- USD/JPY tied to long-term US yields

- CPI, PPI, retail sales data this week could shift Fed rate expectations

- Price signals from futures hint long-term US yields may have peaked

- Bearish momentum favours selling rallies over buying dips

Overview

USD/JPY remains linked to the US interest rate outlook, especially long-term Treasury yields. With key data like CPI, PPI, and retail sales due this week, it could influence Fed rate cut expectations. While strong data may boost short-term yields, signals from rates futures suggest the highs may already be in. Price momentum is also keeling over, favouring selling rallies over buying dips.

Rates reversal warns of downside risks

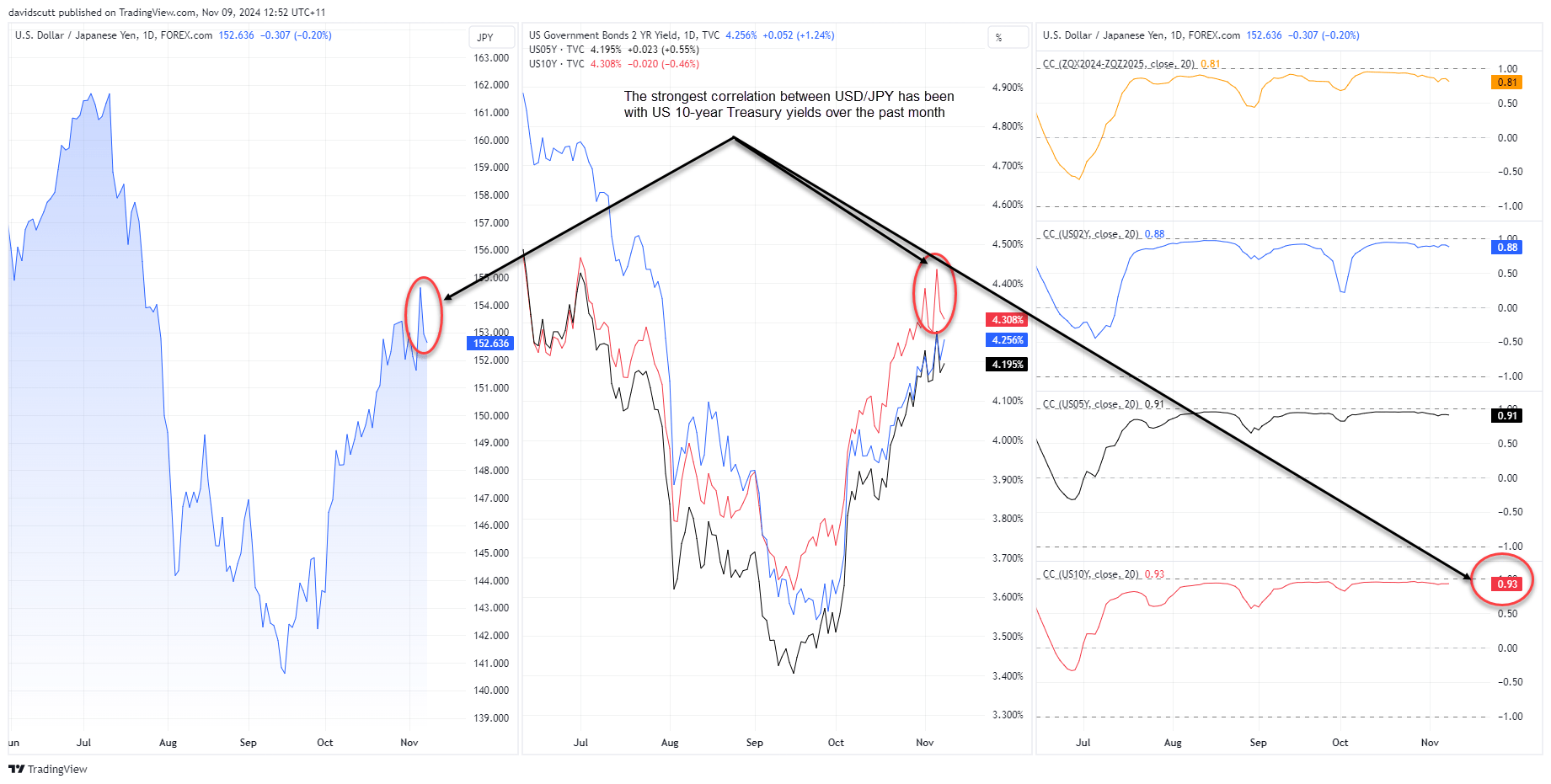

Even with volatility around the US presidential election and Federal Reserve meeting, it’s obvious the US interest rate outlook remains an important driver of USD/JPY movements. Over the past month, the rolling daily correlation with variables ranging from Fed rate cut pricing to long-dated Treasury yields stand at 0.81 to 0.93, indicating thy generally move in the same direction.

The strongest relationship has been with US 10-year yields, implying it’s the longer-term trajectory for US growth and inflation that’s influencing direction, rather than the near-term Fed outlook.

Source: TradingView

While there was a lot of focus on the US fiscal outlook following Donald Trump’s victory in the election, especially with the Republicans closing in on controlling Congress, it was notable that US longer-dated Treasury yields finished lower than where they started the week.

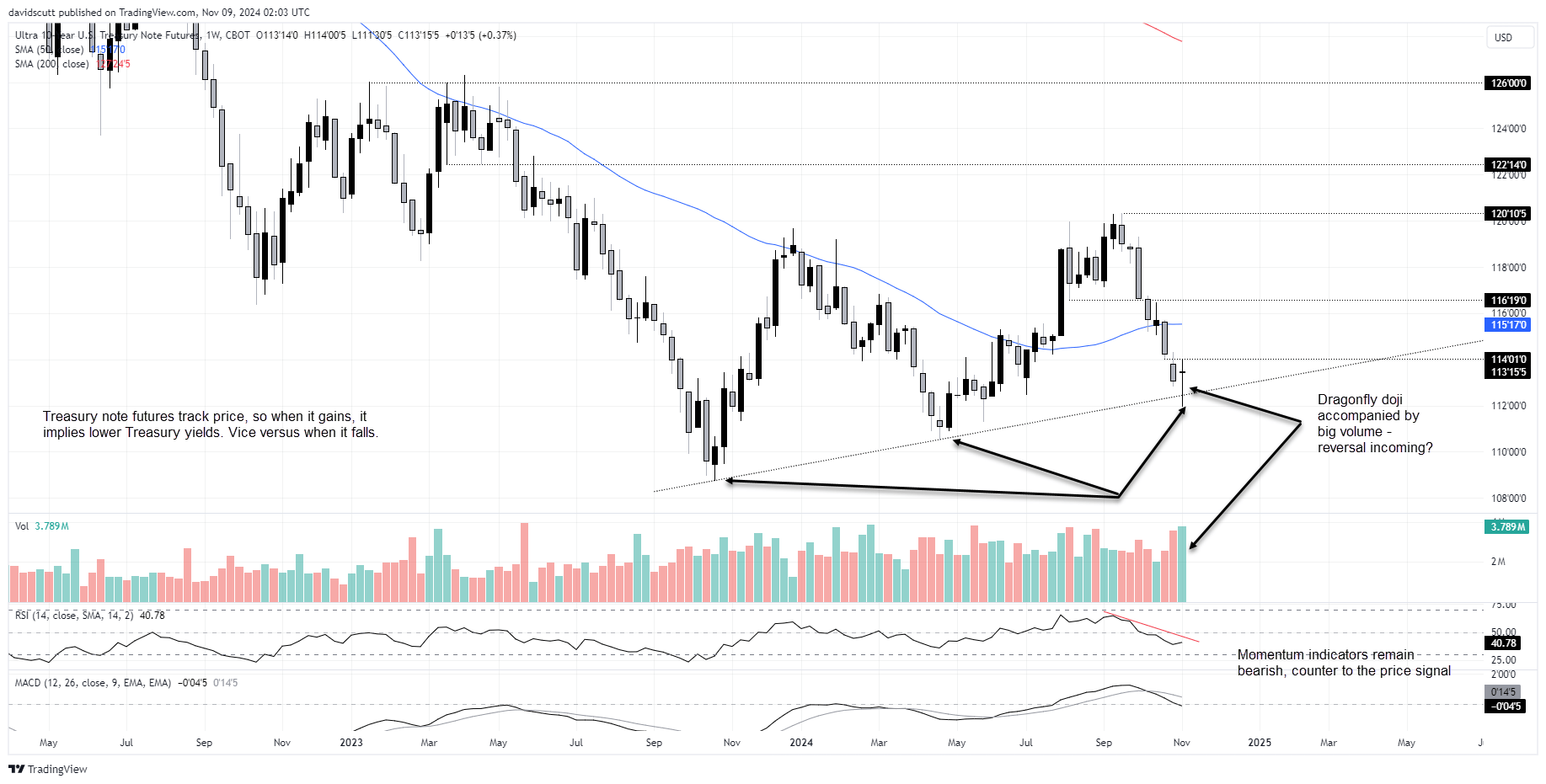

The reversal is evident in US 10-year Treasury note futures, shown in the chart below. They bounced hard on big volumes after briefly falling below uptrend support, printing a Dragonfly doji on the weekly timeframe.

Source: TradingView

Though RSI (14) and MACD haven’t confirmed, coming after a significant decline, the price signal hints we may have seen a near-term bottom for Treasury prices. If correct, it implies we may have seen a near-term peak for yields and USD/JPY, too.

US CPI, PPI, retail sales key

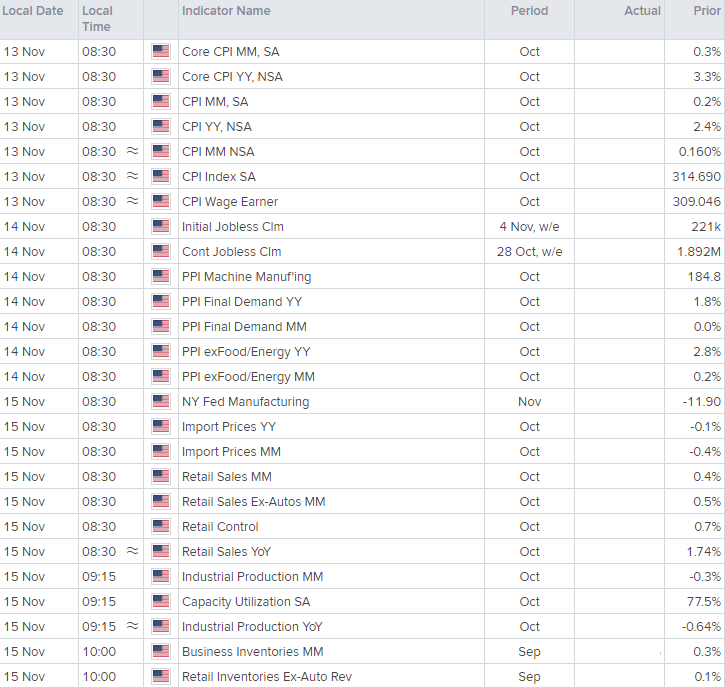

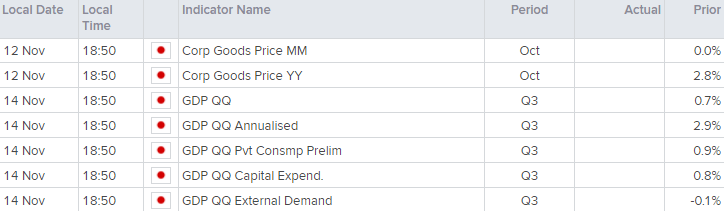

With USD/JPY beholden to the US interest rate outlook, it means traders need to focus on the US event calendar again this week. Three releases stand out as important: CPI on Wednesday, PPI on Thursday and retail sales on Friday.

Source: Refinitiv

If the data continues to question the need for another rate cut from the Federal Reserve in December, it could lead to a further curtailment of easing expectations.

Even though such an outcome will likely boost shorter-dated yields, it may not for longer-term yields given tighter policy settings may see growth and inflation expectations soften. Simply, while strong data is likely to support USD/JPY, it may not be much given the stronger relationship has been with longer-date yields recently.

Watch for Fed guidance

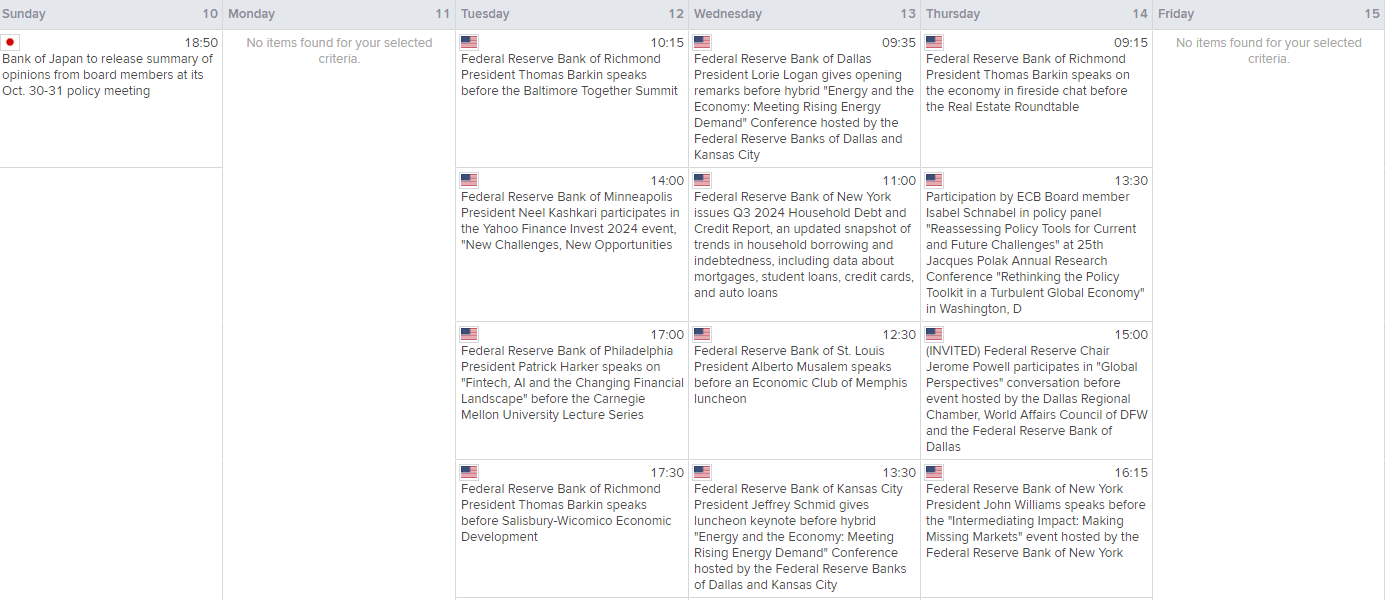

Federal Reserve speakers during the week are also likely to be influential, allowing traders to gauge whether the tone from Jerome Powell last Thursday is consistent throughout the FOMC.

Source: Refinitiv

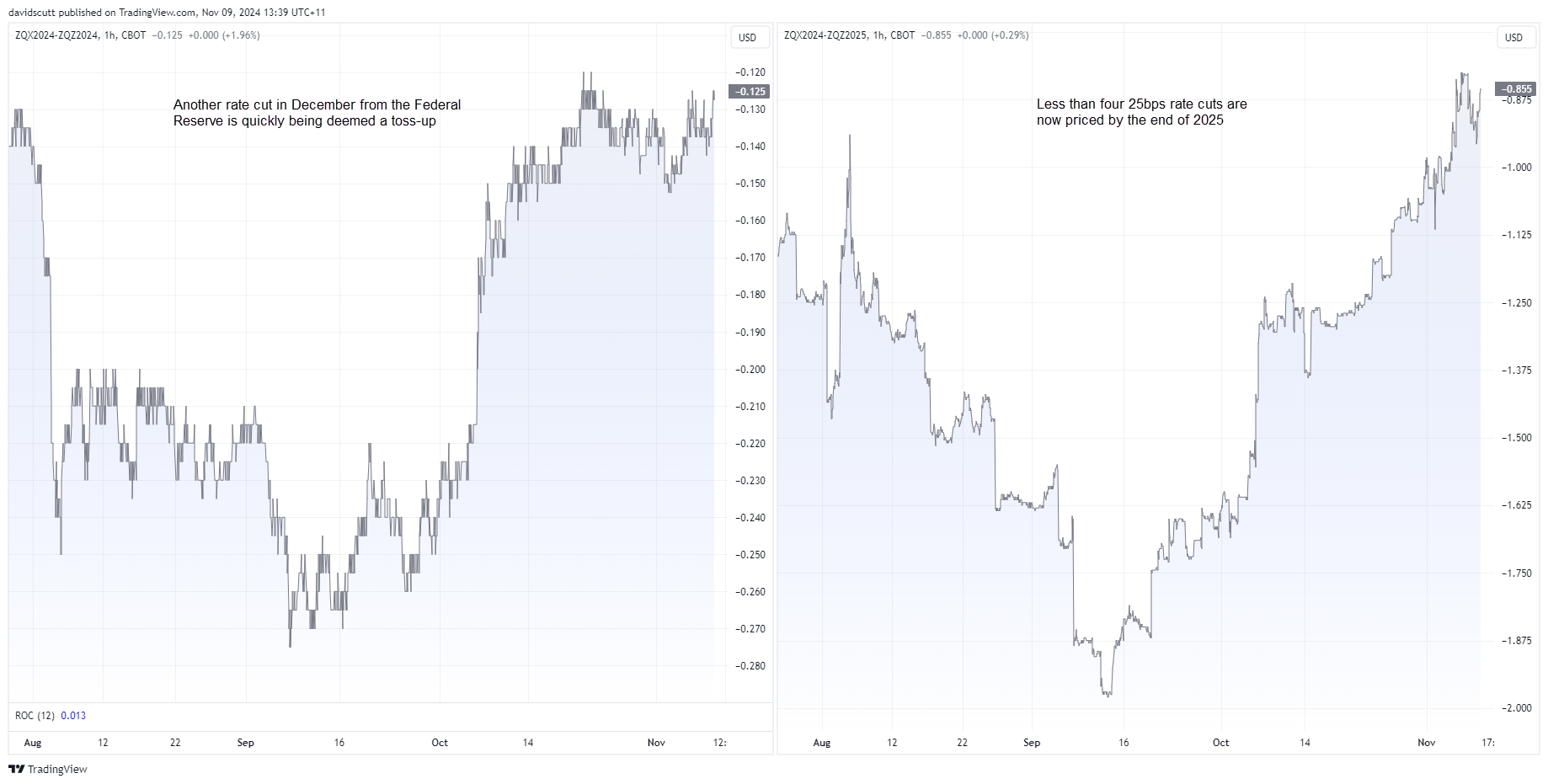

As things stand, another 25bps rate in December is deemed a toss-up, with less than four 25bps moves expected by the end of next year.

Source: TradingView

Beyond the US calendar, no Japanese data screens as being particularly important this week. The preliminary Q3 GDP report may generate some volatility, but it’s generally BOJ commentary that can generate movement from the Japanese side of the ledger.

Source: Refinitiv

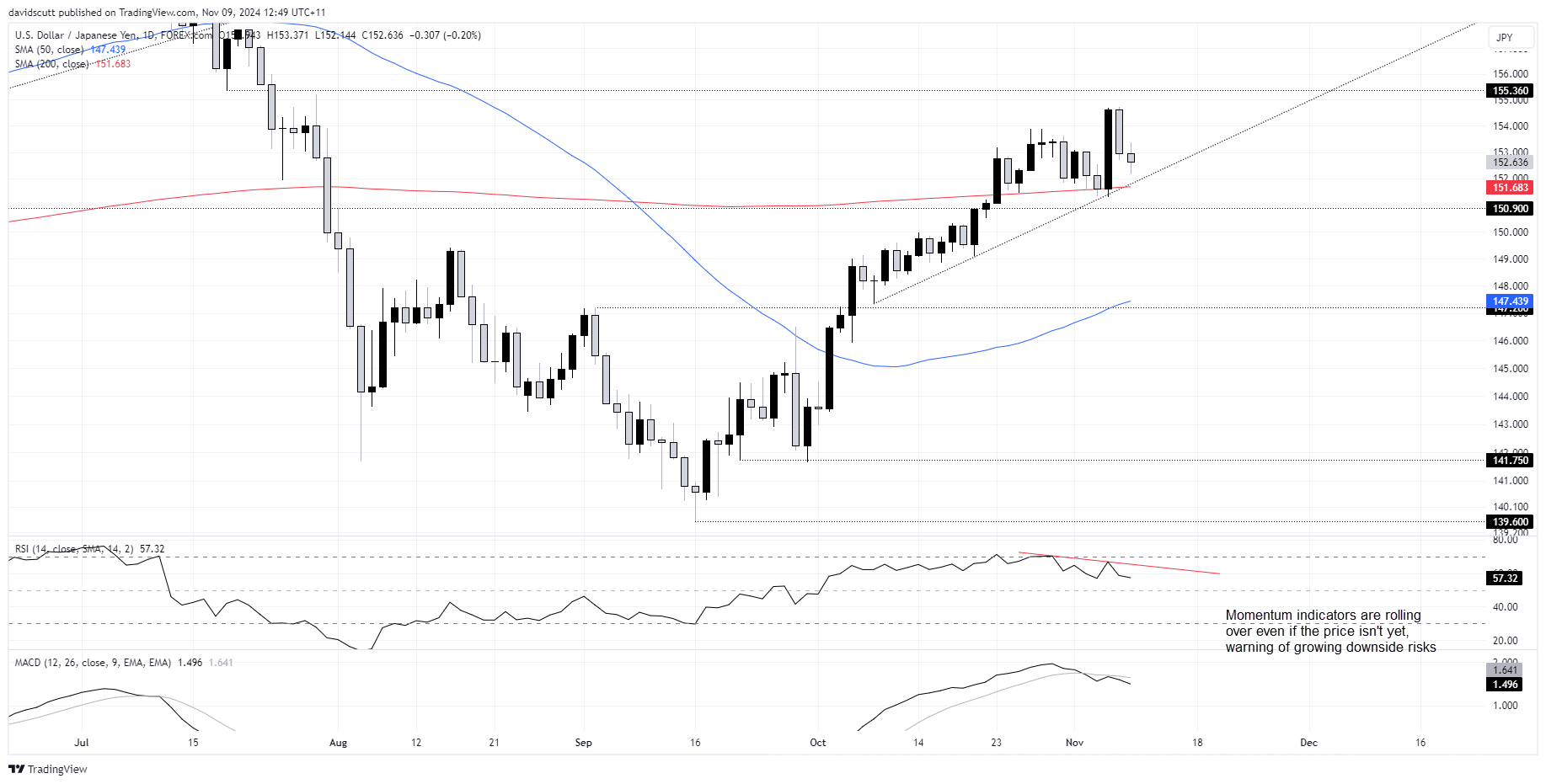

USD/JPY: vulnerable to downside

USD/JPY finished last week lower than where it started, reversing what was a significant push higher on the day of the US election. While there’s no obvious price signal on either the daily or weekly timeframe to guide direction, it’s notable that RSI (14) and MACD are providing bearish signals on momentum. The former also diverged from price, hinting that near-term reversal risks may be increasing.

Levels to watch include:

Support: uptrend running from October 8, located at 151.80 currently, 200-day moving average, 150.90.

Resistance: 154.70, 155.36

With momentum rolling over and given the price signal from US Treasury futures, the inclination is to sell rallies rather than buy dips this week.

-- Written by David Scutt

Follow David on Twitter @scutty