Core PCE and USD/JPY Key Points

- Diverging interest rate expectations between the Federal Reserve and the rest of the developed world have been THE biggest story of the year for FX traders, and Friday’s Core PCE report will be the next major test to determine if that trend will carry over into Q2

- Overall, US inflation readings over the last few months – and arguably the last few quarters! – have stalled above the Fed’s 2% target.

- Continued USD/JPY strength above 155.00, if not checked by intervention from Japanese authorities, could open the door for a bullish continuation toward 156.00 or beyond

When is the US Core PCE Report?

The March Core PCE report will be released at 8:30 ET on Friday, April 26.

What are the US Core PCE Expectations

Economists expect March Core PCE to come in at 0.3% m/m, 2.7% y/y.

This compares with 0.3% m/m and 2.8% y/y last month.

US Core PCE Forecast

Despite the market’s intense focus on the monthly Consumer Price Index (CPI) releases, the Federal Reserve still prefers to focus on Core Personal Consumption Expenditures (PCE) when making decisions about whether – and when – to raise or lower interest rates.

That’s convenient lately, with the Core PCE report running lower than CPI, though notably, it’s still above the Fed’s 2% target. The central bank is in it’s traditional public speaking “blackout” period ahead of its May 1st meeting, but before the blackout started, Fed officials including Chairman Jerome Powell consistently noted that they wanted to see a continued drop in inflation readings before having enough confidence to start cutting interest rates.

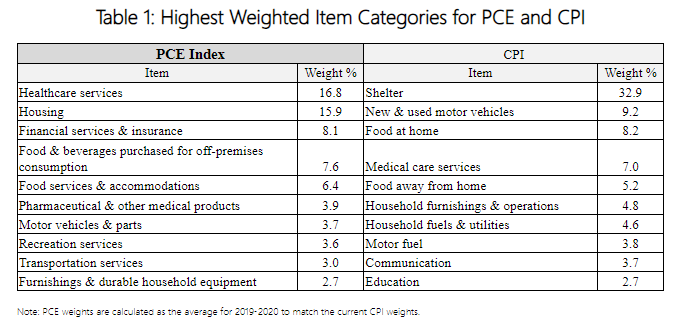

Overall, US inflation readings over the last few months – and arguably the last few quarters! – have stalled above the Fed’s 2% target. Without getting too much into the detailed differences between the CPI and PCE measures of inflation (see a full treatise from the BLS here if you’re interested), one of the most important differences is the weighting of shelter/housing, which many analysts argue is a lagging indicator that is no longer rising significantly. As the table below shows, CPI places a much higher weight on Shelter (nearly one-third of the total) than does PCE (closer to one-sixth):

Source: BEA, BLS, TD Economics

This difference in weighting methodology explains a significant portion of the divergence between CPI and PCE and will influence how traders, and the Federal Reserve, interpret Friday’s reading.

In summary, diverging interest rate expectations between the Federal Reserve and the rest of the developed world have been THE biggest story of the year for FX traders, and Friday’s Core PCE report will be the next major test to determine if that trend will carry over into Q2

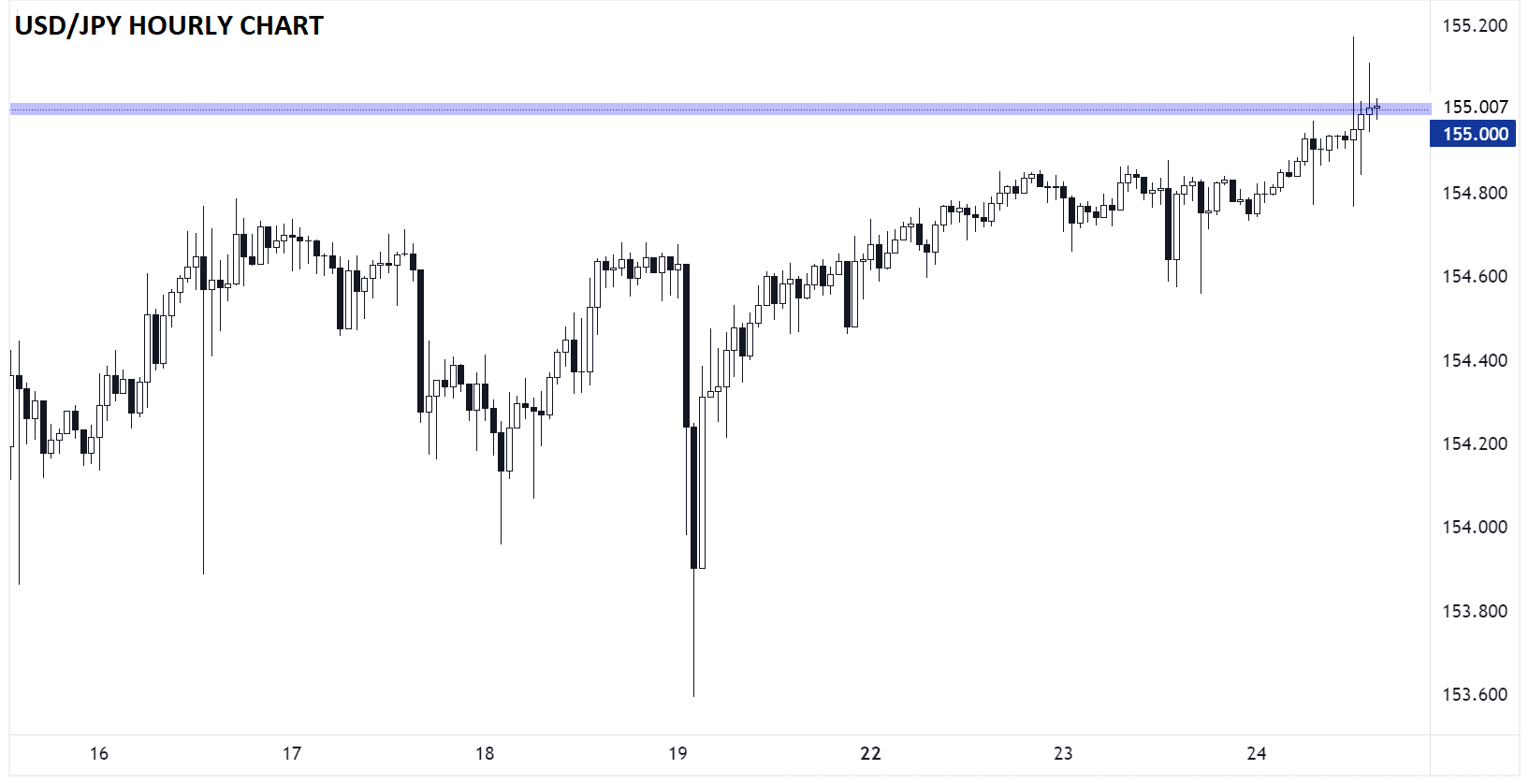

US Dollar Technical Analysis – USD/JPY Hourly Chart

Source: TradingView, StoneX

Stop me if you’ve heard this one before:

USD/JPY is rallying to multi-decade highs, raising fears of the potential for the BOJ to intervene in the FX market to drive the yen higher…but we haven’t heard anything beyond generic jawboning from Japanese policymakers.

It’s that same ol’ song and dance for the moment when it comes to USD/JPY, with the fundamentals of higher interest rates and more robust economic growth driving consistent strength in the US dollar relative to the moribund Japanese yen. From a technical perspective, continued strength above 155.00, if not checked by intervention from Japanese authorities, could open the door for a bullish continuation toward 156.00 or beyond, whereas it feels like outright intervention, a hawkish BOJ meeting, or surprisingly soft US inflation data would be needed to cap USD/JPY’s rally this week.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX