It's possible we'll know who won the first round of France's election by the time markets open in Asia next week, which means the euro and European index futures could be more active than usual. And the election theme doesn't end there, as UK voters head to the polls on July 4th – which is in no way related to Independence Day in the US on the same date. Traders should then look to the pound and FTSE for pre-election jitters, although once again it could be Asian markets that get to witness the results (which seem more than likely to favour Labour, assuming polls haven't got it completely wrong again).

Despite the public holiday on Thursday, the US economic calendar is also packed. Two key ISM reports for manufacturing and services land before July 4th, alongside JOLTS and ADP employment reports, which are the warm-up acts for NFP on Friday.

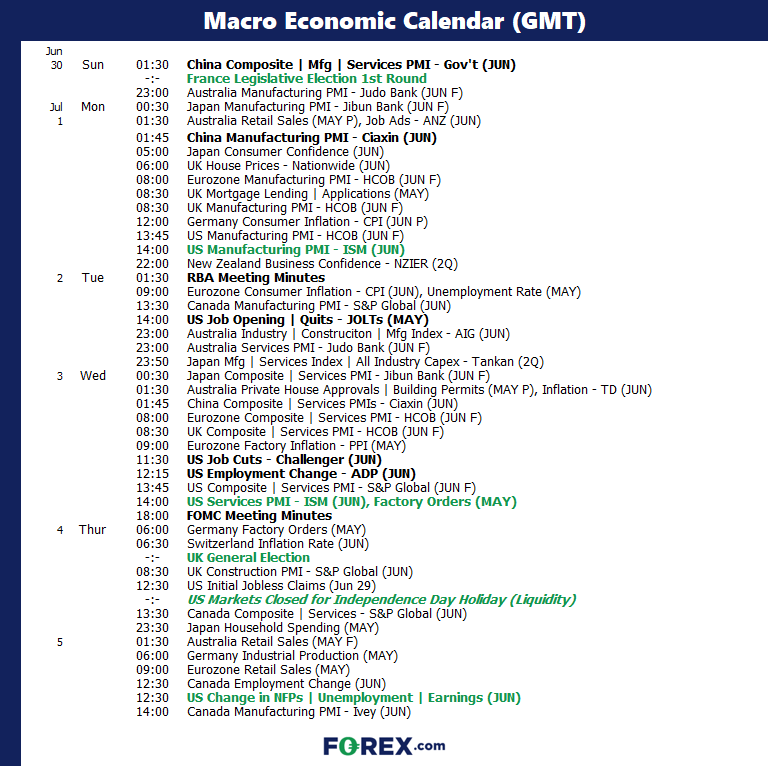

The week ahead: Calendar

The week ahead: Themes and events

- Elections in France and the UK

- US employment reports (NFP, ADP, JOLTS, ADP)

- Central bank minutes from the FOMC and RBA meetings

- PMIs

- US public holiday (Independence Day)

First round of the France Legislative election:

There's a reasonable chance we'll have a good idea who is to win the first round by the time the markets open next week. It's worth noting that the EUR/USD pair gapped significantly higher on news that the far right had not performed as well in the election as expected. We enter this election knowing that popularity for the far right has only grown in recent years.

Will history repeat and induce a bout of risk-on for European markets if these expectations or not met? Or further weigh on sentiment should the French Prime Minister lose significant power to rule and award more seats to the right. This means that traders should keep a close eye on European markets during Monday’s Asian session, as they’re likely to be more exciting than usual.

Marine Le Pen is confident of an outright majority in parliament, which she then intends to use to form a government and hamper President Macron's ability to support Ukraine. This brings an element of geopolitics into the mix alongside ramifications for Europe as a whole.

Trader’s watchlist: EUR/USD, EUR/GBP, DAX 40, CAC 40, STOXX 50

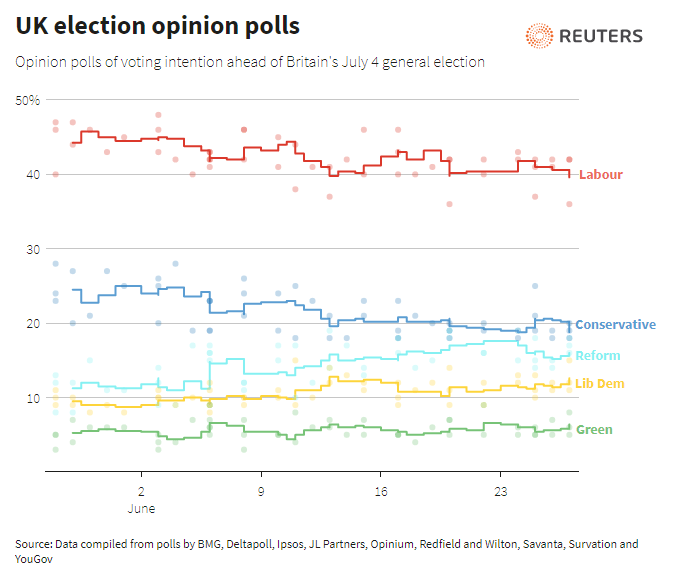

UK election on Thursday:

Rishi Sunak's controversial decision to announce a snap election (which even caught much of his own party by surprise) takes place on Thursday, July 4th. Polling stations are open between 06:00 and 21:00 GMT, where 50 million people are expected to vote. Votes will be counted throughout the night, and while there is no fixed end time, we can usually expect a winner to be announced by 05:00 to 07:00 on Friday.

326 seats are required to form a majority government in Parliament, or just over 50% of the 650 total seats. A Guardian poll estimates a landslide victory for Labour with 424 seats and just over 40% of the total votes, ending the Conservative reign which began in 2010.

This leaves little room for surprise if the polls are correct. While we know that polls have had a tendency to be wrong more often than right in recent years, it is hard to see the Conservatives pulling a rabbit out of the hat on this one. And if there is to be a surprise, perhaps it could be a better-than-expected performance from Farage's Reform Party. Although though recent comments on Ukraine dented support for his party in the polls this week.

Trader’s watchlist: GBP/USD, GBP/JPY, EUR/GBP, FTSE 100

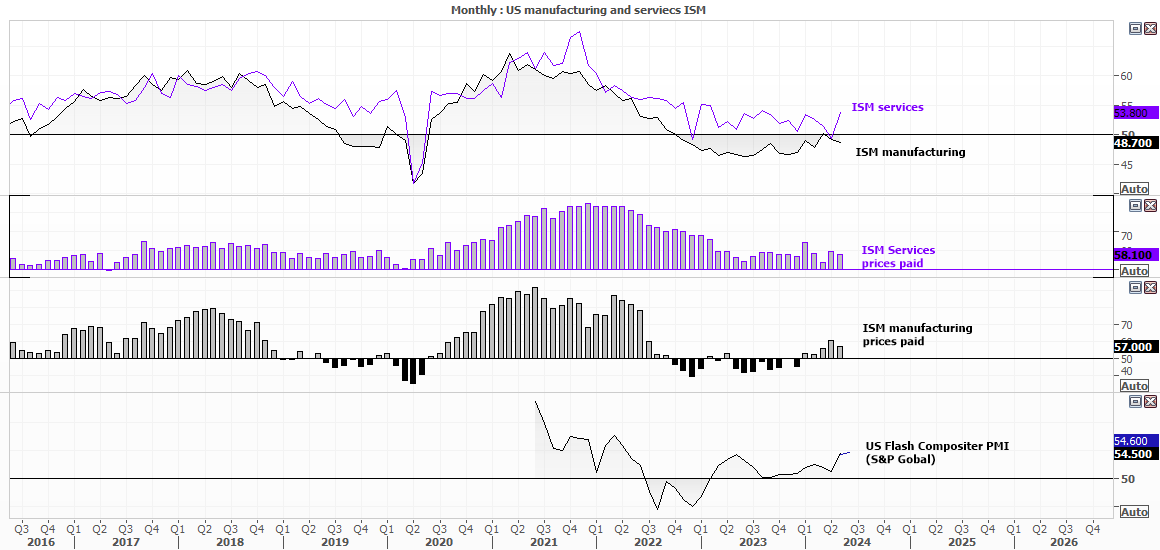

Purchase Managers Index reports (PMIs)

The bulk of purchase manager index (PMI) reports are actually the final reports from S&P Global, which tend not to be big market movers, as the real bets were made on the flash reports. But we also have ISM manufacturing and services reports from the US and government reports from China to keep an eye on.

What traders will really want to see is ISM services expand, but at a much cooler rate. Its 4.5 point increase was its fastest month-over-month pace since January 2023, and prices paid were elevated, even if at a slightly slower pace of expansion. And how significant these numbers become next week also hinges on today's PCE inflation figures. If PCE inflation doesn't soften as expected, a hot set of ISM figures next week likely once again lowers the odds of Fed action sooner rather than later.

Trader’s watchlist: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones, AUD/USD, AUD/JPY, China A50, Hang Seng

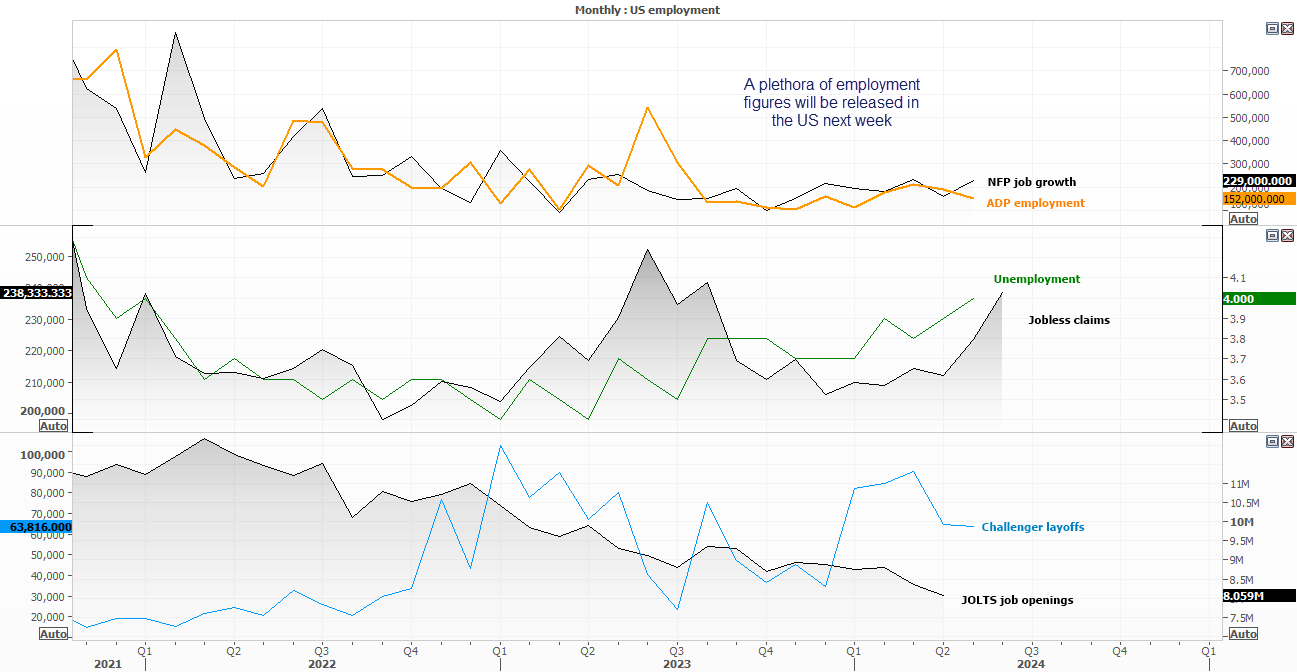

US employment reports (NFP, ADP, JOLTS, ADP)

There were higher hopes that last month's incoming NFP data would disappoint and justify sooner Fed action. It didn't. Sure, unemployment rose to 4%, but the 272k headline job growth figure was around 100k higher than expected. And when combined with the uncomfortably firm services PMI print, hopes for a September Fed cut were slashed. We know the Fed is priming markets for a solitary cut in December, so incoming data is really about how soon and how many cuts we get for 2025. And not only do we have ISM PMI reports next week, but a host of employment figures, including NFP, ADP, and JOLTS job openings.

We know the economic data in the US is deteriorating in some parts, albeit slowly. But the faster the cracks in the employment situation widen, the faster the Fed is likely to act. And the ideal scenario for those hoping for central bank easing is for job openings to continue trending lower, unemployment to rise to 4.1% or higher, alongside decent misses on the headline NFP and ADP job change figures.

Trader’s watchlist: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones, VIX, bonds

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge