If you’ve been following our forecasts for the past year, this won’t deviate too far away from what I’ve been tracking on US stocks. In my mind there’s still no reason to give up expectation for bullish continuation. The two-year gain for the S&P 500 at this point stands at a whopping 57%, which would be the most for the index since the 1997-1998 instance. And in that case, strength stretched for another year with a 20% showing in 1999 and it seems unlikely that such a sense of euphoria would just, suddenly, fade away.

To download the full Equity Forecast for 2025:

But a stretched market makes for a challenging setup for entry. And at that point, there’s a simple way of looking at the matter: Either get long on a stretched market and hope that the index continues to grind-higher. Or wait, try to be patient, get a pullback to a support level, and then take a shot.

To be clear there’s no perfect path forward. With the first scenario the risk is obvious, a sub-optimal entry and the possibility of getting stopped out, even if the trend does ultimately continue-higher. For the second option, the risk is a bit less clear cut but it’s more of an opportunity cost as that pullback may not arrive. And, if it does there’s no assurances that the pullback won’t continue pulling back, so there’s also a risk of getting stopped out in that second, more patient scenario.

But that’s still the side that I lean towards for a couple of reasons. One, there are other markets to trade, so while waiting for stocks to set up I can simply avert my attention elsewhere. But two and perhaps more importantly, the pullback scenario offers a more clear-cut setup for risk management. And rather that ‘buy and hope’ like the first scenario would necessitate, waiting for a pullback to a support level affords some element of clarity for stop placement. The stop goes below support, and if that holds, great; if it doesn’t, well the pullback may continue pulling back, so more patience will be in order.

Over the long-term much of trading is going to dial back to a person’s psychology. As humans we love to win, and we hate to lose, and we often assign some element of value to ourselves based on our own perceptions of how well we navigate each. We also often assign blame for failures, either to ourselves or others. And if we let our excitement get the best of us, what the internet has dubbed as ‘FOMO,’ or the ‘fear of missing out,’ well the blame could be especially heavy because not only did we fail, we failed because we were simply afraid of being left out, or missing the boat.

For anyone that spends enough time in markets a glaring fact becomes obvious, and it’s that none of us can tell the future. Forecasts are, at best, a hypothesis and at no point in time is any forecast a certainty. And for analysis, about the best that one can do is collect facts and follow the direction in which they seem to point. And for now, that seems like continued support for bullish themes in U.S. equities, to me. But I think there’s also clear risk of pullback potential and the near-mania levels of sentiment that we’ve seen after the Presidential election are one of the reasons why.

This, of course, isn’t to say that ‘too good isn’t good enough.’ But more to the point, I think many investors are already stretched aggressively to the long side and given the pricing-in of higher inflations and perhaps even higher long-term rates, there could be a growing opportunity cost of capital in the first-half of next year. I don’t consider this a larger-scale bearish factor. To be sure there is risk with just how extended the US Treasury Department had become under Janet Yellen’s tenure, and the very nature of issuing so much short-dated debt presents a longer-term problem as normalization of the yield curve could, in essence, increase longer-term borrowing costs of the U.S. government while also drawing capital out of equities and into bonds.

But if there’s one thing that we all should’ve learned since the Financial Collapse, it’s that most parties want to see the same thing, and that’s stock prices going-higher. And unless the Fed finds themselves in a predicament similar to early-2022, when inflation is rampant and they have to hurriedly hike rates, the ‘implied third mandate’ around the FOMC can be a driving factor for the bank’s decision making.

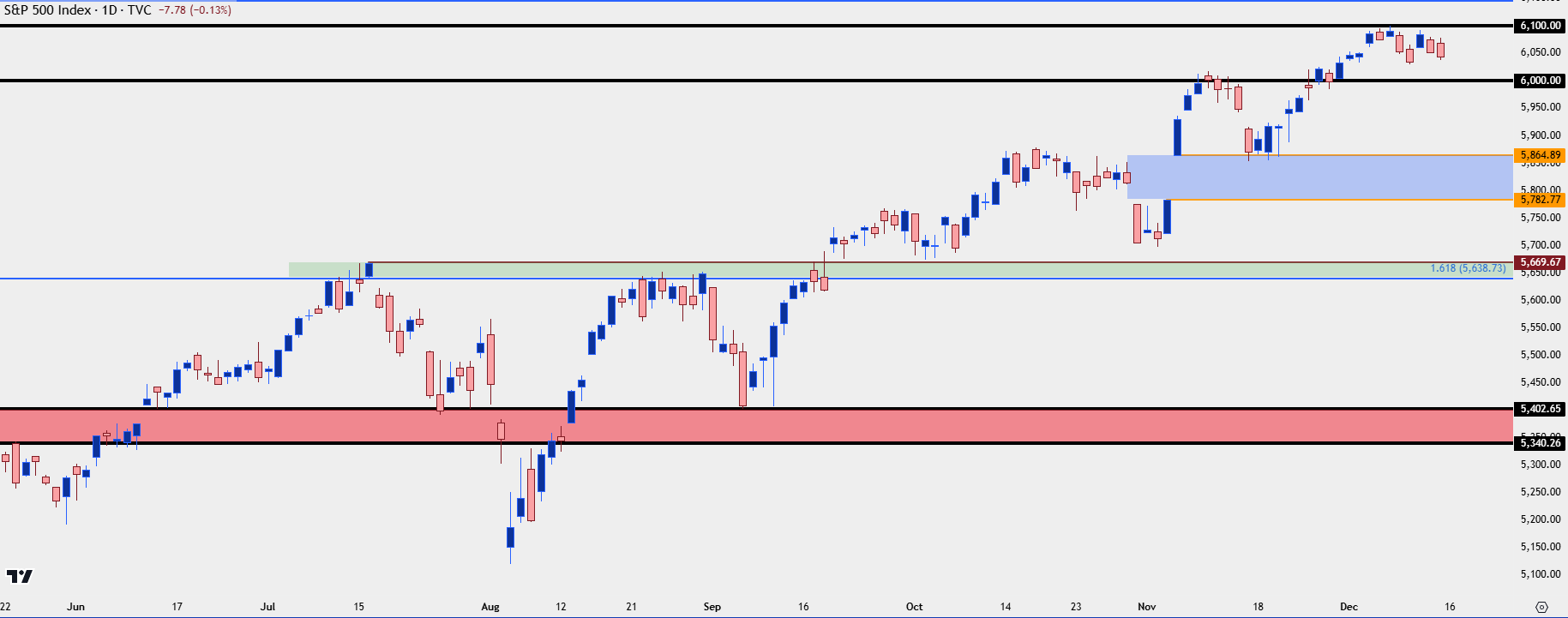

In the S&P 500, there’s a very nearby area of support potential that could satisfy that requirement for a pullback. It’s the same gap produced by the U.S. Presidential election, and it’s just about 5% away from current prices.

Below that gap, there’s a point of prior resistance that’s also around the 161.8% extension of the 2022 pullback move. That’s about 7% away from current price.

SPX Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

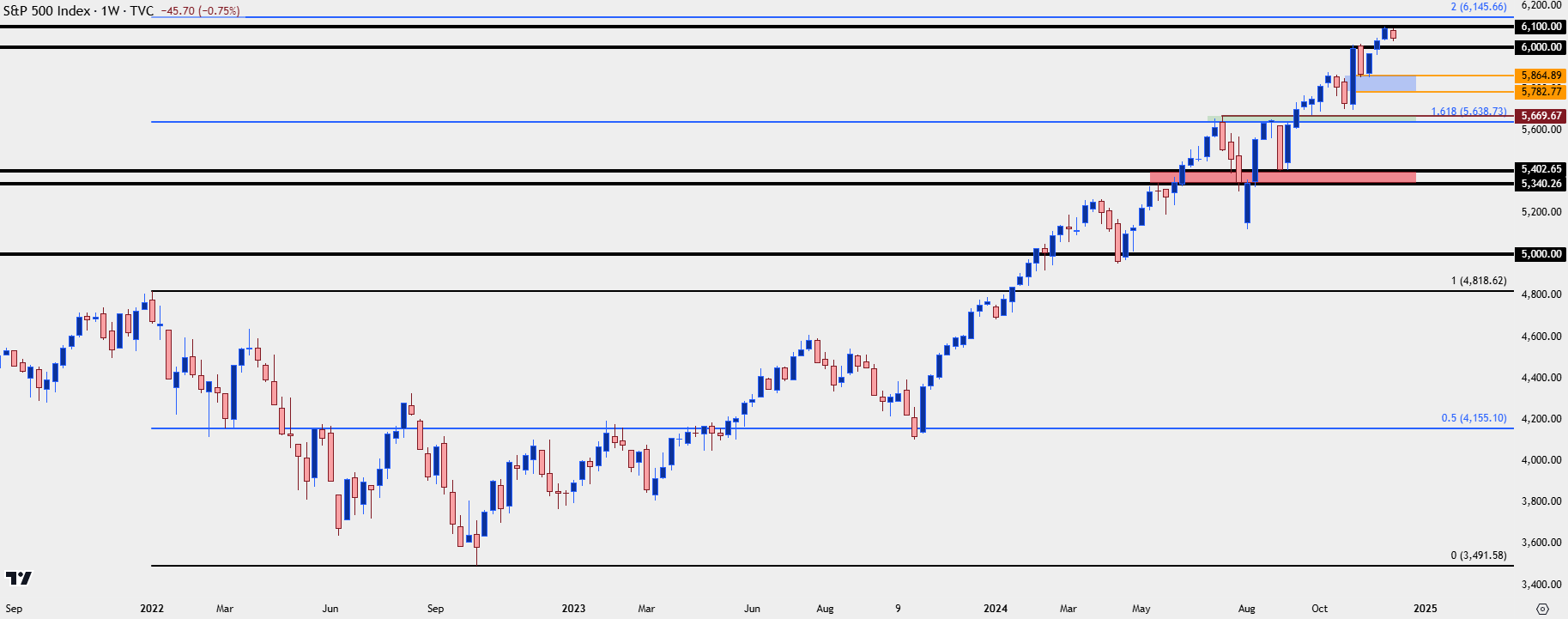

If we see a greater than 7% retracement, I’m going to assume that something has shifted in the fundamental backdrop. From where I sit as of this writing, I’m assuming it would be something to do with long-term US rates. And in that case, I’m looking to the zone from 5,340-5,400 and if buyers can hold the line there, similarly, there would be a case for upside potential following an approximate 11% pullback from current prices.

SPX Weekly Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist