US Dollar Outlook: USD/JPY

USD/JPY appears to be reversing ahead of the October high (153.88) as the Federal Reserve is anticipated to deliver a 25bp rate-cut following the US election, and the forward guidance for monetary policy may sway the near-term outlook for the exchange rate as the central bank moves towards a neutral stance.

US Dollar Forecast: USD/JPY Vulnerable to Looming Fed Rate Cut

USD/JPY gives back the advance from the start of the month to keep the Relative Strength Index (RSI) out of overbought territory, and recent price action may lead to a further decline in the exchange rate as it starts to carve a series of lower highs and lows.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

In turn, the opening range for November is in focus as expectations for lower US interest rates may further influence the carry trade, but USD/JPY may continue to trade to fresh weekly lows ahead of the Fed meeting even though US Treasury yields hold steady.

US Economic Calendar

It remains to be seen if the Federal Open Market Committee (FOMC) will adjust the outlook for monetary policy as Fed officials that ‘the appropriate level of the federal funds rate will be 4.4 percent at the end of this year,’ and more of the same from the Chairman Jerome Powell and Co. may produce headwinds for the Greenback as the central bank prepares US households and businesses for lower interest rates.

With that said, the bearish price series in USD/JPY may persist as it appears to be reversing ahead of the ahead of the October high (153.88), but the recent weakness in the exchange rate may end up short lived should the FOMC deliver a hawkish rate-cut.

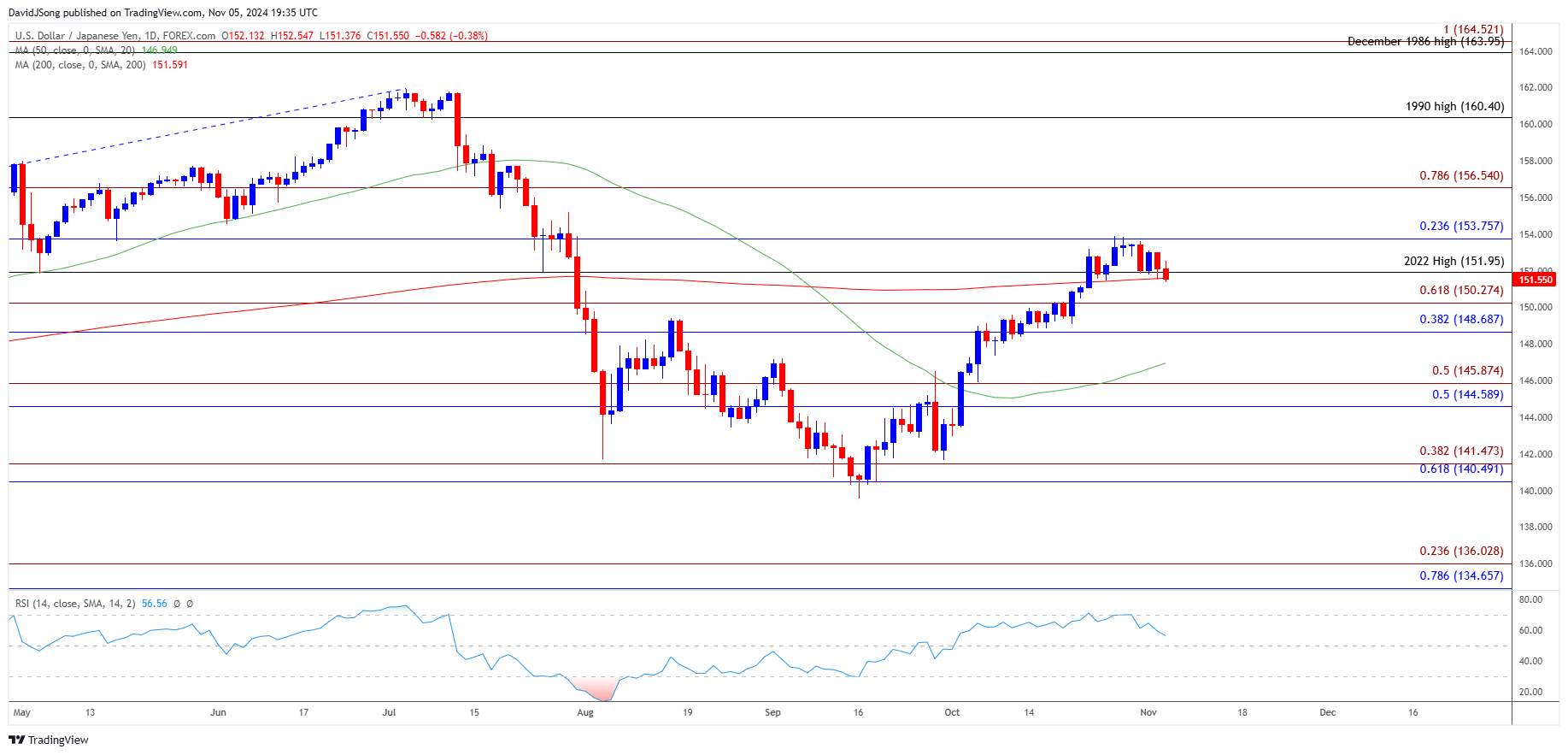

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Strategist; USD/JPY on TradingView

- The five-week rally in USD/JPY seems to be unraveling amid the failed attempt to close above 153.80 (23.6% Fibonacci retracement), with the exchange rate giving back the advance from the start of the month as it trades to a fresh weekly low (151.38).

- A break/close below the 148.70 (38.2% Fibonacci retracement) to 150.30 (61.8% Fibonacci extension) zone brings the 144.60 (50% Fibonacci retracement) to 145.90 (50% Fibonacci extension) region on the radar, with the next area of interest coming in around the October low (142.97).

- Nevertheless, USD/JPY may snap the recent series of lower highs and lows should it push above the weekly high (153.00) but need a close above 153.80 (23.6% Fibonacci retracement) to open up 156.50 (78.6% Fibonacci extension).

Additional Market Outlooks

Monetary vs Fiscal Policy: Implications for FX Markets

AUD/USD Recovery Pulls RSI Away from Oversold Territory

USD/CAD Reverses Ahead of 2022 High with Fed Rate Decision on Tap

Euro Forecast: EUR/USD Recovery Persists Ahead of Euro Area CPI Report

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong