Asian Indices:

- Australia's ASX 200 index rose by 92.6 points (1.32%) and currently trades at 7,099.30

- Japan's Nikkei 225 index has risen by 776.81 points (2.38%) and currently trades at 33,472.74

- Hong Kong's Hang Seng index has risen by 491.55 points (2.83%) and currently trades at 17,888.41

- China's A50 Index has risen by 76.82 points (0.64%) and currently trades at 12,060.35

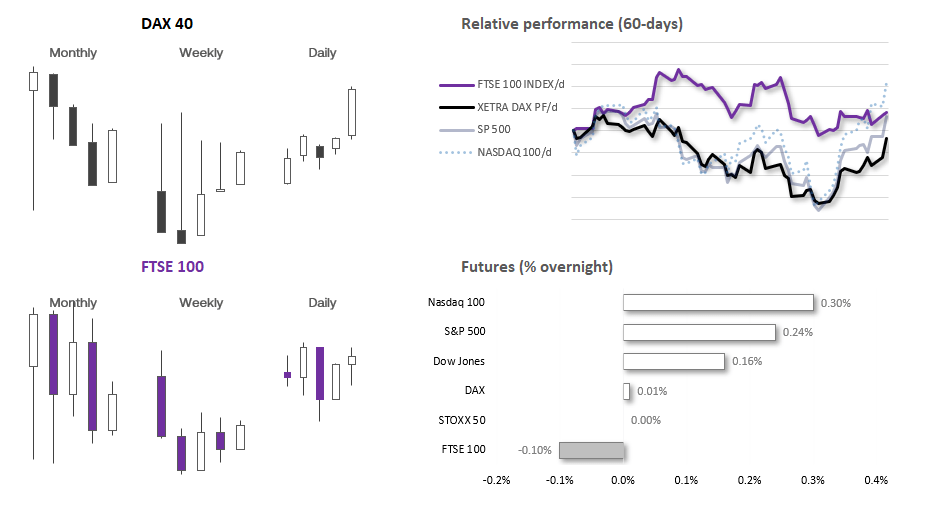

UK and European indices:

- UK's FTSE 100 futures are currently down -6.5 points (-0.09%), the cash market is currently estimated to open at 7,433.97

- Euro STOXX 50 futures are currently up 1 points (0.02%), the cash market is currently estimated to open at 4,292.72

- Germany's DAX futures are currently up 7 points (0.04%), the cash market is currently estimated to open at 15,621.43

US index futures:

- DJI futures are currently up 60 points (0.17%)

- S&P 500 futures are currently up 11.75 points (0.26%)

- Nasdaq 100 futures are currently up 50 points (0.31%)

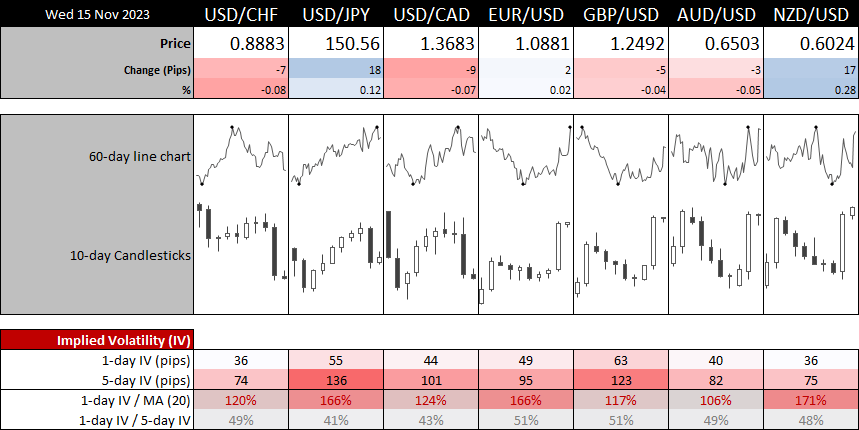

Wage growth in Australia grew at its fastest pace on record at 1.3% q/q, and the annual rate rose 4% y/y (above 3.9% expected). However, it failed to result in a bullish breakout for AUD/USD above the 65c area. Partially this may be because we’d seen an extended move higher on Tuesday, but most likely down to the fact wages were driven higher by temporary factors such as the minimum wage increase and 1.3% q/q was expected.

Japan’s economy contracted faster than expected in Q3, with GDP falling -2.1% y/y, below -0.6% expected and 4.5% prior. The quarterly print was -0.5%, and capex also contracted. Ultimately this may do little to entice the BOJ to turn hawkish any time soon. However, they did

China’s retail sales and industrial production beat expectations demand and factory output are perking up. Beijing also plan to inject ¥1 trillion yuan into the flailing property sector to further boost the economy.

UK inflation is a key market to watch to help decipher if the BOE really do need to hike once more. Whilst recent comments suggest they’d prefer to maintain at the current level of 5.25% for longer, a hot inflation print could tip their hand to pull the lever once more. Take note that GBP/USD closed above its 200-day average yesterday, so 1.244 may provide support if prices pull back towards it.

Events in focus (GMT):

- 07:00 – UK inflation (CPI, PPI)

- 07:45 – French CPI

- 09:00 – Italian CPI

- 10:00 – Euro industrial production

- 21:00 – US mortgage data

- 13:30 – US producer prices, retail sales

- 13:30 – Canadian manufacturing and wholesale sales

- 14:30 – Fed Vice Chair for Supervision Barr speaks

- 15:00 – US business and retail inventories

- 15:30 – Crude oil inventories

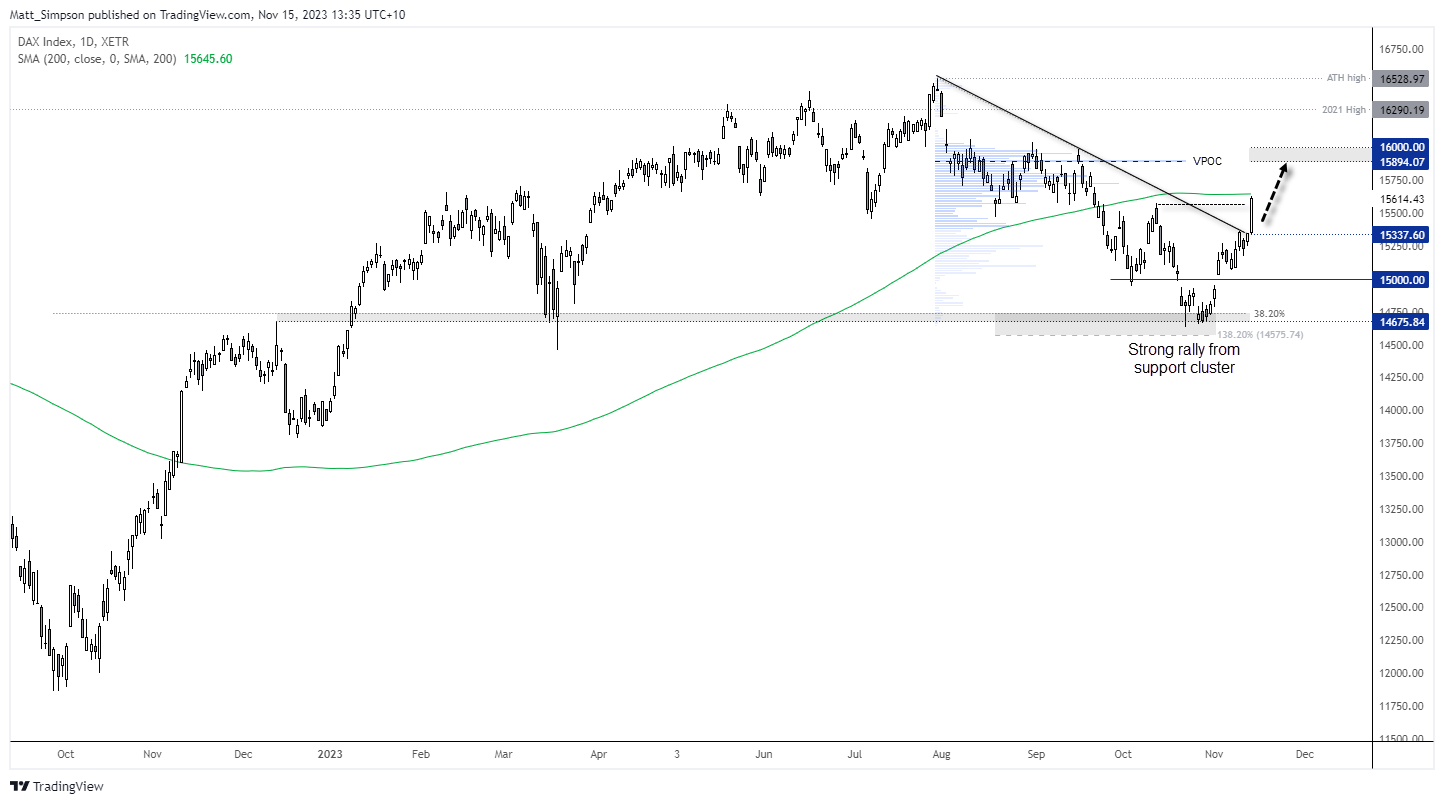

DAX technical analysis (daily chart):

Like global equity indices in general, the DAX delivered strong returns on Tuesday following the softer US inflation figures. Clearly, it invalidated my short bias from Monday, which serves as a reminder as to why risk management is always important and to know where we should invalidate our own bias.

The daily chart shows a strong rally from prior support around 14,750 / long-term Fibonacci 38.2% retracement level, and prices have since broken trend resistance. The DAX even provided a daily close above a prior swing high to warn of a bullish trend reversal.

I suspect prices are now headed for 16,000, given the VPOC (volume point of control) from the prior bearish trend sits just below at 15,895. However, the 200-day MA is capping as resistance, so I won’t be too surprised to see a pullback from current levels.

A retracement within yesterday’s range that holds above the 15,337 low could be considered for dips and potentially improve the reward to risk ratio for an anticipated move to 16,000.

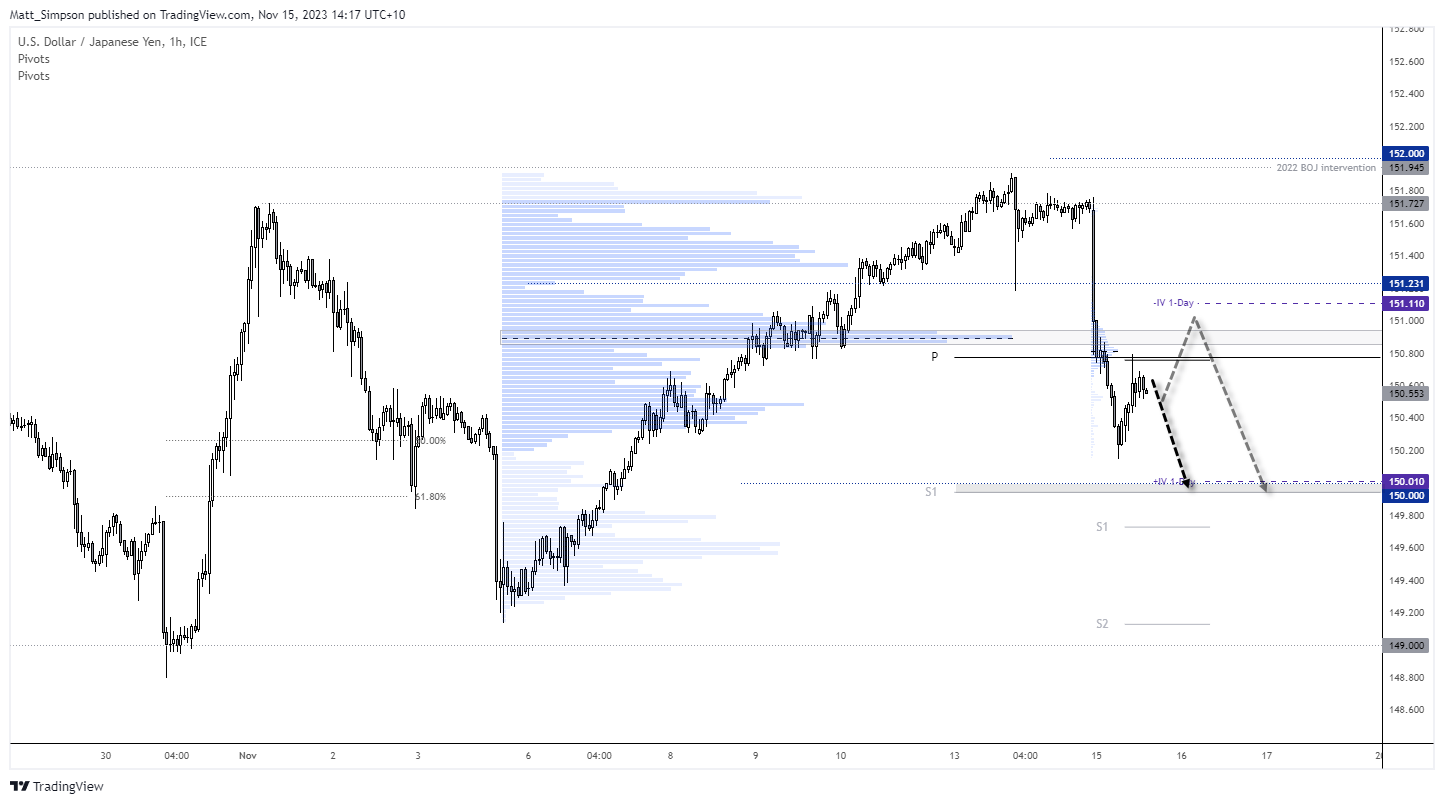

USD/JPY technical analysis (1-hour chart):

The volatility of UD/JPY far exceeded the 1-day implied volatility band – which was already 220% of its 20-day average. Whilst implied volatility remains elevated at 166% of its 20-day average, we may find that volatility today is much smaller unless we get a host of very soft US data.

Still, I suspect USD/JPY may try and head for 150, and for now waiting to see if a swing high has formed or we’re due another leg before it rolls over.

The weekly and monthly pivot points provided resistance earlier today, so bears could seek to fade into low volatility moves towards it. However, if it moves higher then perhaps 151 can provide a better level of resistance for bears to consider fading into.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge