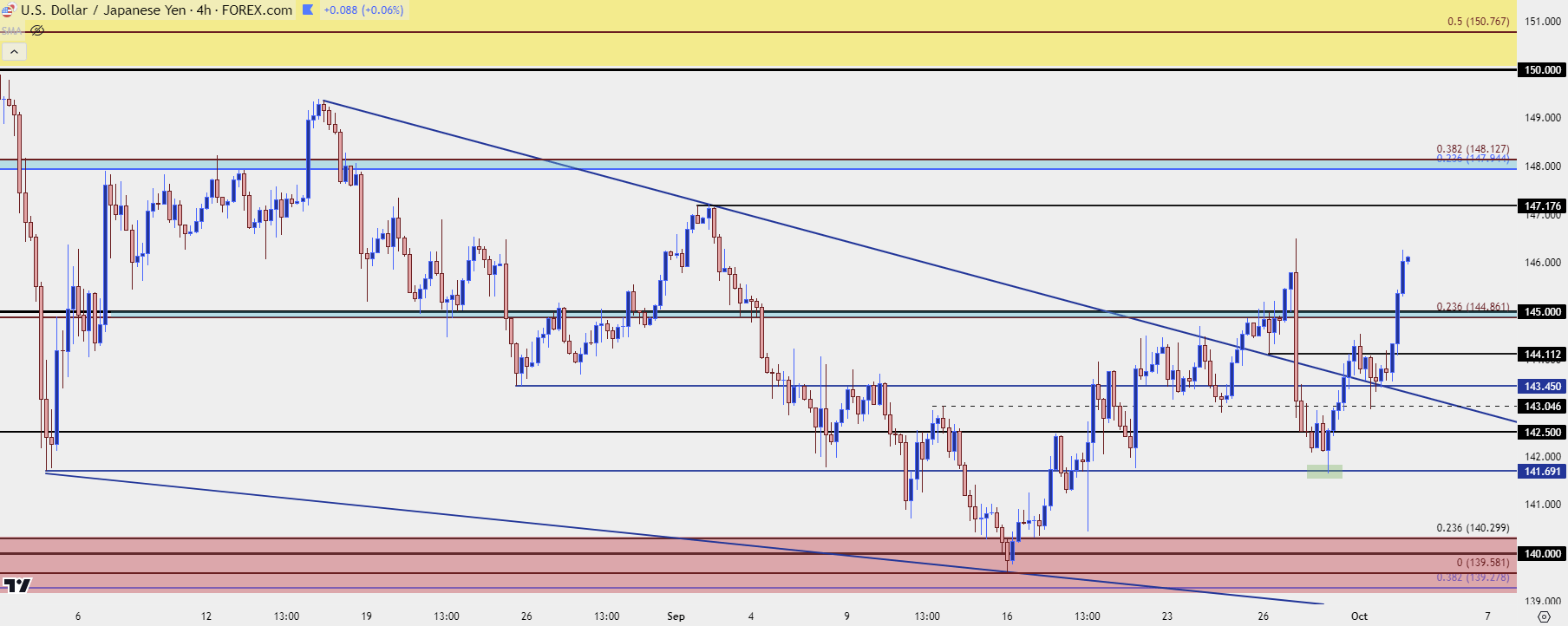

USD/JPY

Since the sell-off last Friday I’ve been calling USD/JPY a ‘wild card.’ This is taken from the fact that I feel the longer-term and fundamental backdrop to both hold bearish appeal.

But – fundamentals aren’t a perfectly direct push-point for price. The only thing that pushes price in a true market environment is buyers and sellers, supply, and demand. And given how aggressively the sell-off hit in July and August, there’s reasonably still a one-sided short stance from near and intermediate-term traders in the pair.

This is what justifies the failed break at 140.00 from a few weeks ago, or the higher-low that printed after the FOMC rate cut announcement. Prices were showing several bullish factors until the results of Japanese elections last Friday, which brought on a 400+ pip move in very short order, which is where my ‘wild card’ statement comes from. In my mind, this was longer-term carry traders using the recent rally to close out of longer-term positions.

But that didn’t last for too long as support showed at the same 141.69 level that held the lows on August 5th, and bulls have been going to work since.

In yesterday’s webinar the pair was grinding back at the trendline that made up the prior falling wedge formation, and bulls have continued to push, forcing a break above the 145.00 handle. This highlights the fact that there could be more to go as we have yet to test the 38.2% retracement of the July-September sell-off. Notably, the 23.6% retracement of that move is confluent with the 145.00 level, and this provides a bit of scope for possible higher-low support.

USD/JPY Four-Hour Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

--- written by James Stanley, Senior Strategist