- The US dollar index (DXY) has been rallying since the beginning of the year

- However, despite US yields hitting fresh multi-month highs late last week, the DXY eased lower

- The dollar’s rally against major European FX names looks to have stalled – it could be Asia’s turn next

The US dollar rally since the start of the year is showing signs of fatigue, unable to build upon gains last week despite widening yield differential between the United States and other major nations, including in Asia. The suspect price action seen USD/JPY and USD/CNH threaten to break their respective uptrends, creating a potential catalyst for a change in direction for broader currency markets.

USD/JPY still being driven by yield differentials even if DXY is not

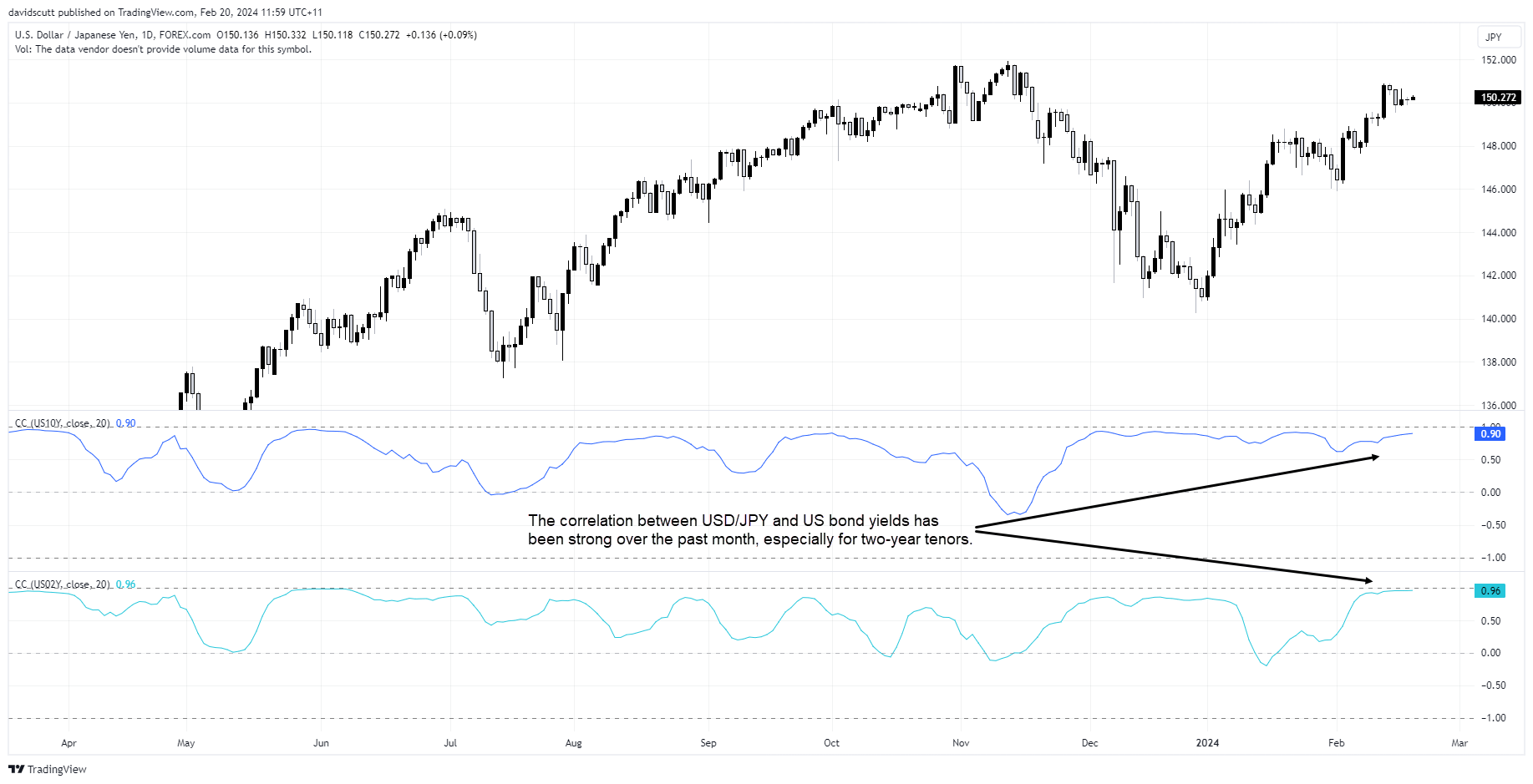

In a week in which hot CPI and PPI reports from the US saw Treasury yields surge to the highest level this year, it came as little surprise to see USD/JPY do the same given the strong correlation between the two, rising back above 150 to levels not seen since mid-November. Over the past month, the correlation with US benchmark 10-year yields has risen to 0.9 using a daily count. It’s evens stronger with two-year yields with the correlation standing at 0.96 – basically moving in lockstep, reflecting expectations for monetary policy from the Fed and Bank of Japan.

However, while USD/JPY is being driven by shorter-dated yields, the US dollar index (DXY) is not with the prior extremely strong relationship between the two weakening over the past fortnight, culminating last week with yields hitting fresh highs while the DXY eased lower. Given its composition and the weakening relationship to yields, it suggests the dollar rally against non-Asia FX names – like EUR – may be coming to an end. If that is correct, the same outcome may be seen in Asian FX names such as the Japanese yen and Chinese yuan.

USD/JPY uptrend remains in place, for now

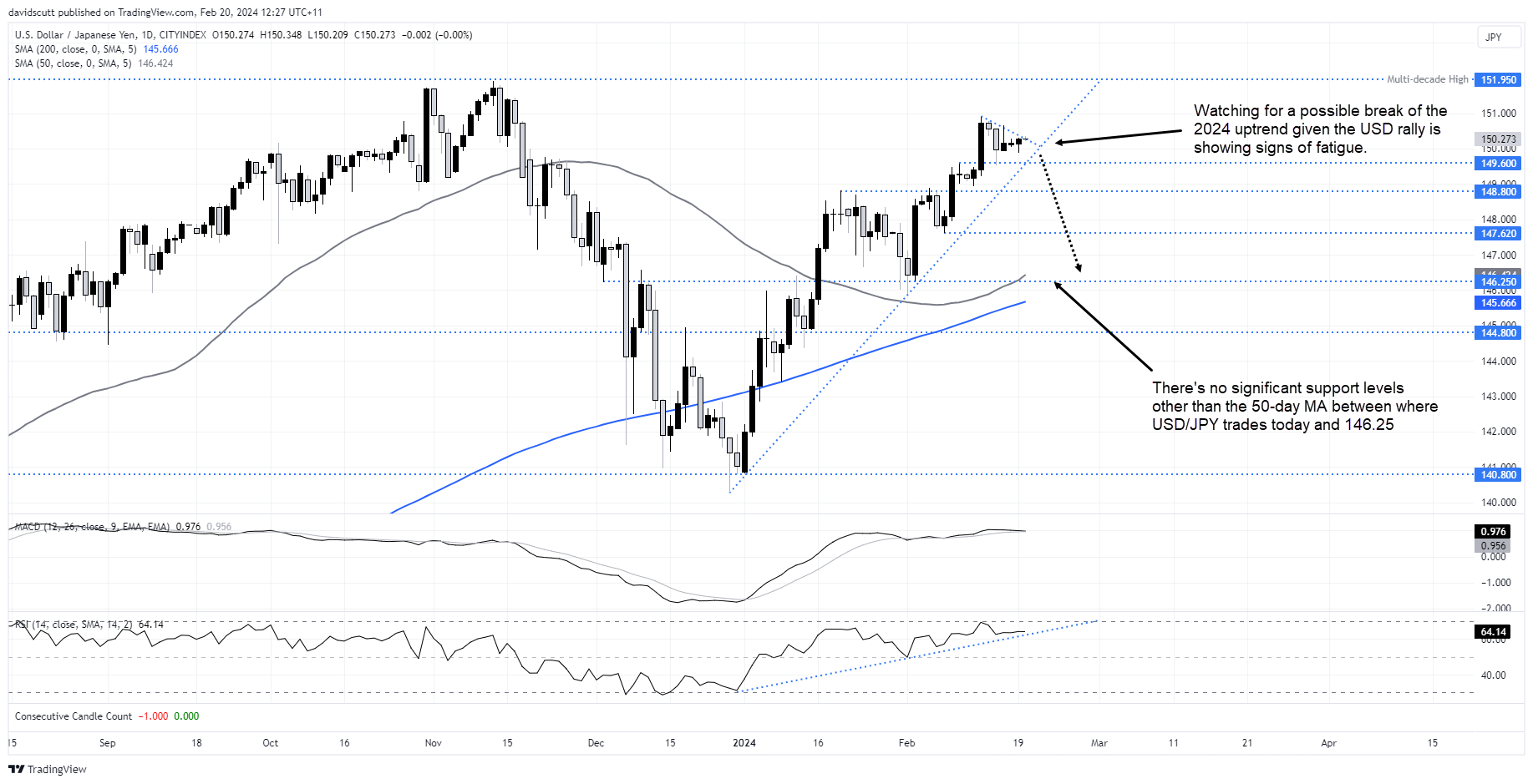

While traders should be on alert for a US dollar breakdown, it’s not at that point yet with USD/JPY. As seen in the daily chart below, it remains comfortably in the uptrend established earlier this year, sitting in a triangle pattern after failing to break 151 last week following the hot US CPI report. A break of the latter would bring 151 and the multi-decade high of 151.95 into play.

However, given the poor price action in DXY last week, I’d prefer to fade rallies at these levels, especially with US yields having risen comparatively quickly since the start of the year. In the absence of the rally resuming near-term, the pair could well be testing uptrend within the coming days. A clean break would bring minor support at 149.60, 148.80 and 147.60 onto the radar. Should they go, 146.25 – where the 50-day moving average and horizontal support intersect – would be the next logical downside target. Right now, MACD and RSI are showing signs of rolling over to the downside.

There’s not a lot on the known risk event calendar this week for either Japan or the United States, meaning sentiment and positioning may play a greater role in determining how USD/JPY trades.

USD/CNH may provide clues on how USD/JPY may trade

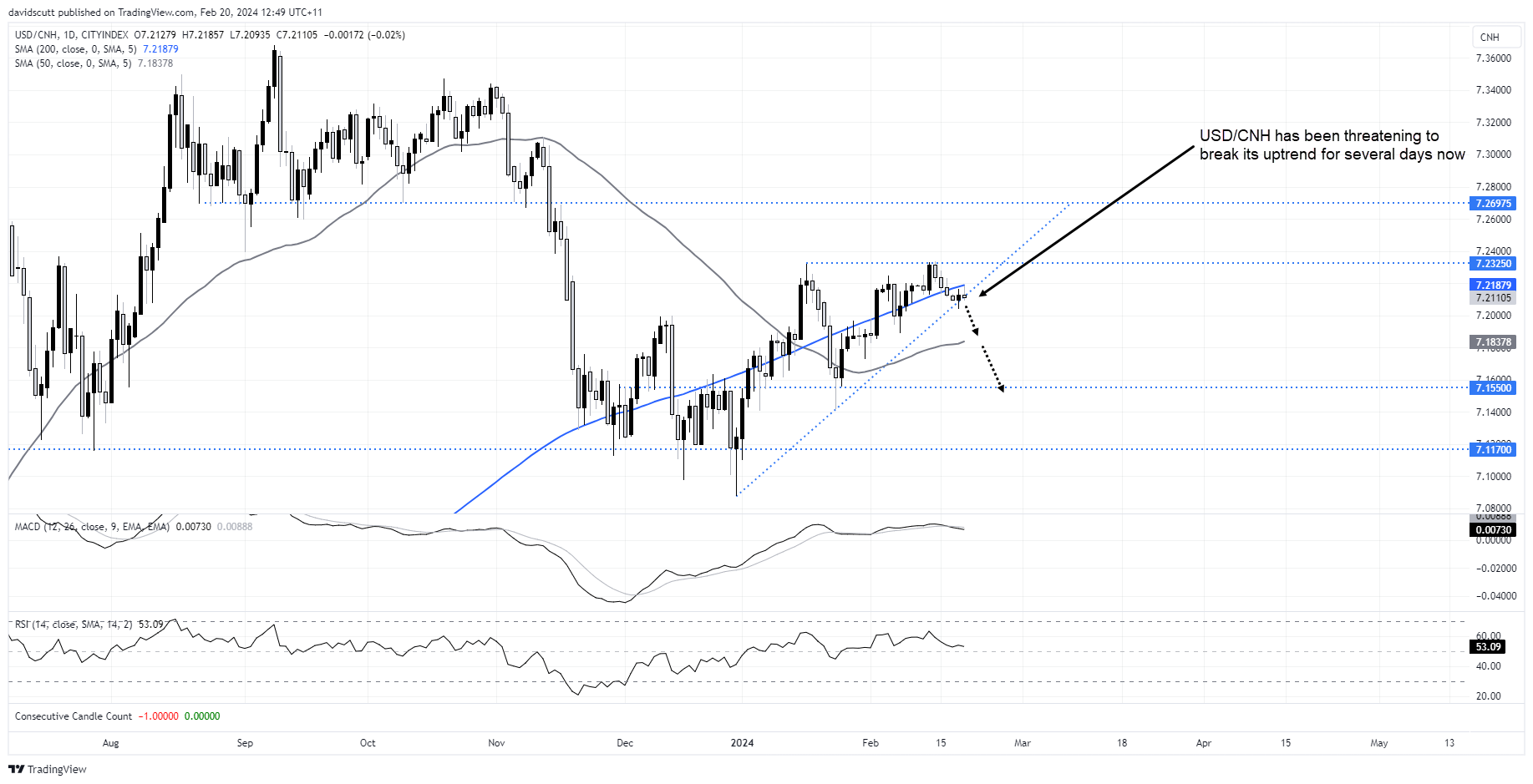

For clues on how USD/JPY may trade, it’s worthwhile keeping an eye on the performance of the other major FX name in north Asia – the Chinese yuan. While USD/CNH’s relationship with US yields has not been as strong as JPY over the past month, it too is threatening the uptrend it’s been in since the start of the year, bouncing modestly on Monday after briefly falling through it upon the resumption of trade of mainland Chinese markets.

Should we see a clean downside break – which looks increasingly likely with price, MACD and RSI threatening to roll over, there’s only really the 50-day moving average standing in the way of a push towards 7.1550. On the topside, USD/CNH has been rejected three times at 7.2325, making that a level to watch should we seen an unlikely bounce near-term.

-- Written by David Scutt

Follow David on Twitter @scutty