Fed members continued to push back on aggressive easing on Monday. Citing a strong and stable economy, Logan is expecting “gradual rate cuts” if economy meets forecasts and sees ongoing risks to their inflation goal. Kashkari sees policy as mainly managing expectations over denting demand, although a quick weakening of the labour market could prompt faster cuts.

With bond traders more than aware that US economic data has outperformed expectations lately, they were quick to send yields broadly higher and drag the USD with them. Markets are also pricing in a better chance of Trump winning the election, with some polls now placing Trump ahead of Harris in the key swing states of Wisconsin, Michigan and Georgia (the three won by Biden in 2020). And with his policies deemed inflationary, its helped propel yields, the USD and weigh on Wall Street ahead of earnings.

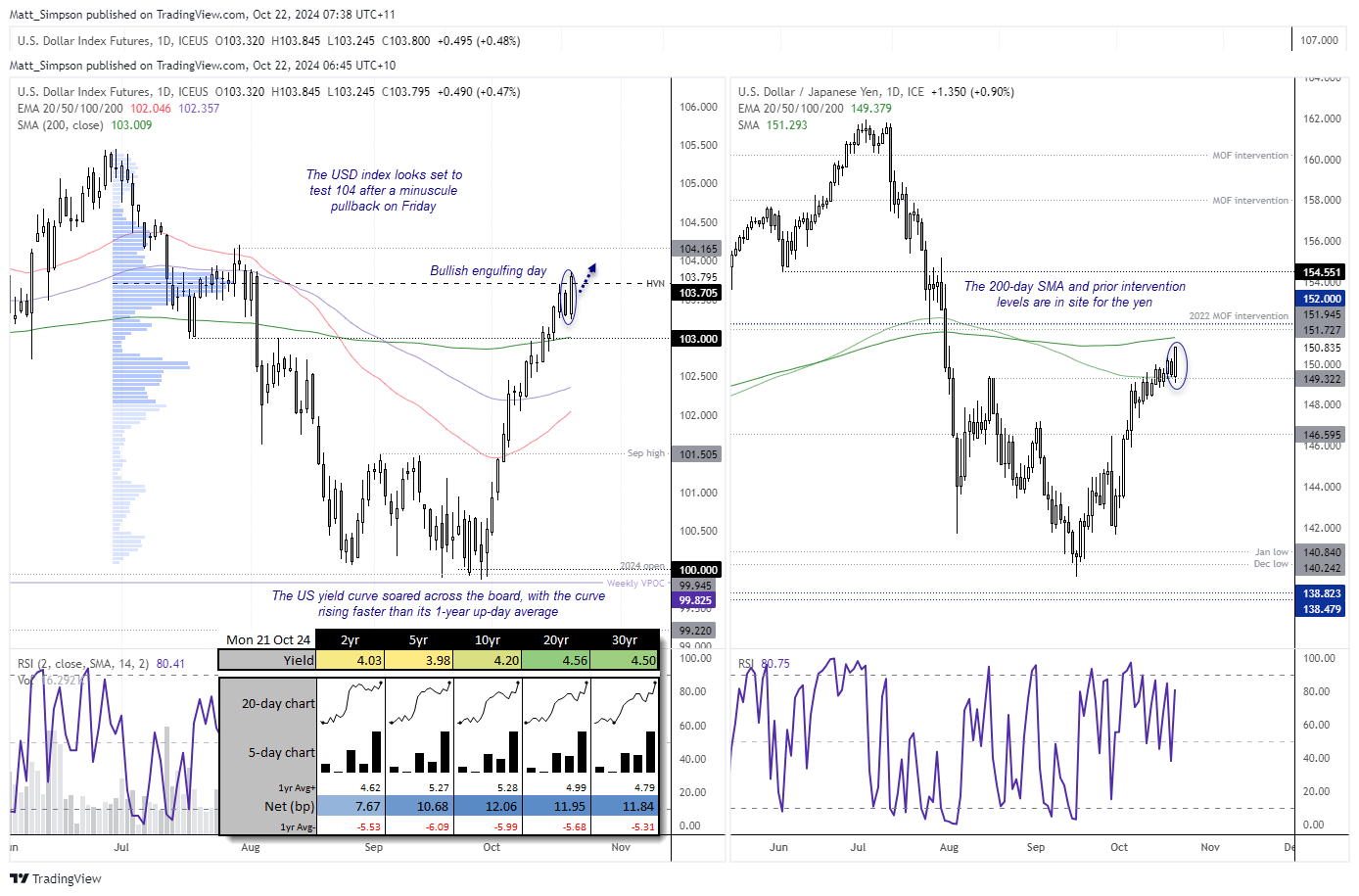

- The 2-year rose 7.6 basis points (bp) to 4.03%, the 5, 10, 20 and 30 year all increased by at least 10.8 bp and all above the 1-year up-day average

- The USD was the strongest major, JPY was the weakest

- AUD/USD formed a bearish engulfing day and probed 66c / 200-day EMA

- EUR/USD formed a bearish outside day and is just pips above the 1.08 handle

- The Dow Jones was the weakest of the ‘big three’, forming a bearish engulfing candle and dragging ASX 200 futures lower overnight

- The S&P 500 formed a hanging man day and retreated further from tis record high set last week

USD index, USD/JPY technical analysis

The USD was the strongest major, with the dollar index forming a bullish engulfing day and closing at a 12-week high. This also places it above the high-volume node which perfectly capped that rally on Thursday ahead of its 1-day, token pullback. The dollar index is now within easy reach of the 104 handle and July 30 high, which points to at least some minor downside potential for EUR/USD, AUD/USD and the likes from here.

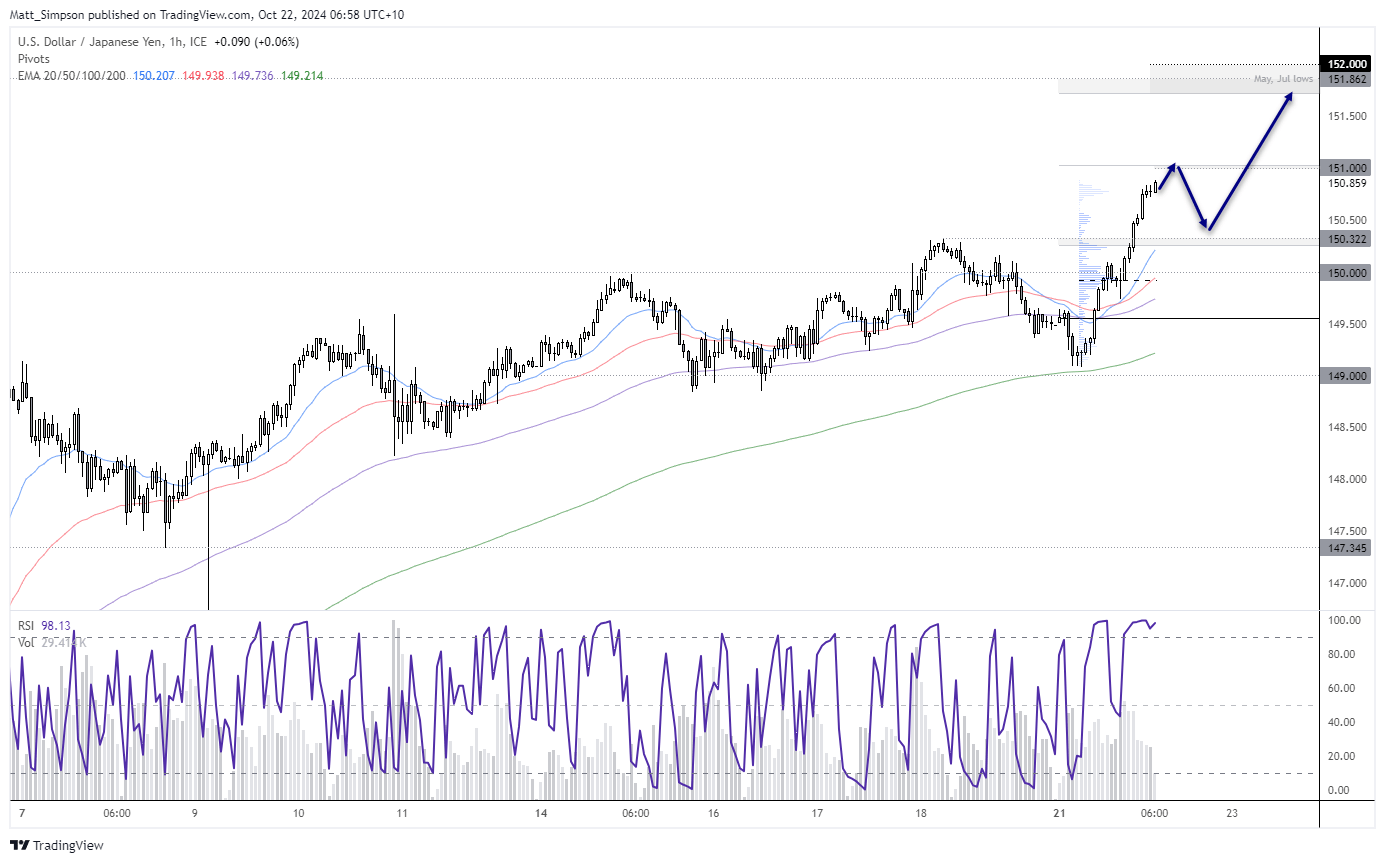

A bullish engulfing day also formed on USD/JPY after it found support at its 200-day EMA. With a solid close above 150, a retest of its 200-day SMA (151.29) seems likely with dip buyers potentially reloading upon any pullback towards 150. Also note the cluster of resistance between 151.75 and 152 which includes the 202 MOF intervention level.

Events in focus (AEDT):

We have central bank members from the Fed, ECB and BOE hitting the wires over the next 24 hours. I can’t say I’m expecting anything too compelling from the Fed or ECB, but there may be some interest in BOE governor Bailey. UK inflation data last week renewed bets of imminent BOE easing, only to find that retail sales surprised to the upside in Friday, helping GBP/USD rise for a second day. Perhaps Bailey can clarify his view in light of the new data and send the pound higher or lower, accordingly.

I suspect Fed members will be reading from the same script, pushing back on aggressive cuts and promoting a more ‘steady as she goes’ approach. This could keep a floor of support under the USD in the first half of the week, until we approach flash PMIs on Thursday.

The ECB delivered a dovish cut last week. I’d be surprised if Lagarde felt compelled to spill her guts and guide policy expectations so close to the meeting. I’m happy to be proven wrong on that one though.

- 08:05 – Fed Schmidt speaks

- 08:45 – NZ trade balance

- 09:40 – FOMC Daly speaks

- 16:00 – JP core CPI (BOJ)

- 21:00 – IMF meetings

- 22:30 – ECB McCaul speaks

- 00:25 – BOE Bailey speaks

- 01:00 – ECB Lagarde speaks

- 04:00 – US M2 money supply

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge