US producer prices for December came in softer than expected on Tuesday, which treated traders to a small risk-on bounce on hopes that CPI data released later today will follow suit. Fed fund futures are now barely pricing in as single cut this year following another NFP report on Friday. While it could take a material weakness in CPI figures to revive hopes of a cut, the PPI data likely shook some Wall Street bears out from the cycle lows. Core PPI was flat at 0% m/m while PPI rose just 0.2% m/m compared with 0.4% expected and 0.3% prior.

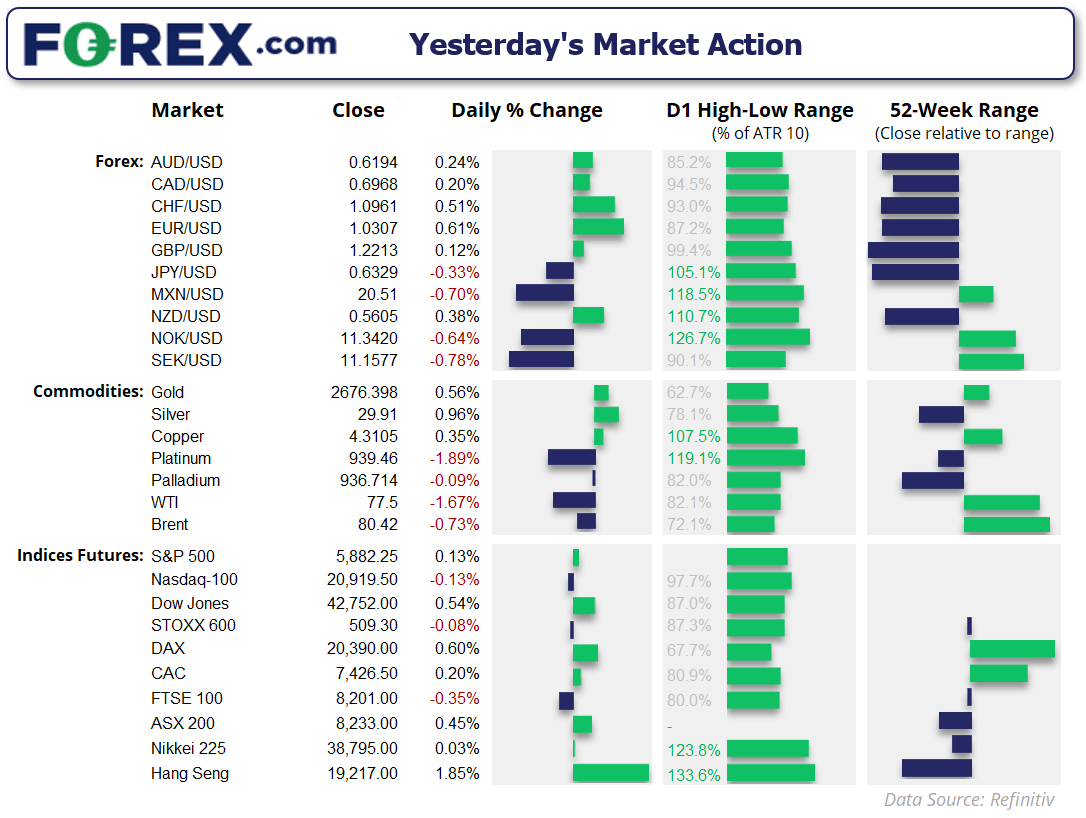

- The Japanese yen and US dollar were the weakest currencies during a slight risk-on session while the euro and Swiss franc were the strongest

- The US dollar index fell for a second day after its bearish pinbar met resistance around the 110 handle and 2022 weekly-close high

- This placed EUR/USD at the top of the leader board on Tuesday and close at a 3-day high, and extend gains from the bullish hammer which found support around the September 2022 high

- The Dow Jones led Wall Street higher with futures rising 0.7% and retest its 10-day EMA

- S&P 500 future were up 0.3% but formed a second consecutive doji day, Nasdaq futures rose just 0.2%

Economic events in focus (AEDT)

- 10:50 – JP M2, M3 money stock

- 11:30 – UK CPI, PPI

- 18:45 – FR CPI

- 19:00 – ES CPI

- 21:00 – EU industrial production

- 00:30 – US CPI

- 01:00 – FOMC member Barkin speaks

- 02:00 – FOMC member Kashkari speaks

- 01:00 – FOMC member Williams speaks

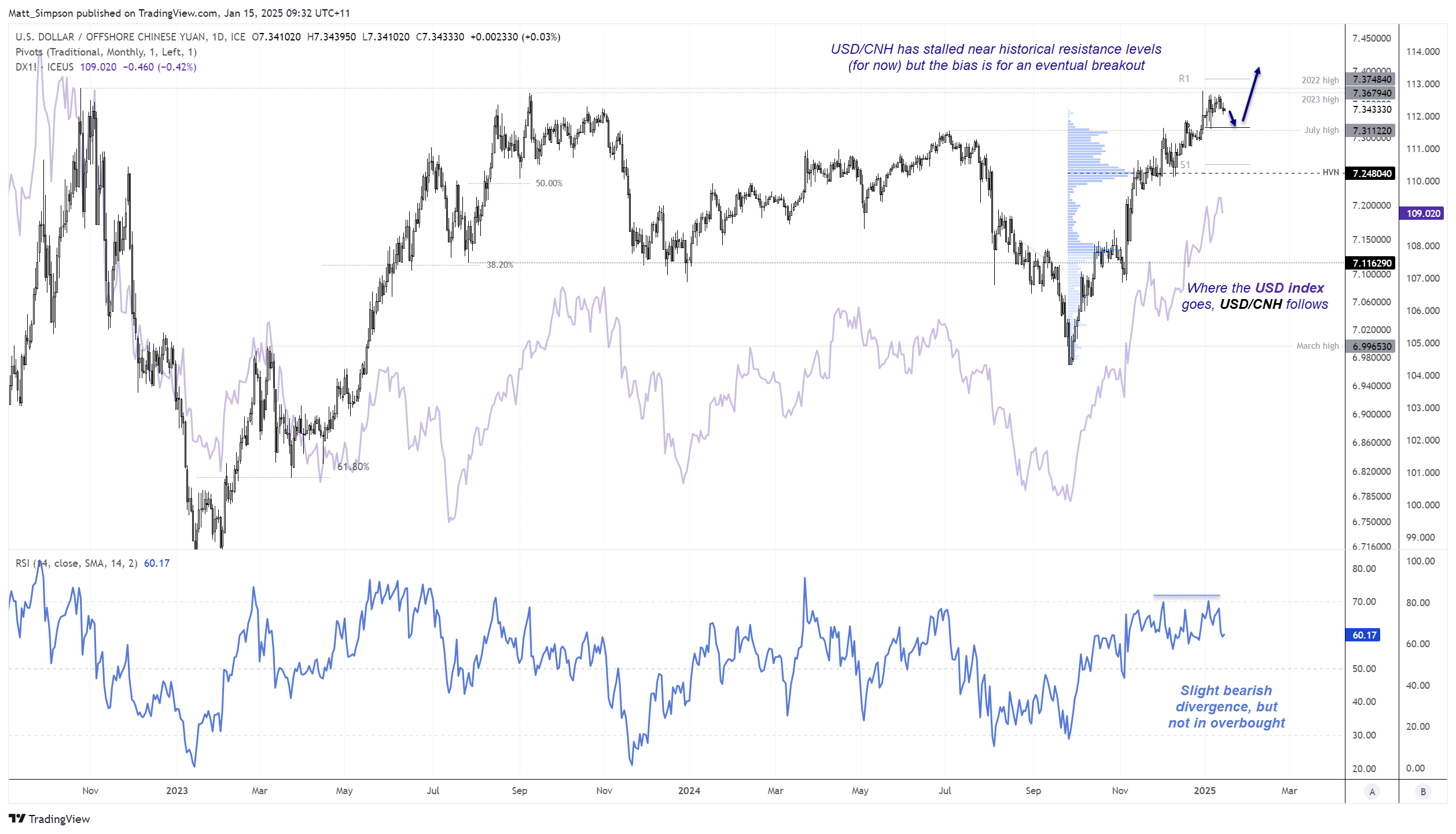

USD/CNH technical analysis:

Where the US dollar goes, USD/CNH follows. So until we get a serious repricing of Fed expectations back to the dovish side to weaken the dollar, a higher USD/CNH is favoured. Especially since we do not yet know how Trump’s tariffs will play out. Yet the strong rally on USD/CNH has stalled just beneath its 2023 and 2022 highs just as the USD index has retraced from its own 2022 high.

For now, I suspect Beijing are happy to let their currency slide. And that also favours an eventual break higher. But if we are treated to a soft CPI print it could shake some USD bulls out of their positions and trigger a pullback on the dollar.

Note the monthly pivot point near the July high (7.3112) which could provide some support before its anticipated break higher.

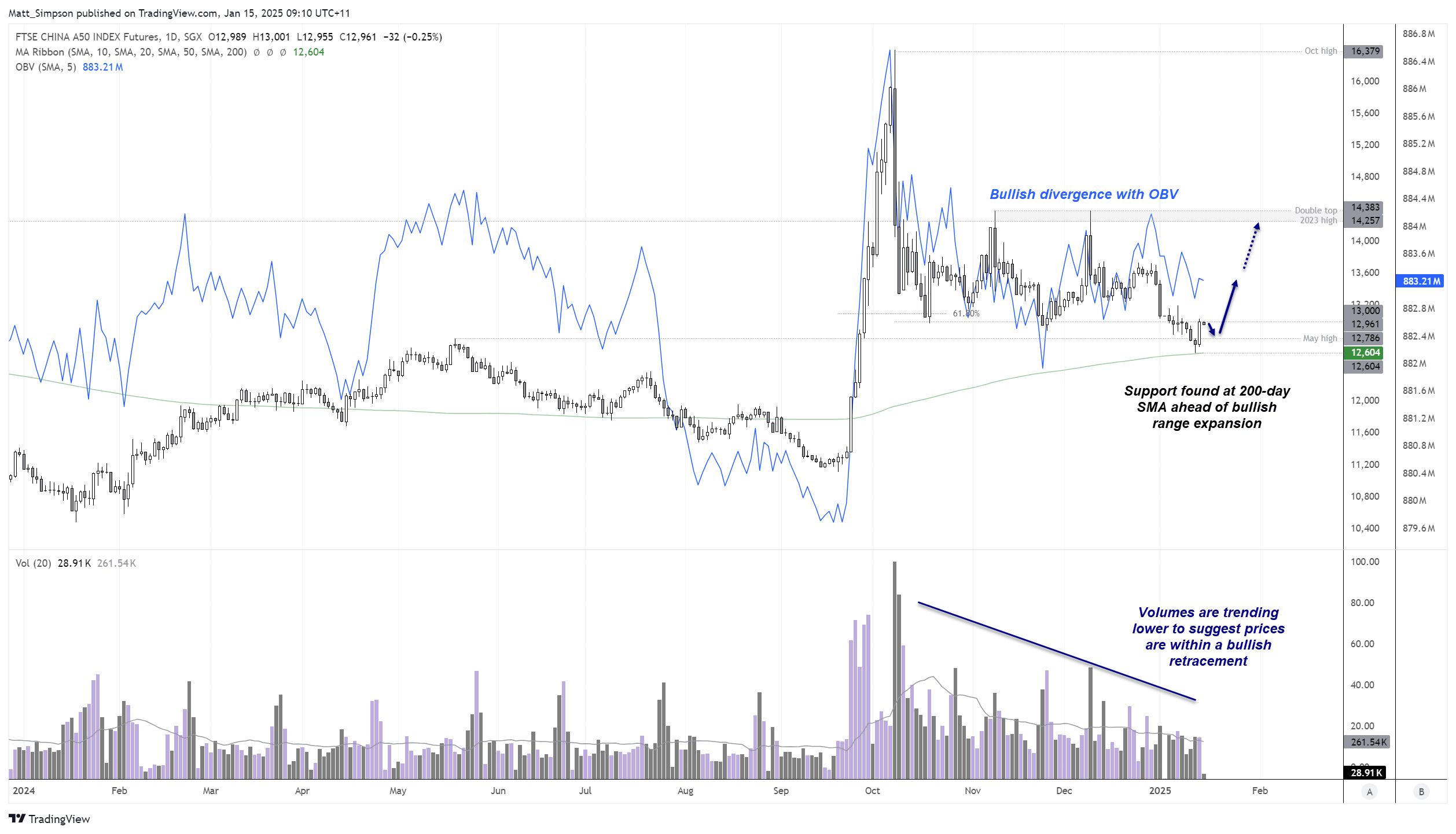

China A50 technical analysis:

It has been over three months now since we saw the China A50’s near 50% surge top out. What made the rally particularly impressive was that it took just three weeks. While price action since then has been choppy, it also appears to be corrective. And that fact that volumes have been trending lower shows a lack of bearish enthusiasm, which also play into the ‘retracement’ theme. And that implies an eventual new high.

Also note that on-balance-volume (OBV) has formed a bullish divergence which suggests bullish pressure is building. And of particular interest is that Monday’s low respected the 200-day SMA (12,604) as support before Tuesday delivered a bullish range expansion day.

- The bias remains bullish above 12,600 and for a rally to at least 13,500

- Bulls could seek dips within Tuesday’s range to try an increase the potential reward to risk ratio

- The May high (12,786) is a potential support level for any such retracement

- If the rally persists, 14,300 is an area of interest for bulls around the 2023 high and double top

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge