China’s major stock market indices have been falling since the middle of May. With little in the way of a decent bounce higher, I continue to suspect one could be due. My attempt at identifying a swing low a couple of weeks ago sadly did not workout. But with several key markets at or near swing lows, I now think we are closer to a potential Inflexion point.

The best of the bunch is the China A50 cash index. That is simply because it is formed a triple bottom around 12,000 on the daily chart. This may not be enough to warrant a strong rally for Chinese equity markets in general, but it could be reason for bears to be cautious around current levels. Furthermore, the China A50 futures market (right) has stalled around the April low and 50% retracement level. If the A50 futures market can hold above this key support levels ~11,800, the China A50 cash market (left) might just get that bounce higher.

A strategy for bulls to consider over the near term is to buy dips upon retracements towards 12,000, stop somewhere beneath that level. We're not looking for anything heroic at this point perhaps it could muster a bounce towards 12,200, just beneath the monthly pivot point.

12,000 provides a clear level to invalidate the near-term bullish bias, should we mention simply continue lower. Because a break beneath it also clears the triple bottom and opens up a run towards 11,800, near the monthly pivot point, 50% retracement level, and April low

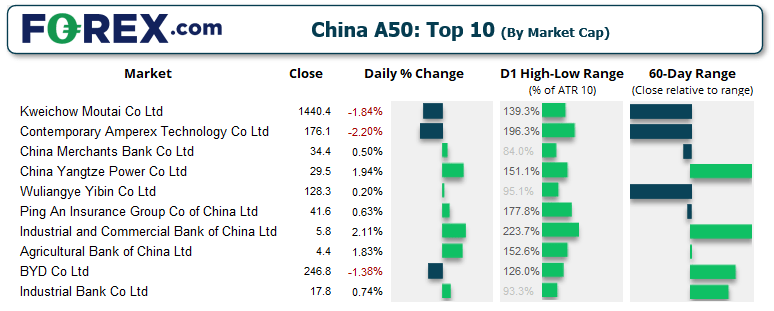

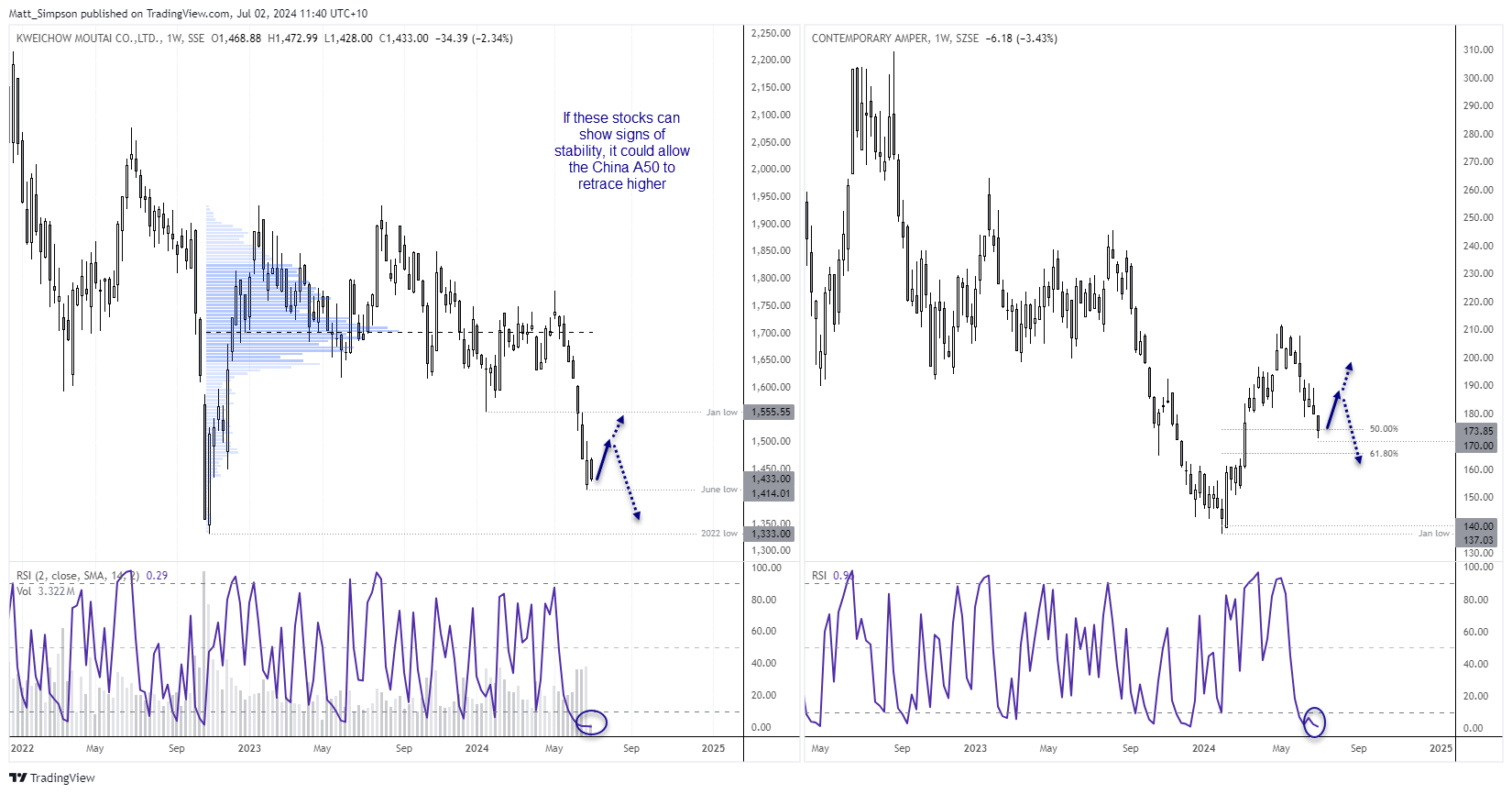

Traders may also want to keep an eye on the two largest stocks in the China A50. Kweichow Moutai has a market cap weighting of 14.23% and Contemporary Amperex Technology of 6%, which means these two stocks alone account for around one fifth of the index. Both stocks have been in decline since early May, which means they provided a good lead ahead of the broader China A50 index. With Kweichow Moutai holding above the June low with RSI heavily oversold, and Contemporary Amper holding above the 170 handle and 50% retracement level with RSI also heavily oversold, stability in these stocks could allow the China A50 to at least produce a minor rebound.

However, both stocks clearly have the ability to move lower in the coming weeks or months, in which case we could expect further declines on the China A50.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge