While the BOJ hiked more aggressively than expected, they fell short on their ETF tapering, rattling the yen during a bout of 2-way volatility. And the risk of volatility remains with a looming FOMC meeting.

- The BOJ hiked by 15bp to take their interest rate to 25bp (10bp hike expected)

- 7-2 in favour of today’s hike

- 2024 inflation outlook downgraded to 2.5% y/y (2.8% previously)

- CPI outlook for 2025 upgraded to 2.1% y/y (1.9% prior)

- They plan to taper bond purchases down to ¥3 trillion by Q1 2026 (down to ~¥6 trillion)

- A midterm review of bond purchases to arrive in June 2025

Where the Bank of Japan exceeded expectations with a rate hike, they fell short on bond tapering. Markets had been primed for a ‘detailed plan’ to reduce bond purchases at this meeting following a report earlier this week in the Nikkei. But all we know is that they will be roughly halved to ¥3 trillion from the current ¥6 trillion in 18 months, with a review not up until June next year.

Bots were quick to bid the yen on the surprise of a 15bp hike, but gains were just as quick to evaporate on the hollow headline numbers. With volatility heightened with month-end flows added in for extra fun, I suspect the yen will weaken heading into the FOMC meeting later today.

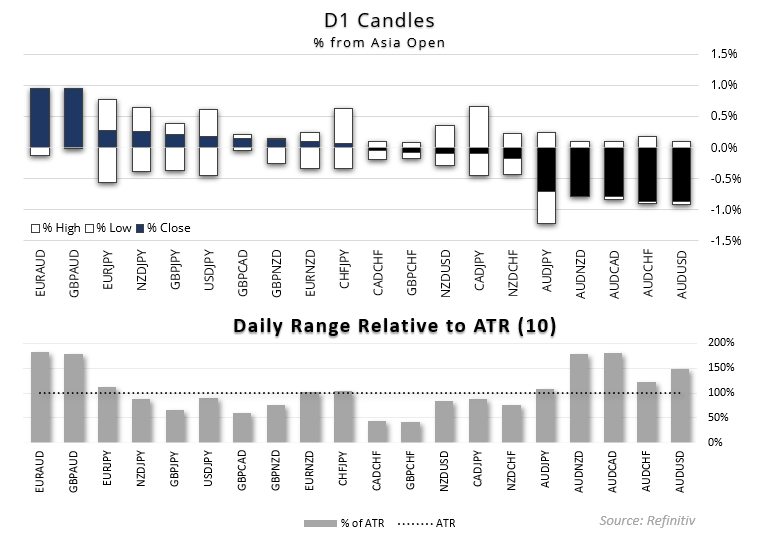

A cursory glance at yen pairs shows how unforgiving trading central bank meetings can be for intraday traders. No sooner has the yen spiked higher, momentum turned and presumably left several liquidity gaps along the way. For now, volatility is likely to subside and prices remain within the 5-min range created at the time of the BOJ’s announcement. But if I had to pick a direction for the yen heading into the FOMC meeting, it would be lower. And that could see USD/JPY, EUR/JPY, GBP/JPY and the like drift higher.

One down, two to go regarding central bank meetings. The FOMC announce their interest decision in just under 12 hours, and the BOE in just over 24 hours. Markets are primed for a dovish meeting, and for once I agree with the consensus. The Fed need to take the symbolic step of hinting at the September cut that is practically priced in already, and that could see yields and the US dollar weaken, at least temporarily.

Yet I suspect BOE are not in a position to be as dovish as markets hope, which leaves the potential for a bounce tomorrow.

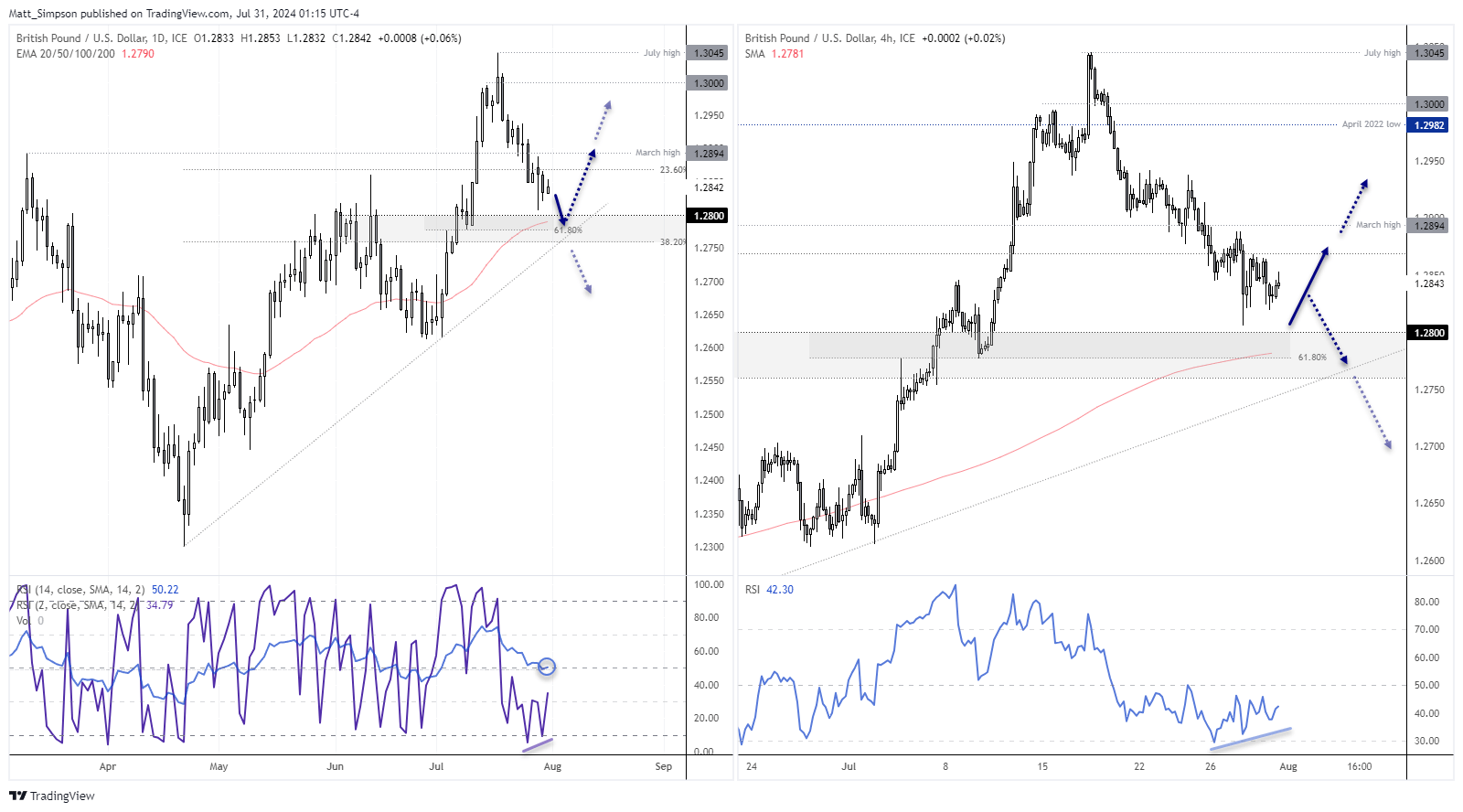

GBP/USD technical analysis:

The weekly chart is amid its third week lower, but the pullback is not severe enough to spoil its uptrend. If anything, it is a healthy move that looks like it wants to break to new highs in the coming weeks. The daily chart shows that the decline from the July high has come in one way, so a bounce (even if small) could be due.

Note the bullish pinbar above 1.28 alongside the small bullish divergence on RSI (2) in the oversold zone, while the daily RSI (14) is holding above 50. A suspect a swing low is near, if not in already.

The 4-hour chart is grinding lower, and a retest and potential break below 1.28 seems plausible. But my hunch that the BOE are in no position to provide a dovish cut (assuming they cut at all) leaves GBP?USD vulnerable to a bounce later this week. And that places a retest and potential break above 1.29 on the cards once we get past the FOMC meeting and cruise towards the BOE and the weekend.

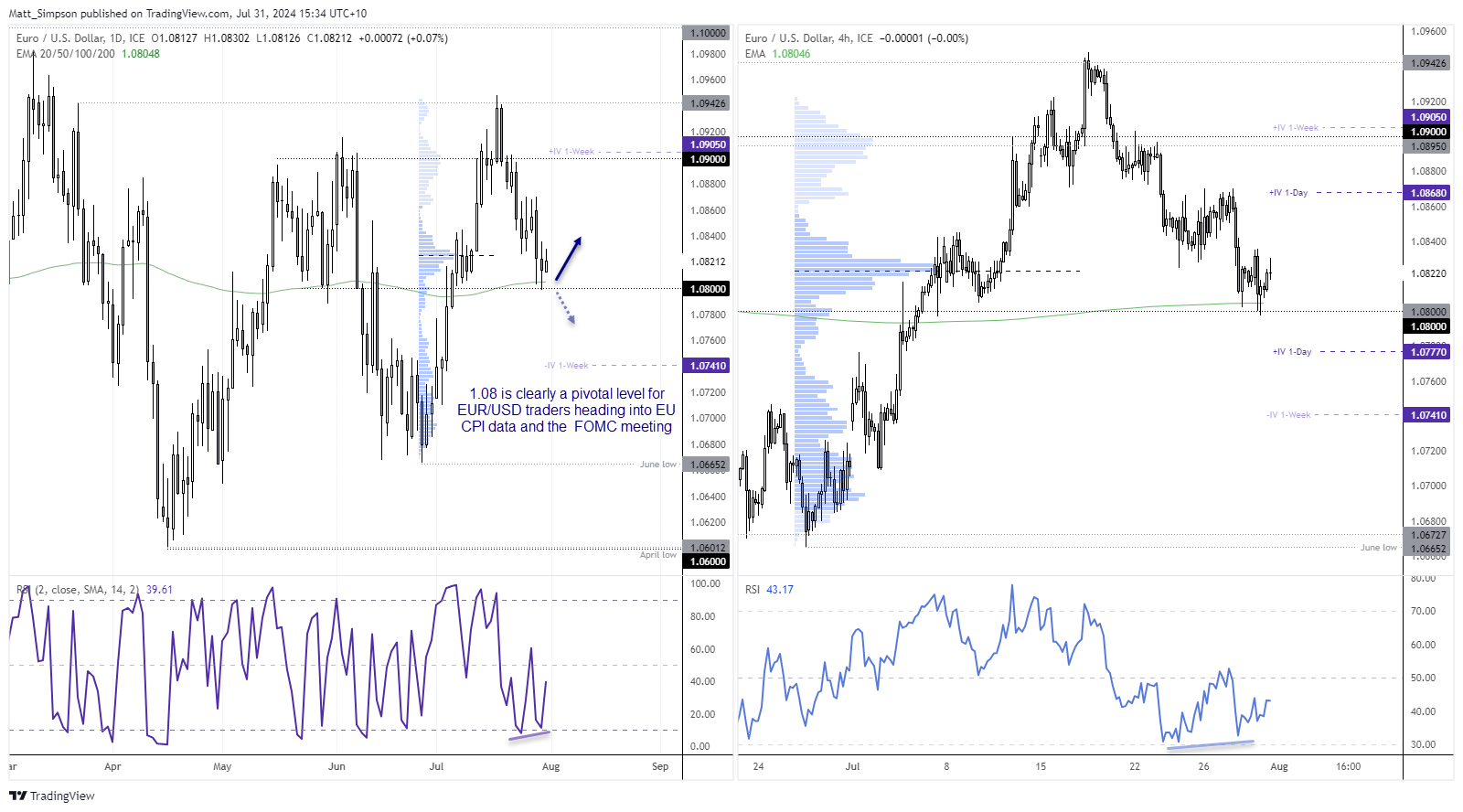

EUR/USD technical analysis:

I have less conviction on EUR/USD regarding its next directional move compared with GBP/USD. But I can at least see how pivotal the 1.08 area is over the near term. Take note that EU inflation data is released ina few hours, and a soft set of figures could help it retrace towards 1.08. And that could act as a springboard if the Fed deliver the dovish tone everyone wants to hear.

A decent break of 1.08 brings 1.0770 into focus, at the lower 1-sday implied volatility band which sits in an area of relatively low volume. As such areas can act as a magnet for prices once revisited.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge