The Fed are expected to deliver their final 25bp cut of the year on Wednesday. With market pricing, economists and myself in agreement, the contrarian reaction would require a surprise hold. Yet I suspect the Fed are likely to take the opportunity to cut ahead of Trump returning to the Whitehouse, knowing they can always hike again later if his policies really are as inflationary as feared.

Besides, next year’s projections are what really count. Markets have been pricing out the cuts they were so eager to price in, so we could find that the USD rally hits a speed bump if the Fed only revise their easing path down to 2 cuts next year. But I also suspect we could be headed for another “buy the rumour, sell the fact” response for the USD, which has enjoyed continued support alongside yields as markets brace themselves for a considerably less dovish Fed. And interestingly, this would ties in with the negative bias on Fed day, which we can look at shortly.

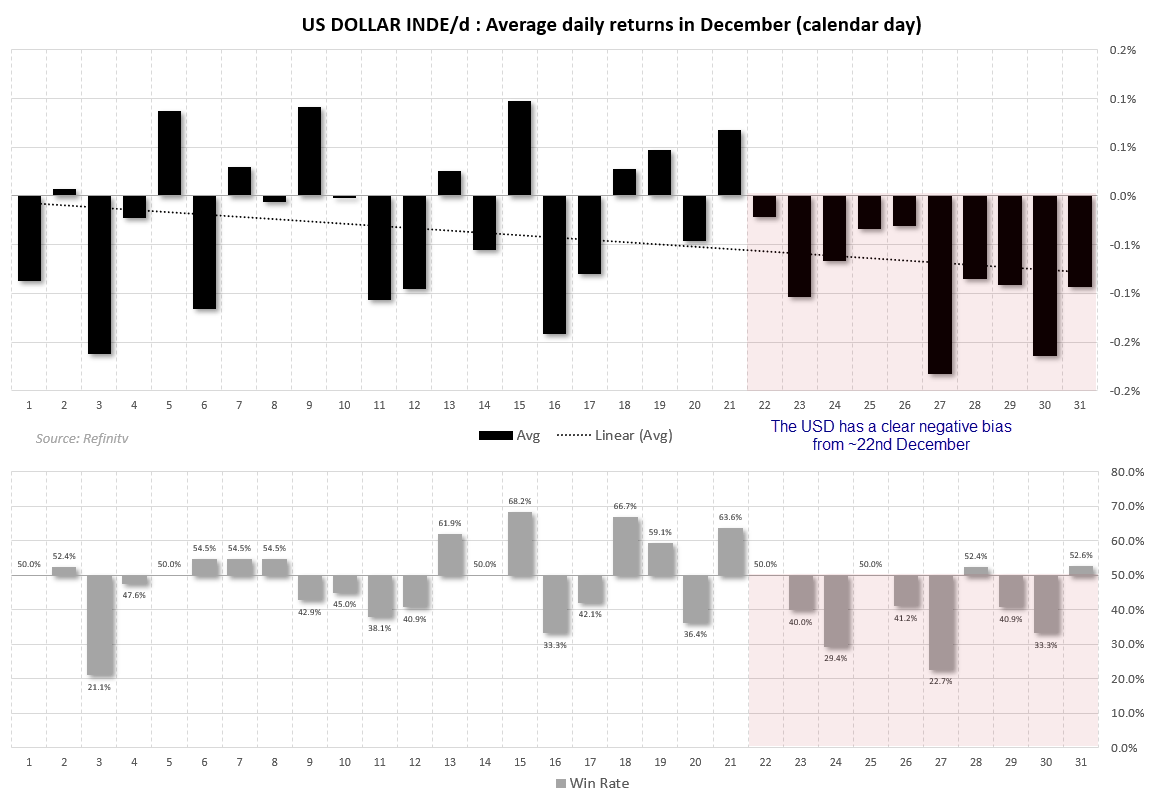

But first, a timely reminder that while the USD tends to suffer in December, much of its losses tend to arrive in the second half of the month. Or more specifically, the 22nd to the 31st of December has negative average returns, the majority of which also have a negative win rate.

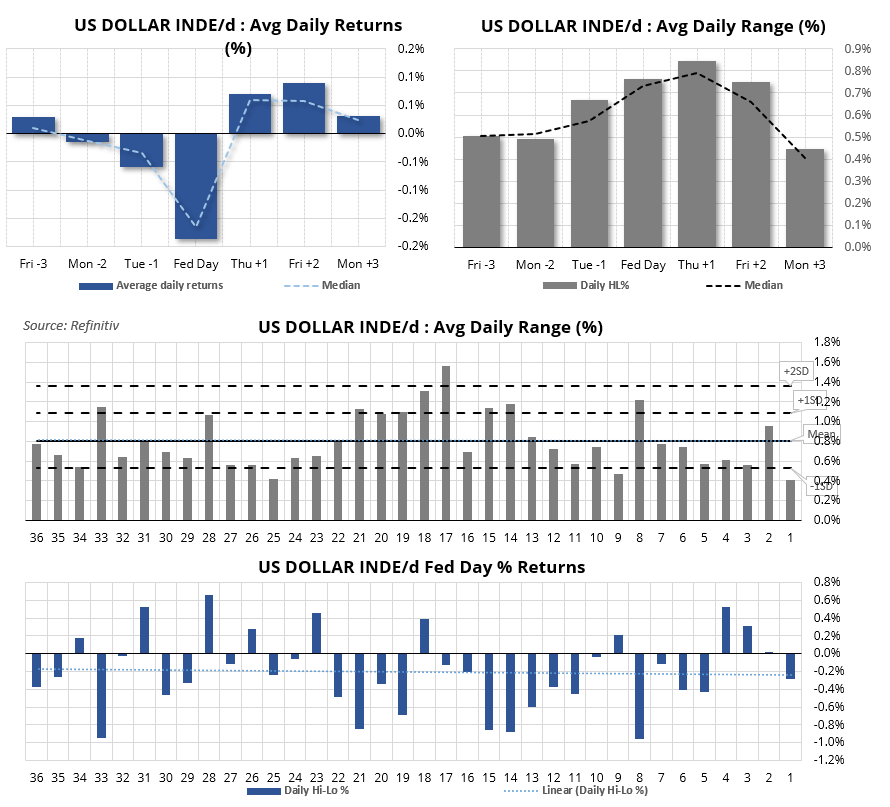

USD index stats around the Fed:

- The USD index has provided negative average and median returns on the day of the Fed meeting, looking at data back to 2007.

- Over the past 36 meetings, there is a clear negative bias for the USD on ‘Fed day’

- Yet the daily range has generally been lower in recent meetings on Fed day

- However, the USD tends to provide positive average and median returns on heading into the weekend

- The daily average range is also at its highest the day after the Fed’s interest rate decisions

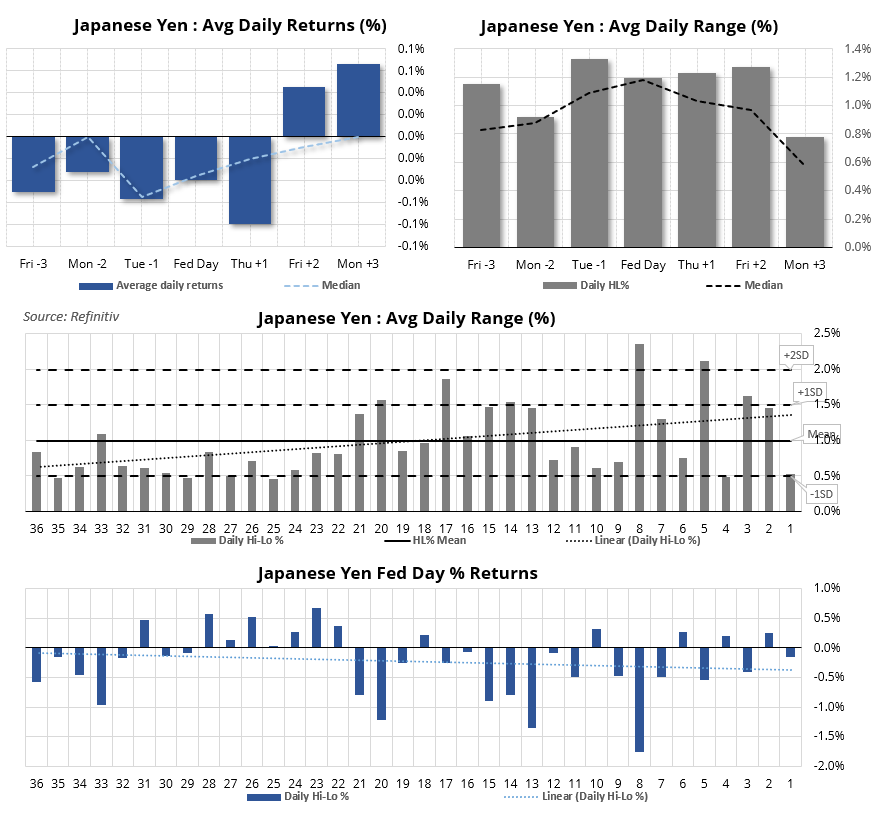

USD/JPY stats around the Fed:

- There is a clear negative bias for USD/JPY heading into the Fed meeting

- Although the strongest negative returns arrives the day after Fed day

- That said, whether it closes up or down on Fed day seems random in recent meetings

- The daily average range is generally the highest on Fed day, looking at median returns

- The average daily range on Fed day has been trending higher

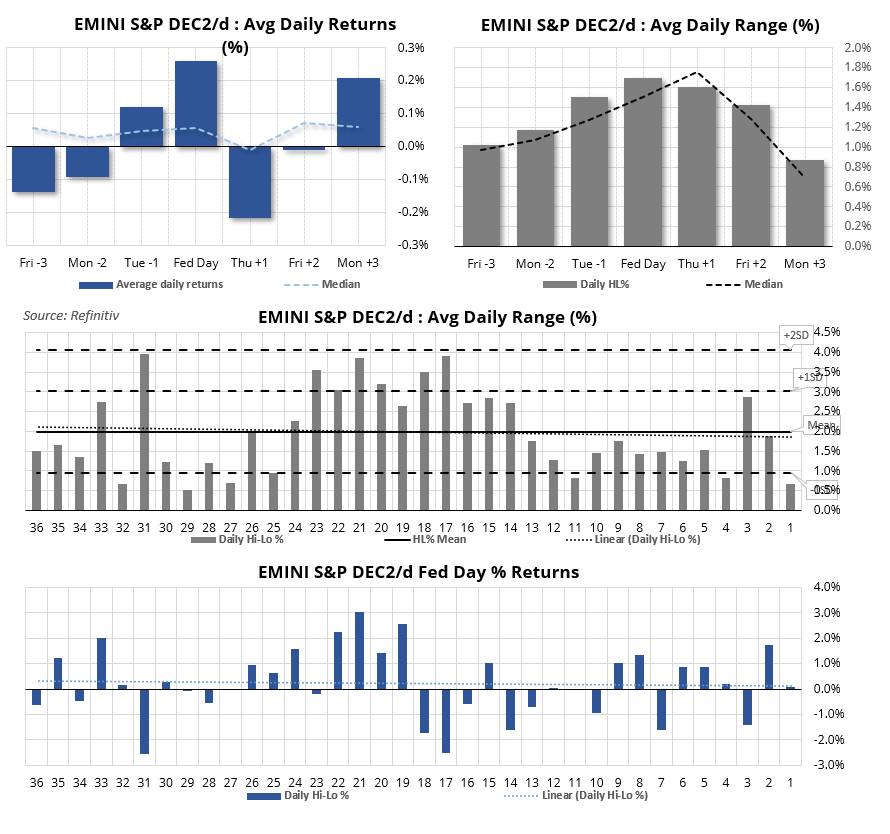

S&P 500 stats around Fed day

- Median returns are positive the three days prior and on Fed day, whereas average returns are positive on the prior Tuesday and on Fed day

- There has been a notable drop in volatility on Fed day over the past year

- Returns on Fed day have also not shown a clear directional bias on Fed day in recent meetings

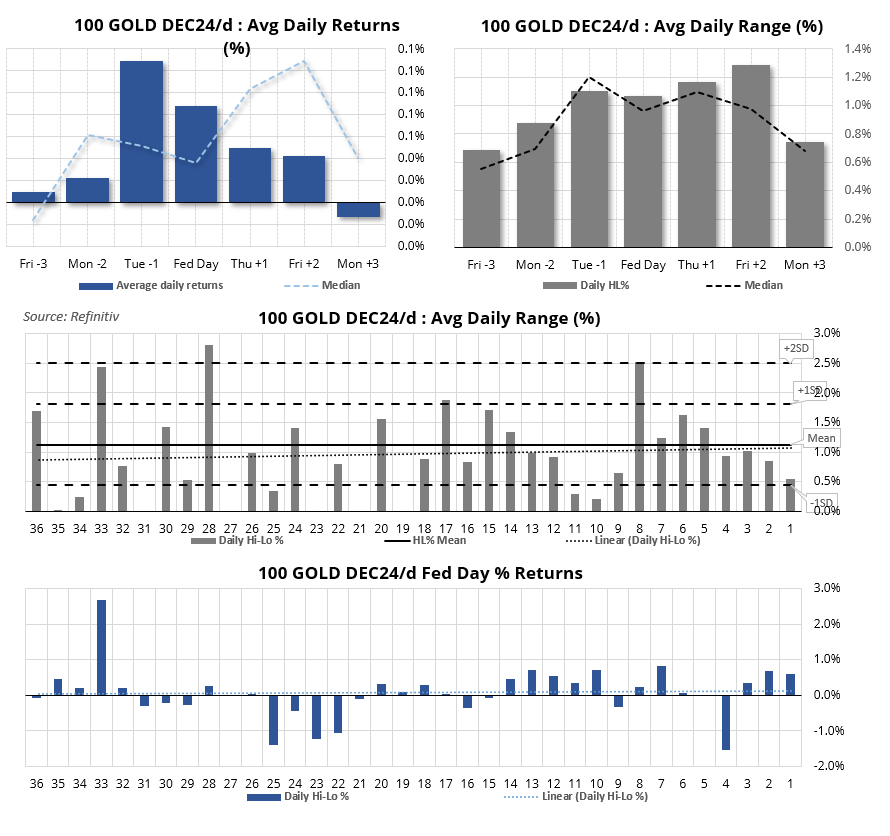

Gold stats around Fed day

- The Tuesday prior to Fed interest rate decisions (today) tend to generate the strongest average returns, with Fed day coming in second place

- Positive median returns are the strongest the Friday after Fed day

- The daily range on Fed day has been trending lower over the past eight meetings

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.