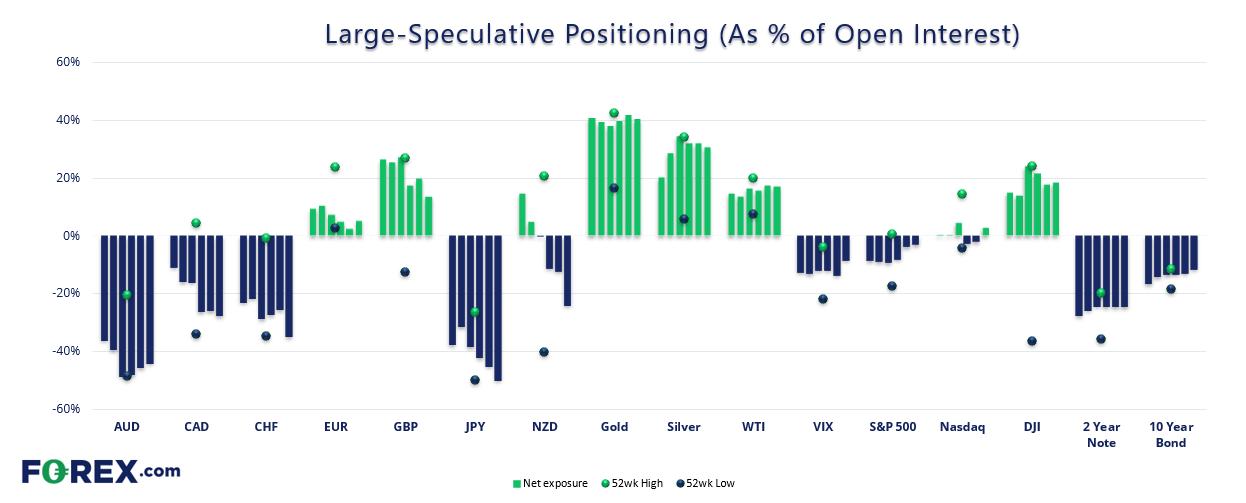

Market positioning from the COT report - as of Tuesday March 19, 2024:

- Net-short exposure to yen futures rose to a 16-year high among large speculators

- Shorting the Swiss franc remained in favour, with large speculators increasing short exposure by +11% (+4.8k contracts) and reducing longs by -21.6% (-4.6k contracts)

- Large speculators were net-short for a fourth week and by their most bearish amount in 18 weeks

- Whilst net-short exposure to AUD/USD futures fell for a third week by last Tuesday, I suspect many have returned since the latest batch of Middle East headlines

- Large speculators increased long gold exposure by 15.7% (+10.1k contracts) and reduced shorts by -7.1% (-8.4k contracts), whereas asset managers are on the cusp of flipping to net-long exposure for the first time in nearly five months

- Asset managers increased long exposure to VIX futures by 14.7% (+2.2k contracts)

- Net-long exposure to Dow Jones futures fell to a YTD low among asset managers

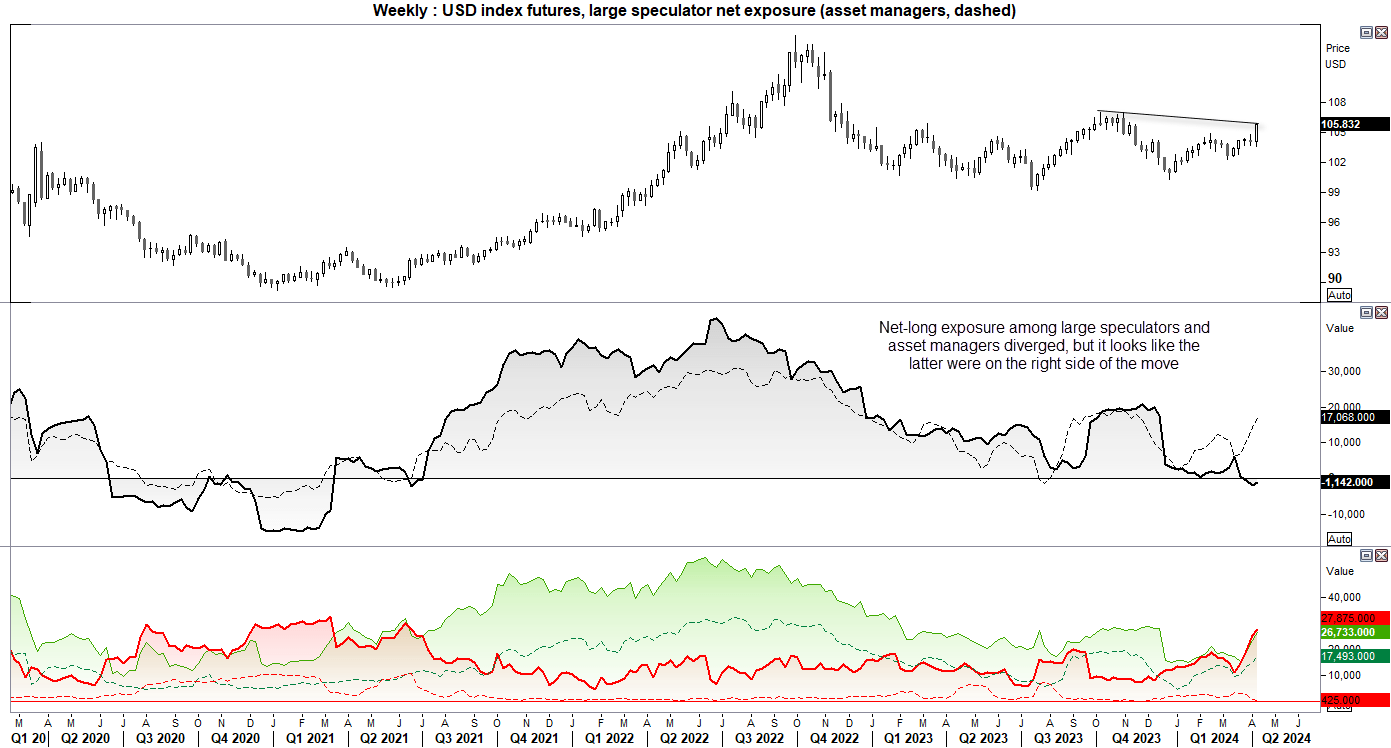

US dollar index positioning – COT report:

I noted the divergence between asset managers and large speculators regarding net exposure, and with the US dollar rising it seems that asset managers were on the right side of the move. The US dollar benefitted from hot CPI, Fed members pushing back on rate cuts and safe-haven flows from Middle East tensions.

Going forward, I now suspect large speculators will begin trimming shorts and adding to longs and flip to net-long exposure by the next COT report (assuming they haven’t already). My 106 target is now within easy reach, and a move to 108 seems feasible.

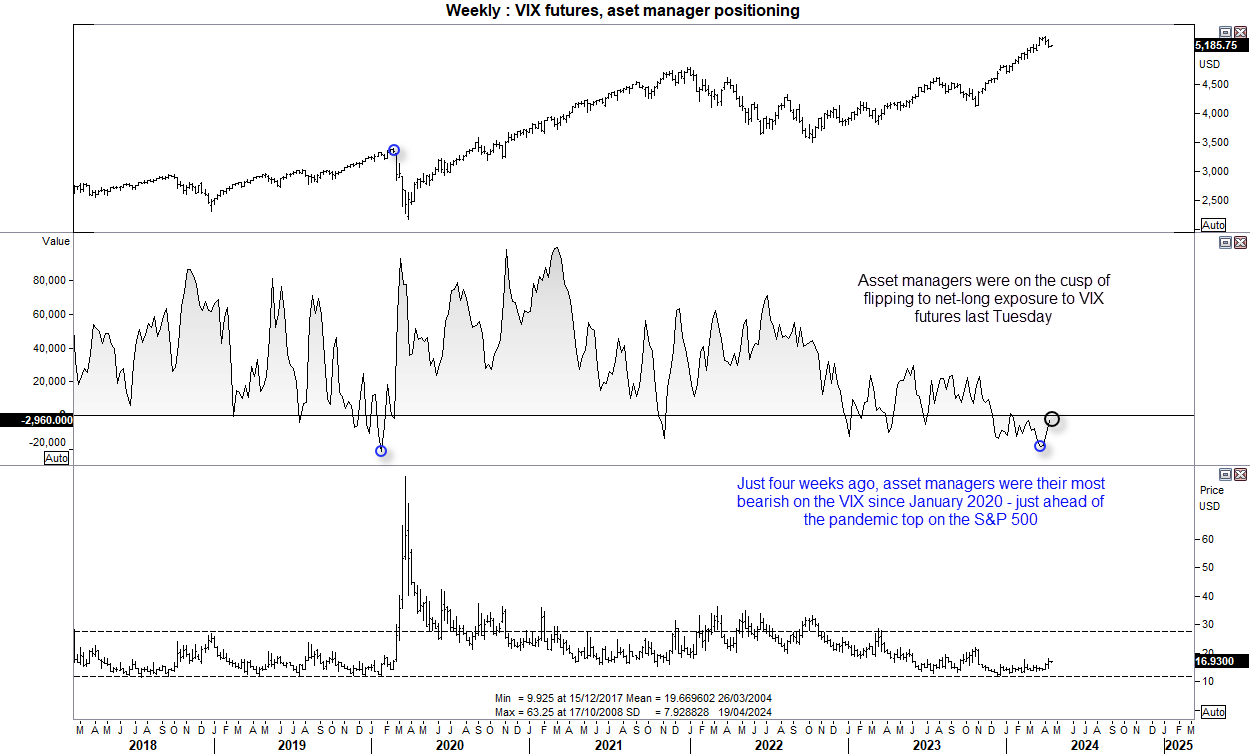

VIX futures positioning – COT report:

Middle East tensions weighed on Wall Street indices on Friday and sent the VIX briefly above 19 for the first day this year. The +2.3 point rise was its most bullish day since October, so it is interesting to note that asset managers and large speculators were trimming short exposure and adding to longs ahead of Friday’s move.

In fact, asset managers are on the cusp of flipping to net-long exposure to VIX futures for the first time since mid January. Yet just fur weeks ago, their net-short exposure was at the most bearish level since January 2020, just weeks ahead of the February 202 high all thanks to the pandemic.

I have conflicting thoughts over how to interpret this. Perhaps asset managers flipping to net-long exposure could indeed nail a market top and we finally see Wall Street indices correct by more than a few percent. Yet looking back through history, there have been many false signals when managers flip to net-long exposure, so perhaps we should wait for large speculators to also flip to net-long exposure before getting too excited over a larger drop for US indices.

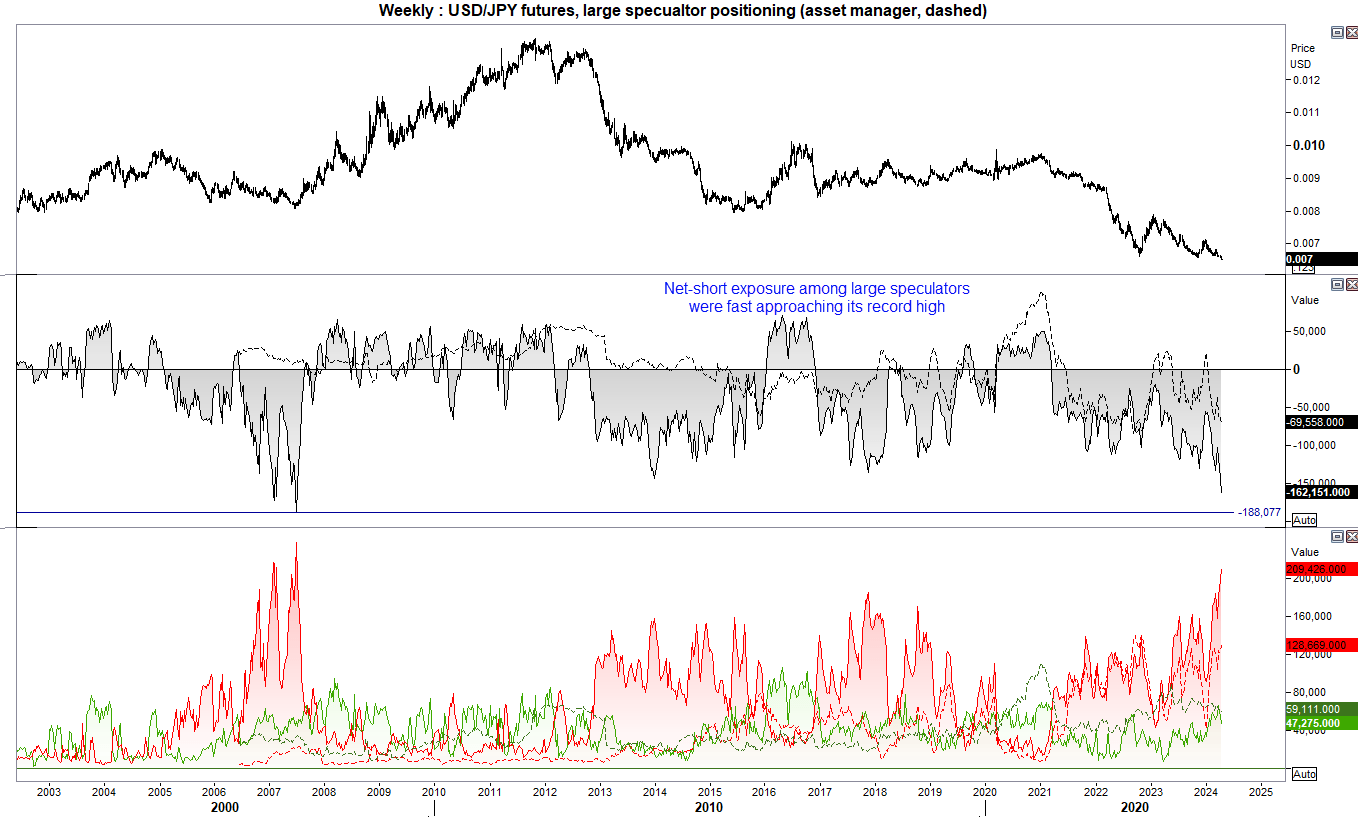

JPY/USD (Japanese yen futures) positioning – COT report:

In July 2007 yen futures reached a record level of net-short exposure. And the recent break of key support which sent USD/JPY above 152 has seen net-short exposure break above the 2013 and 2017 cycle highs, and now within striking distance of the record high ~188 net short exposure. The break above 152 was significant, and there were even some clues from an MOF official that the need to intervene was not a strong as originally though. The next obvious level for traders to keep an eye on is 155 on spot USD/JPY prices, or 0.00646 on yen futures. Yes, yen futures could be at a sentiment extreme, but if there is no threat of intervention and US data continues to justify a stronger US dollar, then the path of least resistance for USD?JPY appears to be higher.

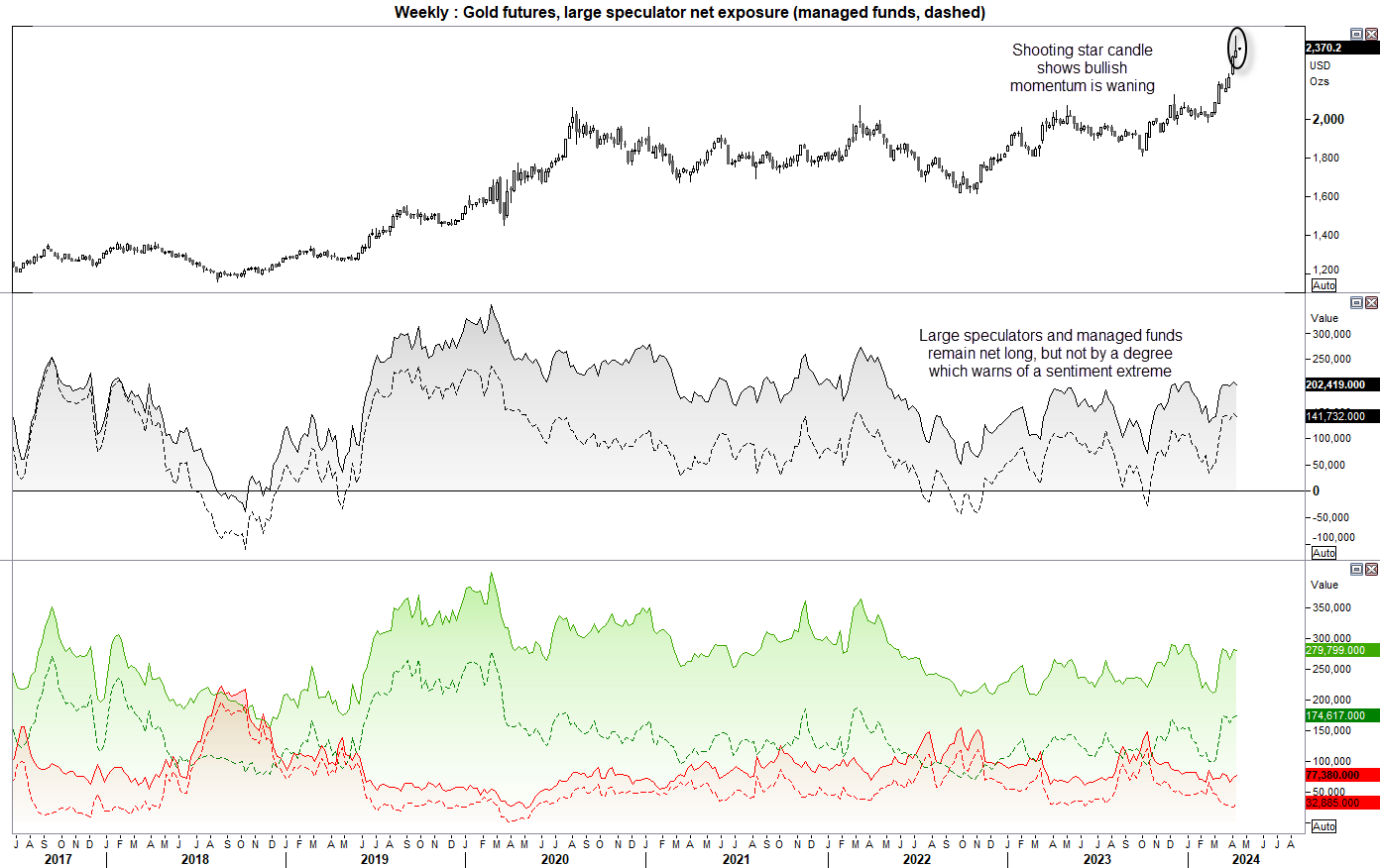

Gold futures (GC) positioning – COT report:

Gold futures rose for a fourth consecutive week and briefly traded above $2400 and formed a fresh record high. A bearish pinbar formed on the weekly chart to suggest bullish momentum is waning. But it is difficult to construct a particularly bearish case from this one candlestick alone. Large speculators and managed funds remain net long, but not by an extreme amount.

Asset managers decreased short exposure to gold by -9.4% (-7k contracts) and increased longs by 1.1% (+703 contracts), whereas large speculators increased long gold exposure by 15.7% (+10.1k contracts) and reduced shorts by -7.1% (-8.4k contracts).

And that means gold remains on the ‘buy the dip’ watchlist, even if dips may be shallow.

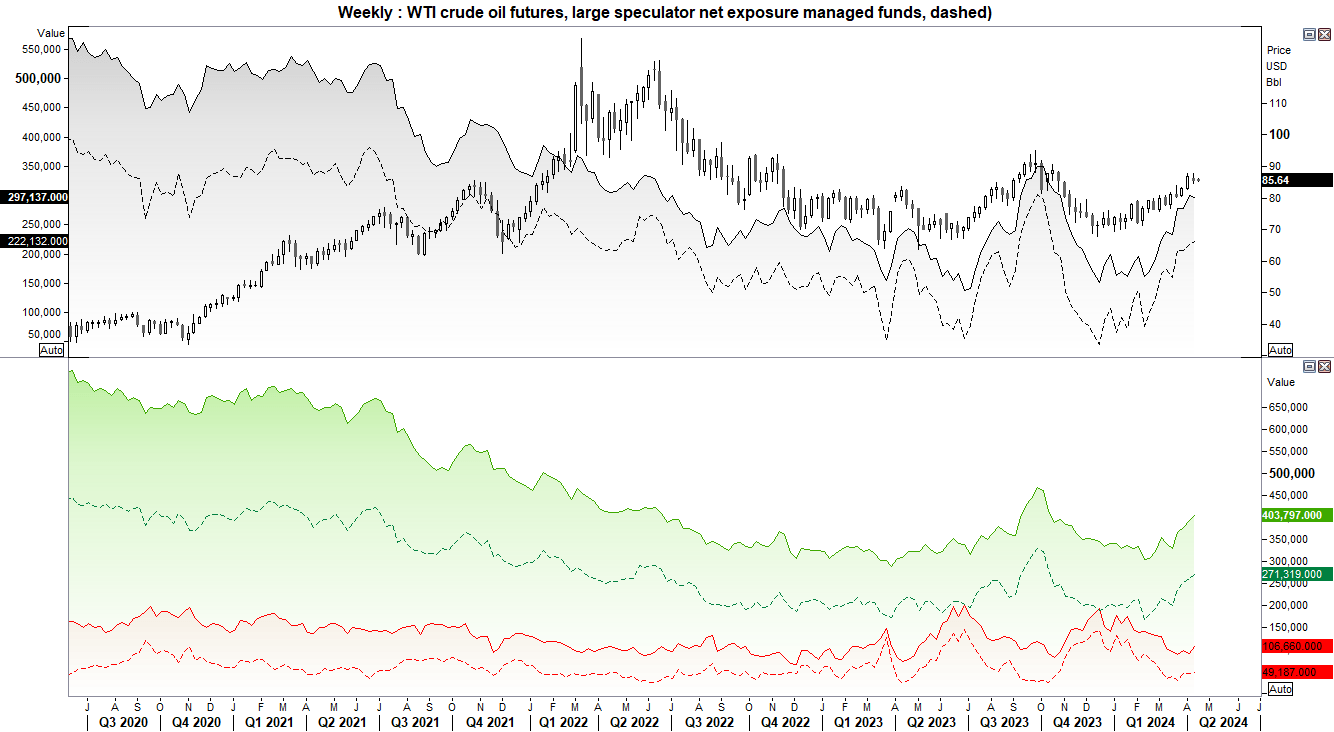

WTI crude oil (CL) positioning – COT report:

If you consider the headlines that were released from Friday and over the weekend regarding a potential Middle East conflict, crude oil’s reaction has been relatively subdued. IN fact, all of the action seemed to be on any market except crude oil, which sent US indices and commodity FX lower, gold and the VIX higher. It could be argued much of this has been priced in, given crude oil has risen ~30% since the December low.

Market positioning shows that large speculators and managed funds increased their net-long exposure for a second consecutive week. And like gold, exposure does not appear to be at a sentiment extreme. There was a slight increase of short bets among large speculators, but they may have since been removed given the headlines that were to follow after the COT data was compiled on Tuesday. And also like gold, WTI remains on the ‘buy the dip’ watchlist, as it is difficult to construct a convincing bearish case. Yet if oil is not rallying hard on Middle East headlines, it begs the question as to whether traders would be wise to indicate longs at these levels without waiting for a pullback first (unless tensions really do escalate).