US Dollar Index Technical Outlook: USD Short-term Trade Levels

- US Dollar plunges to monthly lows on the heels of Trump Inauguration- breaks multi-month uptrend

- USD threatens deeper correction within broader uptrend- Fed, U.S. Inflation on tap next week

- Resistance 108.53, 108.97, 109.50 (key)- Support 107.93-108.06, 106.96, 106.10/35 (key)

The US Dollar Index is poised for a second weekly decline with a break below multi-month uptrend support now testing a major pivot zone at the January range lows. Battles lines drawn on the DXY short-term technical charts heading into next week’s FOMC interest rate decision.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this US Dollar technical setup and more. Join live on Monday’s at 8:30am EST.US Dollar Index Price Chart – USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; DXY on TradingView

Technical Outlook: In my last USD Short-term Outlook, we highlighted a well-defined weekly opening-range in DXY while noting resistance at, “the objective weekly open / 61.8% retracement of the 2022 decline at 108.92/97- a topside breach / close above this threshold would be needed to mark resumption of the broader uptrend towards the swing high at 109.53 and the upper parallels (currently ~110 & 110.50s).”

A topside breach two-days later extended more than 2.2% off the monthly lows with the DXY registering an intraday high at 110.17 before exhausting. The subsequent decline has erased the monthly gains with USD now trading at support near the monthly lows- looking for a possible price inflection off this threshold in the days ahead with a break of the late-September uptrend threatening a deeper correction here.

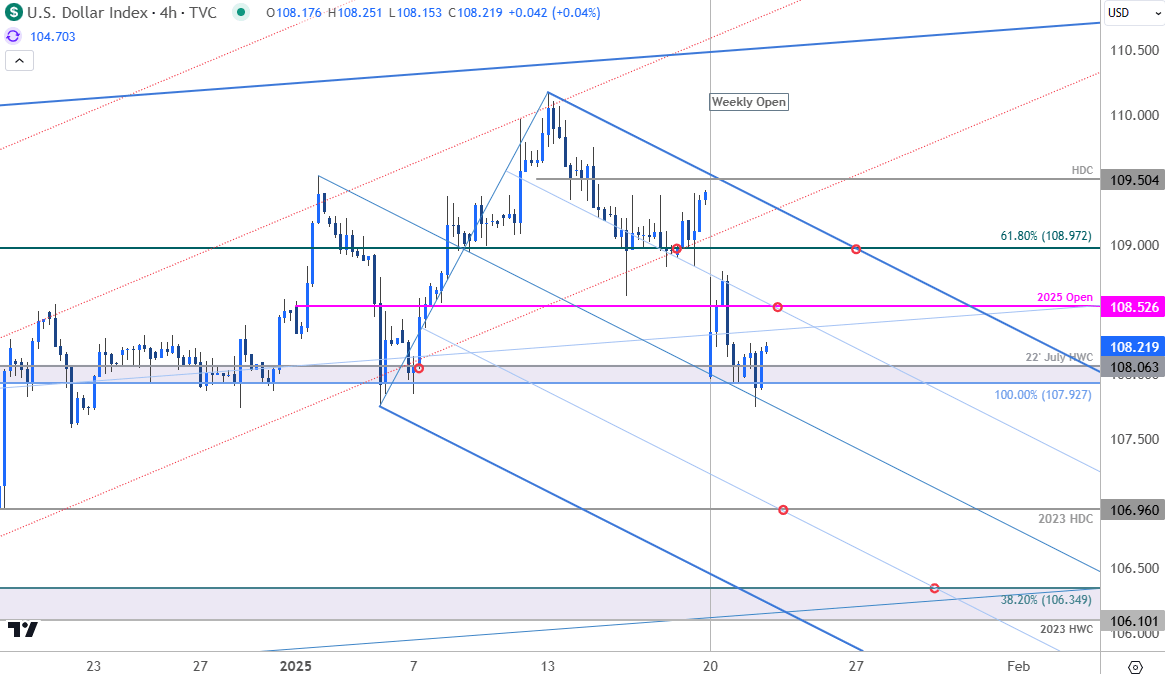

US Dollar Index Price Chart – USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; DXY on TradingView

Notes: A closer look at USD price action shows the index trading within the confines of a descending pitchfork extending off the yearly high with the median-line further highlighting near-term support here at 107.92-108.06- a region defined by the 100% extension of the 2023 advance and the 2022 July high-week close (HWC).

Yearly / monthly open resistance is eyed at 108.53 and is backed by near-term bearish invalidation at the 61.8% retracement of the 2022 decline at 108.97. Ultimately, a breach / close above the high-day close at 109.50 would be needed to mark uptrend resumption.

A pivot below the median-line here would threaten a deeper correction within the broader uptrend towards the 2023 high-day close (HDC) at 107 and 106.10/35- a region defined by the 2023 HWC and the 38.2% retracement of the September advance. Look for a larger reaction there IF reached.

Bottom line: The US Dollar is testing support at the monthly range lows- looking for a reaction off this mark in the days ahead. From a trading standpoint, rallies should be limited to 109 IF price is heading for a deeper correction here with a break below the median-line needed to fuel the next major leg of the decline. Ultimately, a larger pullback here may offer more favorable opportunities closer to trend support with a close above 109.50 needed to mark resumption.

Keep in mind the Federal Reserve interest rate decision is on tap next week with key U.S. inflation data slated for release on Friday. Stay nimble into these events and watch the weekly close here for guidance. Review my latest US Dollar Weekly Forecast for a closer look at the longer-term DXY technical trade levels.

Key US Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Australian Dollar Short-term Outlook: AUD/USD Breakout Looms

- Japanese Yen Short-term Outlook: USD/JPY Bulls Tested Ahead of Trump

- Euro Short-term Outlook: EUR/USD Poised to Snap Six-Week Selloff

- Canadian Dollar Short-term Outlook: USD/CAD Breakout Imminent

- Swiss Franc Short-term Outlook: USD/CHF Bulls Eye the Break

- British Pound Short-term Outlook: GBP/USD Bears Slams into Support

- Gold Short-term Outlook: XAU/USD Poised for Breakout

Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex