Market positioning from the COT report - as of Tuesday 10 September, 2024:

- Net-long exposure to Japanese yen futures rose for a fifth week, and reached a near 8-year high

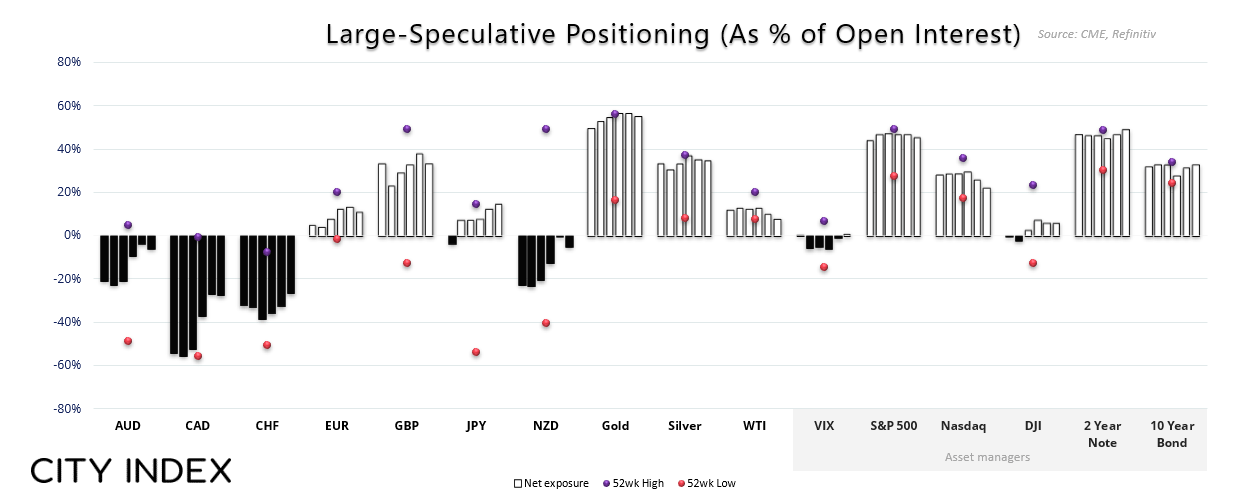

- Large speculators increased net-long exposure to the USD index to their most bullish level since November 2023, again underscoring that their exposure is not a good metric for USD sentiment

- Large speculators increased their net-short exposure to commodity currencies, although both longs and shorts were trimmed

- Net-long exposure to WTU crude oil fell to its least bullish level since July 2023

- Asset managers(real money accounts) increased their gross-short exposure to Nasdaq 100 futures

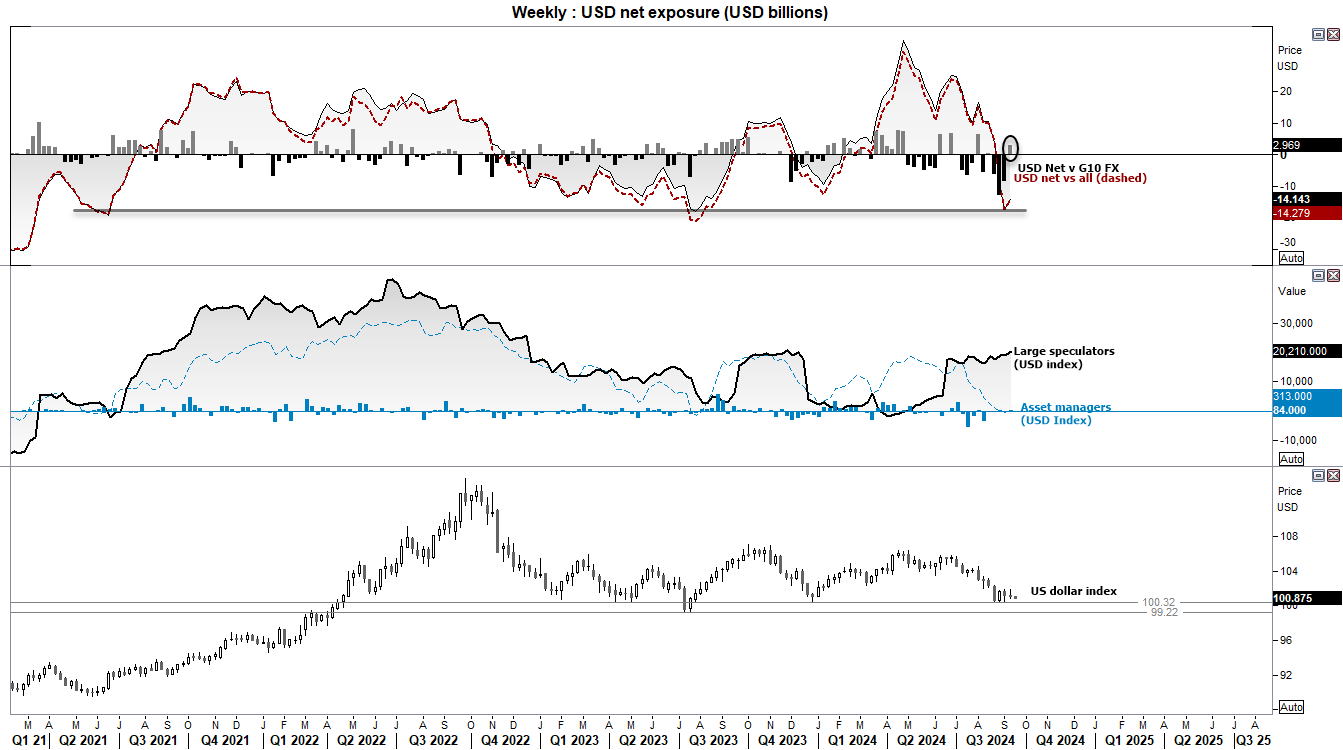

US dollar positioning (IMM data) – COT report:

Being short the USD is a stale trade, looking at market exposure. Futures traders decreased their net-short exposure to the USD for the first week in four, and their exposure was arguably at a sentiment extreme. Also note that the USD index is holding above 100, large speculators increased their net-long exposure to a YTD high and asset managers tipped back into net-long exposure. It might take some very weak data to justify being short the USD from here, and if data outperforms it looks oversold in my humble opinion.

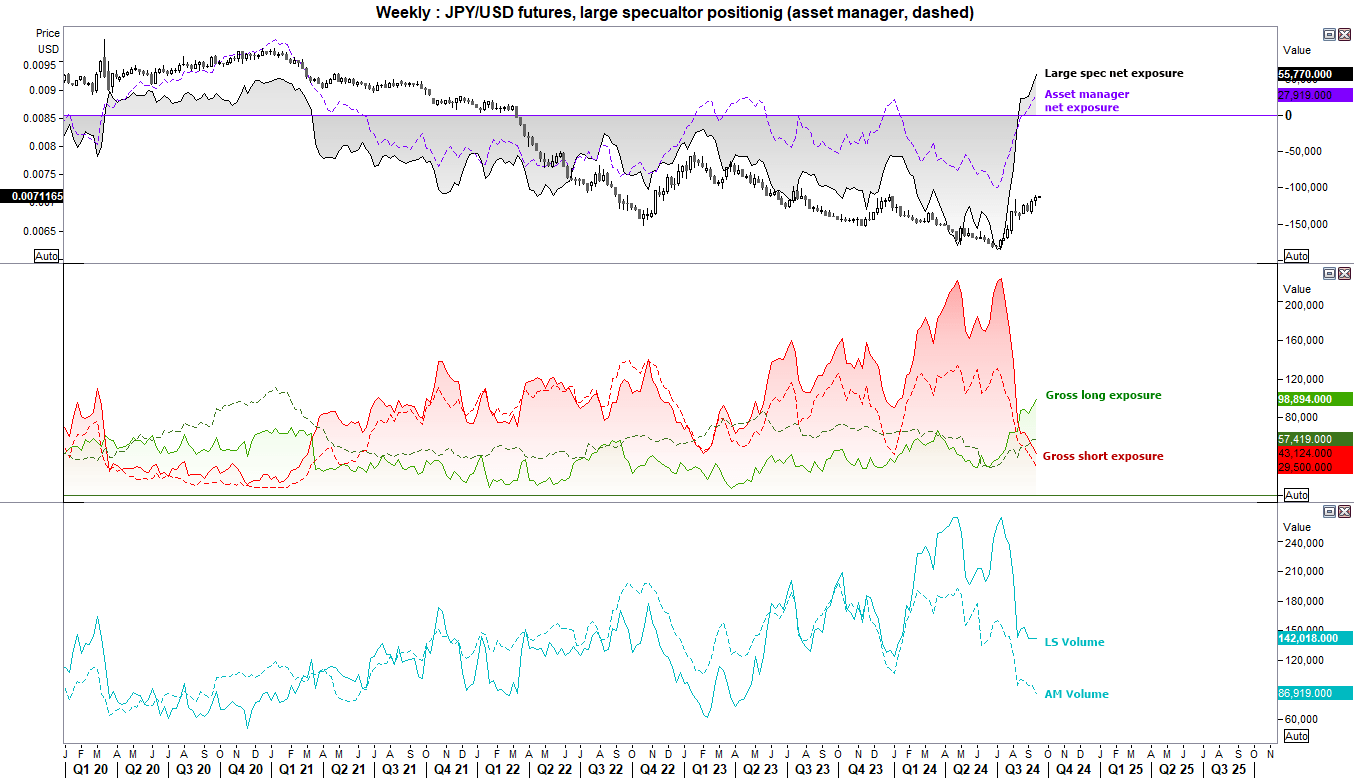

JPY/USD (Japanese yen futures) positioning – COT report:

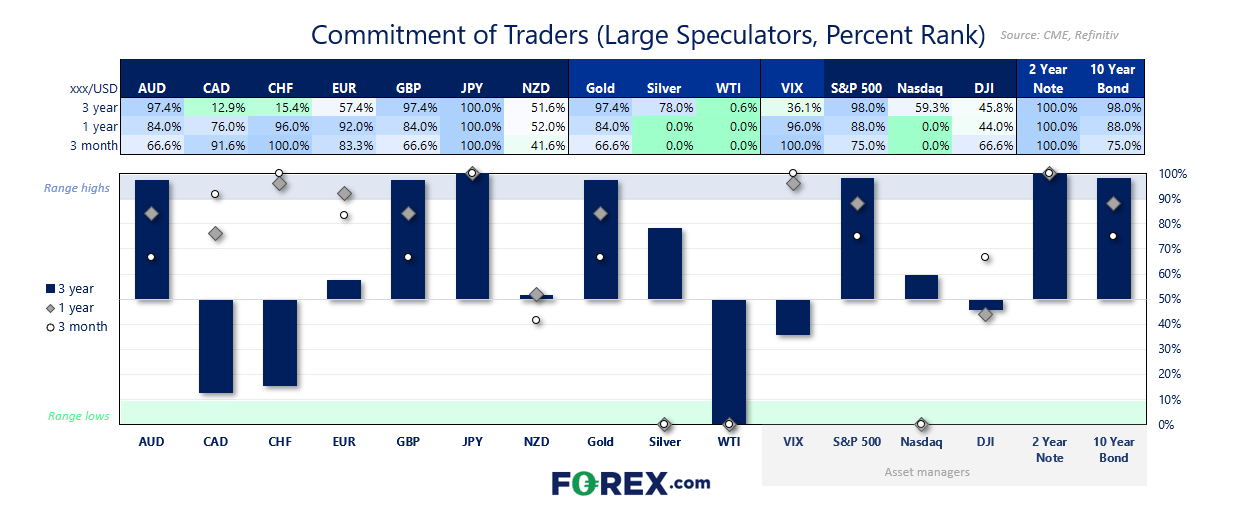

By some metrics, it could be argued that bullish bets on the Japanese yen are at a sentiment extreme. The 3-month, 1-year and 3-year percentage rank are all at 100%, gross-long exposure is at its highest level since October 2016 and gross shorts at their lowest since February 2023. But context matters. USD/JPY was trading at 104 in 2016, and it now trades around 140. And it could trade a lot lower assuming expectations for multiple Fed cuts alongside a hawkish BOJ are met.

However, USD/JPY is currently lower for a third month, and down 14% since the July high. I suspect the meat of this move is closer to the end than the beginning, so bears may want to remain nimble and seek to fade into rallies to rejoin the bearish trend at more favourable prices.

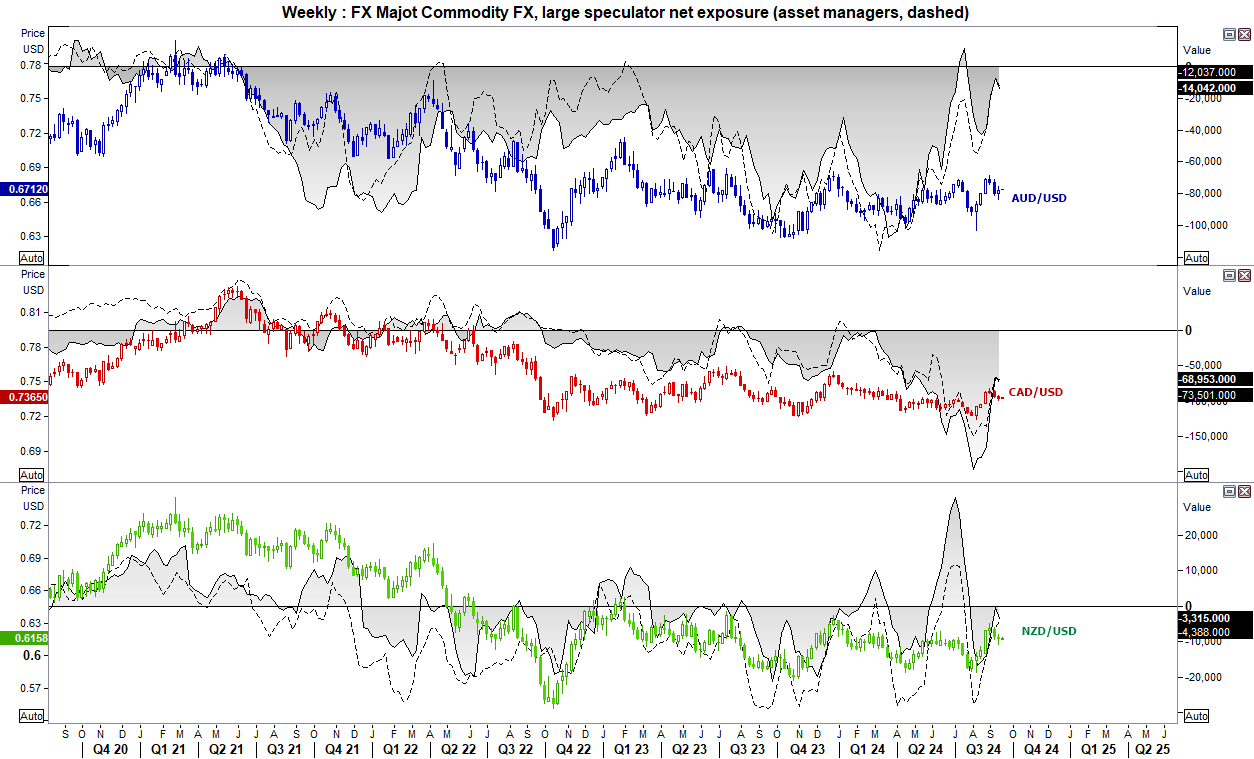

Commodity FX (AUD, CAD, NZD) futures – COT report:

Large speculators increased their net-short exposure to all three commodity FX pairs. Yet in each case, they reduced both long and short exposure. This is not exactly ‘risk-on‘ mentality. Asset managers slightly trimmed net-short exposure to NZD futures, but again it doesn’t scream risk on.

For now, I feel we can ignore any supposed signals from the COT data. Price action on AUD, CAD and NZD futures suggest we saw a swing low last week, which means buying dips is the preferred choice unless we see a sudden shift towards bearish price action.

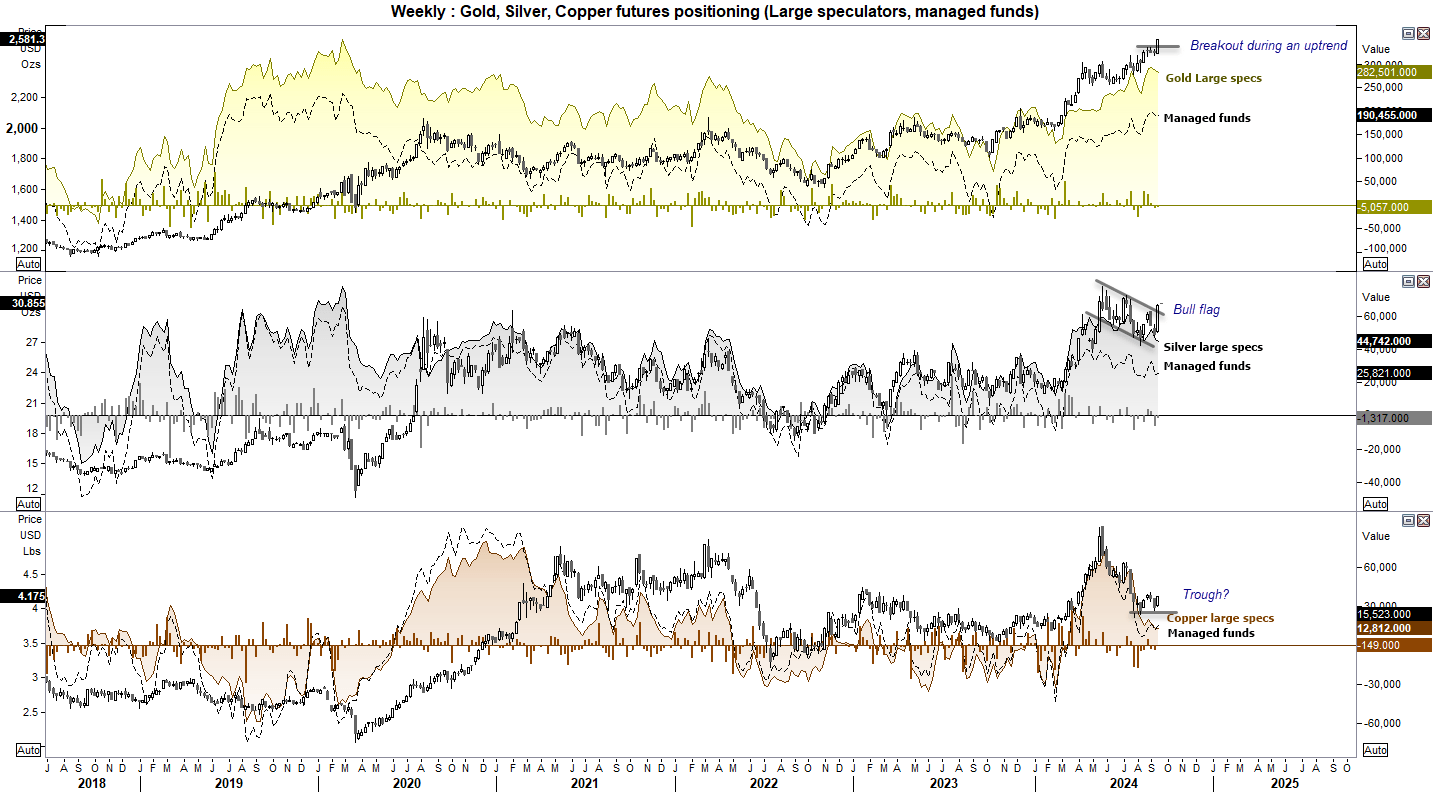

Metals (gold, silver, copper) futures - COT report:

Behold the gold bull. Gold prices saw a decent breakout from a very small consolidation pattern, which underscores its level of bullishness. Yes, traders a very net long, but it is not at a sentiment extreme. And that could pave the way for further gains.

Silver futures appear to be breaking out of a bullish flag, and again bullish positioning is not at a sentiment extreme.

Copper futures may have already seen the corrective low. It is the least bullish of the three metals, but traders remain net long regardless. And it could post further gains if sentiment on Wall Street remains positive.

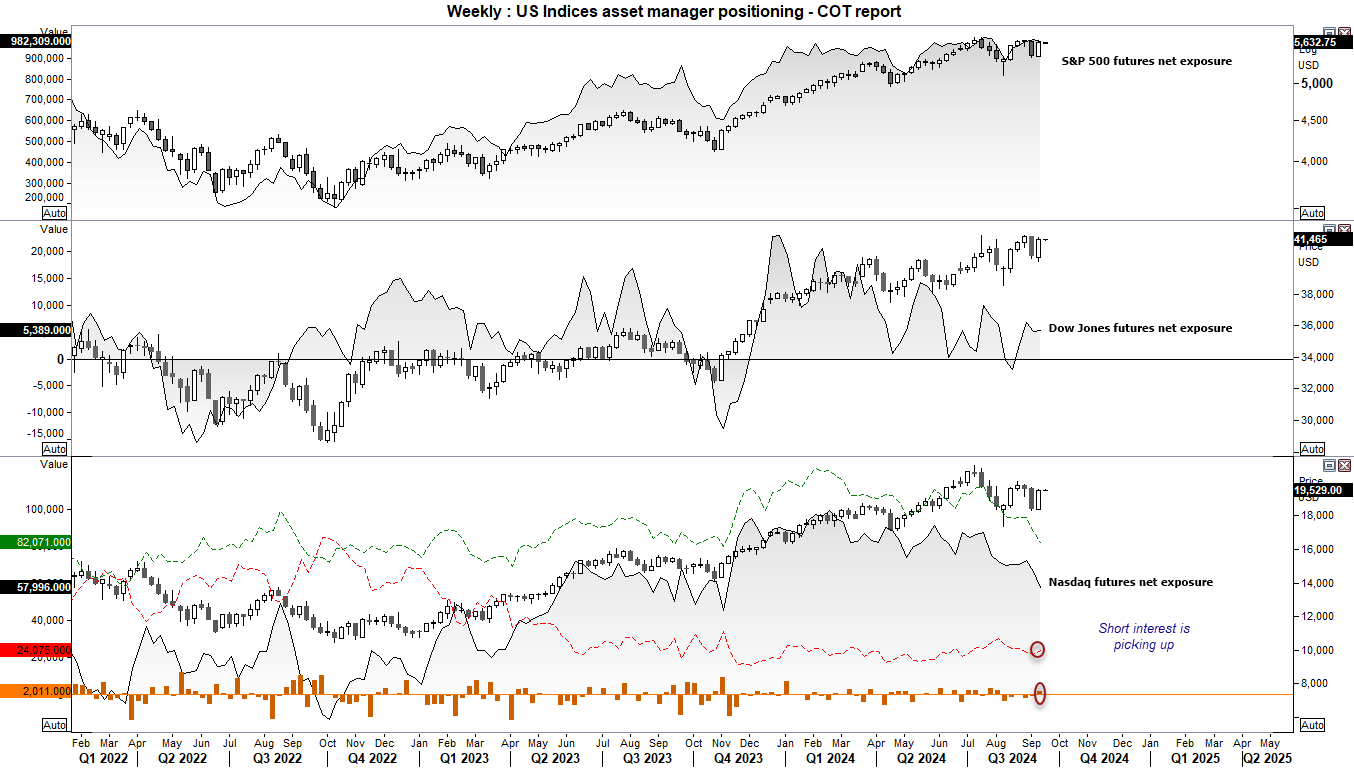

Wall Street indices (S&P 500, Dow Jones, Nasdaq 100) positioning – COT report:

Asset managers have been reducing their net-long exposure to Nasdaq futures since November. But last week they increased their gross-short exposure. This merely backs up my bias that the Nasdaq is the preferred US index to short during times of turmoil, and focus on S&P 500 longs during good times.

Assert managers remain defiantly long S&P 500 futures, which keeps it in poll position for longs during a risk-on environment.

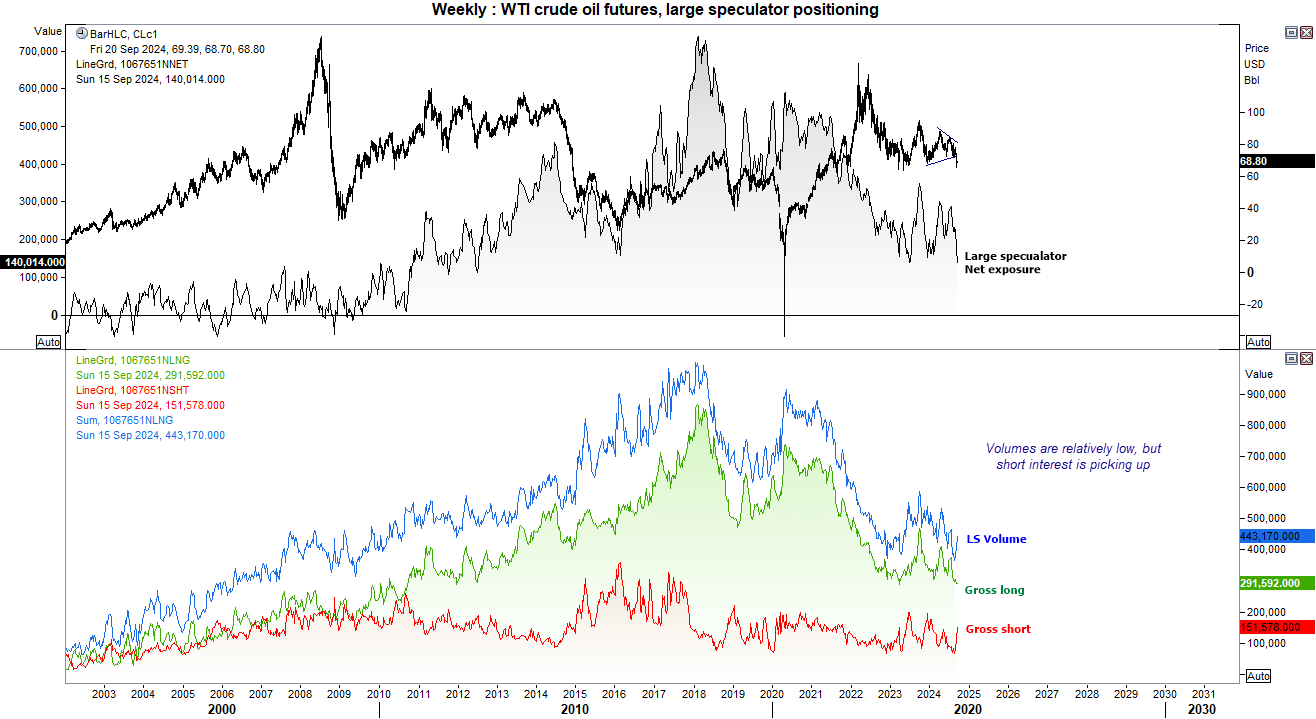

WTI crude oil (CL) positioning – COT report:

Oil prices are falling in a way that makes me question whether they are harbinger for doom. Net-long exposure has fallen to its least bullish level since July 2023, and very close to a 14-year low. Speculative volumes are increasing, driven primarily by a rise on shorts and a culling of longs. And that places oil prices in my ‘fade the rally’ watchlist.