Trades want to sell the USD, but that it causing a headache for the SNB who want a lower franc. And Some already estimate that the central bank is active in the FX market to defend thew 0.94 area. And that puts the SNB interest meeting, US GDP, PMI, PCE reports in focus, alongside the slew Fed members hitting the wires.

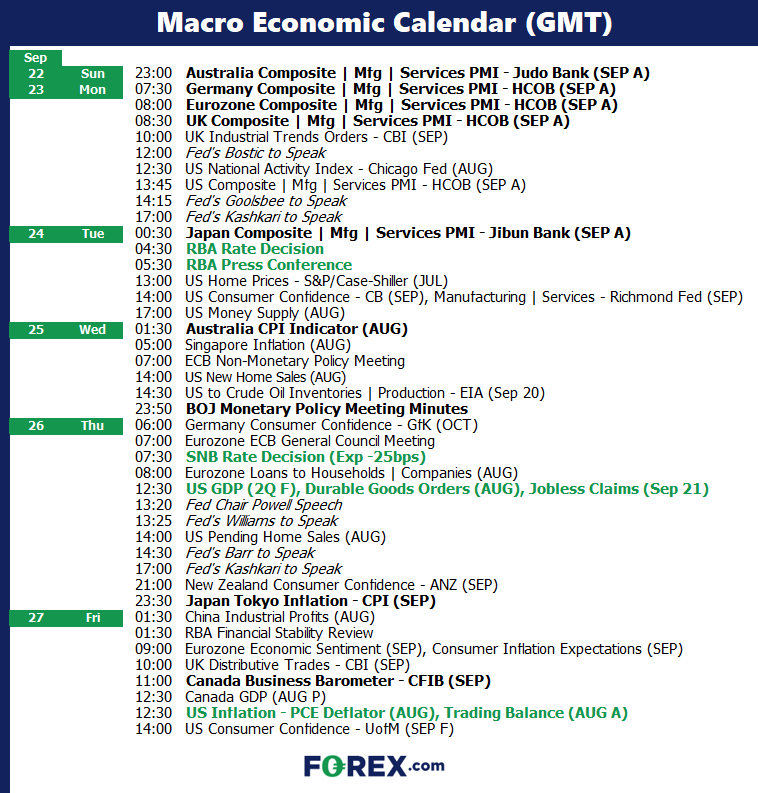

The Week Ahead: Calendar

The Week Ahead: Key themes and events

- Fed members speaking

- US PCE inflation, GDP report

- Flash PMI reports

- RBA interest rate decision

- SNB interest rate decision

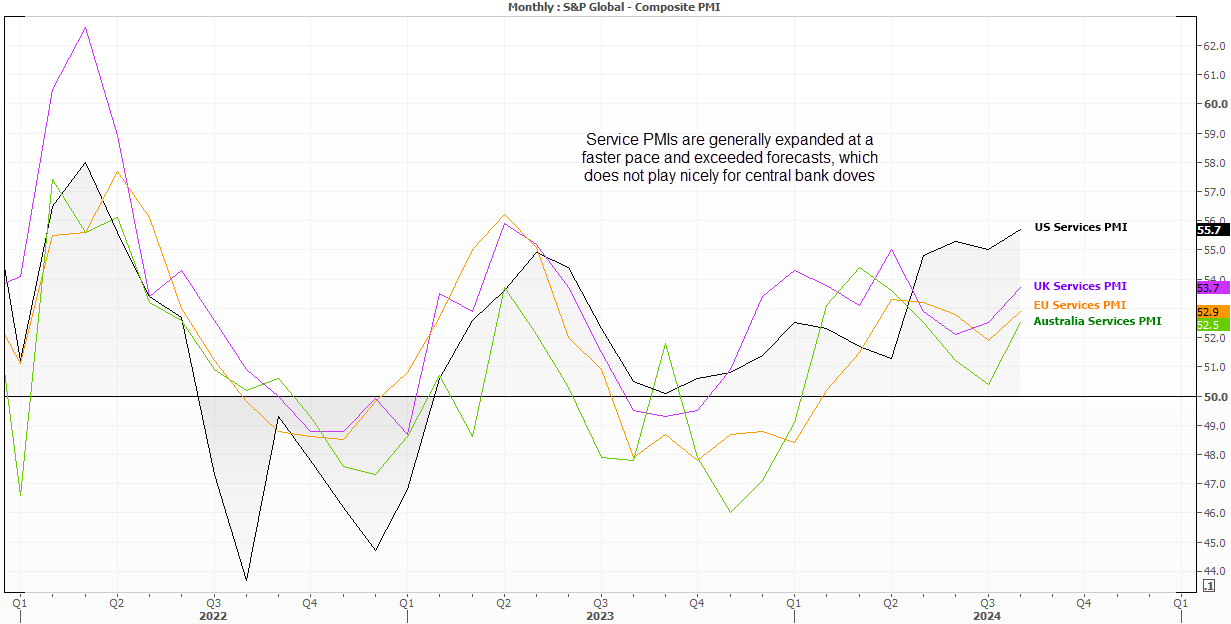

Flash PMI reports

The week kicks off with PMI reports, which help traders assess underlying trends of growth, inflation and employment. While each report includes manufacturing, services and composite indices, services is arguably the more important given elevated levels of services inflation.

It should therefore come as a concern to central bank doves that services PMIs are generally expanding at a faster rate, and outperforming expectations. The US services PMI expanded at tis fastest pace since March 2022, and when placed alongside higher CPI, NFP and ISM reports this past month then another hot services print could shake more USD bears out of the tree.

Trader’s watchlist: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones, AUD/USD, AUD/JPY

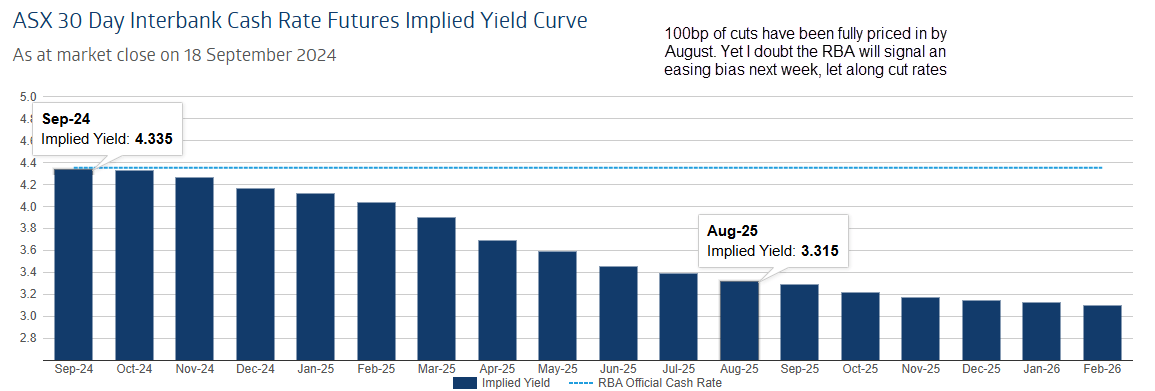

RBA interest rate decision

While the Fed’s 50bp cut and easing bias paves the way for other central banks to lower their rates eventually, it won’t necessarily trigger a flurry of cuts in response. The RBA are no exception, and they’re likely to maintain their cash rate at 4.35% into next year.

Currently, cash rate futures have fully priced in a four 25bp cut s by July. Given the RBA’s August minutes noted that the cash rate may need to remain tighter than market expectations suggested, it is also likely they’ll retain their hawkish bias given inflation remains above target and employment firm.

Also note that Australia’s monthly inflation report is released on Wednesday, a day after the RBA meet.

Trader’s watchlist: AUD/USD, NZD/USD, AUD/NZD, NZD/JPY, AUD/JPY, ASX 200

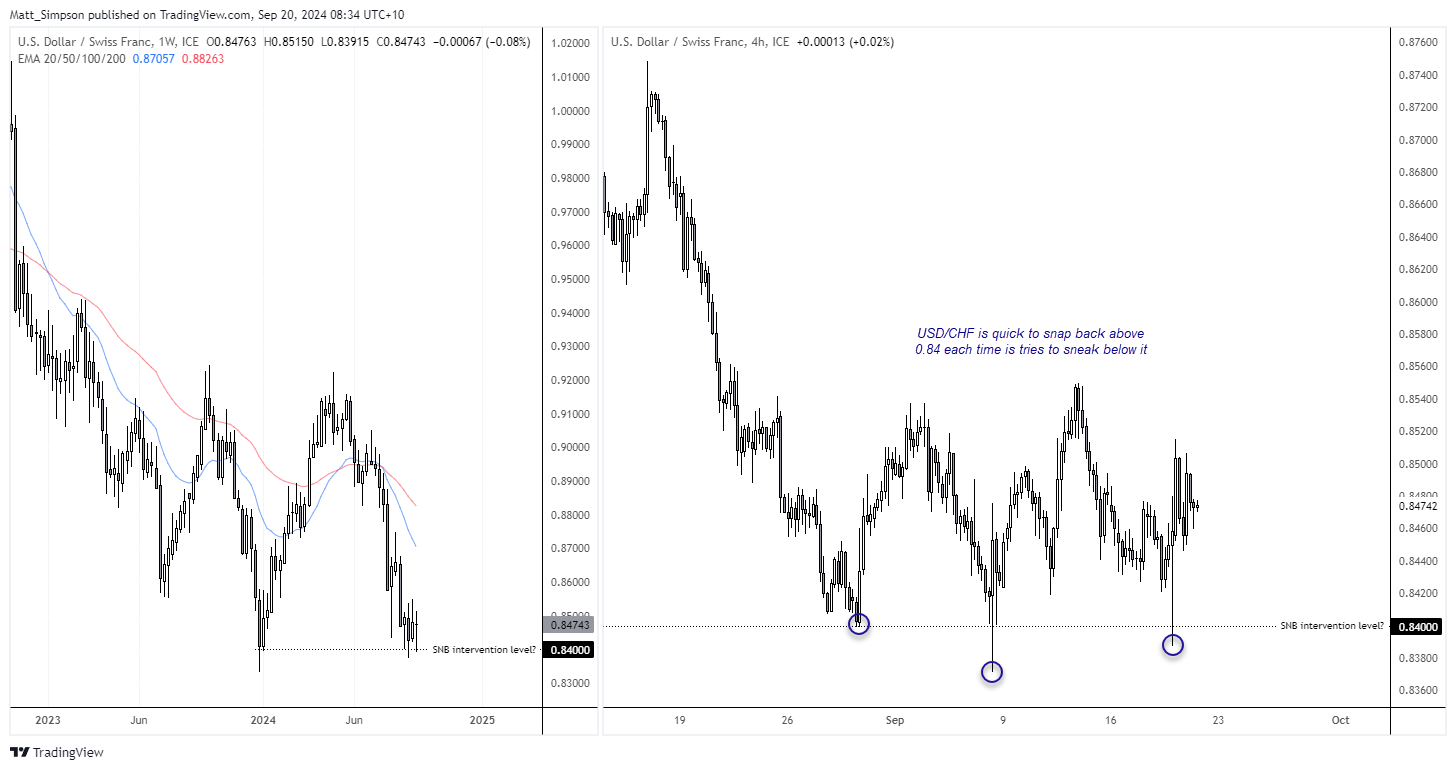

Swiss National Bank (SNB) interest rate decision

The SNB are expected to cut their interest rate by 25bp next week to 1%. Inflation has fallen to 1.1%, well below the SNB’s 2% target. But this is more about the Swiss franc’s impact on imports than it does about the national CPI figures. The central bank has been quite vocal about the high franc, and a Swiss lobby group (Swissmen) have told the SNB that they want EUR/CHF to rise to 0.98, which is around 4% higher from current levels.

The SNB’s wording around the currency may be the bigger event. ING analysts think that the SNB have already been active in the FX market, even though data is yet to fully reveal it. ING estimate Swiss franc selling kicks in when EUR/CHF dips below 0.84 or USD/CHF moves below 0.94. And I’m inclined to believe it, looking at how USD/CHF sprang higher from that level on August 29th, September 27th and September 19th.

And with the US dollar likely to weaken in the coming months, it could make USD/CHF a lively pair to watch. Especially is US PCE inflation surprises to the downside.

Trader’s watchlist: USD/CHF, EUR/CHF

US PCE inflation, GDP report

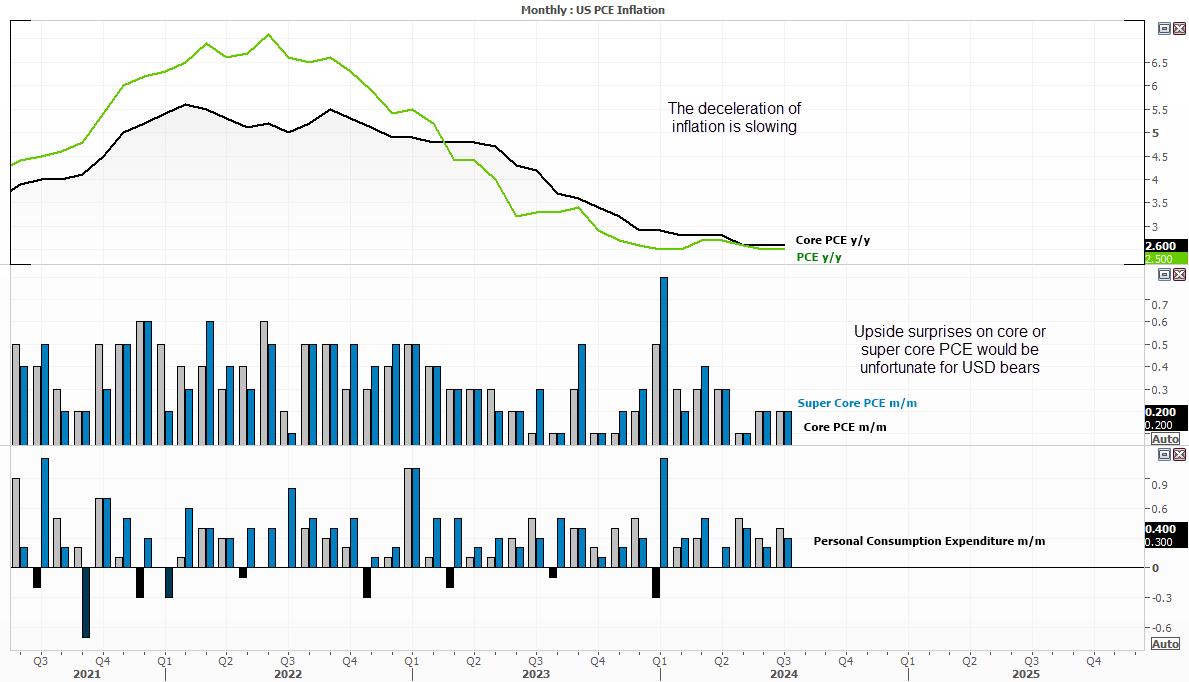

If Friday’s the climax for USD data with the monthly PCE inflation report, Monday’s flash PMIs and Thursday’s GDP are the warm-up acts. PCE inflation is not a particularly volatile release, but it also means it takes less of a deviation from expectations to spark a move. And if we see that US PMIs And GDP outperform expectations, even a 0.1% tick higher on core CPI or super core CPI could spark further short covering on the US dollar.

Trader’s watchlist: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones, VIX, bonds

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge