US Non-Farm Payrolls (NFP)

The US Non-Farm Payrolls (NFP) report showed the economy adding 254K in September versus projections for a 140K print, while Average Hourly Earnings unexpectedly increased to 4.0% from 3.9% during the same period.

US Economic Calendar – October 4, 2024

A deeper look at the report showed Unemployment Rate climbing to 4.0% from 3.9% during the same period, while the Labor Force Participation Rate held steady at 62.7% in September.

The update from the Bureau of Labor Statistics (BLS) also showed that ‘employment continued to trend up in food services and drinking places, health care, government, social assistance, and construction,’ with the report going onto say that ‘the change in total nonfarm payroll employment for July was revised up by 55,000, from +89,000 to +144,000, and the change for August was revised up by 17,000, from +142,000 to +159,000.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

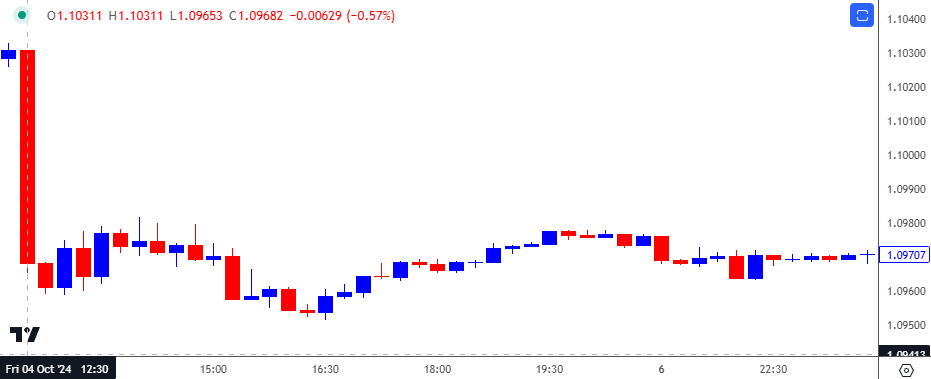

EUR/USD Chart – 15 Minute

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

The US Dollar showed a bullish reaction to the better-than-expected NFP print, with EUR/USD slipping to a fresh session low of 1.0951 following the release. The weakness in EUR/USD carried into the week ahead as the exchange rate closed at 1.0936.

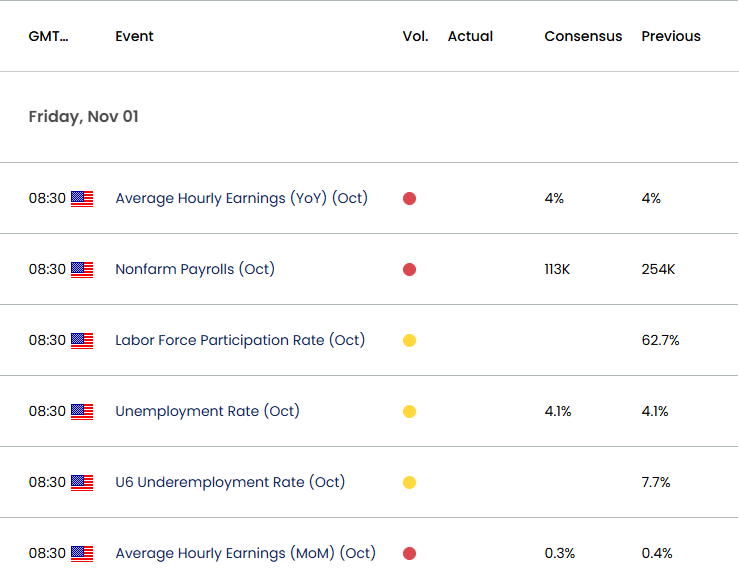

Looking ahead, the US is projected to add 113K jobs in October, while the Unemployment Rate is expected to hold steady at 4.1% during the same period.

With that said, a positive development may prop up the US Dollar as it curbs speculation for another 50bp rate cut from the Federal Reserve, but a weaker-than-expected NFP report may drag on the Greenback as it puts pressure on the Fed to achieve a neutral policy sooner rather than later.

Additional Market Outlooks

Monetary vs Fiscal Policy: Implications for FX Markets

Euro Forecast: EUR/USD Recovery Persists Ahead of Euro Area CPI Report

British Pound Outlook: GBP/USD Recovery Emerges Ahead of UK Budget

USD/CAD Eyes August High as RSI Holds in Overbought Territory

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong