- Economic perceptions between the US and rest of the of the developed world have rarely been this divergent

- This has helped to fuel gains in the US dollar in 2024

- Any information that questions the prevailing narrative can result in significant bouts of FX market volatility

If you’re waiting for economic events outside the United States to spark the next wave of currency market volatility, you’re looking in the wrong place. Because in the absence of a black or grey-swan type event, it will almost certainly come from within the United States.

US economic exceptionalism is priced into USD

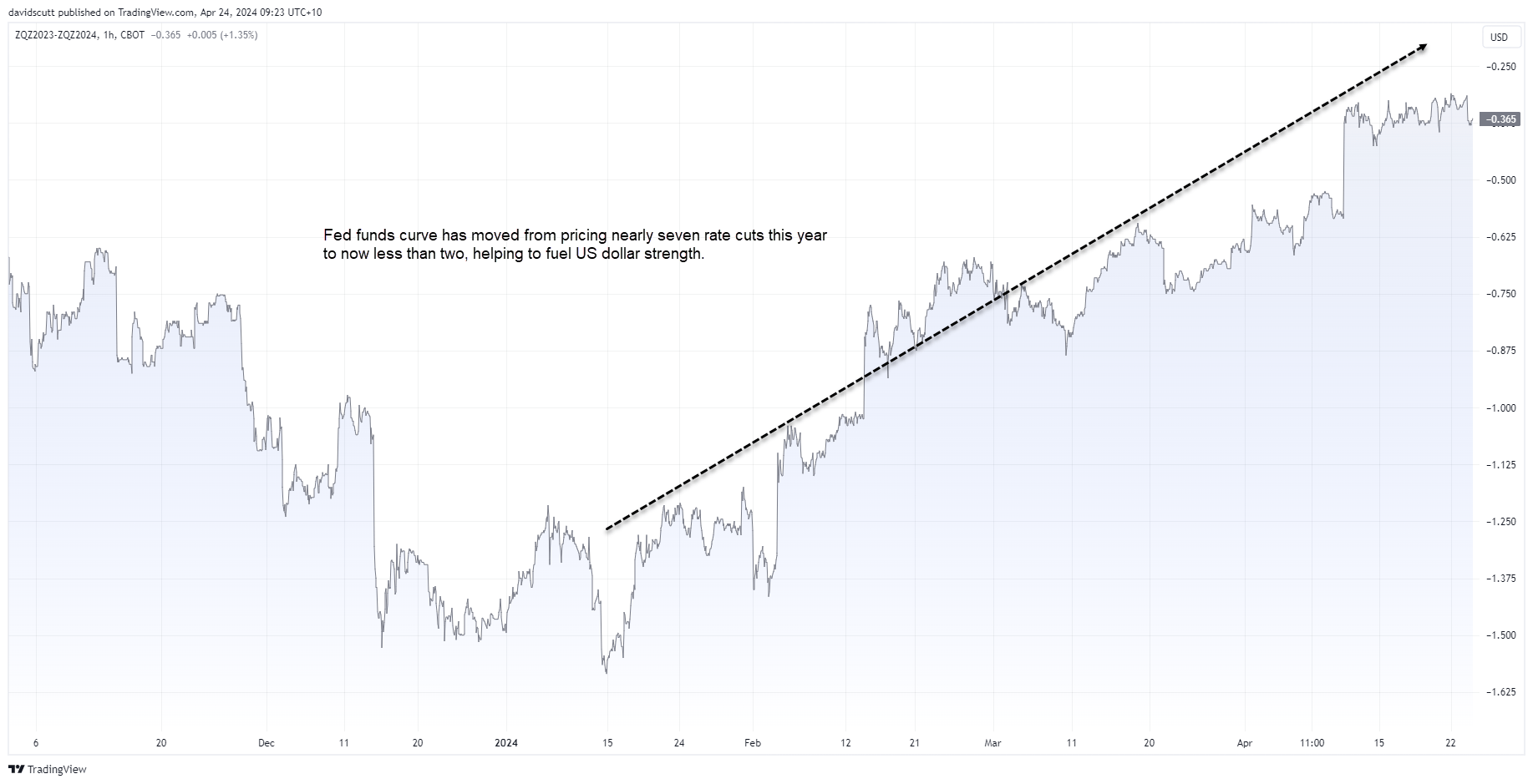

US economic exceptionalism is now baked in the cake. We’ve become accustomed to being constantly impressed by its resilience, delivering the significant repricing in US interest rate outlook this year. From nearly seven rate cuts expected at the start of the year we’re now down to less than two, helping to fuel the big rebound in the US dollar this year.

Weakness elsewhere fuels US dollar strength

In contrast to the US, we’re also accustomed to underwhelming economic outcomes elsewhere in the developed world, resulting in markets shifting aggressively from thinking the Fed would be the first major central bank to start cutting interest rates to now being among the last, driving capital away from other G10 FX names to the big dollar.

It’s been a potent mix.

But USD is vulnerable to data that questions the narrative

However, with these views strengthening by the day, it’s noticeable just how volatile FX markets can be become when the prevailing narrative is challenged. We saw that on Tuesday with the latest batch of flash manufacturing and services purchasing managers’ indices (PMI) from around the world, delivering a near-real time assessment of how activity levels are faring, according to business leaders.

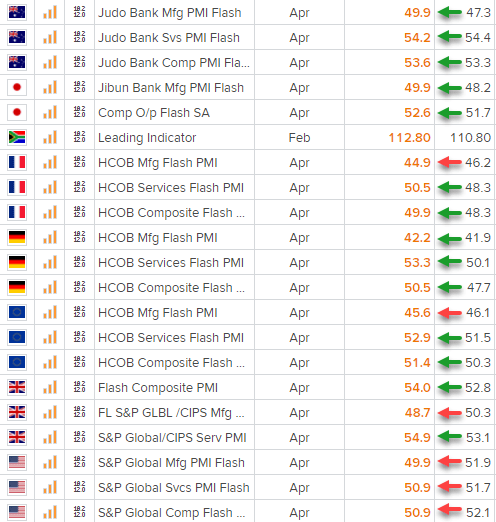

While PMIs measure changes in activity from one month to the next, not aggregate activity, with the flash surveys only capturing opinions from around 85% of total survey respondents, take a look at the report card for April.

The green arrows indicate an improvement or slower pace of decline while the red arrows indicate activity has either slowed or declined at a faster pace. Notice something?

Source: Refinitiv

Across Asia and Europe, almost everything improved, especially in the key services sectors which are responsible for the vast bulk of total economic activity. But in the United States, it was a clean sweep of misses, providing a chink in the armor to the economic exceptionalism story.

Now, I’m not going to extrapolate the findings from one soft survey and declare the US economic juggernaut is finished. But with economic perceptions so divergent, anything that questions that viewpoint can and does create a meaningful market impact.

Data undershoots amplify downside risks for US bond yields

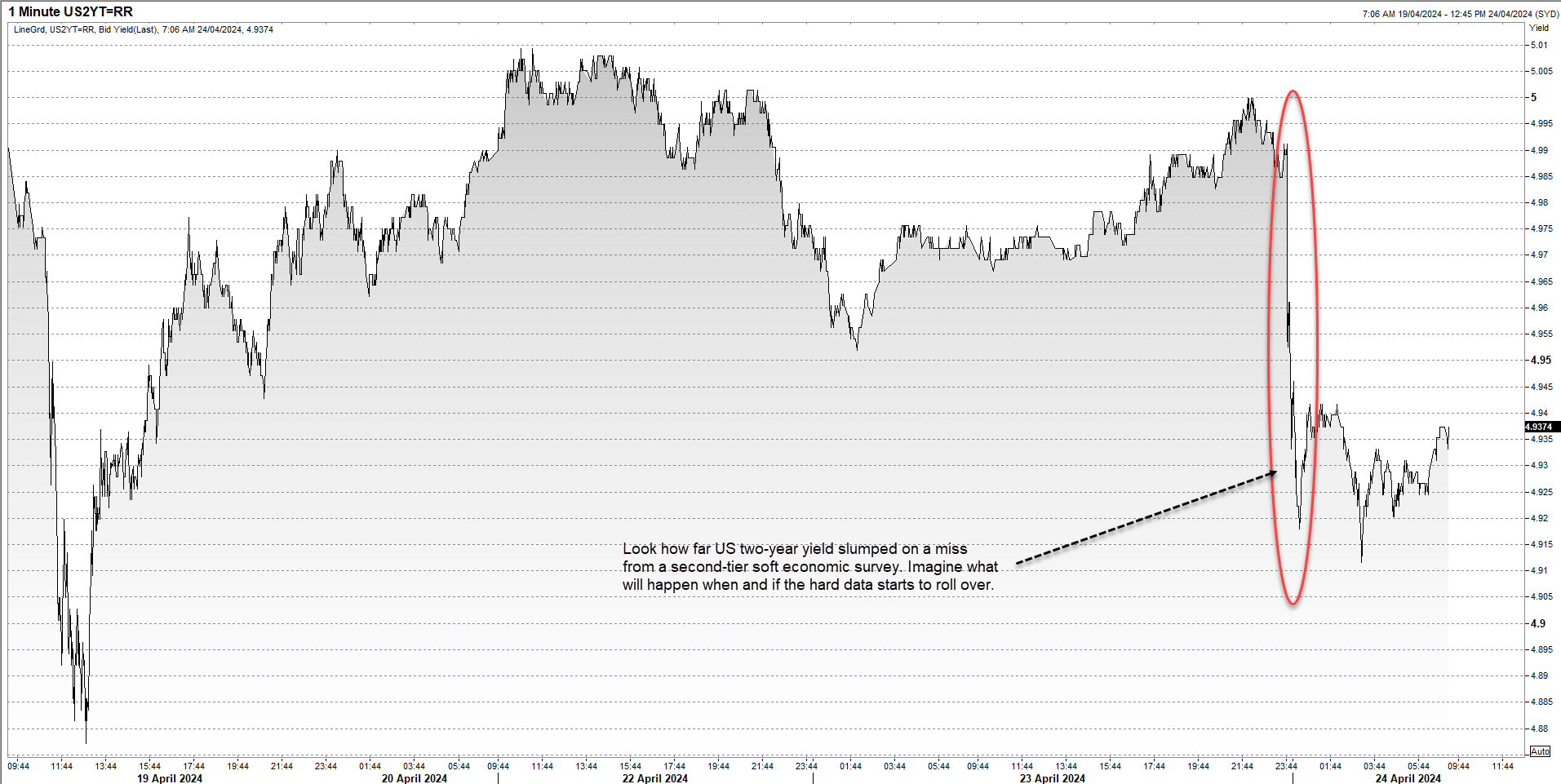

Look at the reaction in US two-year note yields to the flash PMI report. For all the coverage about the record two-year note auction, it’s influence on yields was insignificant relative to the data. If a second-tier release can move one of the most liquid fixed income instruments in the world by seven basis points, imagine what will happen if the hard economic data starts to roll over.

Source: Refinitiv

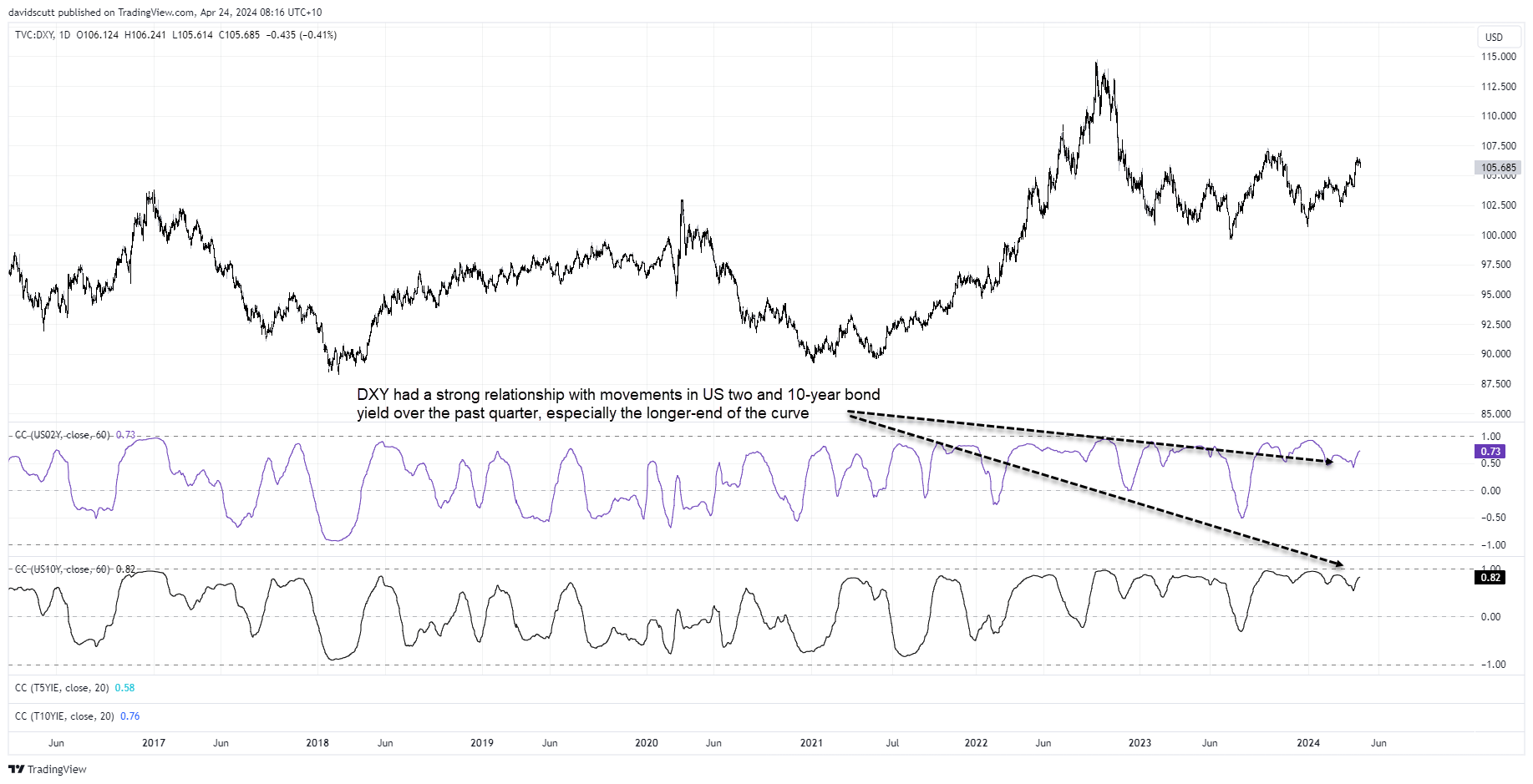

And lower yields typically means a weaker USD

You should care about the shifts in two-year notes as it’s influential on the US dollar, not only influencing relative yield differentials between the US and rest of the world but also mechanically driving movements in US yields further out the curve. That’s important as the daily correlation between the US dollar index (DXY) and US two and 10-year bond yields over the past quarter currently stands at 0.73 and 0.82 respectively. In other words, when yields decline, more often than not the US dollar does too.

That’s why it’s the United States that will almost certainly spark the next wave of FX market volatility. As long as the economic exceptionalism narrative remains intact, it will be hard for the US dollar to weaken substantially But when the tag no longer fits the reality, look out. The moves in currency markets will be big.

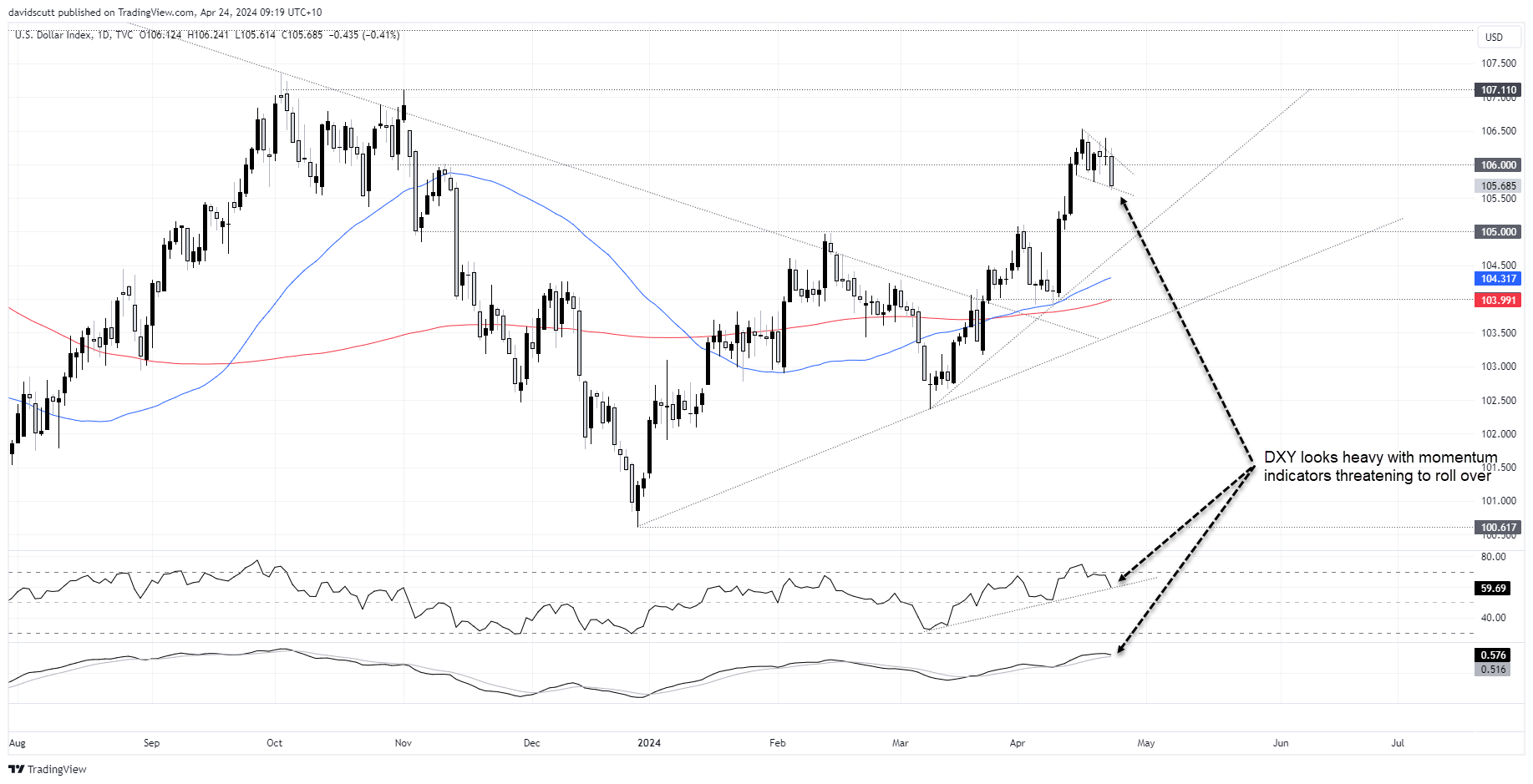

DXY looking heavy

The US dollar index was looking toppy on the charts even before Tuesday’s swoon.

Having rallied above 106 last week on the back of hawkish Fed commentary and haven flows, the price action since has been unconvincing, easing lower within a falling wedge pattern. DXY is now sitting on the lower support and looks heavy, mirroring momentum indicators such as RSI and MACD which are threatening to roll over. It looks like the price may do the same heading into the key US PCE inflation report on Friday.

Downside levels to watch include 105, the minor uptrend dating back to early March, along with 104 which looms as an ominous test for shorts given the proximity of the 200-day moving average.

-- Written by David Scutt

Follow David on Twitter @scutty