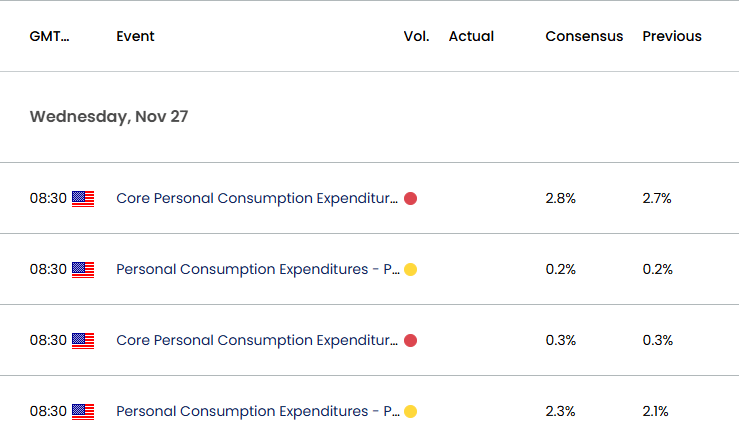

US Personal Consumption Expenditure (PCE) Price Index

The US Personal Consumption Expenditure (PCE) Price Index showed the headline reading narrowing for the second month, with the figure slipping to 2.1% in September from 2.2% per annum the month prior.

US Economic Calendar – October 31, 2024

However, the core PCE, the Fed’s preferred gauge for inflation unexpectedly held steady at 2.7% during the same period, with the update from the US Bureau of Economic Analysis (BEA) revealing that ‘personal income increased $71.6 billion (0.3 percent at a monthly rate) in September.’

A deeper look at the report showed ‘prices for goods decreased 1.2 percent and prices for services increased 3.7 percent,’ with the BEA going onto say that ‘food prices increased 1.2 percent and energy prices decreased 8.1 percent.’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

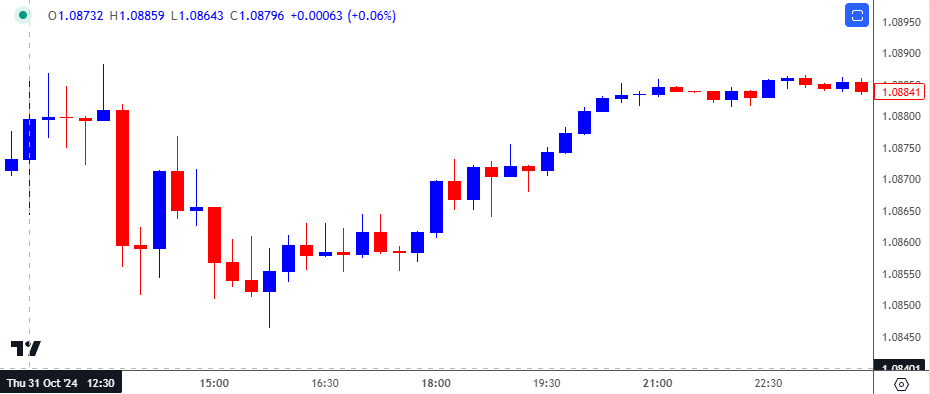

EUR/USD Chart – 15 Minute

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

The US Dollar struggled to hold its ground following the PCE report, with EUR/USD tagging a session high of 1.0888. Nevertheless, EUR/USD came under pressure going into the end of the week as it closed at 1.0834.

Looking ahead, the update to the US PCE index is anticipated to show a rise in both the headline and core reading, and indications of persistent inflation may generate a bullish reaction in the US Dollar as it puts pressure on the Federal Reserve to further combat inflation.

At the same time, a softer-than-expected PCE index may produce headwinds for the Greenback as it encourages the Federal Open Market Committee (FOMC) to further unwind its restrictive policy over the coming months.

Additional Market Outlooks

NZD/USD Rebounds Ahead of 2023 Low with RBNZ Expected to Cut

US Dollar Forecast: USD/CAD to Face Uptick in US PCE Index

Gold Price Stages Five-Day Rally for First Time Since March

US Dollar Forecast: USD/CHF Rally Eyes July High

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong