US futures

Dow futures +0.35% at 33870

S&P futures +0.6% at 3973

Nasdaq futures +0.6% at 11670

In Europe

FTSE -0.7% at 7345

Dax +0.21% at 14194

Inflation falls, consumer confidence up next

US stocks are heading higher for a second straight session after posting the strongest daily gains since 2020.

The post-inflation data rally has extended for a second day while the collapse of the USD also continues to play out.

Following the cooler-than-forecast inflation data, the market is pricing in a more gradual pace of rate hikes from the Federal Reserve. Several Fed speakers cemented those expectations shortly after the data release. Although they also reiterated their commitment to taming inflation.

There is no mistaking that this is a rate hike slowdown moment; the Fed still has work to do to bring inflation back to its 2% target.

According to the CME Fed watch tool, the market is now pricing in an 85% likelihood of a 50-basis point rate hike in December, which is up from 52% prior to the release yesterday.

Looking ahead, attention will now be on US Michigan consumer confidence for October. Will there be any signs of improving morale as price pressures eased? Expectations are for a slight easing to 59.5, down from 59.9.

Corporate news:

Amazon is rising pre-market on a report in the WSJ that the that the e-commerce giant is preparing to make large cost cuts.

Intel falls after JPMorgan downgraded its stance to underweight for the chipmaker, down from overweight.

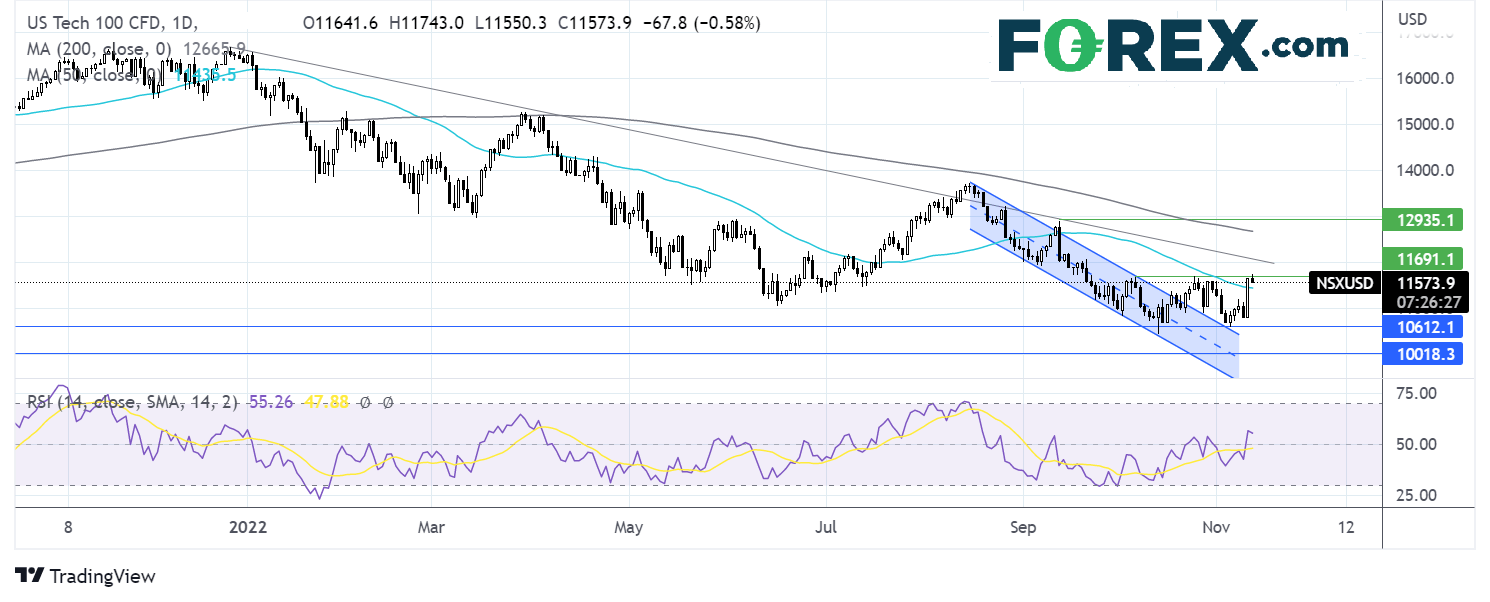

Where next for the Nasdaq?

The Nasdaq has risen above the 50 sma and is testing resistance at 11700. The RSI is above 50 supporting further upside. Buyers will look for a rise over 11700 to create a higher high and expose the falling trendline resistance at 12100. Above here, the 100 sma comes into play at 12700. Sellers could look for a breakout below the 50 sma at11475 to bring 10800 the weekly low into focus.

FX markets – USD rises GBP falls

The USD is falling sharply again today, extending losses from the previous session as investors continue to price in a less aggressive Fed. The US index trades at a level last seen in mid-August posting the largest 2 day fall in 14 years.

EURUSD is rallying, adding to gains from the previous session, taking the pair to a 3-month high. German inflation was confirmed at 11.6%, a record high. The European Commission forecasts that the eurozone economy will contract in the current quarter and Q1 2023 before resuming growth in Q22023.

GBPUSD is rising for a second straight session, capitalizing on the weaker USD. The pair trades at a 10-week high despite the UK economy contracting in Q3. The Q3 GDP dropped -0.2% QoQ, ahead of expectations of a -0.5% decline.

GBP/USD +0.45% at 1.1767

EUR/USD +0.85% at 1.03

Oil jumps as China eases COVID restrictions

Oil prices are rising, adding to gains from the previous session, although oil is still set to record a weekly loss of around 3%.

The recent rally in oil comes after China, the world’s largest importer of oi eased some of the country’s strict COVID curbs. Foreigners travelling to China had the quarantine period reduced by two days, and penalties on airlines for bringing infected passengers were also eliminated.

Whilst these are small steps, they are in the right direction and show that the Chinese authorities, while still sticking to zero-COVID policies, are willing to soften the edges of the strategy.

WTI crude trades +3.1% at $88.60

Brent trades +2.8% at $95.65

Looking ahead

14:00 Michigan consumer confidence

18:00 Baker Hughes rig count