The unwind of carry trades remained the dominant theme overnight and we saw some big moves in the likes of the Japanese yen and Swiss franc, while equity indices and US futures slumped. But once the dust settles in the equity markets, we could see other currencies start to perform better against the dollar too. So far, we have only seen the euro show any signs of strength apart from those where interest rates are lower – JPY, CHF and CNH. The broader US dollar forecast should turn more negative once the equity markets shown signs of stabilisation light of the sharp repricing of US interest rates.

What is happening in FX?

It’s been a rough ride for global risk assets lately, and the turbulence shows no sign of easing at the start of this week. Investors are gripped by fears that the Federal Reserve has waited too long to pivot on its policy, especially in light of Friday’s disappointing US jobs data and a slew of other weak economic indicators pointing toward a looming recession.

It appears as though Friday’s soft jobs report was a game-changer for US rates markets. Short-term US yields took a nosedive as the market consensus shifted dramatically, now expecting the Fed to slash rates significantly this year. We're talking about a massive shift: the market is now pricing in around 120 basis points of Fed rate cuts before year-end, all driven by recession fears. No more hoping for a smooth, orderly adjustment in Fed policy. In fact, investors are now bracing for a 50-basis point cut in September, double the 25 basis points they were anticipating before.

Falling bond yields have flipped the script on low-yielding currencies. After a tough first half of the year, these currencies are now on the rise. With the Fed and other major central banks expected to lower interest rates, the US dollar and other high-beta currencies are being dumped in favour of the Japanese yen, Swiss franc, and Chinese renminbi. The yen, in particular, is getting an extra boost from last week’s hawkish BOJ rate decision, adding to its newfound strength.

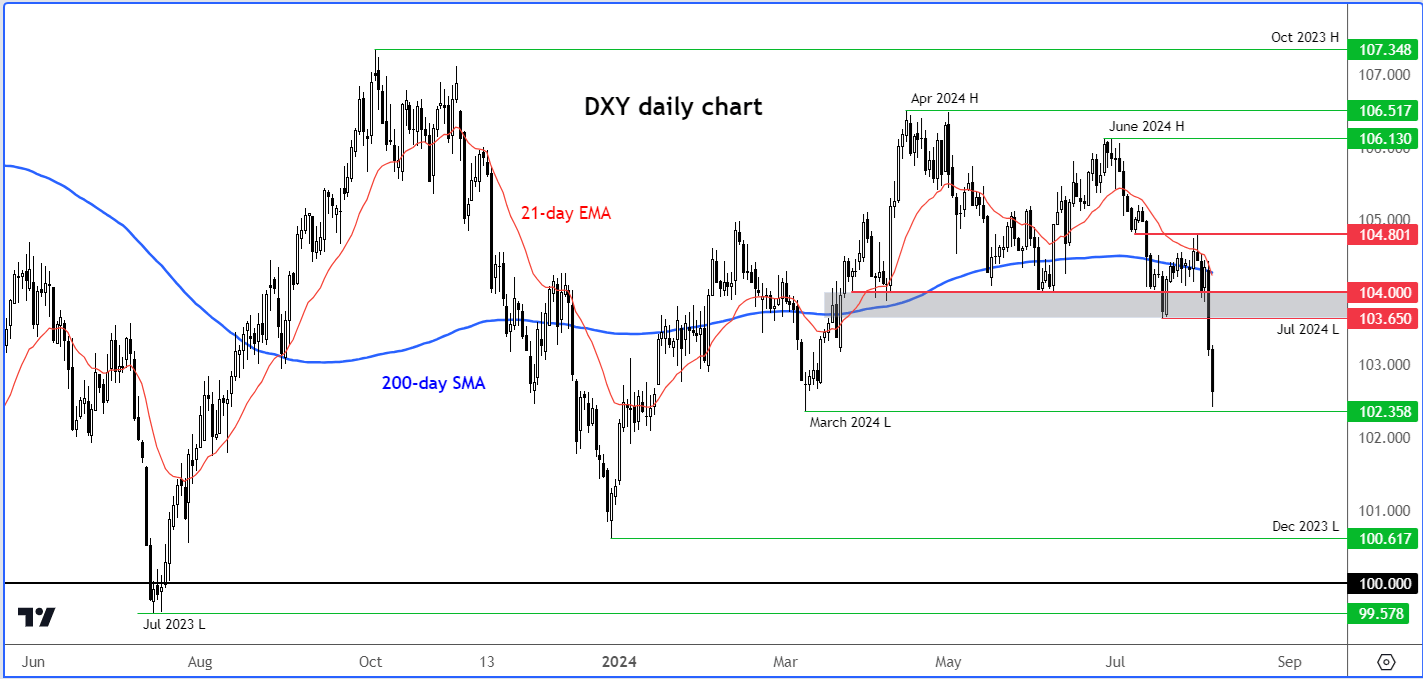

US dollar forecast: What to expect next?

I would be very surprised if the Fed refuses to offer some soothing words in light of the big moves we have seen. There are not many Fed speakers today, but Chicago Fed President Austan Goolsbee is set to appear on CNBC at 13:30 BST. He will have to choose his word carefully, as more evidence of an economic slowdown could emerge from data scheduled for 15:00 – namely, the July ISM services PMI.

The sharp correction in equities is certainly putting high beta currencies under pressure, preventing them from benefiting from significantly lower US rates. It’s a tough environment out there, and it seems like these currencies just can’t catch a break. However, once the asset markets stabilise, we should see a different story unfold. The dollar is likely to weaken across the board as its yield advantage has been substantially reduced. So, while high beta currencies are struggling now, there's potential for a rebound once things settle down.

Source: TradingView.com

What is a carry trade anyway?

In case you were wondering, carry trade is a strategy where traders borrow money at low-interest rates and invest it in higher-yielding assets. It’s a popular tactic in forex trading, where investors take advantage of low-interest rates and weaker currencies in one country to reinvest in another country with higher returns.

Japan has been a favourite for carry trade, thanks to the Bank of Japan’s ultra-loose policy that’s been in place for many years, coupled with a weak yen. This has made the yen an attractive option for global investors looking to maximize their returns through carry trades.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R