US futures

Dow futures -0.33% at 34050

S&P futures -0.41% at 41147

Nasdaq futures -0.26% at 12706

In Europe

FTSE +0.71% at 7918

Dax +0.75% at 15413

Biden’s State of the Union address

US stocks are edging lower, correcting modestly after a Powell-inspired rally in the previous session.

The Nasdaq closed almost 2% higher on Tuesday after Powell decided against upping the hawkish rhetoric following Friday’s blowout jobs report. The Fed Chair acknowledged that interest rates would need to keep climbing if data kept coming in ahead of forecasts. However, he also said that 2023 is expected to see a significant fall in inflation.

Biden’s State of the Union speech covered ground politically, but there was little in there for the markets. A proposal for quadrupling the 1% tax on stock buybacks is likely to garner some interest as well as a pledge to take a strong line against China less than a week after the spy balloon incident.

Attention will shift towards comments from more Federal Reserve policymakers with speeches from New York fed president John Williams Atlanta fed president Bostic and Minneapolis Fed president Neal Kashkari. Investors will be watching closely for clues over whether the US central bank is getting close to pausing its rate hikes cycle.

Company earnings will again be in focus more than half of the SNP 500 companies have reported quarterly earnings with over 69% beating expectations.

Corporate news

Uber jumps pre-market after a blowout end to 2022 and with the promise of delivering a profit this year. Uber revenue rose 49% to $8.61 in Q4 besting estimates of $8.49 billion. Rideshare revenue surged 82%. Net loss was $0.29c per share compared to $0.44c a year earlier.

Disney is due to report after the close. These will be the first earnings after the return of Bog Iger and Wall Street is expecting a rebound in earnings of $0.80c per share after a sharp decline to $0.30 in the three months to September. Ongoing recoveries in the theme park and entertainment businesses are expected.

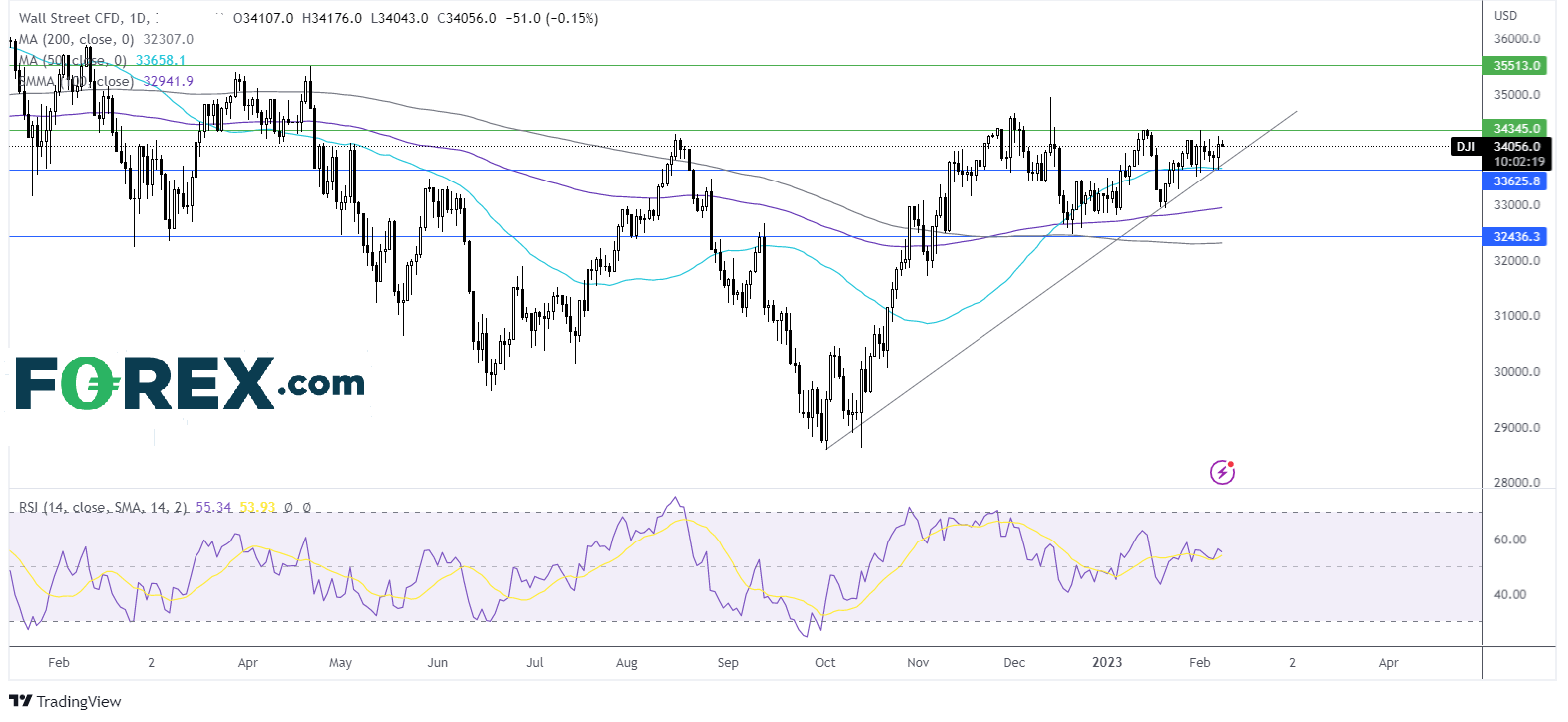

Where next for the Dow Jones?

Dow Jones continues to trade above its multi-month rising trendline, however, it has failed to push over resistance at 34350. The resultant ascending triangle is a bullish formation, which, together with the RSI above 50 keeps buyers hopeful of further upside. A rise above 34350 could see buyers look to 34650 the November high, ahead of 34950 the December high. On the flipside, a break below 33650 the 50 sma, yesterday’s low and the rising trendline support exposes the 100 sma just below 33000.

FX markets – USD falls, GBP rises

The USD is falling, extending losses from yesterday after a less hawkish-than-feared speech from Fed Chairman Jerome Powell.

GBP/USD is 121 after think tank NIESR forecast that Britain was now likely to avoid a technical recession of two consecutive quarters of negative growth. Easing recession fears have boosted the pound, which had fallen over 2.8% last week.

EUR/USD is edging higher, snapping a four-day losing run and capitalising on the weaker U.S. dollar. The eurozone economic calendar is quiet today. Investors will look ahead to German inflation data due tomorrow.

GBP/USD +0.4% at 1.2093

EUR/USD +0.15% at 1.0737

Oil rises as recession fears ease

Oil prices are rising for a fourth straight session, helped higher by easing recession fears, a weaker U.S. dollar, and a surprise draw in API oil inventory data.

Comments from Federal Reserve chair Jeremy Powell on Tuesday were considered less hawkish than feared, boosting risk appetite and pulling the dollar lower. A weaker dollar means that oil is cheaper for buyers with other currencies.

less aggressive US rate hikes expected means there is growing optimism that the world’s largest consumer of oil can avoid a recession.

Meanwhile, API data stockpiles fell by 2.2 million barrels in the week ending February 3rd. Investors will now look ahead to the EIA oil inventory data which is expected to show a 2.45 million barrel build.

WTI crude trades +1.0% at $78.07

Brent trades at +0.8% at $84.23

Looking ahead

N/A