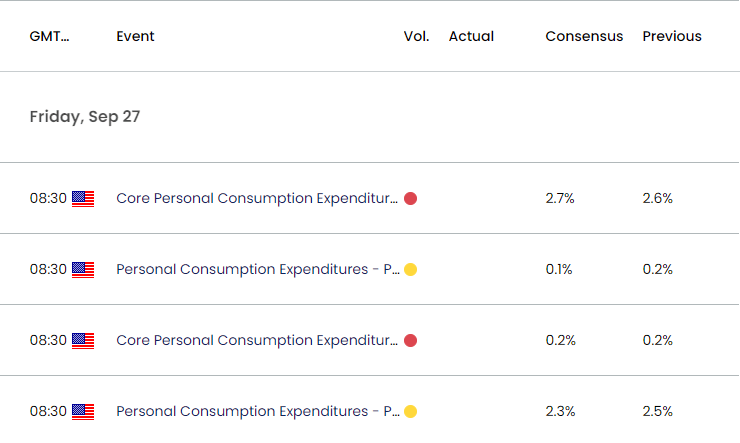

US Personal Consumption Expenditure (PCE) Price Index

The US Personal Consumption Expenditure (PCE) Price Index held steady at 2.5% in July despite forecasts for a 2.6% print.

US Economic Calendar – August 30, 2024

At the same time, the core PCE, which is regarded as the Federal Reserve’s preferred gauge for inflation, stood at 2.6% during the same period, with the U.S. Bureau of Economic Analysis revealing that ‘prices for goods decreased by less than 0.1 percent and prices for services increased 3.7 percent.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

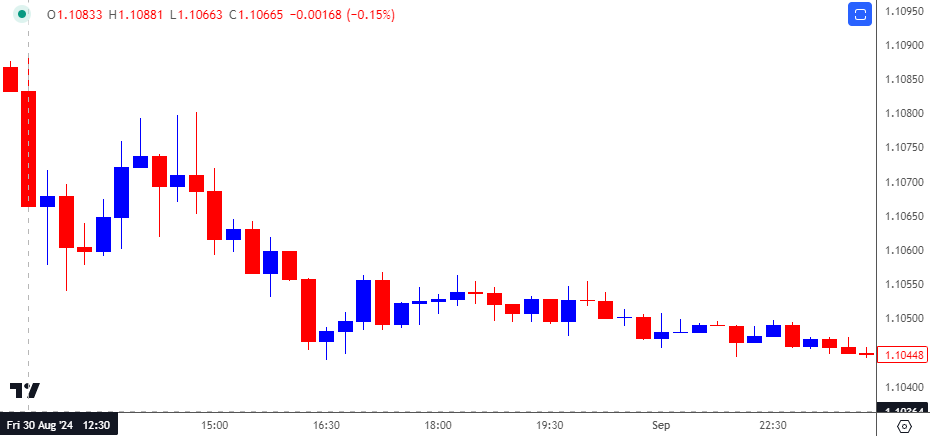

EUR/USD Chart – 15 Minute

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

EUR/USD came under pressure despite the mixed results, with the exchange rate falling throughout the day to close the week at 1.1047. Nevertheless, EUR/USD retraced the market reaction during the first full week of September to close at 1.1085.

Looking ahead, the update to the PCE report is anticipated to show the headline reading narrowing to 2.3% in August from 2.5% per annum the month prior, while the core rate is seen widening to 2.7% from 2.6% in July.

With that said, a slowdown in both the headline and core PCE may produce headwinds for the US Dollar as the Federal Reserve starts to unwind its restrictive policy, but signs of sticky price growth may generate a bullish reaction in the Greenback as it puts pressure on the central bank to further combat inflation.

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong