US Dollar Outlook: USD/CAD

USD/CAD may continue to give back the advance from the monthly low (1.3821) as it takes out last week’s low (1.3931), but the depreciation in the exchange rate may turn out to be temporary as the US Personal Consumption Expenditure (PCE) Price Index is anticipated to show sticky inflation.

US Dollar Forecast: USD/CAD to Face Uptick in US PCE Index

The recent weakness in USD/CAD may persist as it appears to be reversing ahead of the May 2020 high (1.4173), and the exchange rate may face a further pullback should it fail to defend the advance following the US election.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

US Economic Calendar

Nevertheless, the US PCE may sway USD/CAD as the update is anticipated to show the headline reading climbing to 2.3% in October from 2.1% per annum the month prior, while the core PCE, the Federal Reserve’s preferred gauge for inflation, is anticipated to increase to 2.8% from 2.7% during the same period.

With that said, signs of persistent US price growth may curb the recent weakness in USD/CAD as it curbs speculation for a Fed rate-cut in December, but a softer-than-expected PCE report may drag on the Greenback as it encourages the Federal Open Market Committee (FOMC) to implement lower interest rates.

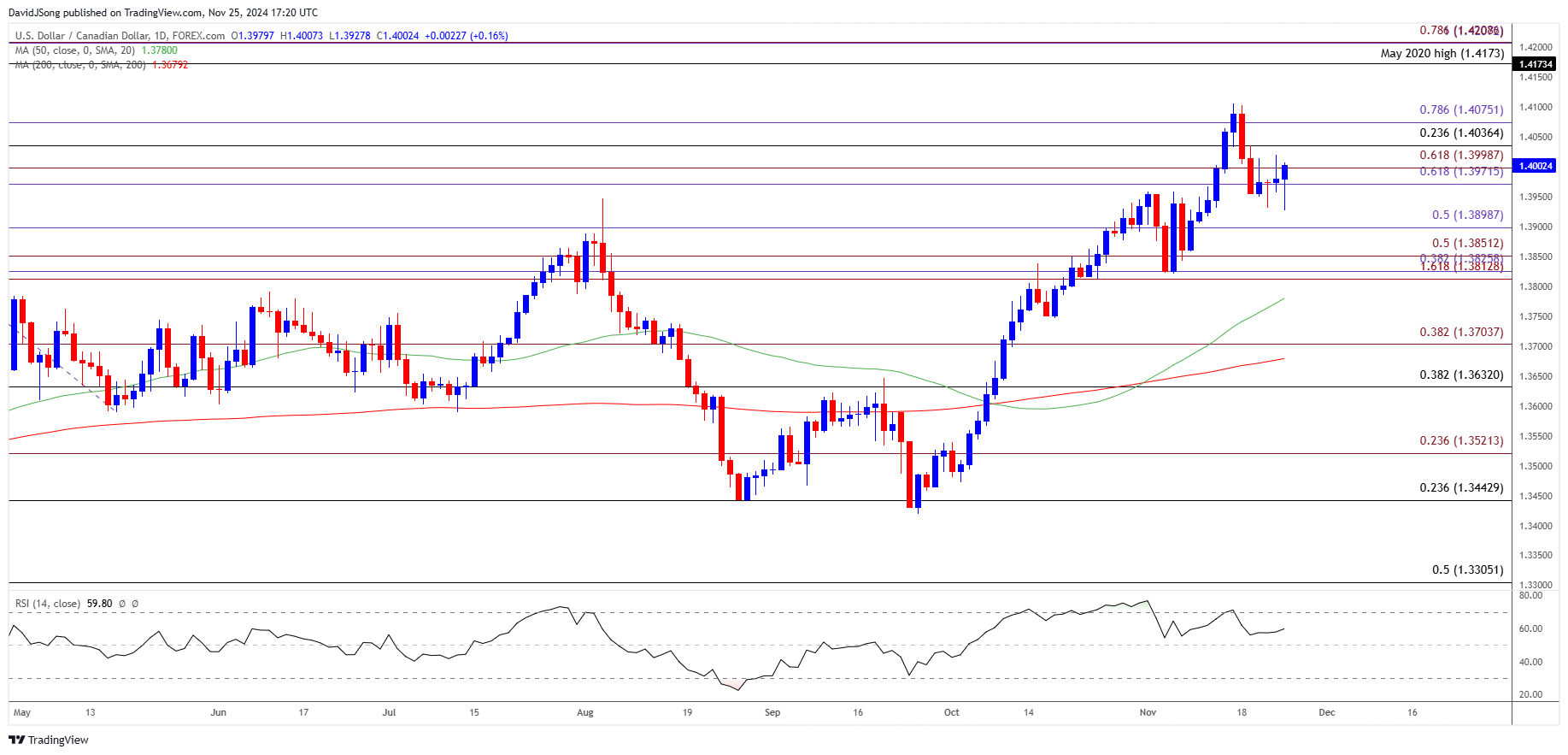

USD/CAD Price Chart – Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD fails to hold within last week’s range as it struggles to trade back above the 1.3970 (61.8% Fibonacci extension) to 1.4000 (61.8% Fibonacci extension) zone, with a break/close below 1.3900 (50% Fibonacci extension) bringing the monthly low (1.3821) on the radar.

- A close below the 1.3810 (161.8% Fibonacci extension) to 1.3850 (50% Fibonacci extension) region opens up 1.3700 (38.2% Fibonacci extension) but a close above the 1.3970 (61.8% Fibonacci extension) to 1.4000 (61.8% Fibonacci extension) zone may push USD/CAD back towards the 1.4040 (23.6% Fibonacci retracement) to 1.4080 (78.6% Fibonacci extension) area.

- A breach above the monthly high (1.4106) brings the May 2020 high (1.4173) back on the radar, with next area of interest coming in around the April 2020 high (1.4299).

Additional Market Outlooks

Gold Price Stages Five-Day Rally for First Time Since March

US Dollar Forecast: USD/CHF Rally Eyes July High

GBP/USD Selloff Pushes RSI Up Against Oversold Zone

USD/JPY Weakness Curbs Threat of Currency Intervention

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong