As we approach key earnings releases this week, United Parcel Service (UPS) and Harley-Davidson (HOG) will be reporting their third-quarter 2024 financial results. Both companies are facing unique challenges, and investors are eager to see how each has navigated the current economic environment. Below is a preview of what to expect from each company.

Harley-Davidson (HOG)

Earnings Release Date: October 2024 Morning

Expected EPS: $0.82 (-40.6% YoY)

Expected Revenue: $970.25 million (-25.7% YoY)

Harley-Davidson is expected to post a significant year-over-year decline in earnings and revenue for Q3 2024, with EPS expected to fall 40.6% and revenues declining 25.7% from the same period last year. These declines highlight the ongoing struggles for the motorcycle maker, which is grappling with weaker demand and cost pressures.

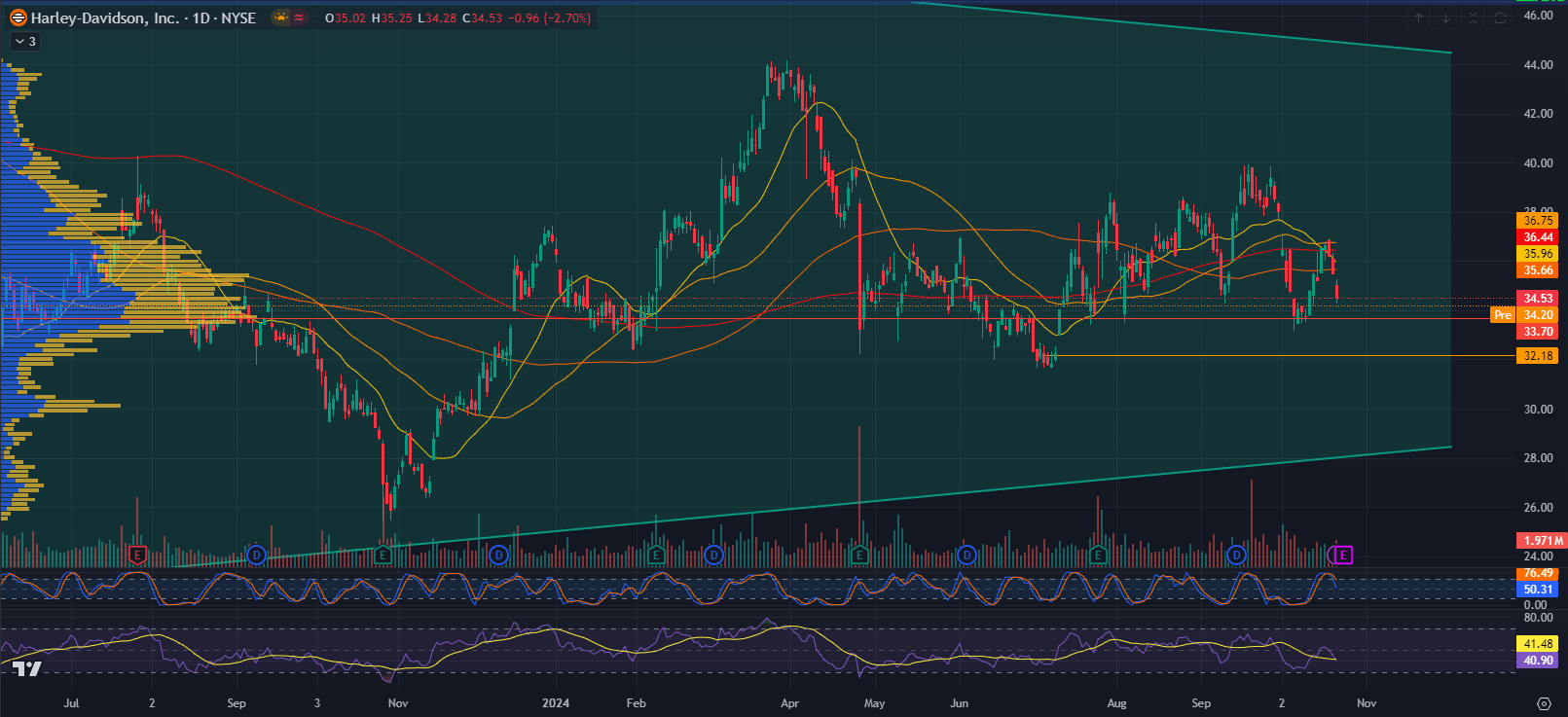

Harley Davidson Technical Analysis 1D Chart

The stock appears to be moving within a broadening wedge, where both support and resistance are expanding. This pattern indicates increased volatility and potential for both upward and downward breakouts.

The upper bound of the wedge, around $44, acts as a potential resistance point, while the lower bound around $32.18 is a critical support level.

The most immediate support is at $34.20, with a stronger support near $32.18, which has held multiple times in the past. The resistance levels are at $36.44 and $35.96, which could act as key levels for a bullish breakout if the stock manages to rally.

The price is hovering around the 50-day and 100-day moving averages, which is a sign of consolidation. Breaking above these levels could trigger a bullish move. The 200-day moving average is slightly above at around $36.75, and the stock needs to close decisively above this for any sustainable upward movement.

The RSI is currently neutral, around 41.48, indicating that the stock is neither overbought nor oversold. The Stochastic Oscillator is at 50.31, showing there’s room for both upside or downside momentum.

If the stock fails to hold the immediate support at $34.20 and breaks through the key support of $32.18, we could see a continuation of the downtrend towards $30 or lower. The broadening wedge would amplify the volatility in this scenario.

On the other hand, if $34.20 holds as support and the stock can reclaim the 200-day moving average around $36.75, it could rally toward the upper resistance levels at $44. Given the broadening wedge pattern, a breakout beyond that could trigger a stronger upside move.

At present, Harley-Davidson is in a consolidation phase near critical support levels. While there’s room for a short-term rebound if support holds, the overall technical indicator remains cautious with a slight neutral-to-bearish bias unless the stock can break key resistance levels.

Key Factors to Watch:

- Shipments and Market Share: In Q2 2024, Harley-Davidson managed to increase global motorcycle shipments by 16%, driven by strong growth in the Touring segment and an improved product mix. Investors will be keen to see if this momentum continued in Q3.

- Parts & Accessories and Apparel: Revenues from these segments were down in Q2, and the company’s ability to revitalize these areas will be crucial. Parts & Accessories revenues were down 10% and Apparel revenues declined 4% in the previous quarter.

- Strategic Focus: Harley-Davidson remains committed to its Hardwire strategy, which focuses on innovation, cost productivity, and expanding market share. The company also announced plans to repurchase $1 billion in shares through 2026, signaling confidence in long-term growth.

Despite challenges, Harley-Davidson has beaten consensus EPS estimates in three of the past four quarters, giving hope for another possible earnings surprise.

United Parcel Service (UPS)

Earnings Release Date: October 2024 Morning

Expected EPS: $1.63

Expected Revenue: $22.08 billion

UPS has had a difficult year, with its stock down 16.3% year-to-date, and the company now faces increasing competition from FedEx and Amazon, both of which have lower union obligations and are operating in more profitable channels.

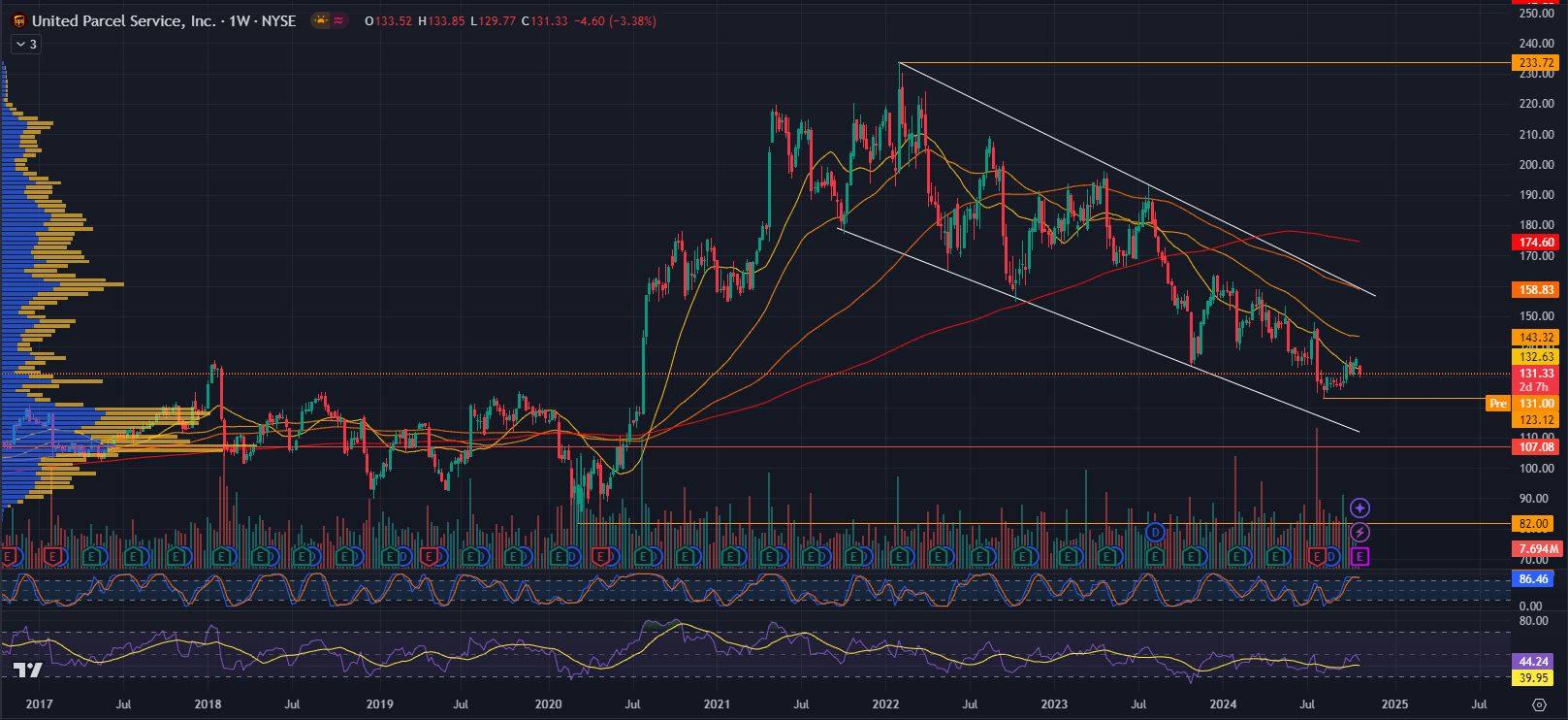

UPS Technical Analysis 1W chart

The stock is currently trading within a well-defined downward channel, which began after reaching highs around $220 in 2021.

The current price is near the lower section of the channel, suggesting that the stock might continue to oscillate within this channel unless it breaks out.

The nearest support level is around $123.12, where the stock has previously bounced. This level could provide some price stability. Below that, the next significant support appears to be around $107, a level not tested since 2020. The closest resistance level is near $143.32, with a secondary resistance at $158.83.

The stock is trading below key moving averages (50, 100, and 200-week), which signals a bearish trend in the longer term. The shorter-term moving averages (50-week) are trending downward and crossing over the longer-term averages (200-week), indicating further weakness unless a reversal occurs.

The RSI is hovering around the oversold region, indicating that the stock may be undervalued at current levels and could see a short-term bounce or relief rally.

The stochastic oscillator is also near oversold levels, reinforcing the potential for a short-term move upward or consolidation before continuing its current trend.

If the stock continues to follow the downward channel and fails to break above resistance at $143, it is likely to retest the $123.12 support level. In the event of a further decline, the stock may move toward $107.

Should UPS manage to maintain support near $123 and oscillators like RSI and stochastic support a recovery, there is potential for a short-term relief rally. In this case, the stock could attempt to break through the $143 resistance level and possibly test $158.

Key Factors to Watch:

- Freight Environment: The freight market remains challenging, and analysts are cautious about UPS’s ability to generate growth in the near term. Barclays downgraded UPS stock recently, citing concerns over a "lackluster freight environment" and stiff competition from Amazon and FedEx.

- Labor Costs and Competition: The new labor deal signed by UPS has increased its cost base, which could weigh on earnings. Furthermore, FedEx and Amazon operate in more efficient channels with fewer labor constraints, which may pressure UPS's long-term profitability.

- Acquisitions and Strategic Moves: UPS recently acquired Frigo-Trans and BPL, expanding its healthcare logistics capabilities in Europe. These acquisitions, along with plans to hire 100,000 seasonal workers for the holiday season, will be closely watched to gauge how UPS plans to bolster its growth in an increasingly competitive market.

- Dividend and Valuation: Despite the challenges, UPS remains a strong dividend payer, with a current yield of 4.8%. The company has raised its dividend for 14 consecutive years, making it an appealing option for income-focused investors.

Conclusion

Both UPS and Harley-Davidson are facing their own set of challenges heading into their Q3 earnings releases. Harley-Davidson is likely to report weaker year-over-year results but may surprise on EPS given its history of beating expectations. Meanwhile, UPS is grappling with a challenging freight market and rising labor costs but is making strategic acquisitions and remains attractive for income-focused investors due to its strong dividend history. Investors will be looking for insights from both management teams regarding future growth prospects and strategies for overcoming current obstacles.