Whether it is Biden stepping aside or Trump grabbing headlines with potential policies, it is difficult to see US politics taking a back seat next week. Already we’re seeing correlations break down and markets move on political assumptions, and we have another four months until the actual election. Fed watchers have the US PCE inflation report to look forward to, and global central bank watchers have flash PMIs. The BOC are expected to cut rates, but will they signal more next week?

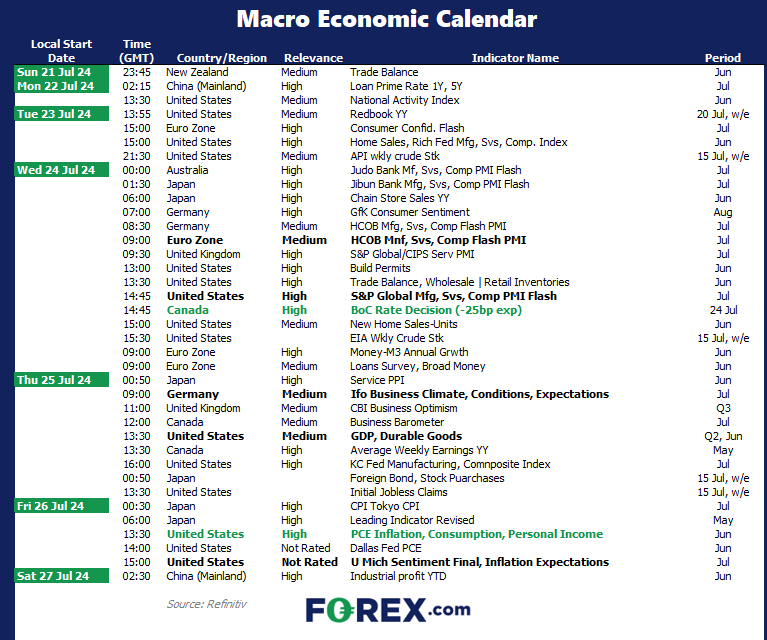

The Week Ahead: Calendar

The Week Ahead: Key themes and events

- Will Biden stand down?

- US PCE inflation

- Bank of Canada (BOC) interest rate decision

- Global flash PMIs

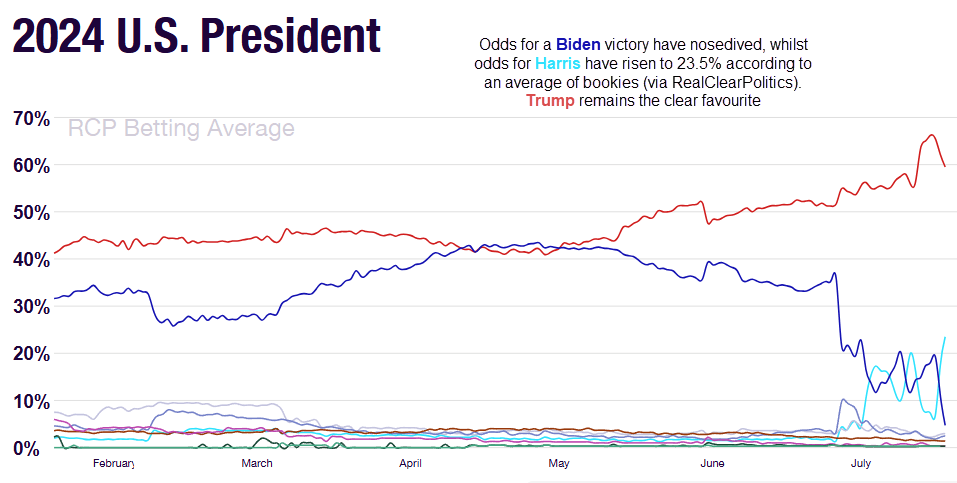

Will Biden stand down?

In a move that could be a relief to the entire US political landscape, pressure is mounting for Joe Biden to step aside and not run for re-election. Whilst these headlines have been spouting up for a while, they may have more clout now that Biden has Covid. Besides, he literally said the day before being diagnosed that he would not rerun if he was sick. The timing is suspiciously convenient for him to withdraw from the race without losing face. And I wouldn’t be surprised if he does just that over the weekend, if not sooner.

Odds of a Biden victory have nosedived to 4.7%, according to an average of bookies via RealClearPolitics. And with Kamilla Harris tipped to replace Biden for the run to the Whitehouse, her odds have risen to 23.5%. Whilst Trump’s have diminished this past week, he remains the clear favourite with an estimated 59.5% of the votes.

Trader’s watchlist: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones, VIX, bonds

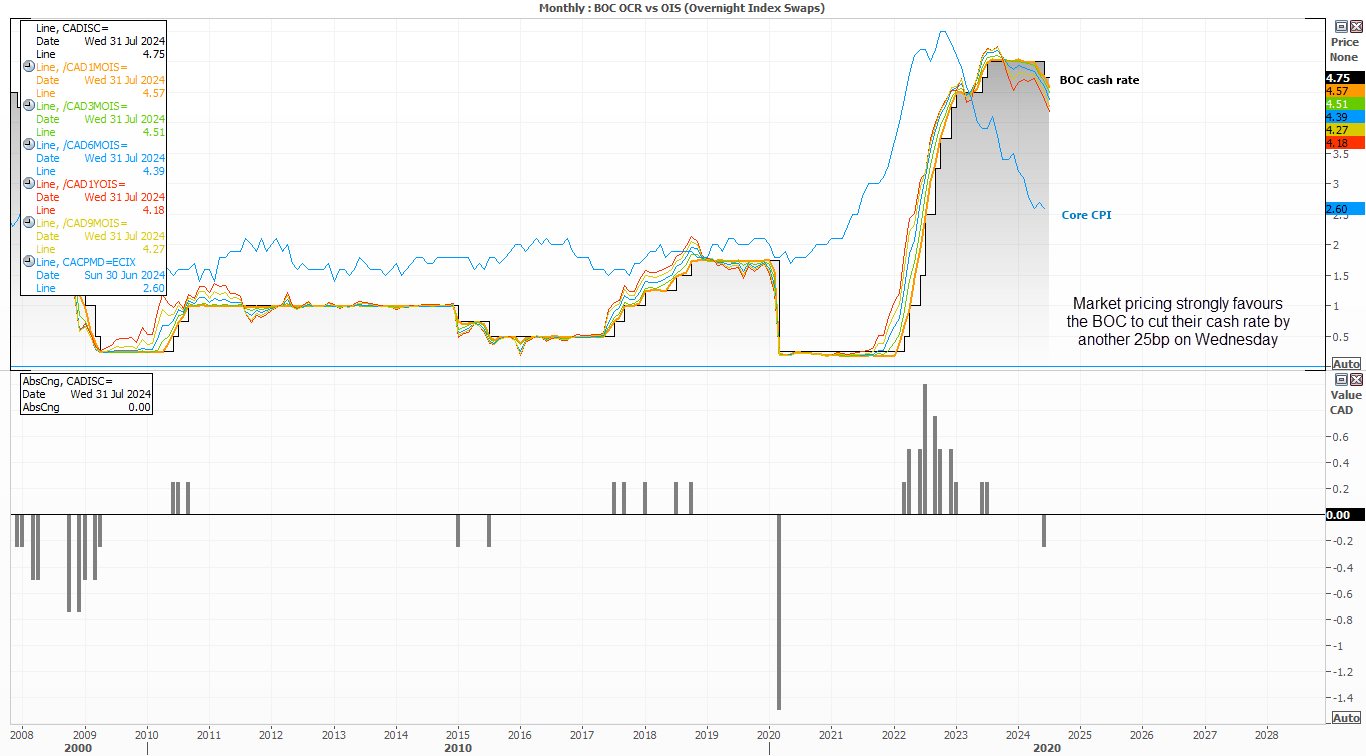

Bank of Canada (BOC) interest rate decision

There’s a 90% chance of the BOC cutting their cash rate by 25bp to 4.5% next week, according to Reuters pricing. This would mark their second cut this cycle, and there could be another two or three lined up by December if some forecasters are right.

I’m not convinced they’ll signal multiple cuts, even though odds of a cut are high. Although the lower inflation figures we’ve seen of late could warrant them. Just keep in mind that traders were positioned for a much more dovish tone than was delivered at their last meeting, which saw the Canadian dollar hand back earlier gains on pre-emptively dovish bets.

Trader’s watchlist: USD/CAD, CAD/JPY, NZD/CAD

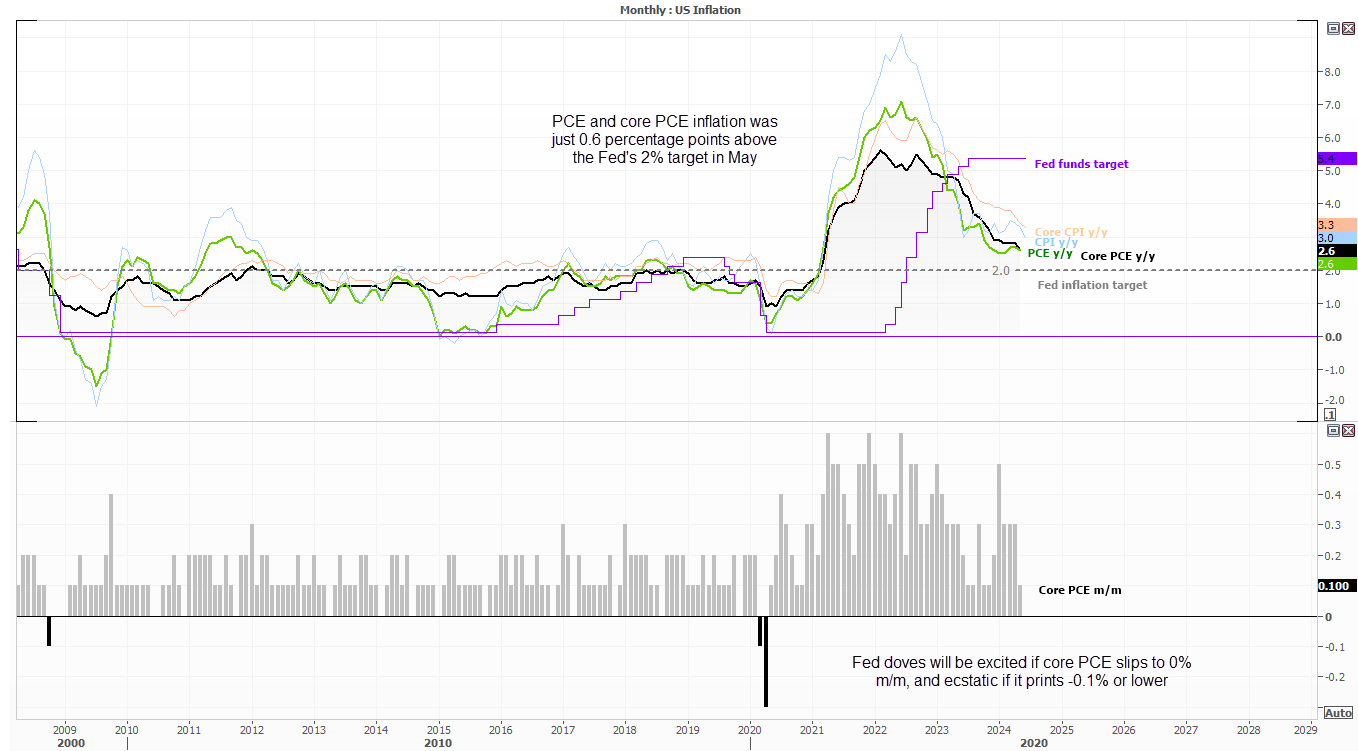

US PCE inflation

With Fed fund futures implying a 92% chance of a cut in September and 55% chance of another in November, it would take quite an upside inflation surprise next week to dispel expectations of multiple Fed cuts over the next year. But if it comes in soft, it could see odds of cuts arriving from December through to March rise above 50%. And as CPI and core PCE inflation rose just 0.1% m/m in May, I’d expect quite a volatile reaction from market should they deflate by crossing beneath the 0% barrier. And that could be a bearish case for the US dollar and yields. Whether that translates as a positive story for Wall Street indices could be down to general sentiment, as for now they’re on the ropes with the VIX reaching a 12-month high amid a complex political landscape.

Trader’s watchlist: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge