US CPI Key Points

- US CPI Expectations: 3.4% y/y headline, 3.6% y/y ‘Core” inflation

- Between cooling ISM Prices Paid and disinflationary base effects, we should see CPI inflation fall this month

- USD/JPY is stretched to the topside and traders are increasingly nervous about the potential for more intervention.

When is the US CPI Report?

The April US CPI report will be released at 8:30am ET on Wednesday, May 15, 2024.

What Are the US CPI Report Expectations?

Traders and economists expect the US CPI report to fall to 3.4% y/y on a headline basis, with the “Core” (ex-food and -energy) reading expected to fall to 3.6% y/y.

US CPI Forecast

I’ve never done the job, but I can say with confidence that being the head of a central bank is a relatively straightforward job at least some of the time.

If a global pandemic is shutting down the economy completely, you probably want to be cutting interest rates and flooding the system with liquidity. Meanwhile, if inflation has been in the double digits for years and workers expect continued price pressures for the foreseeable future, as the US saw in the early 1980s, you’d probably want to hike interest rates very high to get inflation under control.

This current environment is NOT one of those time for Fed Chairman Powell, and a big reason why is the persistence of slightly above-target inflation.

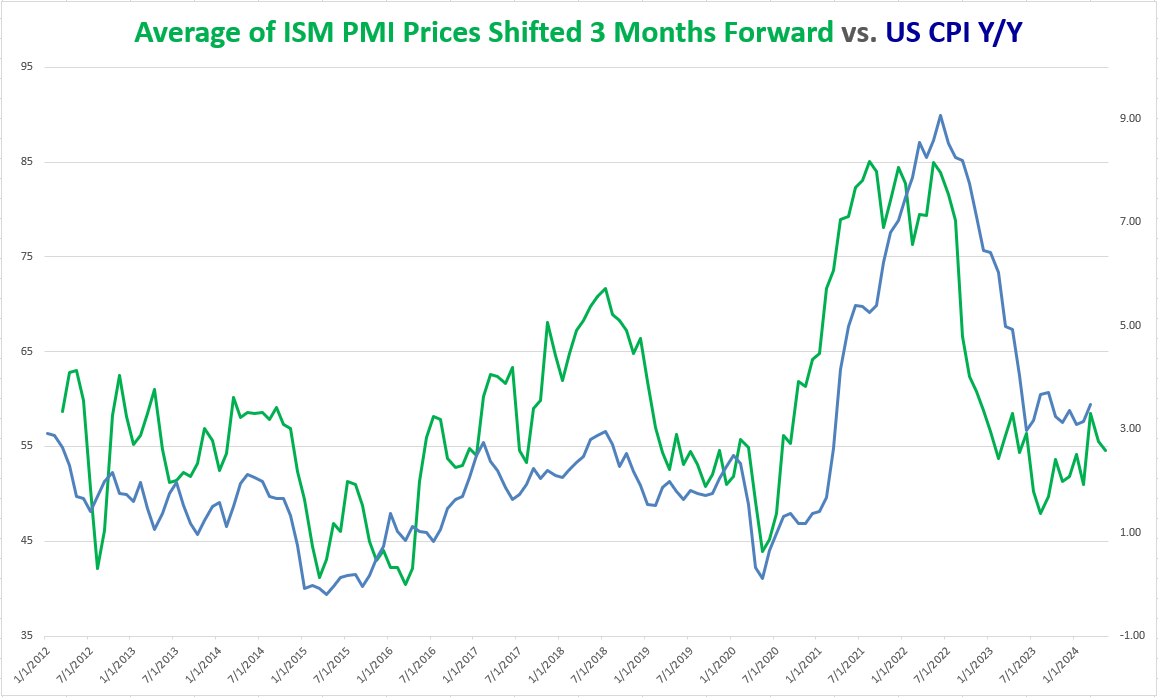

As many readers know, the Fed technically focuses on a different measure of inflation, Core PCE, when setting its policy, but for traders, the CPI report is at least as significant because it’s released weeks earlier. As the chart below shows, the year-over-year measure of US CPI has flatlined around 3.3% for the better part of a year now, and perhaps thankfully for Jerome Powell and Company, one of the best leading indicators for future CPI readings, the ISM PMI Prices component, is hinting that some further relief may be coming:

Source: TradingView, StoneX

As the chart above shows, the “Prices” component of the PMI reports has ticked lower over the last few months, suggesting that price pressures may be moderating slightly.

Crucially, the other key component to watch when it comes to US CPI is the so-called “base effects,” or the influence that the reference period (in this case, 12 months) has on the overall figure. Last April’s 0.4% m/m reading will drop out of the annual calculation this year, opening the door for a drop in the headline year-over-year CPI reading. The base effect for Core CPI is even more extreme, with a 0.5% m/m reading rolling off the annual measure.

Between a cooling in the ISM Prices Paid and favorable base effects, we should see CPI inflation fall this month, but that’s no guarantee that it will continue to drop toward the Fed’s target as we move through the summer.

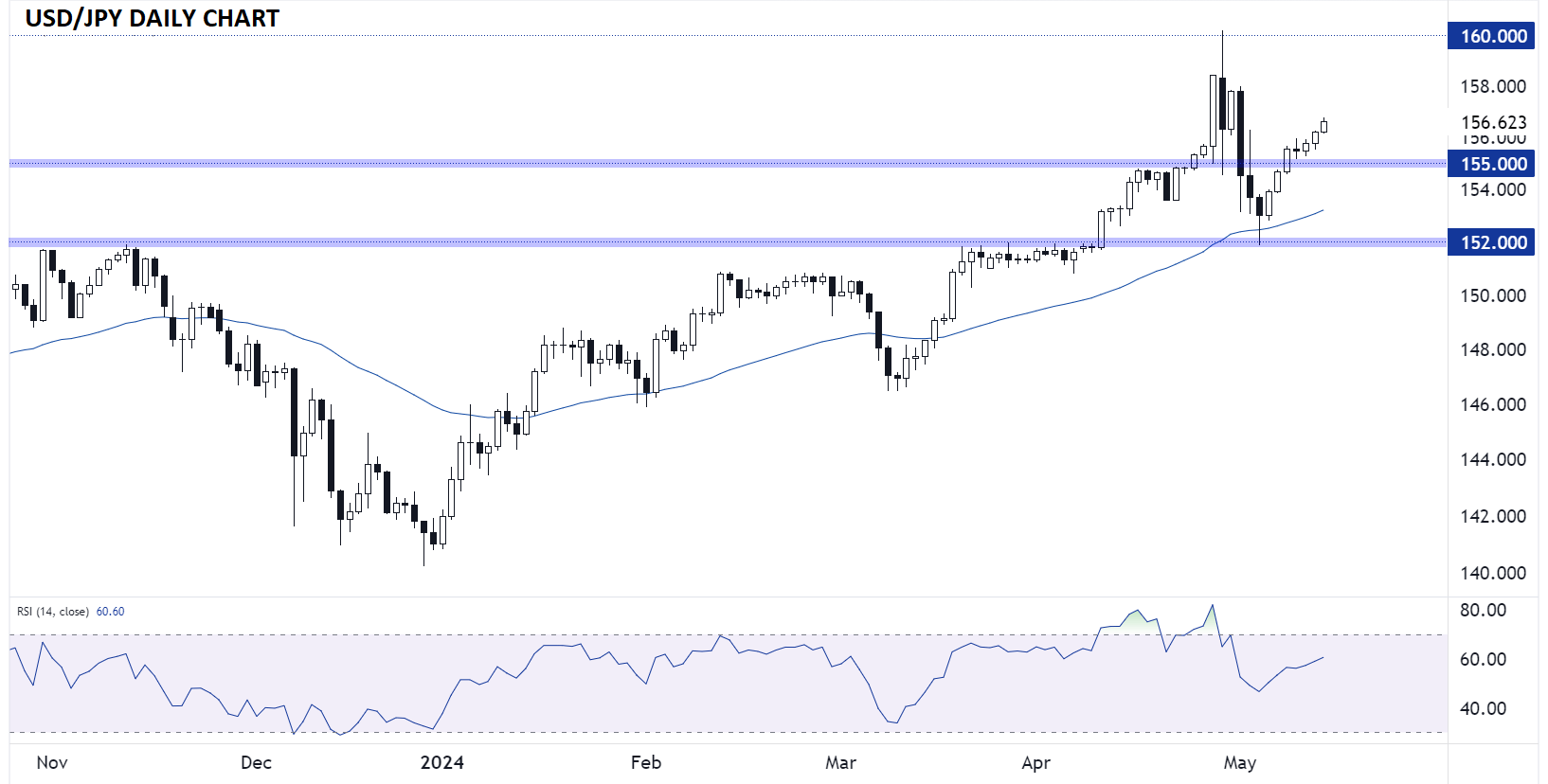

US Dollar Technical Analysis – USD/JPY Daily Chart

Source: TradingView, StoneX

Turning our attention to the charts, USD/JPY is quietly edging back up toward last month’s 34-year high. Despite two rounds of intervention by the Ministry of Finance and Bank of Japan, the pair has found its bullish footing again and is on track for its 3rd highest close in the past 3 decades. From a purely technical perspective, the pair has room for more upside into the 158.00-160.00 range, but bulls are likely to be on edge with every tick higher. Accordingly, a softer-than-expected US CPI report could easily be the catalyst that drives an outsized drop in USD/JPY, with the key 155.00 level potentially coming into play if traders start to price in a summer rate cut from the Fed.

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos on YouTube and be sure to follow Matt on Twitter: @MWellerFX