US CPI Countdown: How September's Report Could Shape Economic Policy

Mark Wednesday in your calendars because that's when the Fed will examine inflation once more before deciding on future policy.

On Wednesday, the CPI, considered as one of the leading inflation data, is released.

The Fed and Jerome Powell will meet on the 17th and 18th.

Goldman Sachs believes that if the economy continues to deteriorate, the Fed may reduce rates by an additional 25 basis points.

The week's most important event for the US, is Wednesday's CPI inflation report, but because this is Kamala Harris and Donald Trump's first debate, the outcome could potentially affect the markets.

Overnight, the US session saw advances in the Nikkei 225, Hang Seng, and ASX 200, but mainland China indices and the Kospi saw declines. Overall, the Asian day was uneventful. During the three months leading up to July, average earnings increased by 4%, while the unemployment rate in the UK fell to 4.1%.

On the agenda for Wednesday 11th September - GMT Time

13:30 USD Core CPI (MoM) (Aug)

13:30 USD Core CPI (YoY) (Aug)

13:30 USD CPI (YoY) (Aug)

13:30 USD CPI (MoM) (Aug)

15:30 USD Crude oil inventories

What we saw until today

Employment Figures: May Have Been Worse

The jobs data released on Friday left economists deeply emotional.

Some experts view the U.S.'s August job growth of 142,000, which was less than the 165,000 jobs that were anticipated, as concerning.

However, there was a bright spot in the economic clouds: the jobless rate decreased from 4.3% to 4.2%.

That may indicate that, while not quickly enough to cause a "three alarm fire," the labour market is cooling off faster than the Fed would like.

Regarding the jobs report, U.S. Treasury Secretary Janet Yellen is not concerned.

Her thoughts? Companies aren't firing workers even when hiring has slowed, which helps control inflation: "It really has been amazing to be able to get inflation down as meaningfully as we have. This is what most people would call the soft landing."

Additionally, the ISM manufacturing was weak (again below the 50 threshold), and the JOLTS job opening number fell (7673k new vs. 8100k expected), with the job opening vs. unemployment falling to 1.07, which is below the pre-covid level. On September 6, the payroll number was also lower than expected (142k vs. 165k expected, and a -89k revision of the previous two months).

Expectations

Based on an economist survey conducted by Dow Jones Newswires and The Wall Street Journal, prices increased 2.6% year over year through August, which is less than the 2.9% annual increase in July, according to the Consumer Price Index (CPI) report that is expected out on Wednesday.

Several experts stated that declining petrol prices and stable food prices probably contributed to the overall reduction in inflation. The yearly inflation rate would reach a new low since March 2021 if the projection comes true.

How swiftly rents increased will determine whether or not CPI inflation reaches experts' estimates. Two thirds of the price index's overall value is comprised of housing costs.

When formal government actions catch up to the cooling rent increases indicated by other, more recent data sources, many economists anticipate rent to begin exerting downward pressure on inflation. The report from last month surprised everyone by revealing an unanticipated rise in rent.

One of the final significant economic data sets that Fed officials will receive before deciding how to adjust interest rates at their policy meeting on September 17–18 is the inflation report.

The Fed is widely expected to cut the fed funds rate by 25 basis points at their next meeting. However the CME Group's FedWatch tool, which predicts rate movements based on fed funds futures trading data, indicates that financial markets are pricing in an outside chance of a larger 50 basis point cut.

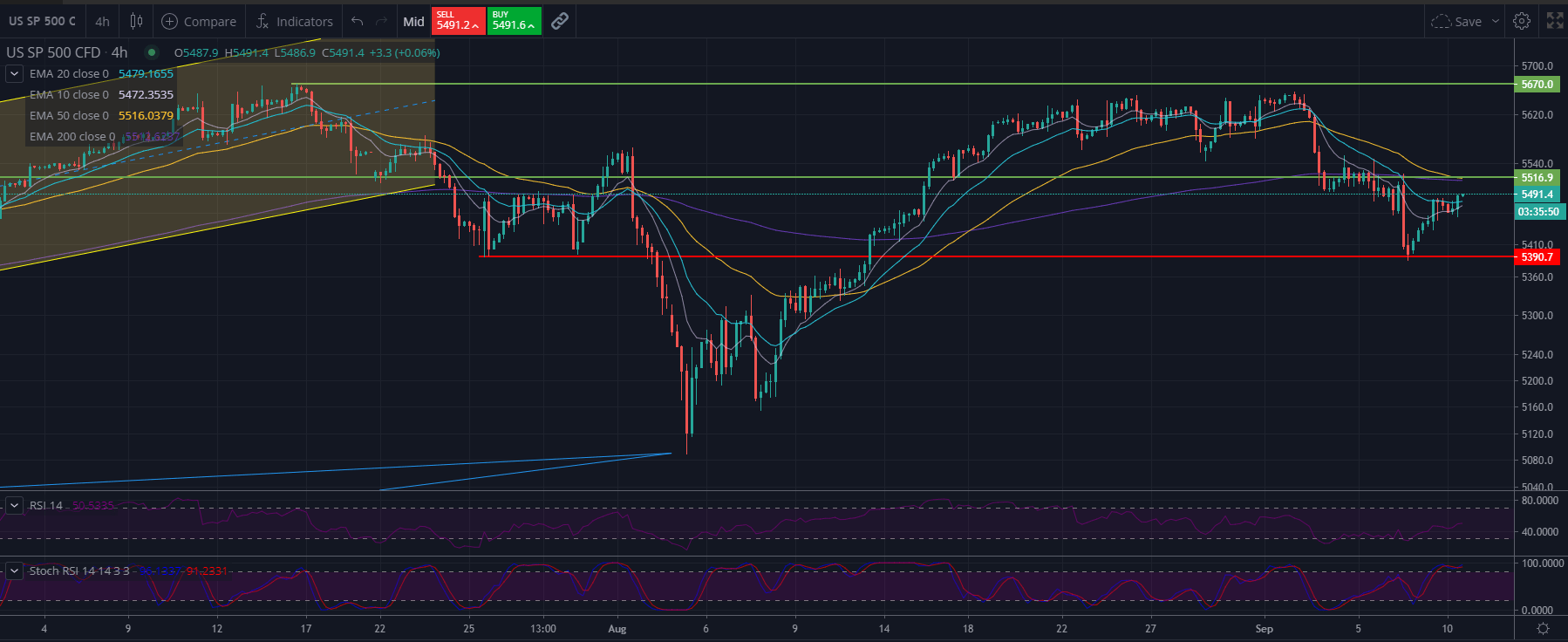

S&P 500 Technical analysis – 4 hour

The S&P touched the bottom support after the NFP scare from Friday. After the price is currently around the 5500 level, which is just slightly below previous highs. This is a critical level to watchas volume at those levels were considerably high.

The RSI is sloping upwards from oversold levels and is slightly above the 50 center, indicating continuous purchases, bidding up the price slightly. A slight divergence can also be seen in the indicator with higher lows while the price had created lower lows, and thus showing a potential bullish continuation.

A contradiction from the stochastic RSI shows overbought levels which could indicate a potential consolidation at this level. However, historically this was not always accurate as seen at the beginning of August where the stochastic RSI was above overbought levels for an extended period of time as the price increased.

The Moving averages show that the price broke through the 10 and 20 EMA, making the next resistance point the 50EMA levels, if bullish momentum persists.

To the downside we have the 5,390 level being around previous lows acting as support.

- Philip Papageorgiou