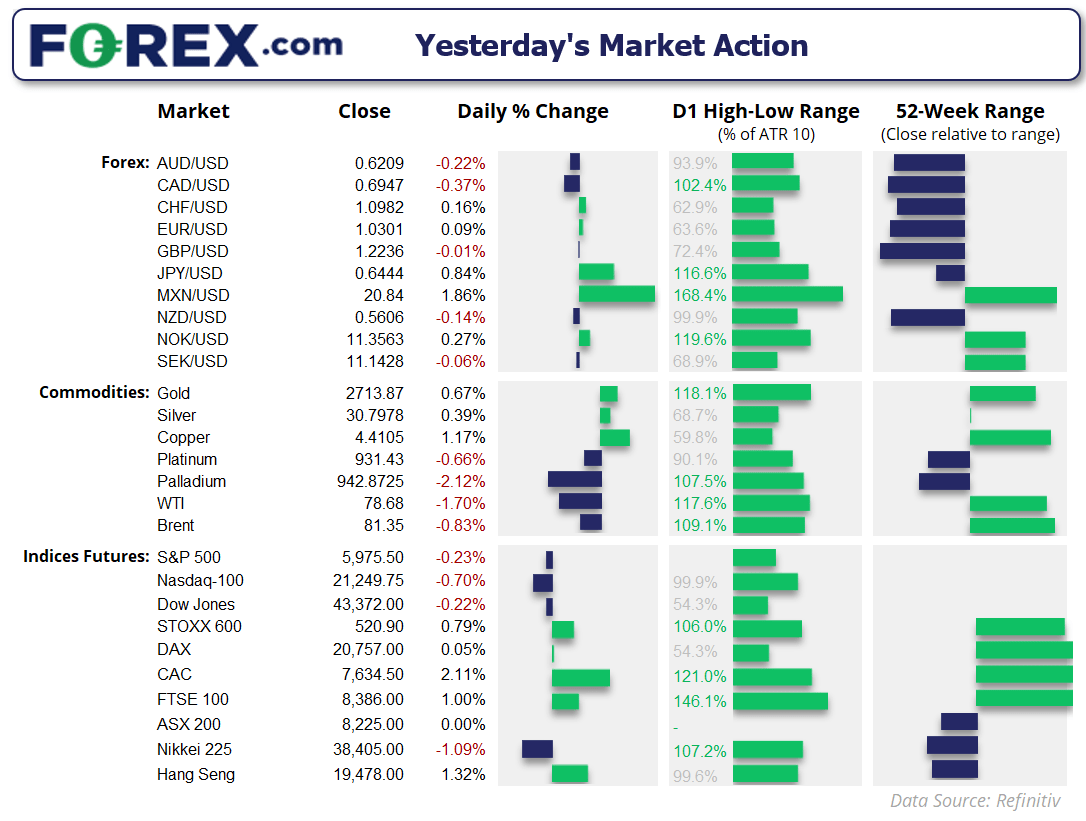

The US dollar was dragged lower by yields again on Thursday after FOMC Waller said he sees a path for the Fed to cut rates in the first half of the year. The US dollar index was lower for a third day, the 2-year yield was down for a fourth and closed at a two-week low.

The Japanese yen was again the strongest currency, which rose against all of its FX major peers. Looking through the charts suggests there could be further downside for USD/JPY and AUD/JPY.

Wall Street’s rally paused on Thursday which kept overnight gains for ASX 200 futures capped. With a resistance zone nearby between 8347 – 8366. I’m on guard for another dip lower.

Australia’s employment rate ticked higher by 0.1 percentage point in December to 4% as expected, reversing its surprise decline to 3.9% in November. And while the 56.3k jobs added far surpassed the 28.2k expected, full-time jobs fall by -23.7k. The 80k Part-time jobs added made up the baulk of the figures. While the report does not flash recession, it still leaves the door open for a rate cut in February. Markets continue to price in three RBA cuts this year, beginning with a 25bp cut next month.

Economic events in focus (AEDT)

- 10:50 – JP foreign investments in Japanese stocks and bonds

- 12:30 – CN House Prices

- 13:00 – GDP, industrial production, retail sales, fixed asset investment, unemployment, NBS press conference

- 18:00 – UK retail sales

- 21:00 – EU CPI

- 01:15 – US industrial production

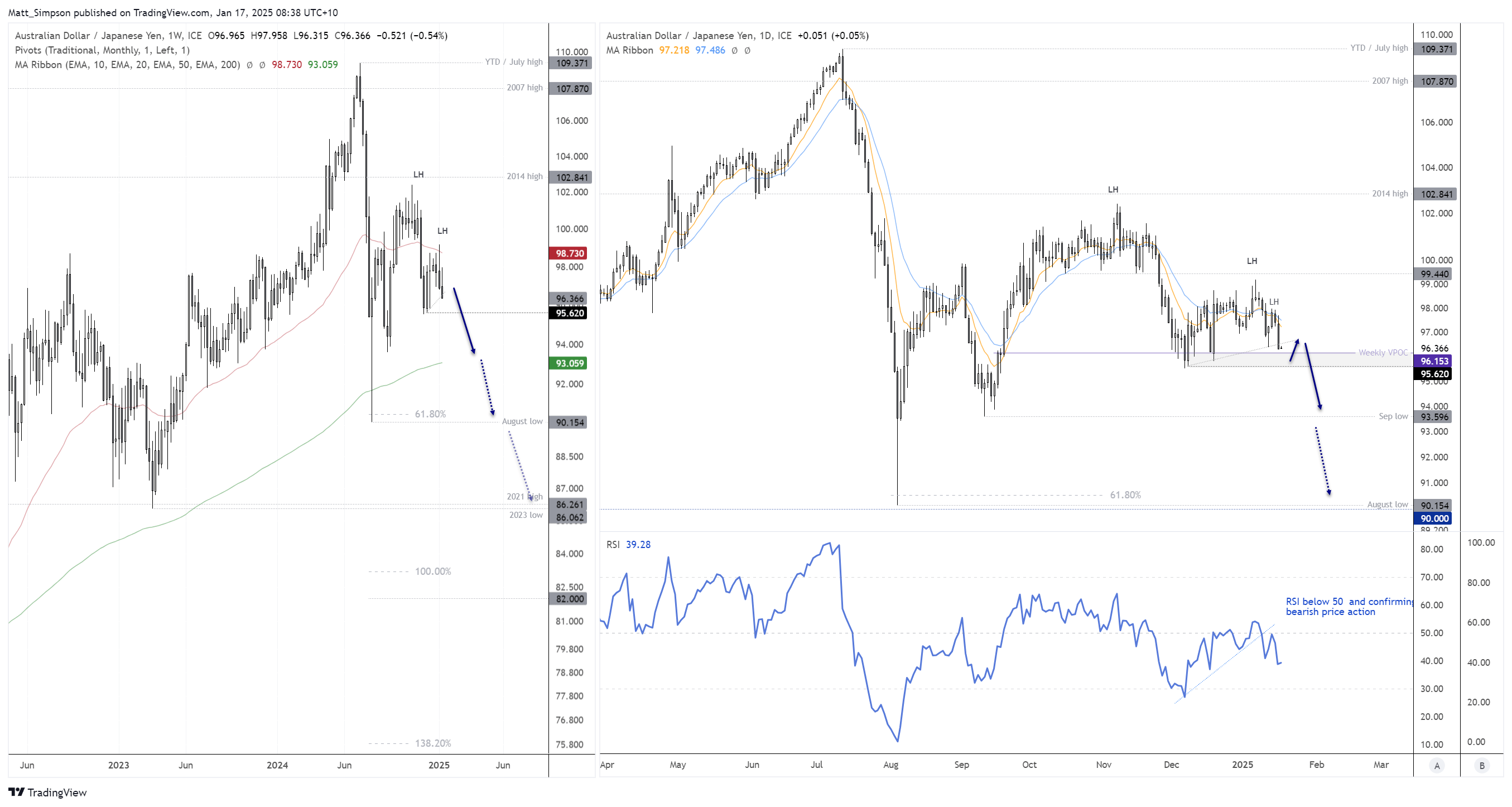

AUD/JPY technical analysis:

In November and December I outlined a particularly bearish case for AUD/JPY, which could see prices fall to the lower 90s or even lower-mid 80s this year. For now, that bias remains in place. The weekly chart shows a bearish engulfing candle formed at the 50-week EMA last week, and momentum has continued lower to suggest another lower high has formed around 99.

The daily chart shows a lower high around the 98 handle and bearish momentum has resumed, with a daily close beneath a correction line. Given the strength of the yen and bearish bets against the Australian dollar, the bias is to fade into retracements within daily candles and assume a break beneath the 95.62 low and move towards the 94 handle.

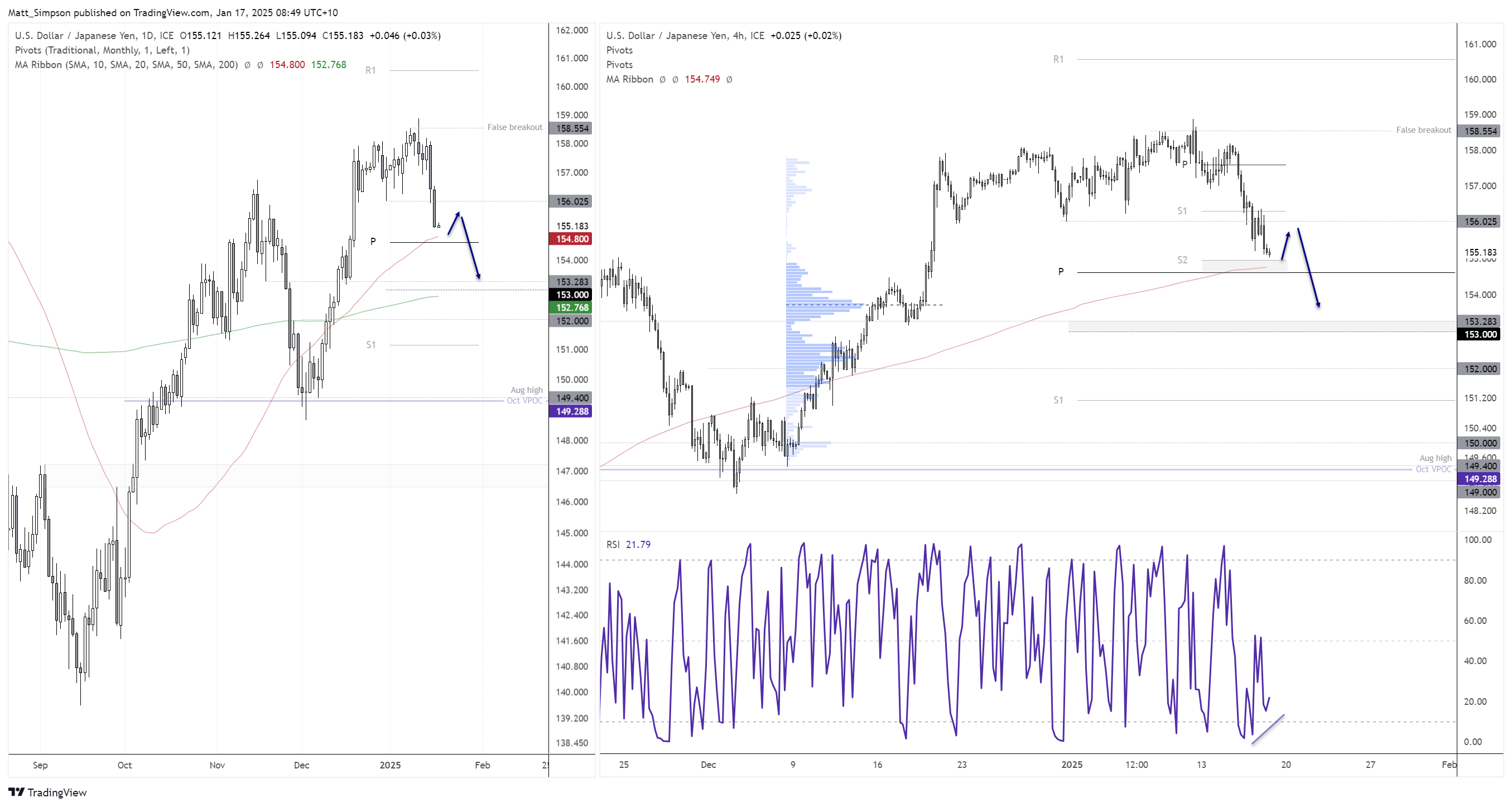

USD/JPY technical analysis:

My bearish bias on USD/JPY played out nicely on Thursday, although we didn’t get much of a bounce before losses resumed in yesterday’s Asian session. A correction is now fully underway, and the losses of the past two days opens the door for a deeper correction beyond the monthly pivot point (154.60).

However, bears beware that support is nearby which could prompt at least a small bounce before momentum potentially continues lower. A bullish divergence has formed with the 4-hour RSI (2) and prices are trying to hold above the weekly S1 pivot (154.95). Therefore, bears could seek to fade into minor rallies within Thursday’s range in anticipation of a break below the monthly pivot, to try and increase the potential reward to risk ratio.

The 153 handle is the next major support level, near as high-volume node (HVN) from the prior rally.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge